Tennessee Sub-Operating Agreement

Description

How to fill out Sub-Operating Agreement?

Are you currently in a position where you need papers for possibly enterprise or personal uses almost every time? There are a lot of authorized papers layouts available on the Internet, but locating versions you can rely is not straightforward. US Legal Forms delivers a huge number of form layouts, like the Tennessee Sub-Operating Agreement, which are written to meet state and federal requirements.

When you are currently informed about US Legal Forms website and have a free account, simply log in. After that, you can acquire the Tennessee Sub-Operating Agreement design.

If you do not provide an bank account and wish to begin using US Legal Forms, adopt these measures:

- Find the form you want and make sure it is for that correct metropolis/state.

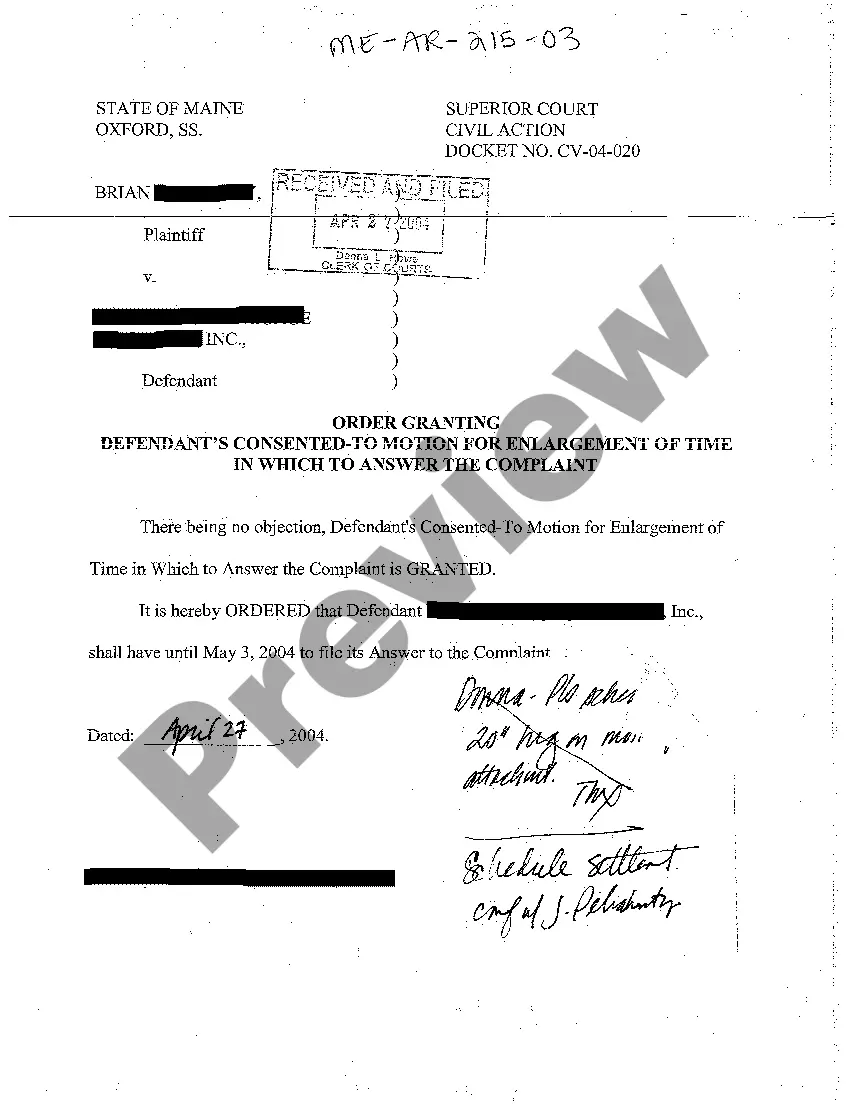

- Make use of the Preview option to examine the form.

- See the explanation to ensure that you have chosen the right form.

- If the form is not what you are looking for, make use of the Look for field to discover the form that meets your needs and requirements.

- Whenever you obtain the correct form, click on Acquire now.

- Select the pricing strategy you need, complete the required information and facts to produce your bank account, and purchase an order utilizing your PayPal or bank card.

- Decide on a practical paper file format and acquire your version.

Get all the papers layouts you have bought in the My Forms food selection. You can aquire a extra version of Tennessee Sub-Operating Agreement anytime, if required. Just go through the needed form to acquire or printing the papers design.

Use US Legal Forms, one of the most substantial assortment of authorized types, in order to save some time and avoid mistakes. The support delivers expertly made authorized papers layouts that you can use for a range of uses. Generate a free account on US Legal Forms and start generating your way of life easier.

Form popularity

FAQ

An operating agreement is similar to a shareholder agreement, but it is tailored for a limited liability company. Instead of shareholders, the company has members.

The state of Tennessee does not require an LLC Operating Agreement, but it may still be recommended for many LLCs. Without an Operating Agreement, disputes are governed by the default LLC operating rules outlined in Tennessee law (Tenn. Code Tit. §§ 48-201-101 through 48-250-115).

Yes. Because each series within the Series LLC acts as its own independent company, all series must file and pay the Tennessee Franchise and Excise tax.

Key Components of an S-Corp Operating Agreement Identification of Parties. ... Management Structure. ... Ownership and Equity. ... Shareholder Rights and Obligations. ... Distributions and Allocations. ... Financial Matters. ... Meetings and Decision-Making. ... Amendments and Dissolution.

An LLC operating agreement is a document that customizes the terms of a limited liability company ing to the specific needs of its members. It also outlines the financial and functional decision-making in a structured manner. It is similar to articles of incorporation that govern the operations of a corporation.

An operating agreement should include the following: Percentage of members' ownership. Meeting provisions and voting rights. Powers and duties of members and management. Distribution of profits and losses. Tax treatment preference. A liability statement. Management structure. Operating procedures.

The good news is that you're free to write your operating agreement in any way that you wish. There aren't any legal requirements regarding what you must include in the agreement. Drafting the best operating agreement for your LLC simply means tailoring it to your business's specific needs.

An LLC operating agreement should contain provisions to cover: Basic information about the LLC. ... A profit and loss allocation plan. ... The LLC's purpose. The management structure. ... Ownership percentages of each member. ... Voting rights and procedures. ... Meeting frequency. Procedures for bringing in new members.