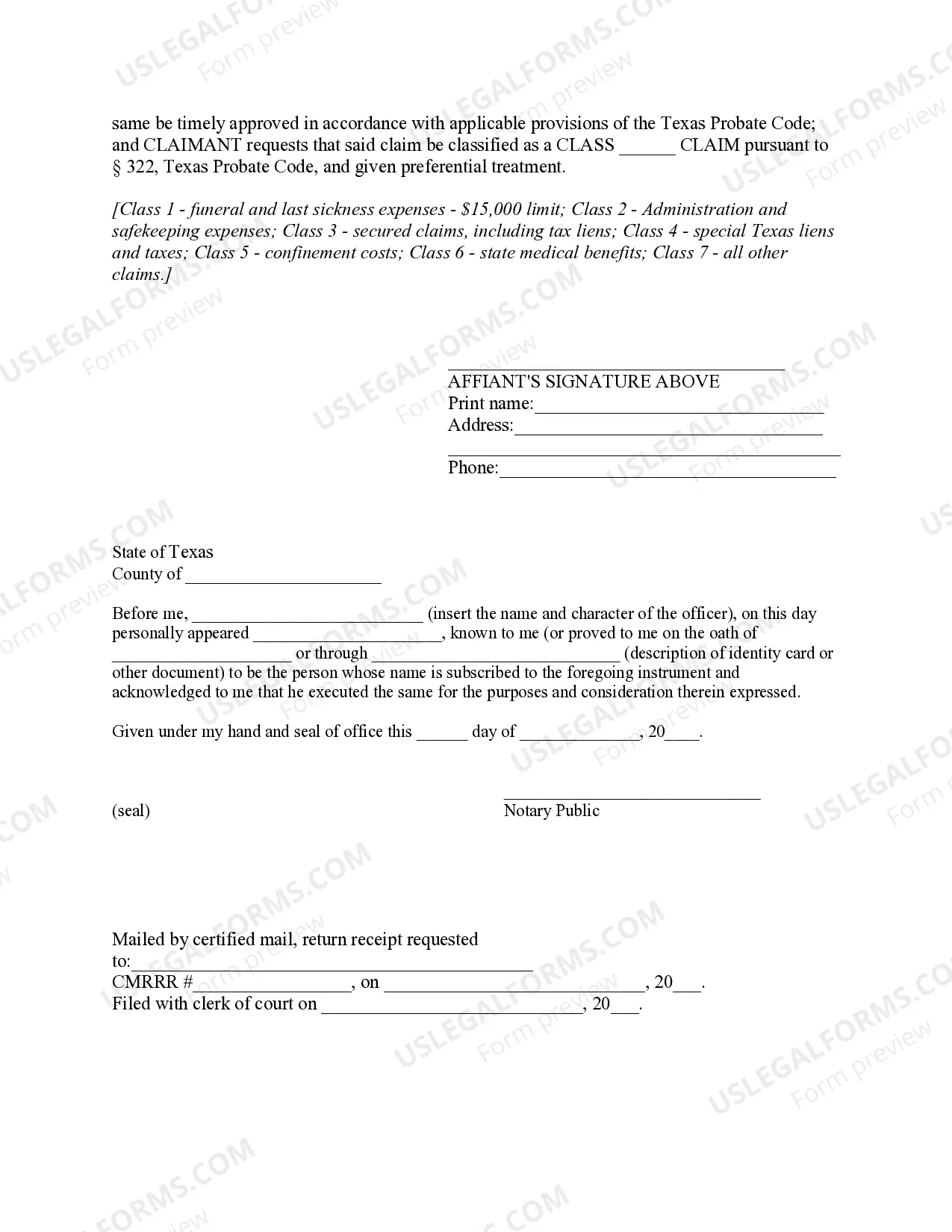

Texas Sworn Statement Supporting Claim Against Estate

Description Texas Claim Against Estate Form

How to fill out Sworn Statement Texas?

Get access to top quality Sworn Statement Supporting Claim Against Estate - Texas forms online with US Legal Forms. Steer clear of days of wasted time browsing the internet and lost money on forms that aren’t up-to-date. US Legal Forms provides you with a solution to just that. Get above 85,000 state-specific legal and tax forms that you could download and fill out in clicks in the Forms library.

To receive the sample, log in to your account and then click Download. The file is going to be saved in two places: on the device and in the My Forms folder.

For people who don’t have a subscription yet, check out our how-guide below to make getting started simpler:

- See if the Sworn Statement Supporting Claim Against Estate - Texas you’re considering is suitable for your state.

- Look at the sample using the Preview option and browse its description.

- Check out the subscription page by simply clicking Buy Now.

- Choose the subscription plan to go on to sign up.

- Pay out by credit card or PayPal to finish making an account.

- Pick a preferred format to download the document (.pdf or .docx).

Now you can open the Sworn Statement Supporting Claim Against Estate - Texas sample and fill it out online or print it and get it done by hand. Consider giving the file to your legal counsel to make sure things are filled out correctly. If you make a mistake, print and complete sample again (once you’ve made an account every document you save is reusable). Create your US Legal Forms account now and get a lot more forms.

Texas Sworn Statement Download Form popularity

Sworn Statement Claim Fill Other Form Names

Texas Statement Estate Pdf FAQ

When you use a small estate affidavit , you have to pay the decedent's bills before paying money to anyone else. For example, the decedent might have owed money to a credit card company when they died. If you use the small estate affidavit, you must give money from the estate to pay the credit card company.

Each county has its own specific form for the small estate affidavit, so obtain the form from the website or office of the probate court in the county in which your loved one was a resident. Although each form is slightly different, they all require the following information: Name and address of decedent. Date of death.

Each county has its own specific form for the small estate affidavit, so obtain the form from the website or office of the probate court in the county in which your loved one was a resident. Although each form is slightly different, they all require the following information: Name and address of decedent. Date of death.

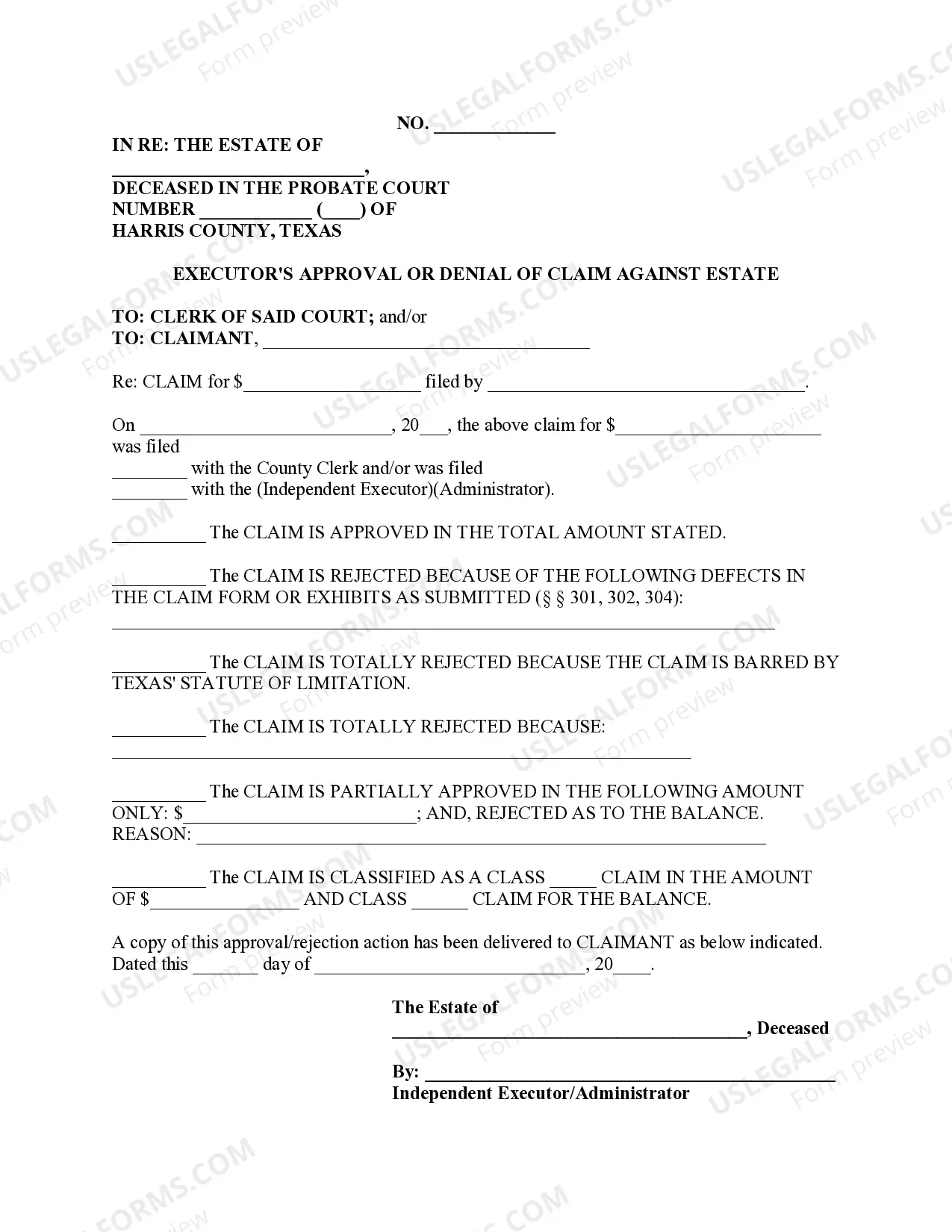

Find the Correct Probate Court. The probate court handles issues involving a deceased person's estate, along with potential disputes regarding outstanding debts, issues with heirs, etc. Confirm the Debt. Complete the Claim Form. File the Claim Form.

Godoy. After someone dies, anyone who thinks they are owed money or property by the deceased can file a claim against the estate. Estate claims range from many different types of debts, such as mortgages, credit card debt, loans, unpaid wages, or breach of contract.

For example, creditors normally have two years to file a claim against the estate once the executor publishes legal notice of the death. However, Texas provides a special notice, called Permissive Notice to Creditors, that bars executors from paying claims after four months from the date of notice.

The Texas Small Estate Affidavit is for use when a decedent (the person who died) left $75,000 or less in property and died without a will.The form must be approved by the probate court in the county in which decedent resided at the time of death before it can be used to collect the decedent's property.

Guadalupe County Small Estate Affidavit Checklist Individuals then fill out a form without reading the statute and without understanding Texas intestacy law. They pay a $261 filing fee and expect approval.

In most states, however, there is the option to use a small estate affidavit when the assets of the estate are under a certain dollar amount, which varies by state. An attorney is not required to file a small estate affidavit, although it may be helpful to consult with one prior to filing the small estate affidavit.