Texas Contract for Deed related forms. This is the Notice of Default form used when the Buyer has paid 40% of the principal of the contract or made a total of 48 or more payments. This form complies with the Texas law, and deal with matters related to Contract for Deed.

Texas Contract for Deed Notice of Default When 40% of Loan Paid or 48 Payments Made

Description Contract When Loan

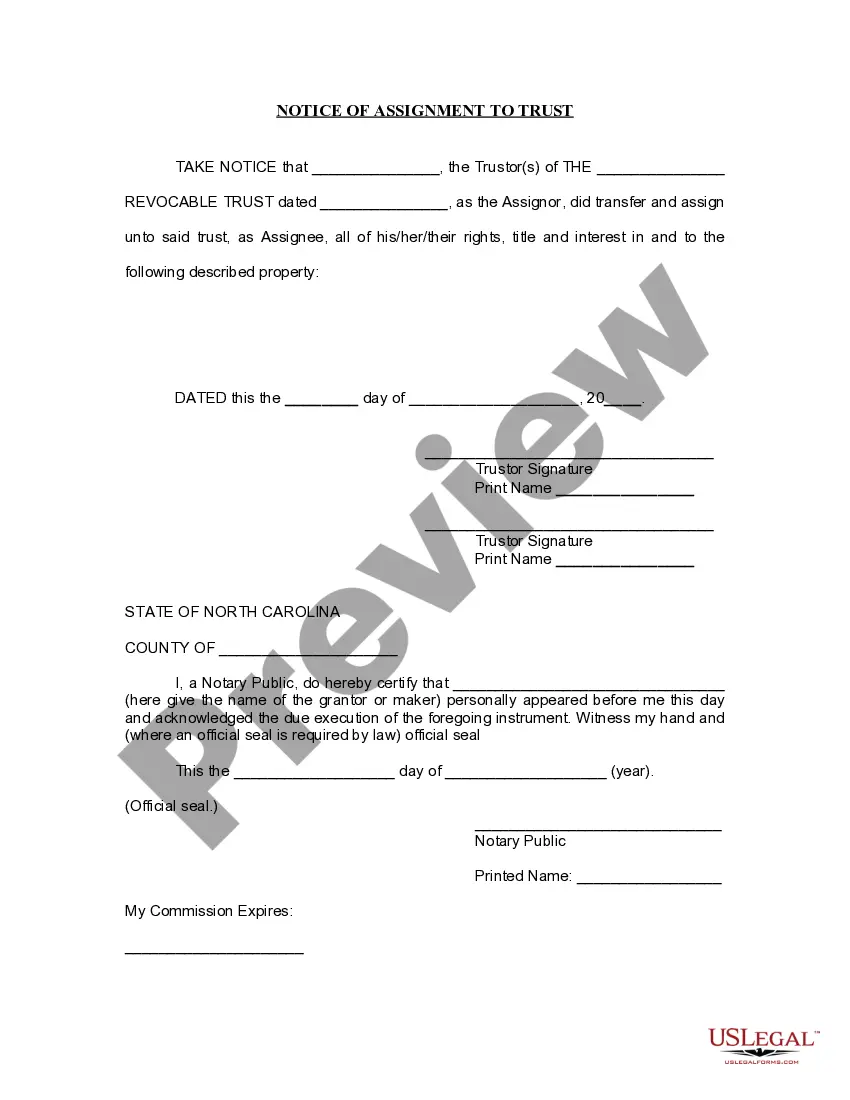

How to fill out Deed When Loan?

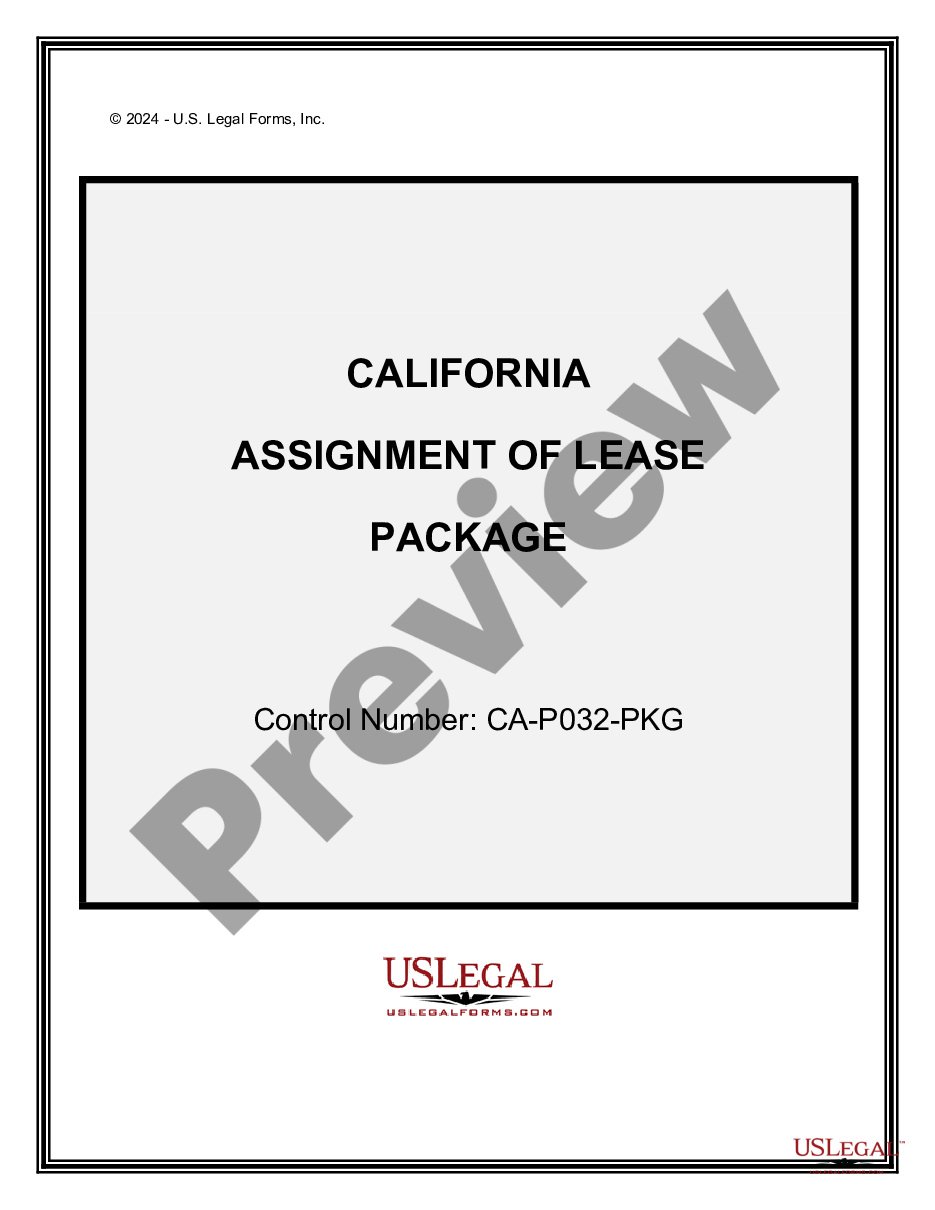

Get access to high quality Texas Contract for Deed Notice of Default When 40% of Loan Paid or 48 Payments Made templates online with US Legal Forms. Prevent hours of lost time browsing the internet and lost money on documents that aren’t up-to-date. US Legal Forms offers you a solution to just that. Get over 85,000 state-specific authorized and tax templates that you could download and fill out in clicks in the Forms library.

To find the sample, log in to your account and click on Download button. The file will be saved in two places: on your device and in the My Forms folder.

For people who don’t have a subscription yet, have a look at our how-guide below to make getting started simpler:

- Verify that the Texas Contract for Deed Notice of Default When 40% of Loan Paid or 48 Payments Made you’re considering is suitable for your state.

- View the form making use of the Preview function and browse its description.

- Check out the subscription page by simply clicking Buy Now.

- Select the subscription plan to keep on to register.

- Pay by card or PayPal to complete creating an account.

- Select a preferred file format to download the document (.pdf or .docx).

You can now open up the Texas Contract for Deed Notice of Default When 40% of Loan Paid or 48 Payments Made template and fill it out online or print it out and get it done yourself. Take into account sending the document to your legal counsel to ensure all things are completed appropriately. If you make a error, print out and fill sample again (once you’ve created an account every document you save is reusable). Make your US Legal Forms account now and get access to more forms.

Notice Default Payments Form popularity

Deed Paid Payments Other Form Names

Tx Deed Notice FAQ

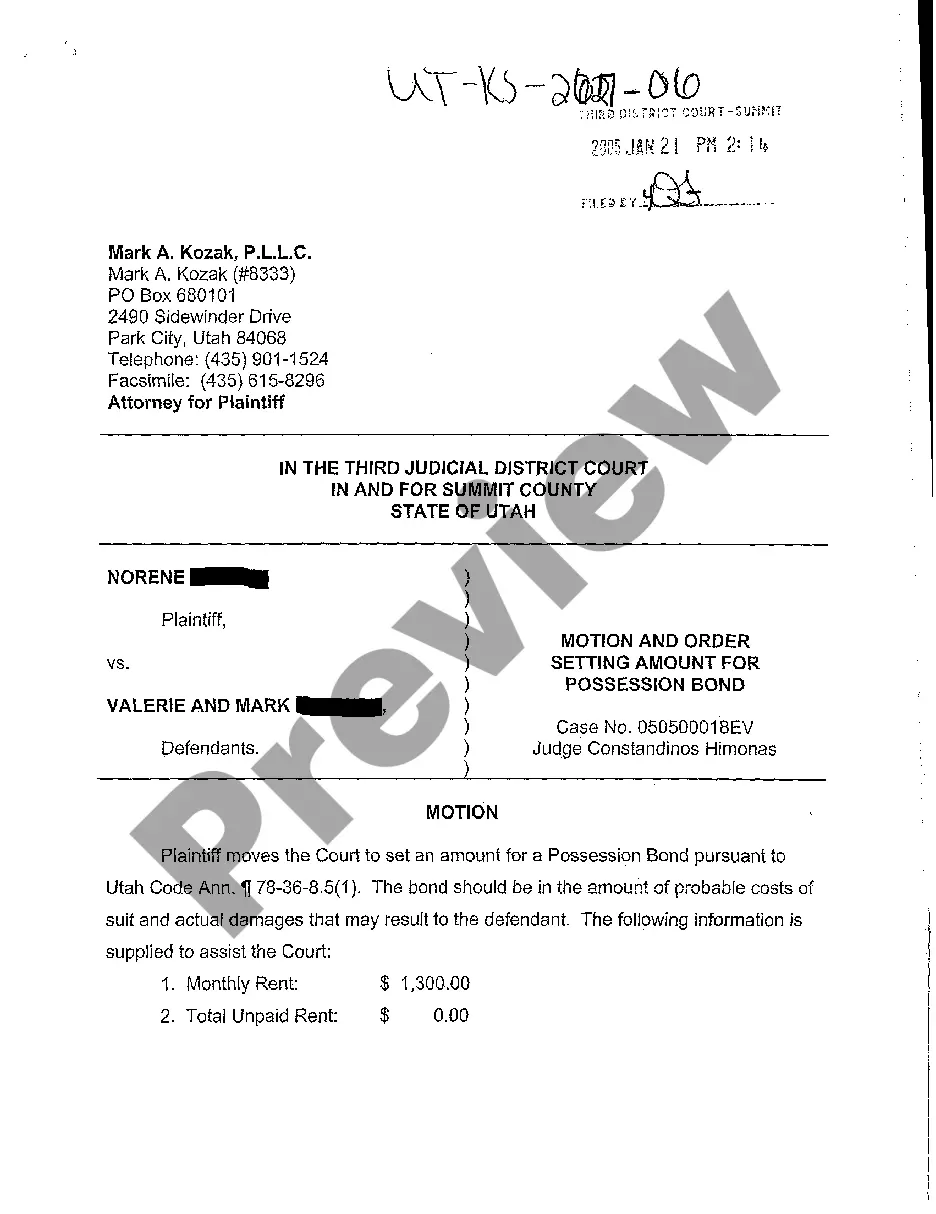

The buyer must record the contract for deed with the county recorder where the land is located within four months after the contract is signed. Contracts for deed must provide the legal name of the buyer and the buyer's address.

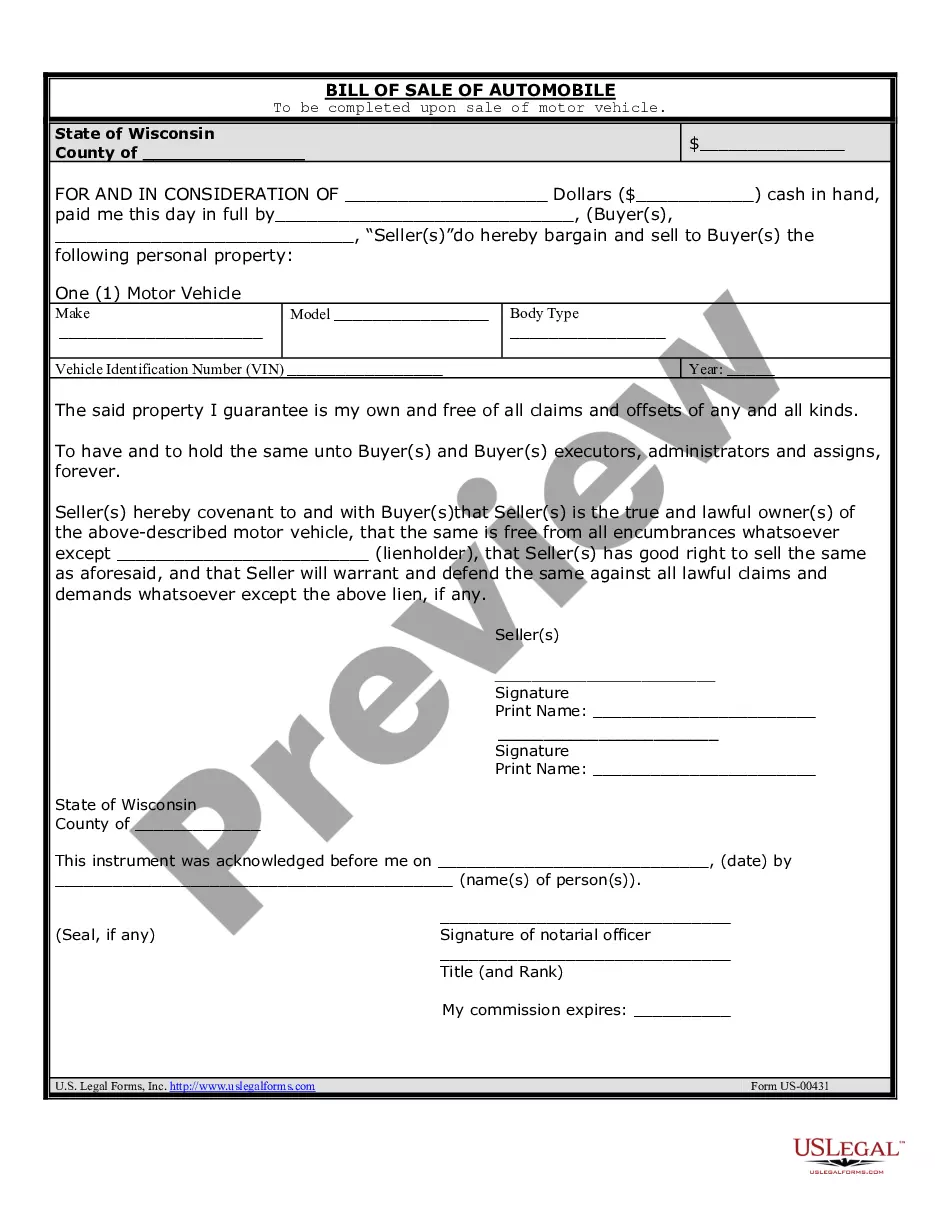

Generally, contract for deed sellers use IRS Form 6252 to report installment sales in the year in which they take place. You also use Form 6252 during each year you receive income from your contract for deed.

The buyer should record the contract for deed with the county recorder where the land is located and does so normally within four months after the contract is signed, though the time may vary depending on state law.

In the first instance, if your deed is not recorded, there is nothing in the public record to stop the seller from conveying the property to another person.The second situation could happen if your seller fails to pay his or her debts and the seller's creditors file liens or judgments against your property.

A contract for deed is a different form of seller-finance. In a contract for deed, the seller keeps the title to the property and the buyer does not receive a deed to the property.In Texas, contracts for deed on residential property are considered potentially predatory and subject to strict consumer-protection laws.

This means that if you default and can?t make your payments, you lose the property and all of the money you have already paid into it (often including repairs and improvements). Unlike a traditional mortgage, a defaulting buyer in a contact for deed may only have 30-60 days to cure the default or move out.

Purchase price. Down payment. Interest rate. Number of monthly installments. Responsibilities of the buyer and seller. Legal remedies for the seller if the buyer does not make payments.