Tennessee Estate Planning Questionnaire and Worksheets

What this document covers

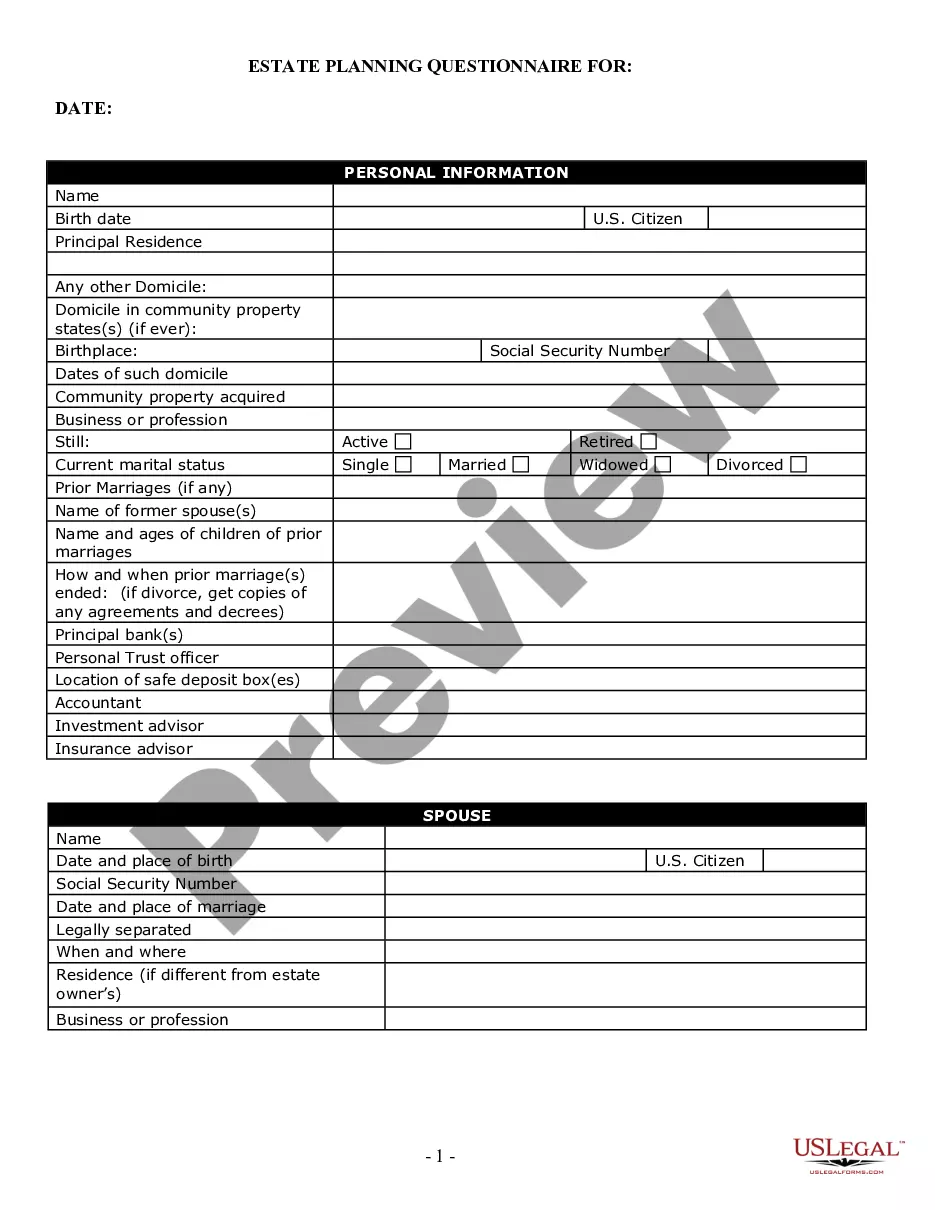

The Estate Planning Questionnaire and Worksheets is a comprehensive tool designed to help individuals gather and organize relevant information about their estate. This form includes detailed questions regarding personal and financial details, making it ideal for client interviews or for individuals to assess their overall financial situation to facilitate effective estate planning. Unlike other estate planning forms, this questionnaire focuses on collecting essential information rather than making legal declarations or decisions.

Key components of this form

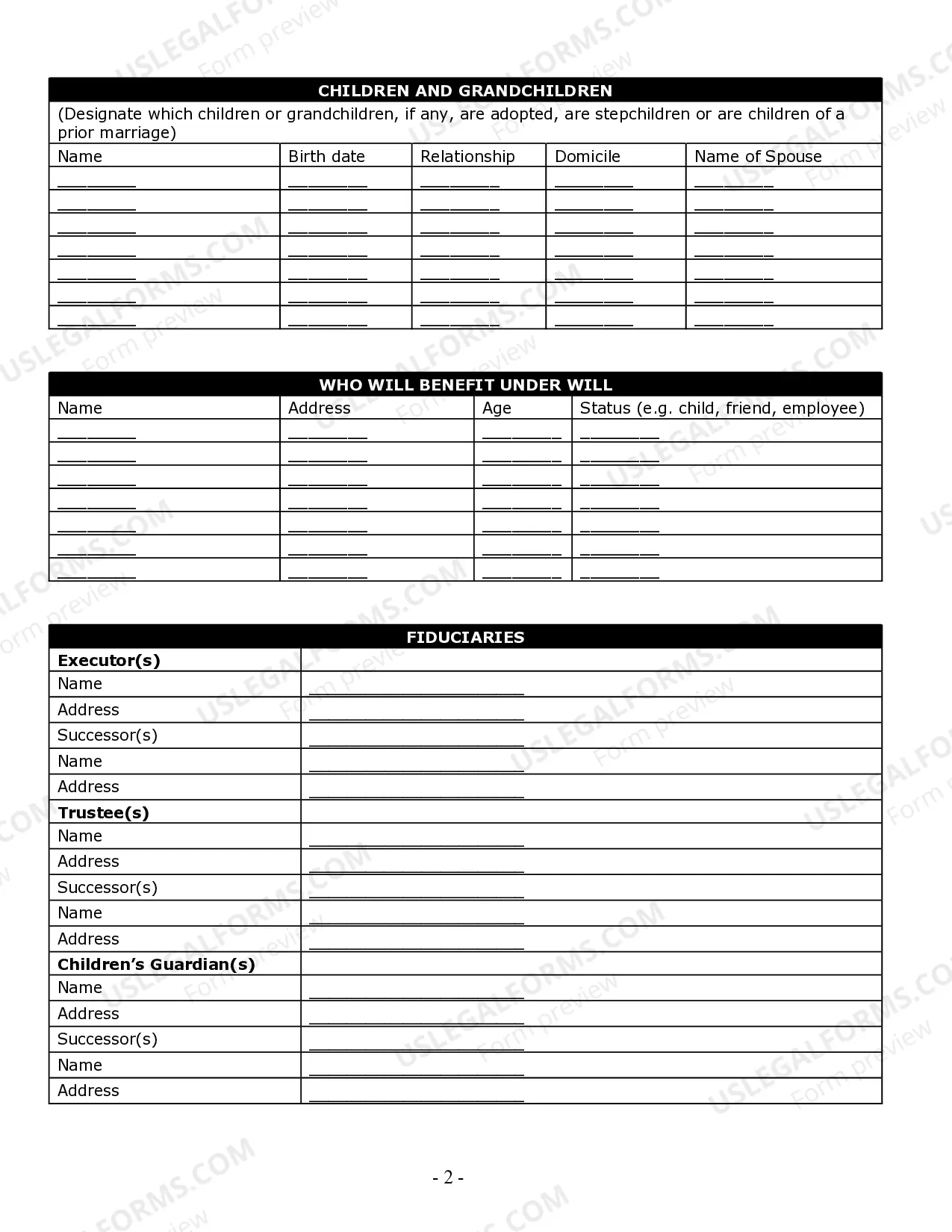

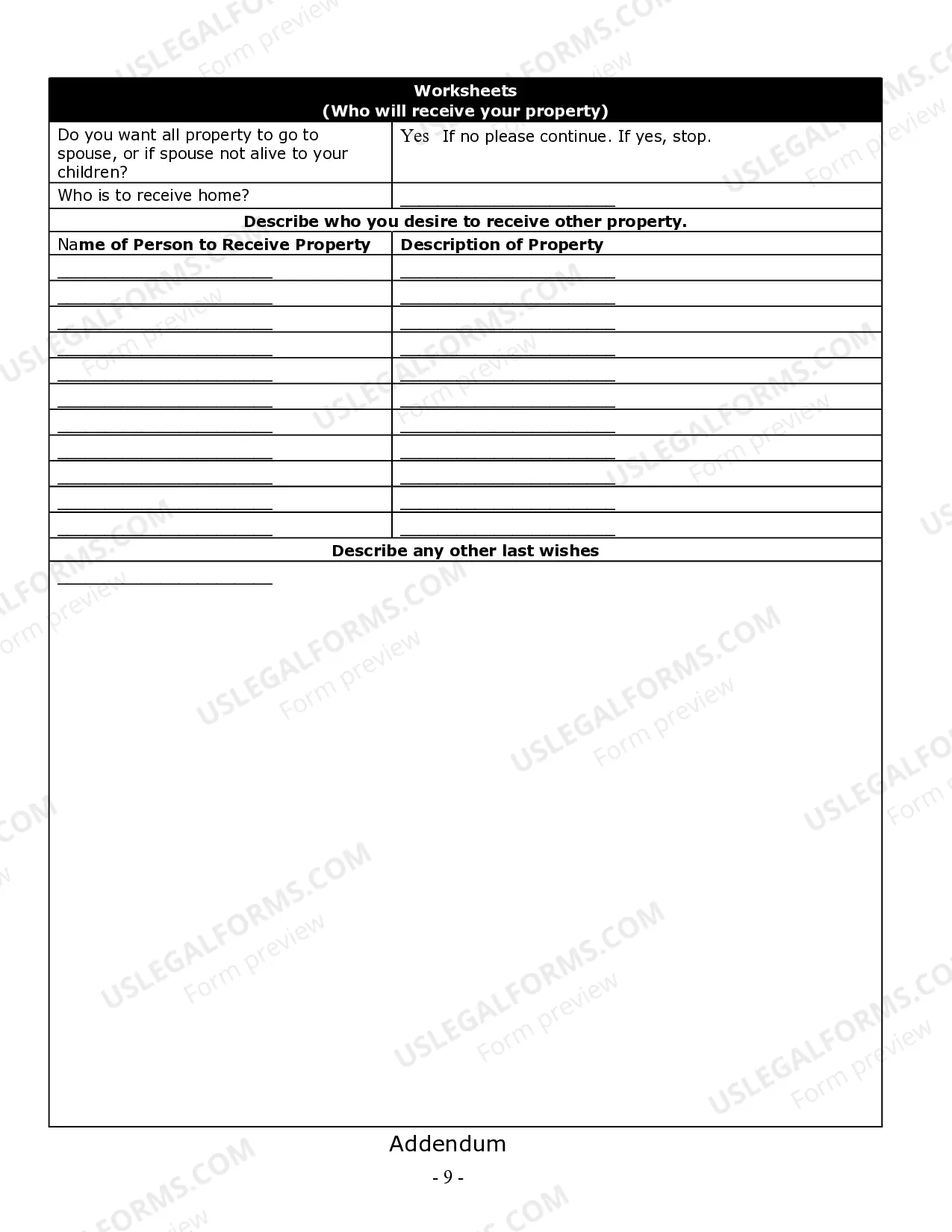

- Personal information section for family and beneficiaries.

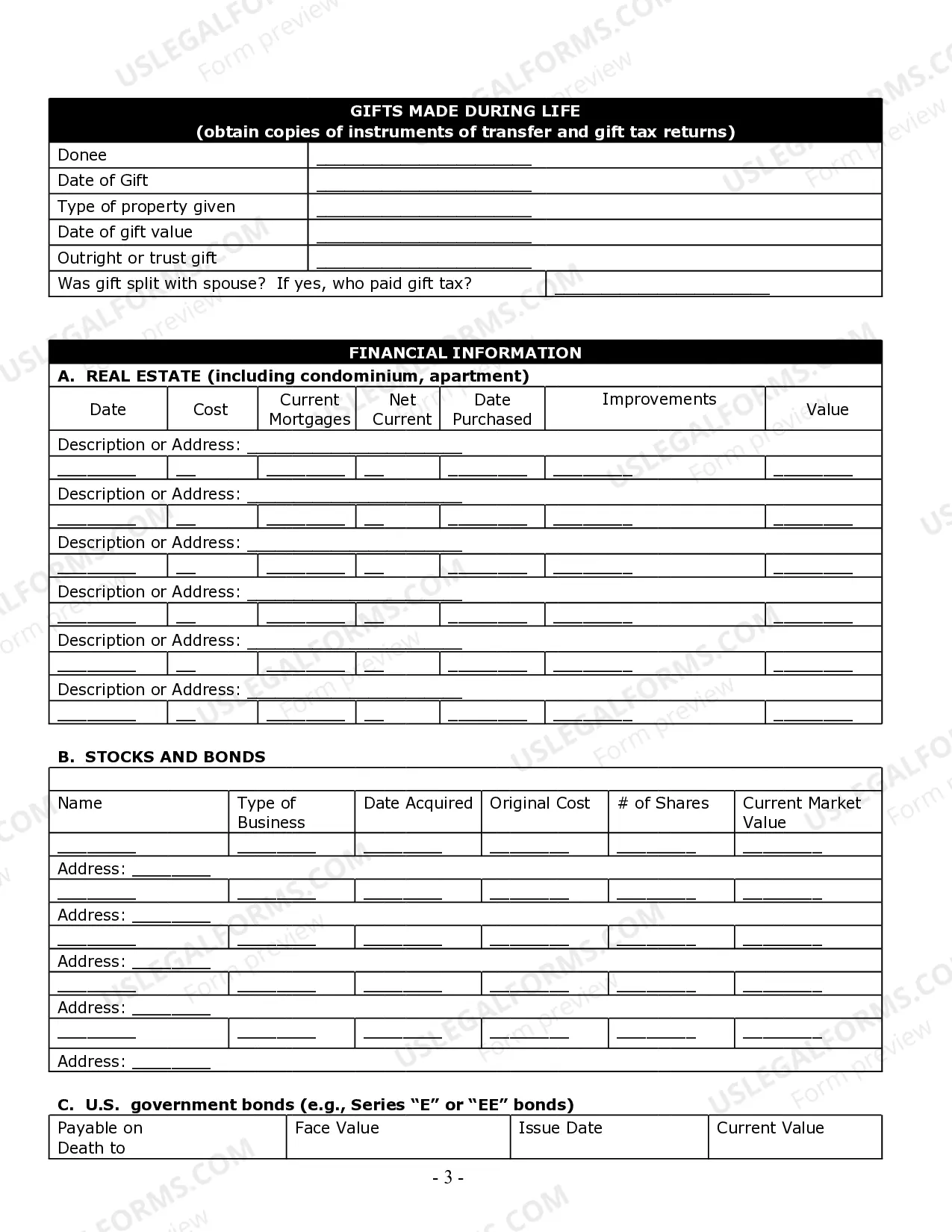

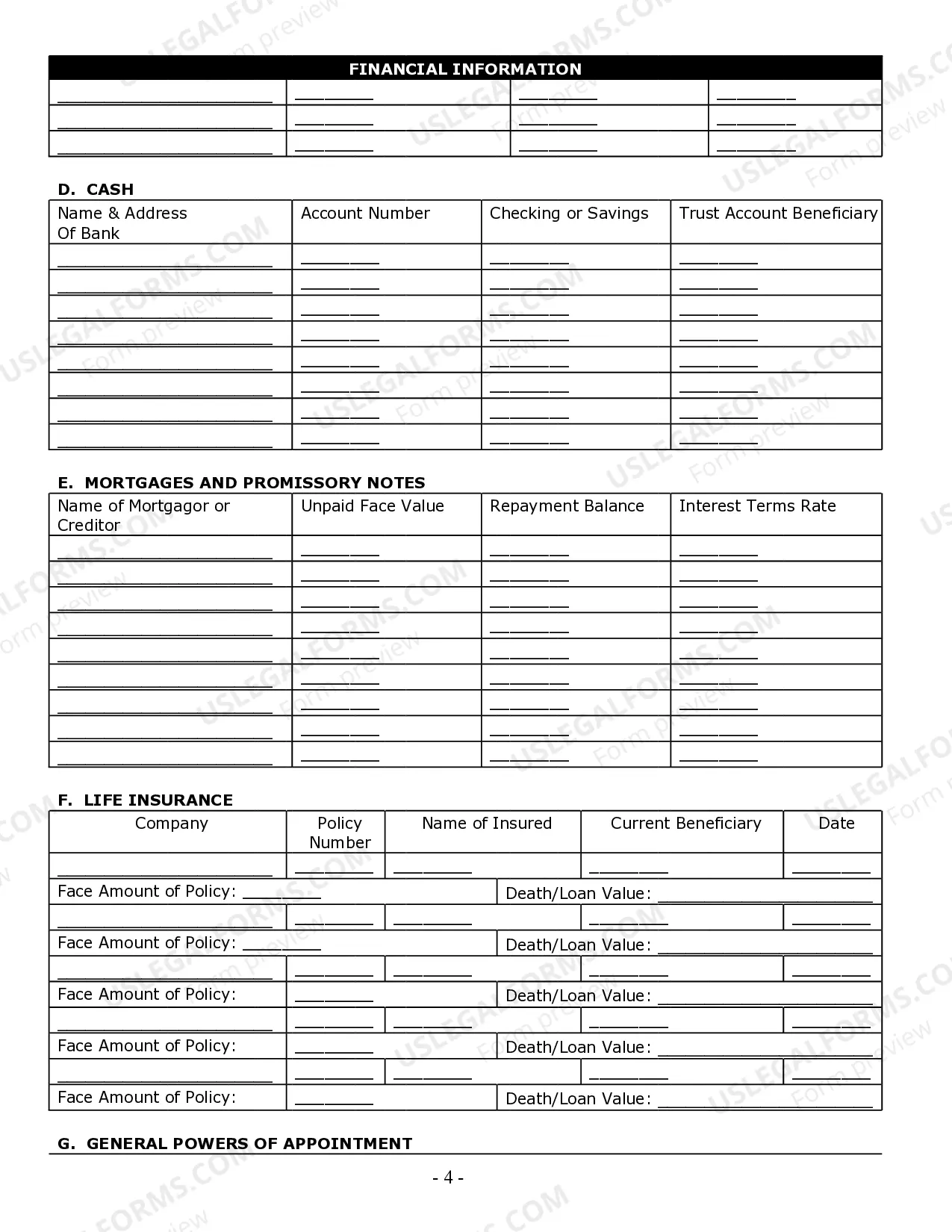

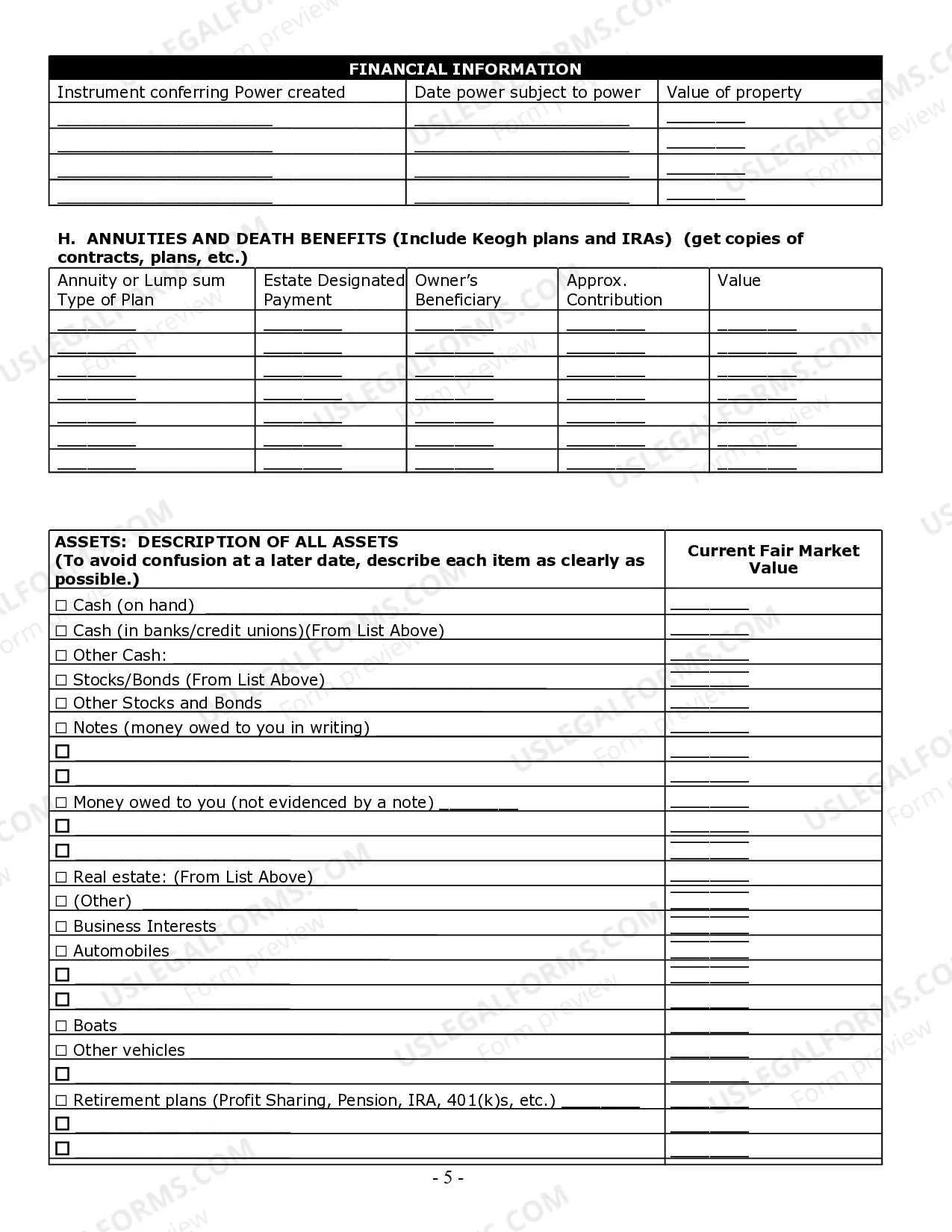

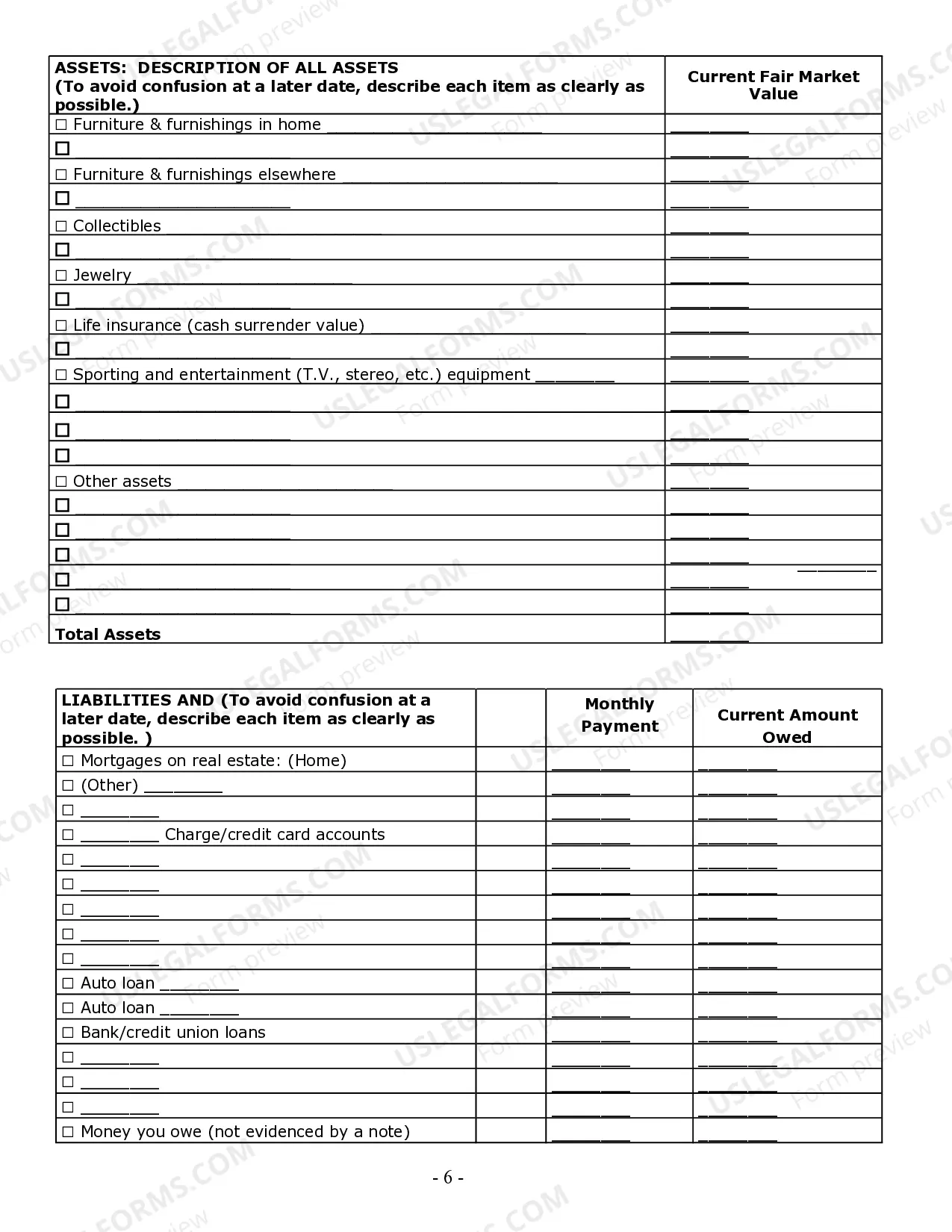

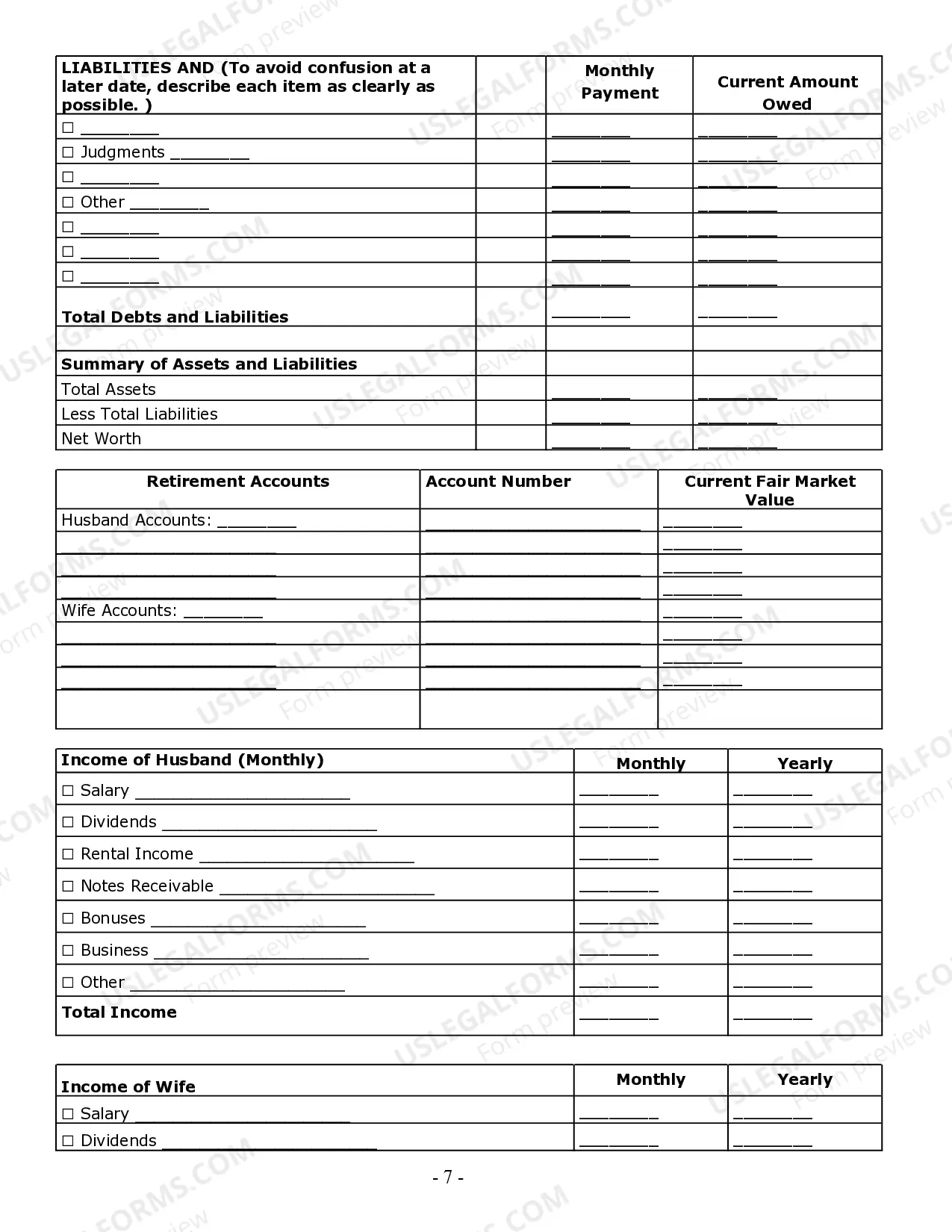

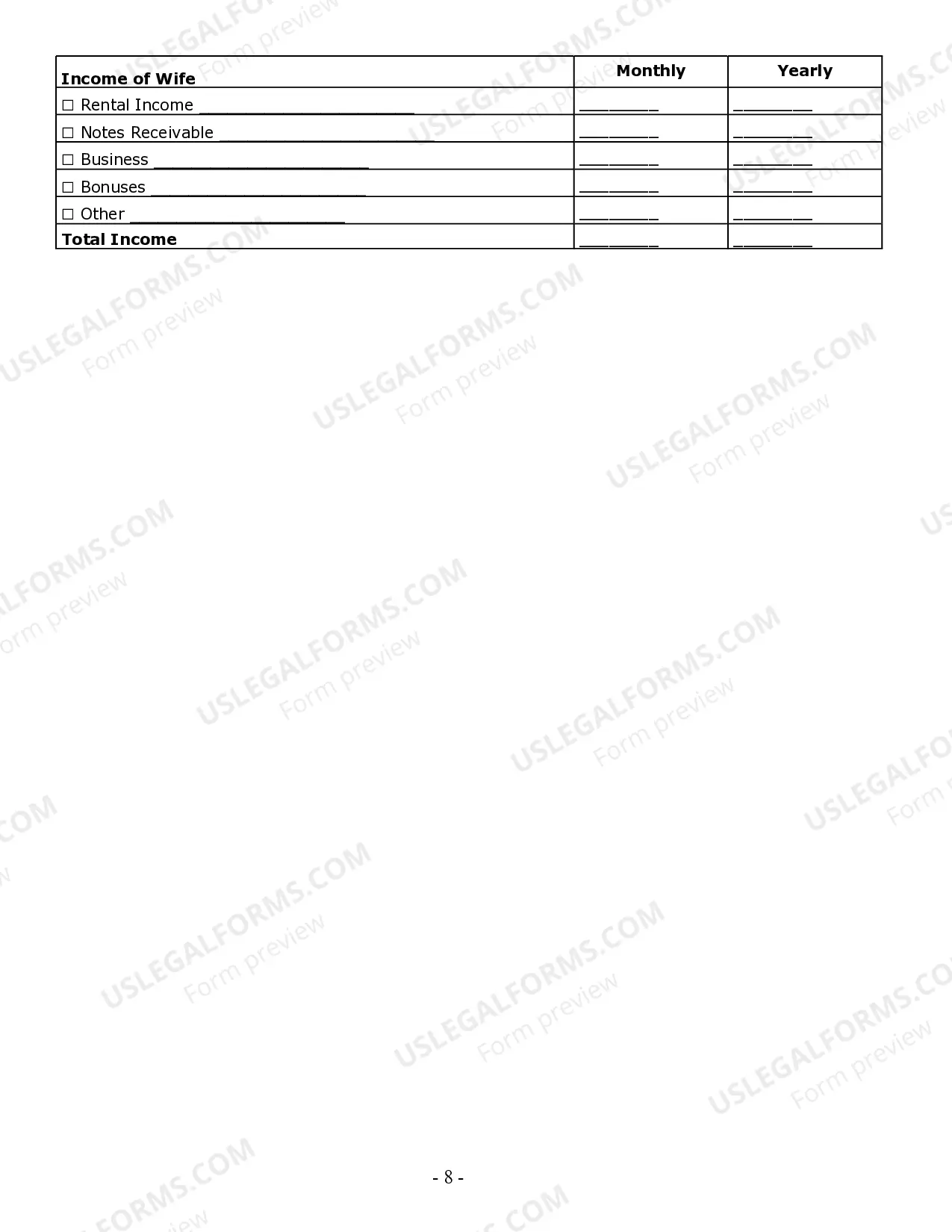

- Financial overview for assets, debts, and income sources.

- Questions regarding healthcare wishes and power of attorney designations.

- Components for capturing funeral and burial preferences.

- Space for notes and additional considerations related to estate planning.

When this form is needed

This form is useful when you are preparing for estate planning discussions, whether you are an individual creating or updating your estate plan or a legal professional conducting client interviews. It helps clarify your financial situation and intentions regarding asset distribution, medical decisions, and personal wishes after death.

Who this form is for

This form is intended for:

- Individuals planning their estate.

- Clients meeting with estate planning attorneys.

- Family members assisting a loved one in organizing estate affairs.

- Anyone wanting to evaluate their financial circumstances for estate planning purposes.

Completing this form step by step

- Begin by entering your personal information, including your name and contact details.

- List all financial assets, such as real estate, bank accounts, and investments.

- Detail any existing debts and financial obligations.

- Answer questions concerning your medical and funeral preferences.

- Review your answers for completeness before finalizing the form.

Notarization requirements for this form

This form usually doesn’t need to be notarized. However, local laws or specific transactions may require it. Our online notarization service, powered by Notarize, lets you complete it remotely through a secure video session, available 24/7.

Avoid these common issues

- Failing to include all financial assets and liabilities.

- Not discussing personal preferences with family members ahead of time.

- Overlooking important healthcare decisions.

Benefits of using this form online

- Convenience of accessing and filling out the form at your own pace.

- Editable format allows for easy updates as your financial situation changes.

- Reliable resource drafted by licensed attorneys to ensure legal soundness.

Quick recap

- The Estate Planning Questionnaire is essential for organizing estate-related information.

- Complete the form thoroughly for effective planning and discussions.

- Utilizing this form online provides convenience and editable features.

Form popularity

FAQ

A Last Will and Testament. When it comes to estate planning, having a last will and testament is likely the first thing that will come to mind. A Document Granting Power of Attorney. An Advance Medical Directive. Revocable Living Trust.

Creating an estate plan is a lot like getting into better shape. Step 1: Sign a will. Step 2: Name beneficiaries. Step 3: Dodge estate taxes. Step 4: Leave a letter. Step 5: Draw up a durable power of attorney. Step 6: Create an advance health care directive.

Liquidity. This refers to assets that can be easily converted into cash, with minimum impact on the price. Sentiment. These are assets that have sentimental value, like personal properties and vacation homes. Tax Planning. Taxes come into play in estate planning as well, adding complications and expenses.

There are four main elements of an estate plan; these include a will, a living will and healthcare power of attorney, a financial power of attorney, and a trust.

More Than a Last Will. Itemize Your Inventory. Follow with Non-Physical Assets. Assemble a List of Debts. Make a Memberships List. Make Copies of Your Lists. Review Your Retirement Account. Update Your Insurance.

Estate planning is all about protecting your loved ones, which means in part giving them protection from the Internal Revenue Service (IRS). Essential to estate planning is transferring assets to heirs with an eye toward creating the smallest possible tax burden for them.

Proposal, directives, power of attorney, trusts.

Generally, yes. The Tennessee statute on Wills recognizes the validity of holographic or handwritten Wills. T.C.A. § 32-1-105.

For the vast majority of individuals, my cost to prepare an estate package including a Will, Power of Attorney, Healthcare Power of Attorney and Living is a flat rate of $450.00. I charge this same flat rate for both single individuals and married couples.