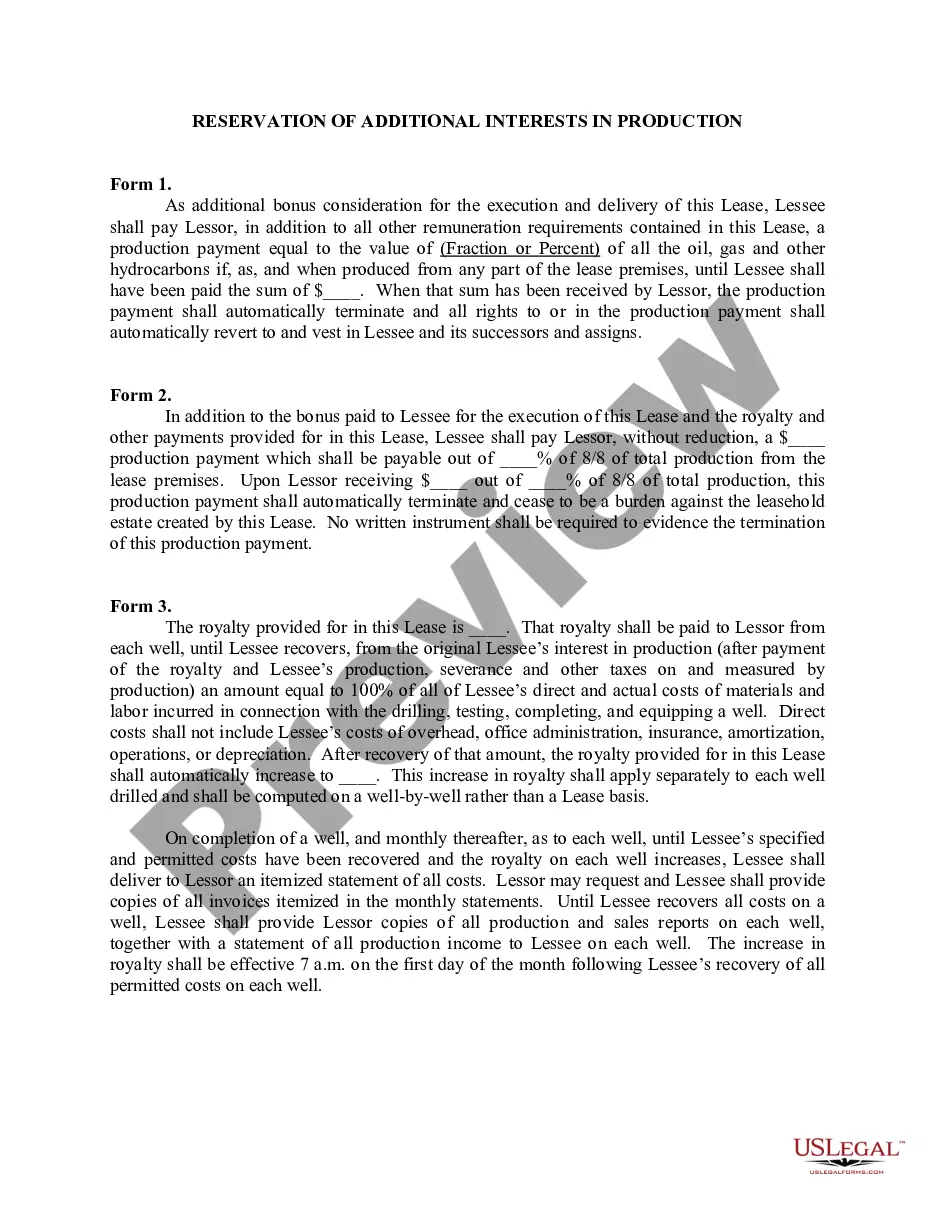

This lease rider form may be used when you are involved in a lease transaction, and have made the decision to utilize the form of Oil and Gas Lease presented to you by the Lessee, and you want to include additional provisions to that Lease form to address specific concerns you may have, or place limitations on the rights granted the Lessee in the “standard” lease form.

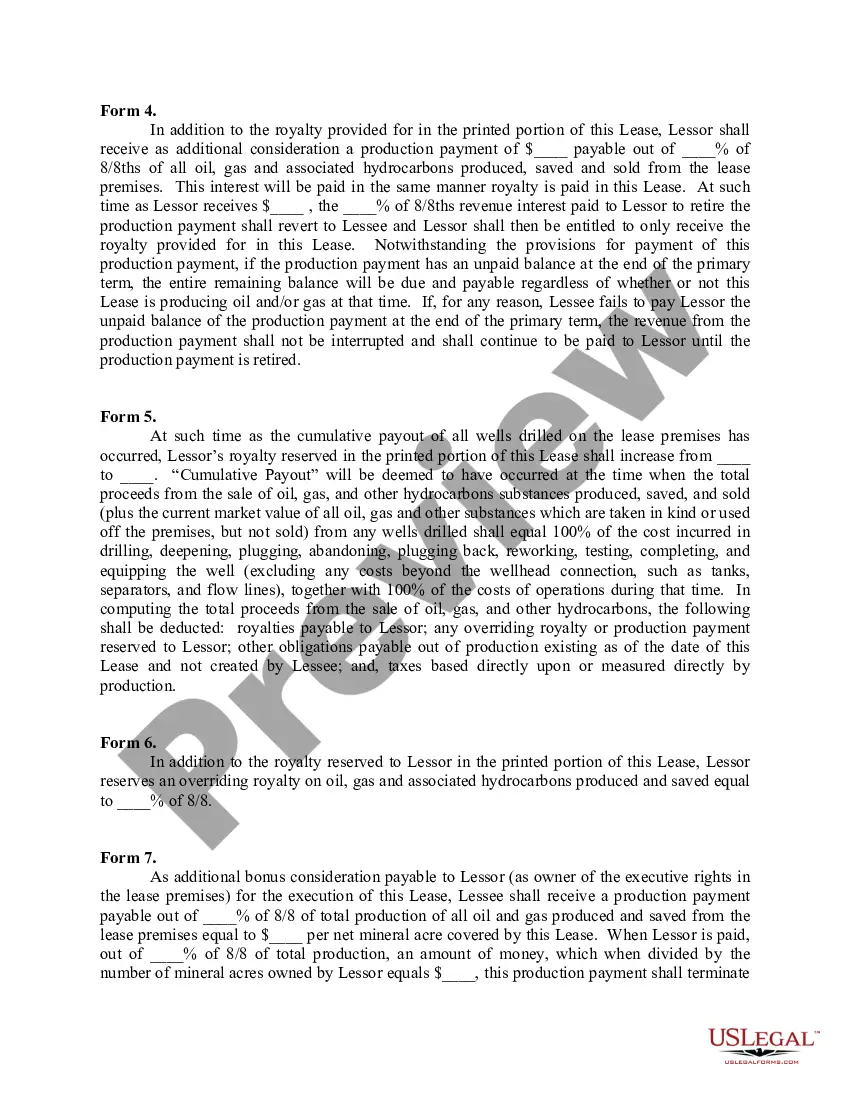

The Tennessee Reservation of Additional Interests in Production refers to a legal provision in the state of Tennessee which allows landowners to retain certain rights and interests in minerals and other resources found on their property, even after selling or leasing the property for production purposes. This reservation ensures that the landowner is entitled to a share of the profits or royalties generated from the production activities. One type of Tennessee Reservation of Additional Interests in Production is the Mineral Interest Reservation. Under this type, the landowner maintains ownership of the minerals present in the land while granting the lessee or buyer the right to extract and produce those minerals. The landowner is typically entitled to a percentage share of the produced minerals' value or royalties. Another type is the Oil and Gas Interest Reservation. In this case, the landowner retains the rights to any oil and gas resources that may be discovered and extracted from the property. The lessee or buyer has the right to explore, develop, and produce oil and gas, while compensating the landowner with a portion of the proceeds or royalties from the production. The Timber Interest Reservation is yet another type of reservation. Here, the landowner reserves the rights to any timber resources present on the property. The lessee or buyer can engage in logging activities, but the landowner is entitled to receive a share of the revenues generated from the sale of timber. The Water Interest Reservation is also worth mentioning. This reservation allows the landowner to maintain control over any water resources found on the property. The lessee or buyer may use the water for various purposes, but the landowner may negotiate and receive compensation or royalties for its use. The Tennessee Reservation of Additional Interests in Production is a critical provision that protects landowners' rights and provides them with a means to benefit from the natural resources located on their property even after selling or leasing it.