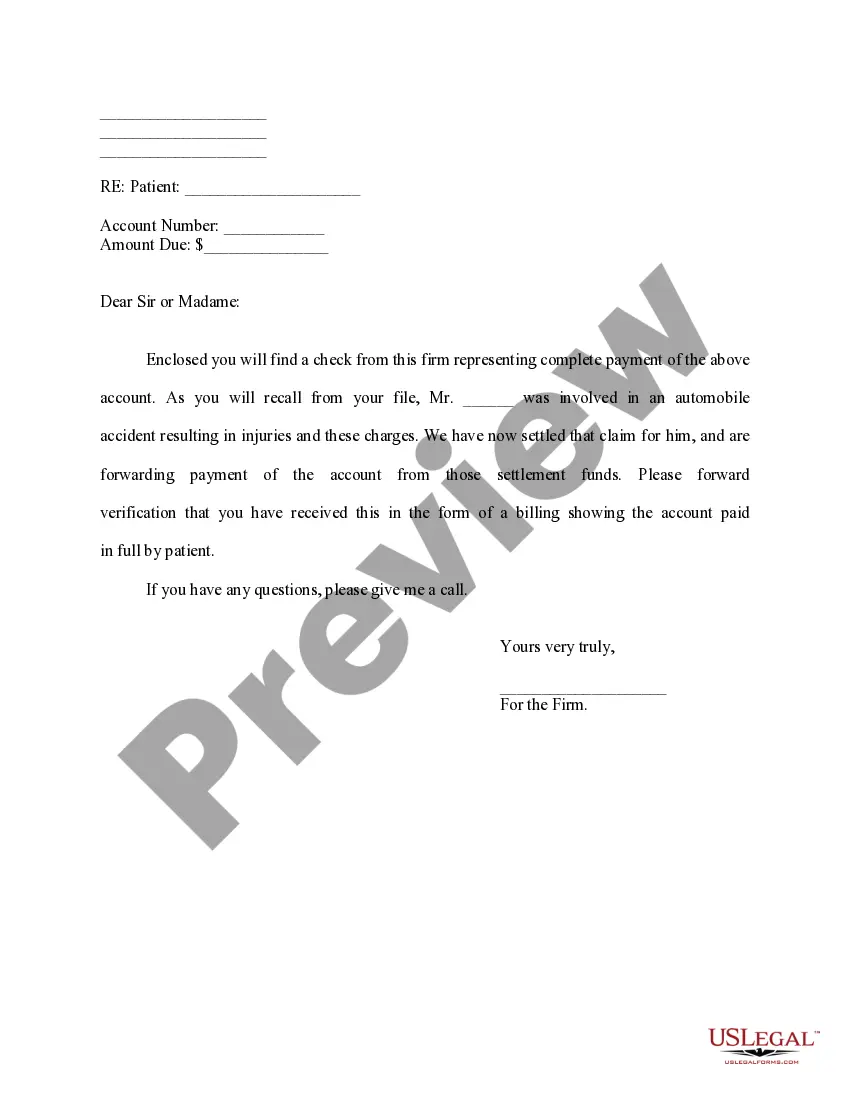

Tennessee Letter regarding Wage Statement

Description

How to fill out Letter Regarding Wage Statement?

US Legal Forms - one of several biggest libraries of legitimate kinds in America - provides a wide array of legitimate file themes it is possible to obtain or produce. Making use of the website, you can get thousands of kinds for organization and personal reasons, categorized by categories, states, or keywords and phrases.You will discover the most recent versions of kinds much like the Tennessee Letter regarding Wage Statement within minutes.

If you have a membership, log in and obtain Tennessee Letter regarding Wage Statement in the US Legal Forms catalogue. The Acquire key will show up on each and every kind you perspective. You get access to all earlier acquired kinds in the My Forms tab of your accounts.

If you would like use US Legal Forms for the first time, listed here are straightforward recommendations to obtain started off:

- Make sure you have picked out the right kind to your town/area. Click the Review key to analyze the form`s articles. Browse the kind description to actually have chosen the correct kind.

- If the kind doesn`t fit your needs, utilize the Look for discipline on top of the display screen to discover the one that does.

- In case you are content with the form, affirm your option by clicking on the Get now key. Then, opt for the pricing plan you favor and offer your references to sign up for an accounts.

- Approach the deal. Make use of your credit card or PayPal accounts to finish the deal.

- Pick the file format and obtain the form on your own device.

- Make modifications. Complete, change and produce and signal the acquired Tennessee Letter regarding Wage Statement.

Every single web template you added to your account lacks an expiry day and is the one you have forever. So, in order to obtain or produce one more backup, just proceed to the My Forms area and click on the kind you will need.

Gain access to the Tennessee Letter regarding Wage Statement with US Legal Forms, the most substantial catalogue of legitimate file themes. Use thousands of professional and express-distinct themes that fulfill your company or personal requires and needs.

Form popularity

FAQ

Employers who fail to pay minimum wage or overtime, refuse to pay for all hours worked, or misclassify employees are engaging in wage theft. The Fair Labor Standards Act (FLSA) prohibits this behavior and empowers employees with the tools they need to fight back.

The Premium Report contains fields for reporting the number of workers who were on an employer's payroll during the first, second, and third months of the quarter. Employers must report all full-time and part-time employees who worked during or received pay for the payroll period that included the 12th of the month.

In Tennessee you are generally going to be able to draw unemployment compensation unless you (a) are unable to work, (b) voluntarily quit or (c) did something to cause yourself to get fired. These are what are known as disqualifying events. The statute setting these out can be found here.

Tax rates range from 0.01% to 2.3% for positive-rated employers and from 5% to 10% for negative-rated employers. Tennessee is the only state to determine experienced employer unemployment tax rates on a semiannual basis. The standard unemployment tax rate for new employers is 2.7% for fiscal year 2023, ...

(4) For purposes of subdivision (a)(11), ?wages in lieu of notice? means wages paid under circumstances where the employer, not having given an advance notice of separation to the employee, and irrespective of the length of service of the employee, makes a payment to the employee equivalent to the wages the employee ...

In practical terms, this means workers have the right to: Discuss wages, benefits, and working conditions. Circulate a petition for better hours and pay. Discuss ongoing workplace investigation (absent a legitimate business reason)

Unemployment insurance tax If you are responsible for paying these taxes, the Department of Labor and Workforce Development will assign you a Tennessee unemployment eight-digit employer account number, with new employers paying a flat rate of 2.7%.

GENERAL INFORMATION AND INSTRUCTIONS Quarterly Premium and Wage reports (Forms LB-0456 and LB-0851) are required from all employers covered under Tennessee's Unemployment Insurance (UI) law. They must be submitted with the appropriate payment by the date due, even if no wages were paid this quarter.