Tennessee Limited Liability Company (LLC) Agreement for New General Partner is a legal document that outlines the terms and conditions of the partnership between a new general partner and an existing LLC in the state of Tennessee. This agreement is crucial for establishing a clear understanding of the roles, responsibilities, and rights of the new general partner within the LLC structure. Keywords: Tennessee LLC, limited liability company agreement, new general partner, partnership, legal document, terms and conditions, roles, responsibilities, rights, LLC structure. There are various types of Tennessee Limited Liability Company LLC Agreement for a New General Partner. Some of them include: 1. General Partnership Agreement: This agreement defines the partnership relationship between the newly appointed general partner and the existing LLC. It outlines the duties of the general partner, profit-sharing arrangements, decision-making authority, and other relevant provisions. 2. Operating Agreement: This agreement sets out the operational guidelines for the new general partner and the LLC. It covers key aspects such as management structure, capital contributions, profit and loss distribution, voting rights, and dispute resolutions. 3. Articles of Organization: This is a foundational document that establishes the LLC as a legal entity. It includes essential information about the new general partner, the purpose of the LLC, the duration of the partnership, and the provision of limited liability protection. 4. Buy-Sell Agreement: In case the new general partner wishes to exit the LLC in the future, this agreement outlines the terms and conditions for the buyout or sale of their partnership interest. It includes valuation methodologies, buyout triggers, and the process for executing the transaction. 5. Amendment Agreement: This agreement is used if already existing Tennessee Limited Liability Company LLC Agreement needs to be modified to accommodate the addition of a new general partner. It outlines the specific changes to be made and must be executed to ensure legality and clarity in the partnership structure. By utilizing one or a combination of these agreements, the Tennessee Limited Liability Company LLC Agreement for New General Partner can be tailored to meet the specific needs and requirements of the new general partner and the existing LLC, providing a solid foundation for their partnership.

Tennessee Limited Liability Company LLC Agreement for New General Partner

Description

How to fill out Tennessee Limited Liability Company LLC Agreement For New General Partner?

Discovering the right authorized record design can be quite a have difficulties. Obviously, there are plenty of templates accessible on the Internet, but how will you get the authorized develop you need? Use the US Legal Forms web site. The service offers a huge number of templates, for example the Tennessee Limited Liability Company LLC Agreement for New General Partner, that can be used for company and personal needs. All of the forms are checked out by professionals and fulfill federal and state demands.

If you are already registered, log in for your accounts and then click the Acquire option to get the Tennessee Limited Liability Company LLC Agreement for New General Partner. Utilize your accounts to search through the authorized forms you possess bought formerly. Check out the My Forms tab of the accounts and obtain another duplicate from the record you need.

If you are a whole new consumer of US Legal Forms, allow me to share easy instructions that you can adhere to:

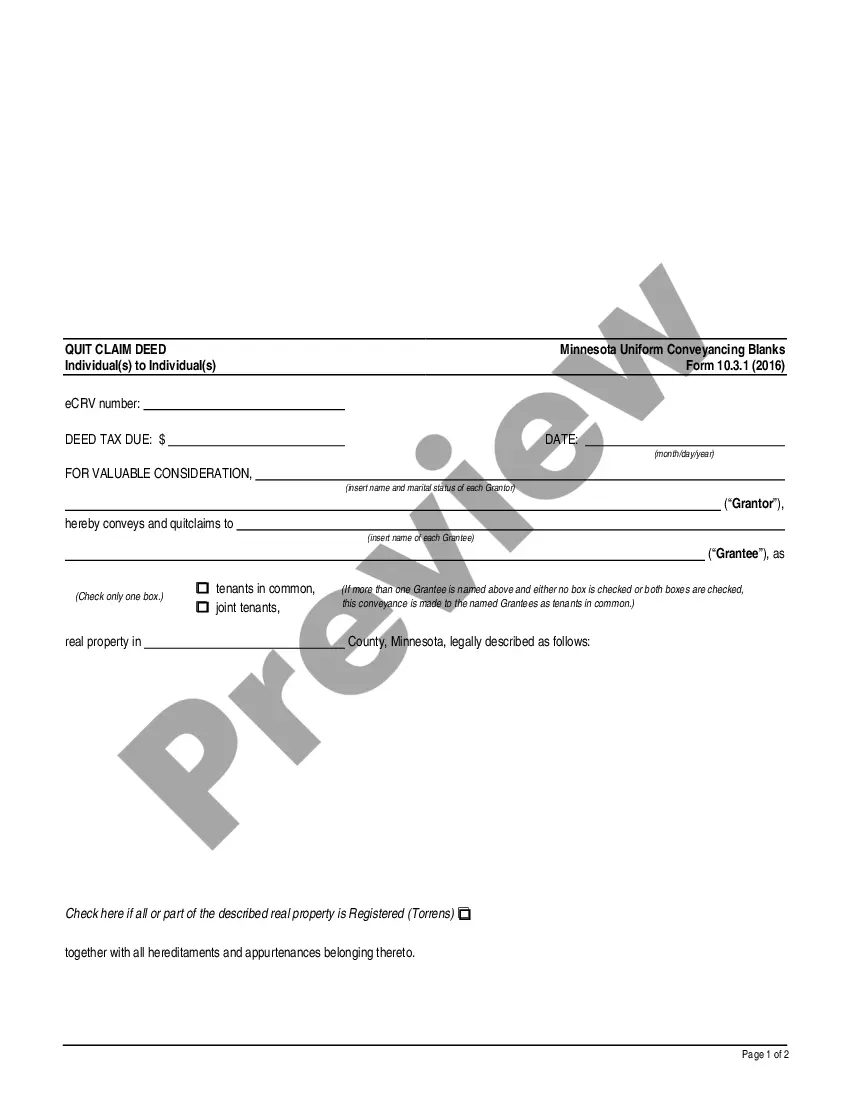

- Initial, make certain you have selected the appropriate develop for the area/area. You may look over the form while using Review option and read the form explanation to ensure this is the best for you.

- If the develop fails to fulfill your preferences, utilize the Seach area to get the proper develop.

- When you are certain that the form is acceptable, click on the Acquire now option to get the develop.

- Opt for the pricing prepare you need and enter the needed details. Create your accounts and pay for the transaction using your PayPal accounts or bank card.

- Select the document structure and down load the authorized record design for your device.

- Full, modify and print out and indication the obtained Tennessee Limited Liability Company LLC Agreement for New General Partner.

US Legal Forms is the largest library of authorized forms that you can see numerous record templates. Use the service to down load skillfully-produced papers that adhere to condition demands.

Form popularity

FAQ

How to form a Tennessee General Partnership ? Step by Step Step 1 ? Business Planning Stage. ... Step 2: Create a Partnership Agreement. ... Step 3 ? Name your Partnership and Obtain a DBA. ... Step 4 ? Get an EIN from the IRS. ... Step 5 ? Research license requirements. ... Step 6 ? Maintain your Partnership.

While there is no legal requirement for a partnership to put a partnership agreement in place, the majority do tend to use them to define specific details of their partnership, such as: Varying degrees of capital contributed. Profit (and loss) sharing.

Any corporation, limited partnership, limited liability company or business trust chartered/organized in Tennessee or doing business in this state must register with the secretary of state and file annual reports.

Yes. Any Tennessee business that use a name that that is not its legal business name will need to register a DBA, either with the state (LLCs, corporations, etc?), or in the county (sole proprietors and general partnerships) where they operate.

A General Partnership is a formal agreement between two or more people to operate a business together. The partners share the business assets, profits, and debts. Tennessee's Uniform Partnership Act (Title 61, Chapter 6 of the Tennessee Code) governs General Partnerships in the state.

Partnerships are unique business relationships that don't require a written agreement. However, it's always a good idea to have such a document.

Unlike the general partnership, a limited partnership cannot exist without a formal Certificate of Limited Partnership. This document is signed by each of the partners and is filed with the Secretary of State in Tennessee which has adopted the Revised Uniform Limited Partnership Act.

We'll walk you through it. Consult your Tennessee LLC operating agreement. ing to TN Code § 48-249-501, the members (owners) of an LLC get to decide whether and how they will admit new members. ... Amend your operating agreement. ... Issue membership certificates. ... Contact the IRS. ... File your Tennessee annual report.