Tennessee Clauses Relating to Preferred Returns refer to specific provisions found in investment contracts or agreements in the state of Tennessee that dictate how profits or returns will be allocated among investors or shareholders. These clauses define the preferred return, which is the fixed percentage or rate of return that certain investors are entitled to receive before any profits are distributed to other investors or participants in an investment deal. The purpose of these clauses is to establish a priority order for the distribution of profits and ensure that certain investors, often senior or preferred investors, receive a pre-determined return on their investment before other participants can benefit from the profits generated by the investment project. There are two common types of Tennessee Clauses Relating to Preferred Returns: 1. Fixed Preferred Return Clause: This clause specifies a fixed rate or percentage of return that preferred investors will receive before any other distributions are made. For example, if the fixed preferred return is set at 8%, it means that preferred investors will receive an 8% return on their investment before any profits are shared with other parties. 2. Variable Preferred Return Clause: This type of clause allows for a preferred return rate that may fluctuate based on certain factors, such as the performance of the investment or the overall market conditions. The variable preferred return may be tied to a benchmark or an index, ensuring that preferred investors receive returns that align with the overall performance of the investment. These Tennessee Clauses Relating to Preferred Returns are crucial for both investors and project sponsors as they provide clarity and assurance regarding the distribution of profits. By naming these clauses within investment contracts, parties can establish transparent and fair expectations, reducing potential conflicts that may arise from ambiguous profit-sharing arrangements. It is important to consult legal professionals or experts well-versed in Tennessee law to draft and interpret these clauses accurately within the context of specific investment deals. Additionally, it is advisable to consider each party's requirements and objectives while determining the type and terms of the preferred return clauses.

Tennessee Clauses Relating to Preferred Returns

Description

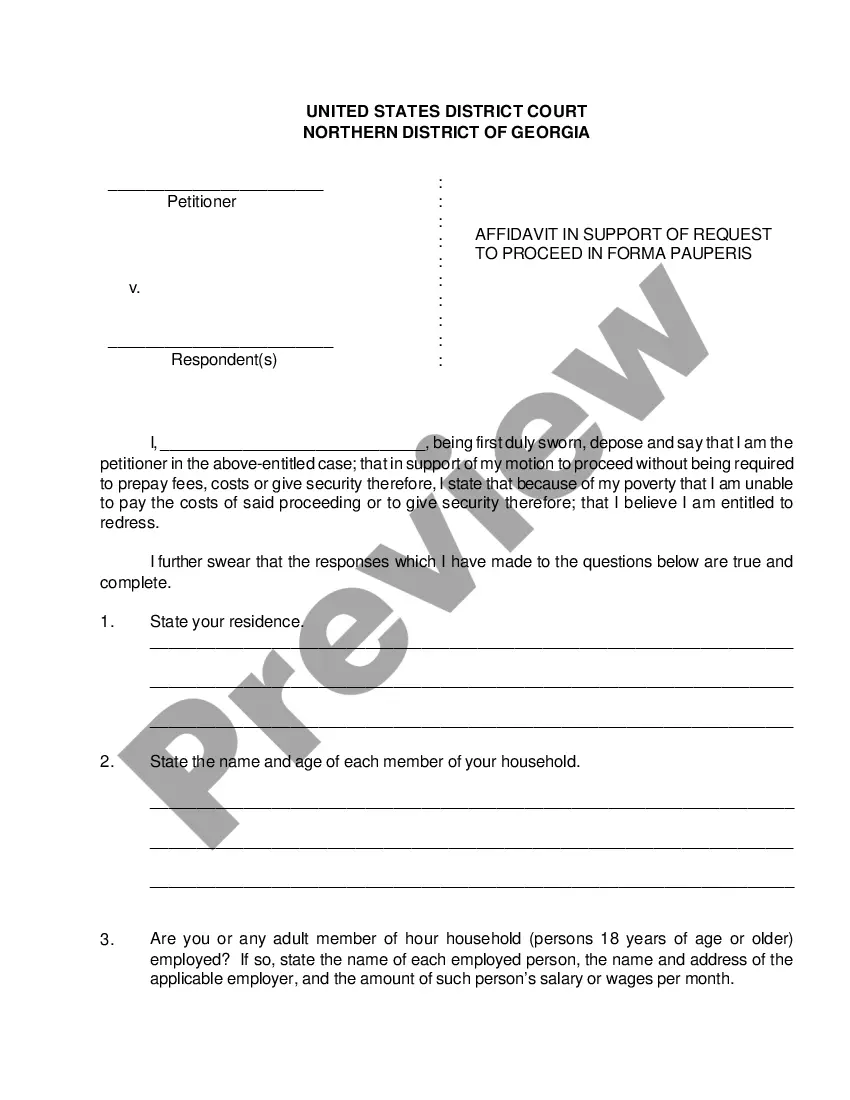

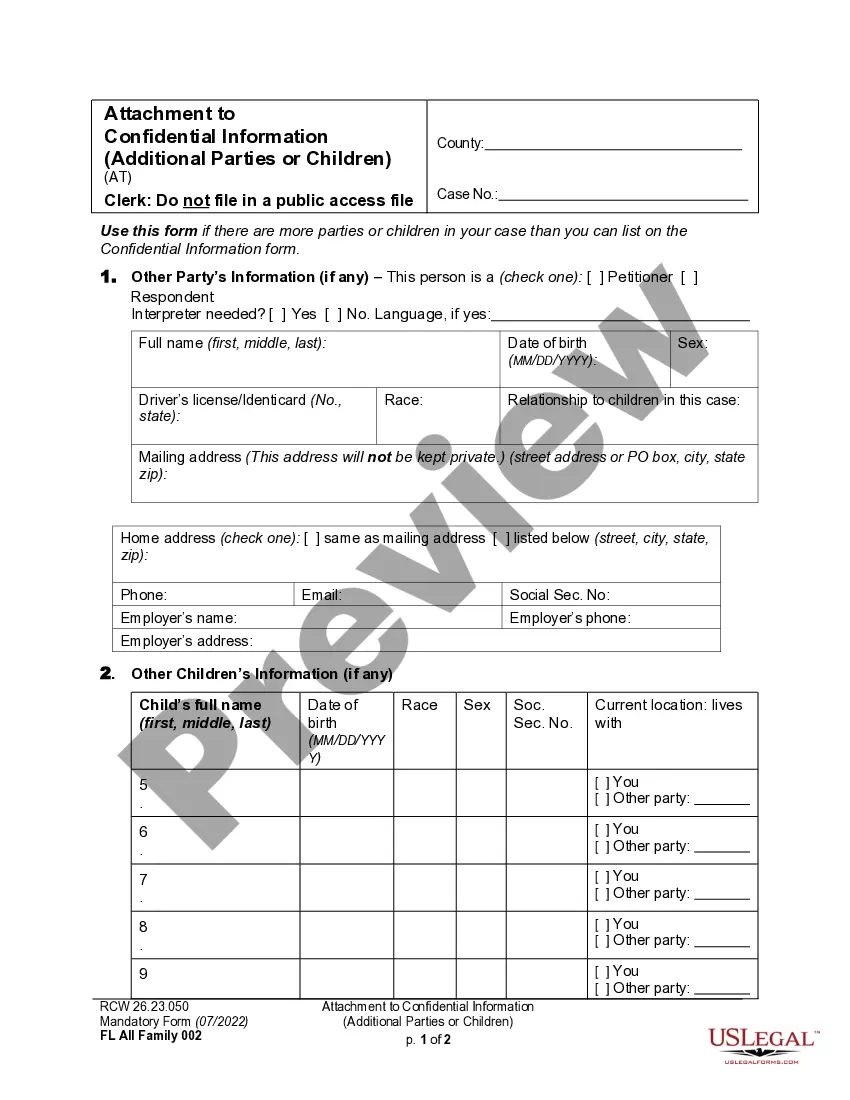

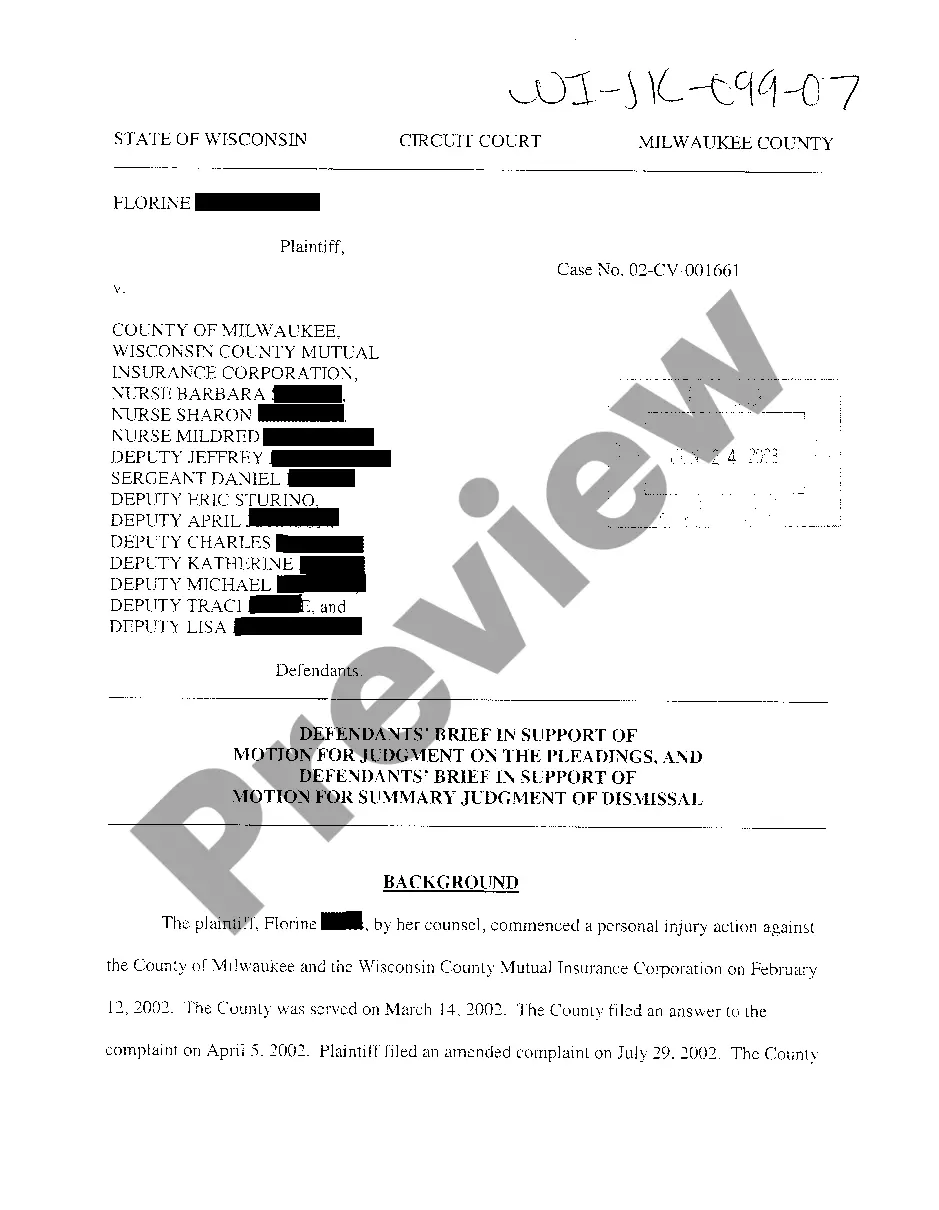

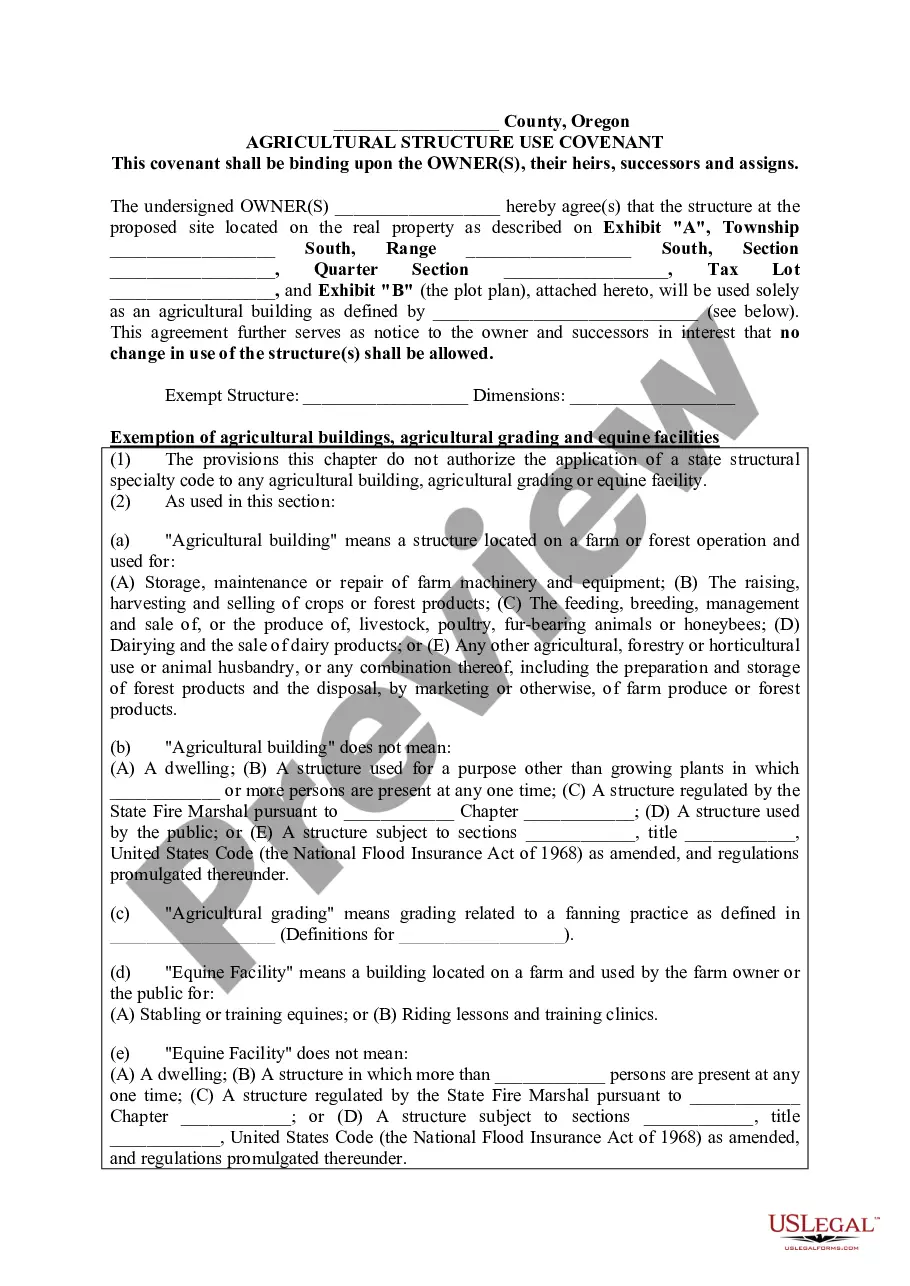

How to fill out Tennessee Clauses Relating To Preferred Returns?

You are able to invest several hours on the Internet attempting to find the legal papers template that meets the state and federal needs you need. US Legal Forms gives a huge number of legal kinds that happen to be reviewed by experts. It is possible to acquire or produce the Tennessee Clauses Relating to Preferred Returns from our services.

If you currently have a US Legal Forms bank account, it is possible to log in and click the Down load key. Afterward, it is possible to comprehensive, change, produce, or indication the Tennessee Clauses Relating to Preferred Returns. Each legal papers template you purchase is your own property eternally. To obtain one more backup for any acquired kind, proceed to the My Forms tab and click the related key.

Should you use the US Legal Forms website for the first time, adhere to the simple guidelines listed below:

- Very first, make sure that you have selected the correct papers template to the county/city that you pick. Look at the kind outline to ensure you have chosen the appropriate kind. If readily available, make use of the Review key to search throughout the papers template also.

- If you would like find one more edition of your kind, make use of the Research area to obtain the template that suits you and needs.

- Upon having found the template you want, just click Acquire now to continue.

- Select the pricing prepare you want, key in your references, and sign up for an account on US Legal Forms.

- Total the financial transaction. You can use your bank card or PayPal bank account to pay for the legal kind.

- Select the formatting of your papers and acquire it for your product.

- Make modifications for your papers if needed. You are able to comprehensive, change and indication and produce Tennessee Clauses Relating to Preferred Returns.

Down load and produce a huge number of papers themes making use of the US Legal Forms website, which offers the largest collection of legal kinds. Use expert and status-certain themes to tackle your organization or person requirements.

Form popularity

FAQ

Right to Counsel. Every person accused of any crime or misdemeanor whatsoever is entitled to counsel in all matters necessary for the person's defense, as well to facts as to law. Code 1858, § 5205 (deriv.

That slavery and involuntary servitude, except as a punishment for crime, whereof the party shall have been duly convicted, are forever prohibited in this state.

A preferred return is a profit distribution preference whereby profits, either from operations, sale, or refinance, are distributed to one class of equity before another until a certain rate of return on the initial investment is reached.

Section 27 Any member of either House of the General Assembly shall have liberty to dissent from and protest against, any act or resolve which he may think injurious to the public or to any individual, and to have the reasons for his dissent entered on the journals.

Under Supreme Court case law, the Sixth Amendment right to counsel specifically requires that each and every adult who cannot afford to hire a lawyer at prevailing compensation rates in his jurisdiction must be given a qualified and trained lawyer.

Tenn. Code Ann. § 68-57-102(a) contains what is known as a ?grandfather clause.? A grandfather clause is ?an exception to a restriction that allows all those already doing something to continue to do it, even if they would be stopped by the new restriction.? Teague v. Campbell County, 920 S.W.

Article VII, Section 1 of the Tennessee Constitution now provides counties with the following constitutional officers: county executive, sheriff, trustee, register, county clerk, and assessor of property.