Title: Tennessee Provisions Which May Be Added to a Division Or Transfer Order Introduction: In Tennessee, the provisions added to a division or transfer order are essential for determining the distribution of assets and liabilities during a divorce or property transfer. These provisions play a crucial role in ensuring a fair and equitable distribution and outlining the responsibilities of each party involved. This article will provide a comprehensive overview of the various types of Tennessee provisions that can be added to a division or transfer order to protect the rights and interests of the involved parties. 1. Property Division Provisions: — Equal Distribution: This provision ensures that marital assets, including real estate, vehicles, financial accounts, and personal belongings, are divided equally between both parties. — Separate Property Allocation: Addresses the division of assets acquired before the marriage or inherited by one spouse during the marriage, ensuring their exclusion from the assets subject to equitable distribution. — Marital Debt Distribution: Specifies the division of debts accrued during the marriage, including loans, credit card debts, and mortgages, ensuring a fair allocation of financial responsibilities. 2. Spousal Support or Alimony Provisions: — Temporary Alimony: Provides financial support to one spouse during the divorce process until a final alimony arrangement can be determined. — Permanent Alimony: Enables a spouse with less earning capacity or financial resources to receive ongoing support after the divorce. — Lump-Sum Alimony: In some cases, a one-time, fixed-sum payment is agreed upon as a settlement to avoid prolonged financial dependency. 3. Child Custody and Support Provisions: — Custody Arrangements: Establishes the legal and physical custody of children, outlining shared or sole custody arrangements, visitation schedules, and decision-making responsibilities. — Child Support: Ensures financial support from one parent to the other to meet the needs of the children for expenses such as education, healthcare, and general welfare. 4. Retirement and Pension Benefits Provisions: — Division of Retirement Assets: Outlines how retirement plans, including pensions, 401(k) accounts, and IRAs, will be divided between the parties. — Qualified Domestic Relations OrderQDRRO): A provision clarifying the process for transferring a portion of one spouse's retirement benefits to the other, ensuring compliance with federal regulations. 5. Insurance and Healthcare Provisions: — Health Insurance Coverage: Addresses the continuation of health insurance coverage for one spouse and the children, especially if provided through the other spouse's employer. — Life Insurance: Requires the continuation of life insurance coverage to protect the financial interests of the supported spouse or children, particularly in cases of alimony or child support. Conclusion: Tennessee provisions in a division or transfer order encompass a broad range of factors related to property division, spousal support, child custody and support, retirement and pension benefits, and insurance coverage. It is essential for divorcing couples or those involved in property transfers to carefully consider these provisions to safeguard their rights and ensure a fair and equitable resolution. Seeking legal advice or guidance is highly recommended ensuring compliance with Tennessee laws and protect individual interests during these processes.

Tennessee Provisions Which May Be Added to a Division Or Transfer Order

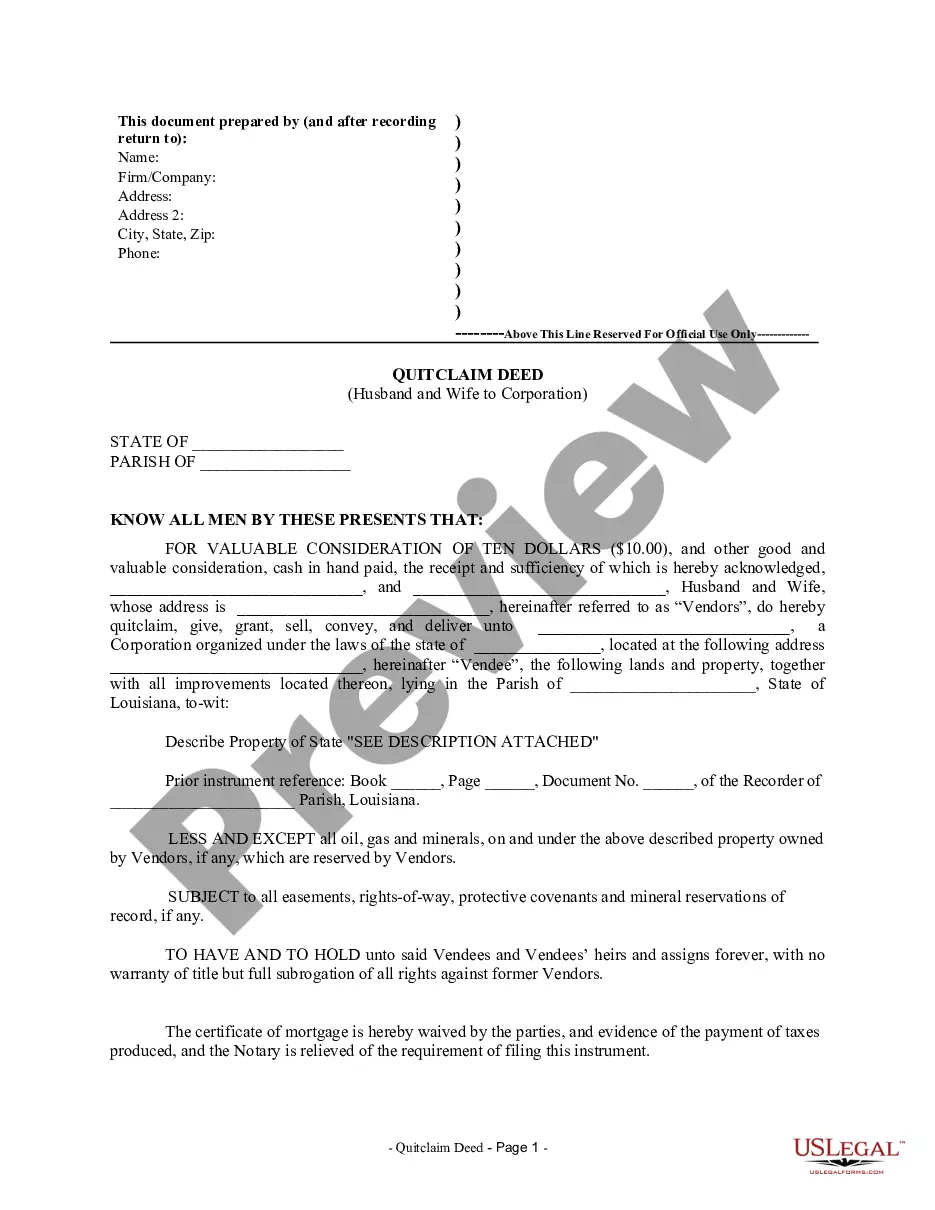

Description

How to fill out Tennessee Provisions Which May Be Added To A Division Or Transfer Order?

US Legal Forms - one of several most significant libraries of legitimate kinds in the USA - offers an array of legitimate file web templates you can acquire or print out. Making use of the internet site, you will get a huge number of kinds for company and personal purposes, sorted by classes, states, or search phrases.You can get the most recent models of kinds like the Tennessee Provisions Which May Be Added to a Division Or Transfer Order in seconds.

If you already possess a membership, log in and acquire Tennessee Provisions Which May Be Added to a Division Or Transfer Order in the US Legal Forms collection. The Obtain button will show up on each and every type you look at. You have accessibility to all in the past acquired kinds inside the My Forms tab of your profile.

In order to use US Legal Forms initially, listed below are straightforward guidelines to get you started:

- Make sure you have chosen the right type for your personal metropolis/county. Select the Review button to analyze the form`s content material. Read the type explanation to ensure that you have selected the proper type.

- In case the type does not satisfy your specifications, make use of the Look for discipline near the top of the screen to find the one who does.

- In case you are pleased with the shape, affirm your option by visiting the Get now button. Then, select the prices prepare you favor and supply your qualifications to register for the profile.

- Procedure the financial transaction. Make use of credit card or PayPal profile to finish the financial transaction.

- Pick the format and acquire the shape on your gadget.

- Make alterations. Complete, revise and print out and indicator the acquired Tennessee Provisions Which May Be Added to a Division Or Transfer Order.

Every single design you included with your account does not have an expiry date and is also your own property for a long time. So, in order to acquire or print out yet another duplicate, just check out the My Forms area and click on about the type you require.

Gain access to the Tennessee Provisions Which May Be Added to a Division Or Transfer Order with US Legal Forms, probably the most considerable collection of legitimate file web templates. Use a huge number of expert and status-particular web templates that fulfill your organization or personal requirements and specifications.