This form is designed for use between Site Work Contractors and Property Owners and may be executed with either a cost plus or fixed fee payment arrangement. This contract addresses such matters as change orders, work site information, warranty and insurance. This form was specifically drafted to comply with the laws of the State of Texas.

Texas Site Work Contract for Contractor

Description

How to fill out Texas Site Work Contract For Contractor?

Get access to quality Texas Site Work Contract for Contractor samples online with US Legal Forms. Avoid hours of wasted time looking the internet and dropped money on forms that aren’t updated. US Legal Forms offers you a solution to exactly that. Find above 85,000 state-specific legal and tax templates you can download and fill out in clicks in the Forms library.

To receive the example, log in to your account and click Download. The file is going to be saved in two places: on your device and in the My Forms folder.

For individuals who don’t have a subscription yet, take a look at our how-guide below to make getting started easier:

- Verify that the Texas Site Work Contract for Contractor you’re looking at is suitable for your state.

- See the form making use of the Preview option and read its description.

- Visit the subscription page by simply clicking Buy Now.

- Select the subscription plan to continue on to sign up.

- Pay by card or PayPal to finish creating an account.

- Choose a preferred file format to save the document (.pdf or .docx).

You can now open the Texas Site Work Contract for Contractor sample and fill it out online or print it and get it done yourself. Think about giving the file to your legal counsel to be certain everything is filled in appropriately. If you make a error, print and complete sample once again (once you’ve registered an account all documents you save is reusable). Make your US Legal Forms account now and get access to far more templates.

Form popularity

FAQ

Terms. This is the first section of any agreement or contract and states the names and locations of the parties involved. Responsibilities & Deliverables. Payment-Related Details. Confidentiality Clause. Contract Termination. Choice of Law.

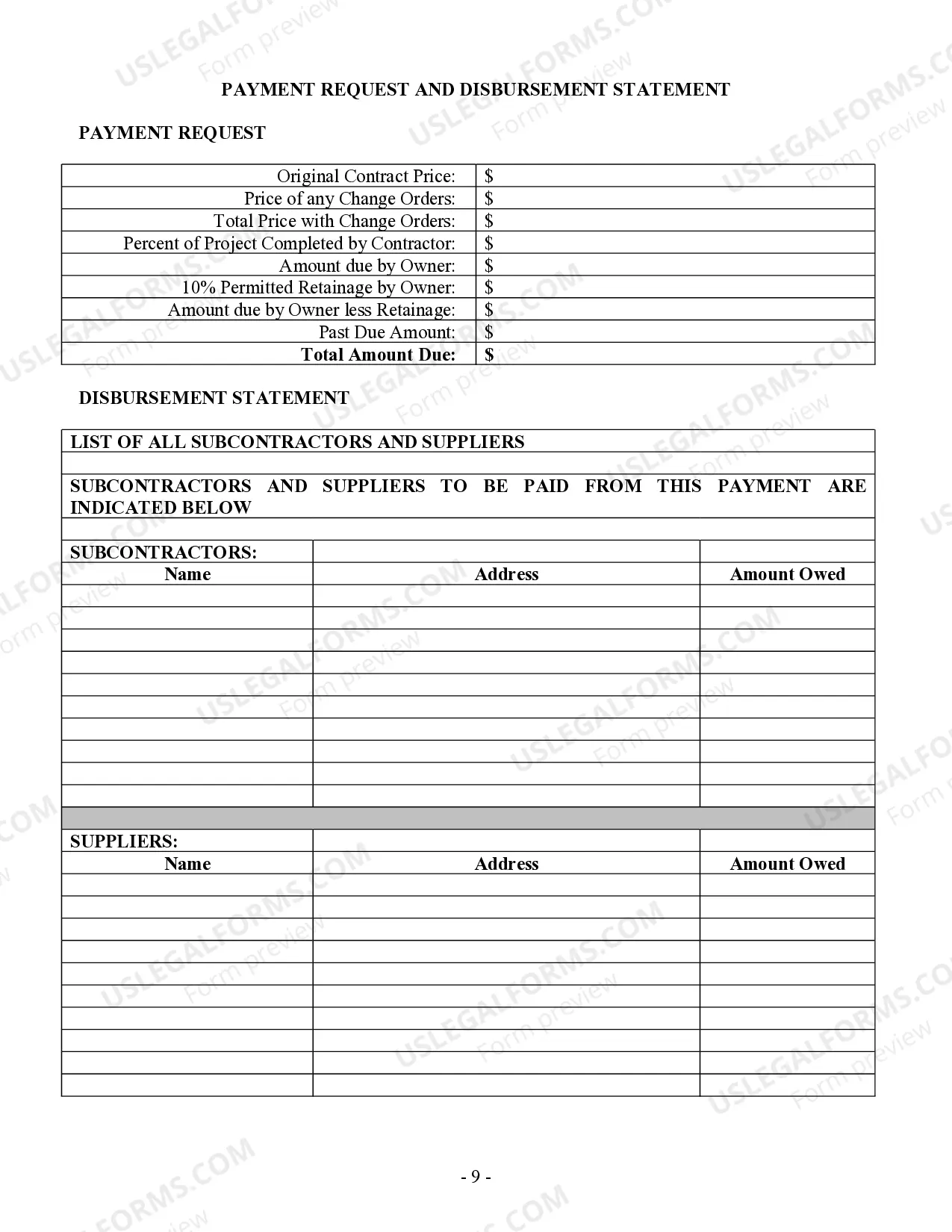

Typically, pay no more than 1/3rd up front. completed 1/3rd of the job. to your satisfaction. Don't sign your insurance check over to a contractor.

Identifying/Contact Information. Title and Description of the Project. Projected Timeline and Completion Date. Cost Estimate and Payment Schedule. Stop Work Clause and Stop Payment Clause. Act of God Clause. Change Order Agreement. Warranty.

You shouldn't pay more than 10 percent of the estimated contract price upfront, according to the Contractors State License Board.

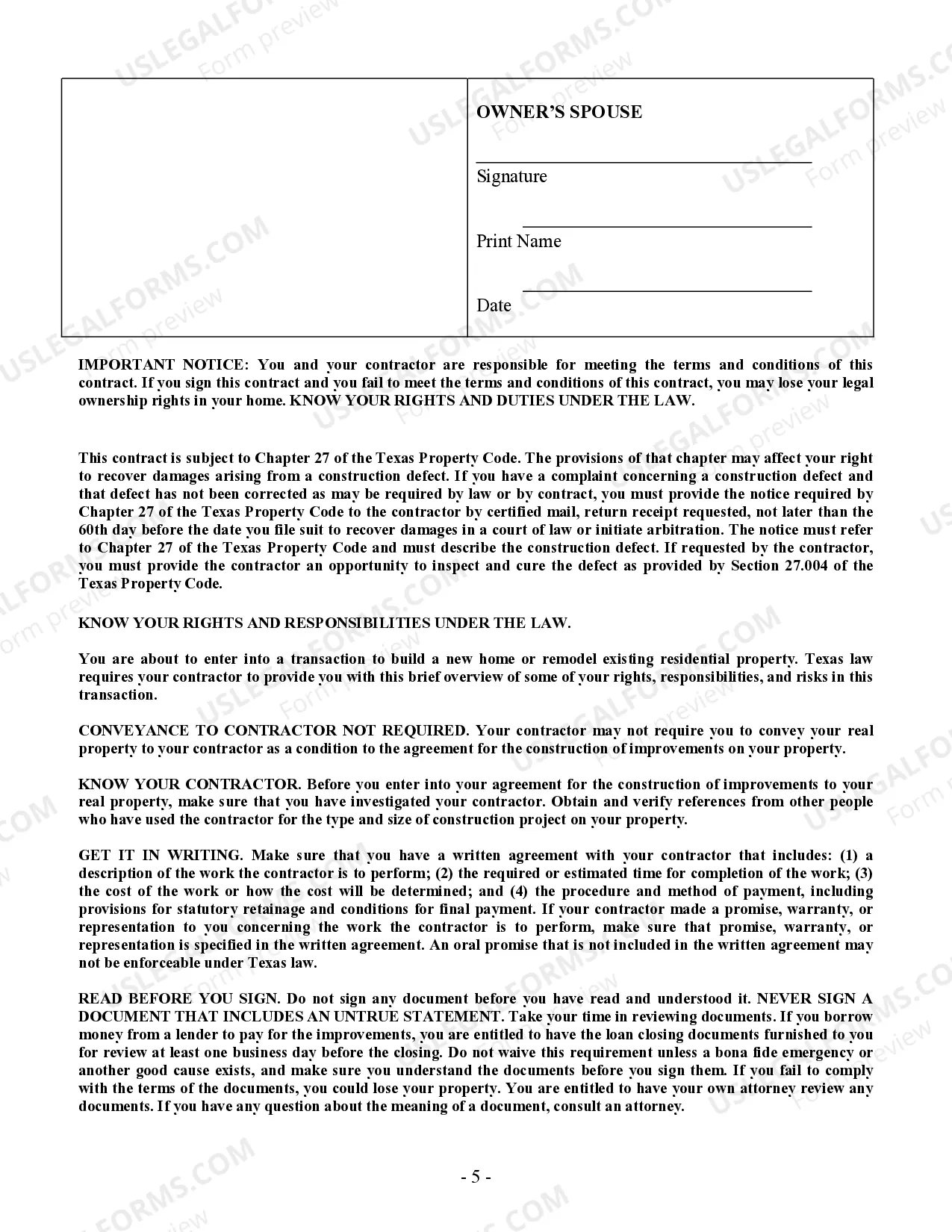

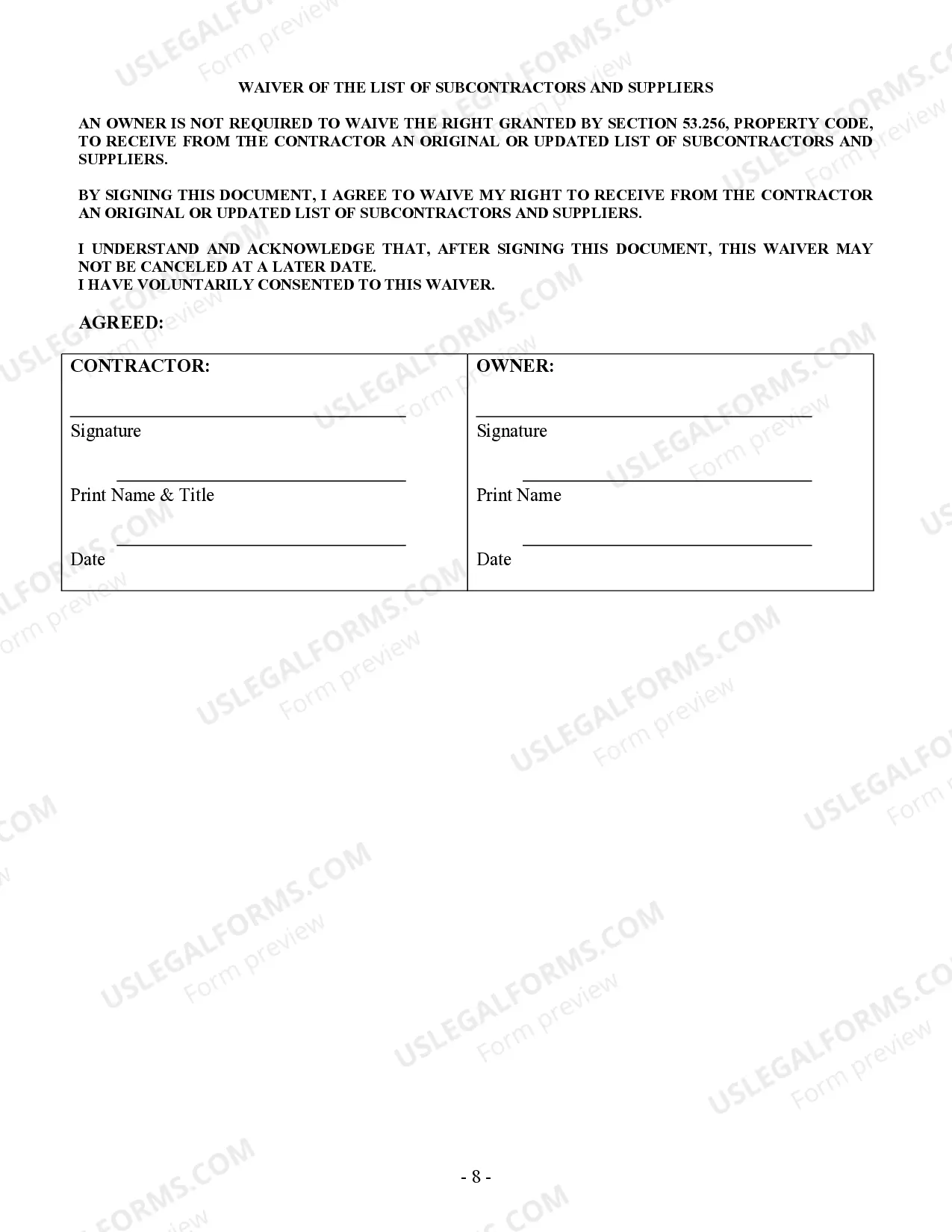

Both parties should sign the contract, and both should be bound by the terms and conditions spelled out in the agreement. In general that means the contractor will be obliged to provide specified materials and to perform certain services for you. In turn, you will be required to pay for those goods and that labor.

For most types of projects you hire an independent contractor (IC) to do, the law does not require you to put anything in writing. You can meet with the IC, agree on the terms of your arrangement, and have an oral contract or agreement that is legally binding. Just because you can doesn't mean you should, however.

For most types of projects you hire an independent contractor (IC) to do, the law does not require you to put anything in writing. You can meet with the IC, agree on the terms of your arrangement, and have an oral contract or agreement that is legally binding. Just because you can doesn't mean you should, however.

When working as an independent contractor, your client does not have the right to control your project.According to the Communications Workers of America, Under the Copyright Act of 1976, an independent contractor who has created a work for an employer owns the rights to that work, except in limited circumstances.

1. Not Having a Written Contract.The taxing, labor and employment, and insurance authorities expect a written contract that states that the worker is an independent contractor and will be paid as such with no tax withholding, no benefits, etc.