This form is a General Warranty Deed conveying a Life Estate where the Grantors are Husband and Wife, or Two Individuals, and the Grantee is an Individual. Grantors convey and generally warrant the described property interest to the Grantee. This deed complies with all state statutory laws.

Texas Warranty Deed Conveying Life Estate Deed from Husband and Wife, or Two Individuals, to a Grantee.

Description

Key Concepts & Definitions

Life Estate Deed: A legal document used in real estate and estate planning, transferring ownership of a property to a beneficiary for the duration of the beneficiary's life. This is commonly known as establishing a 'life estate'.

Warranty Deed: A form of deed where the grantor guarantees that they hold clear title to a piece of real estate and have a right to sell it.

Step-by-Step Guide to Conveying a Life Estate Deed

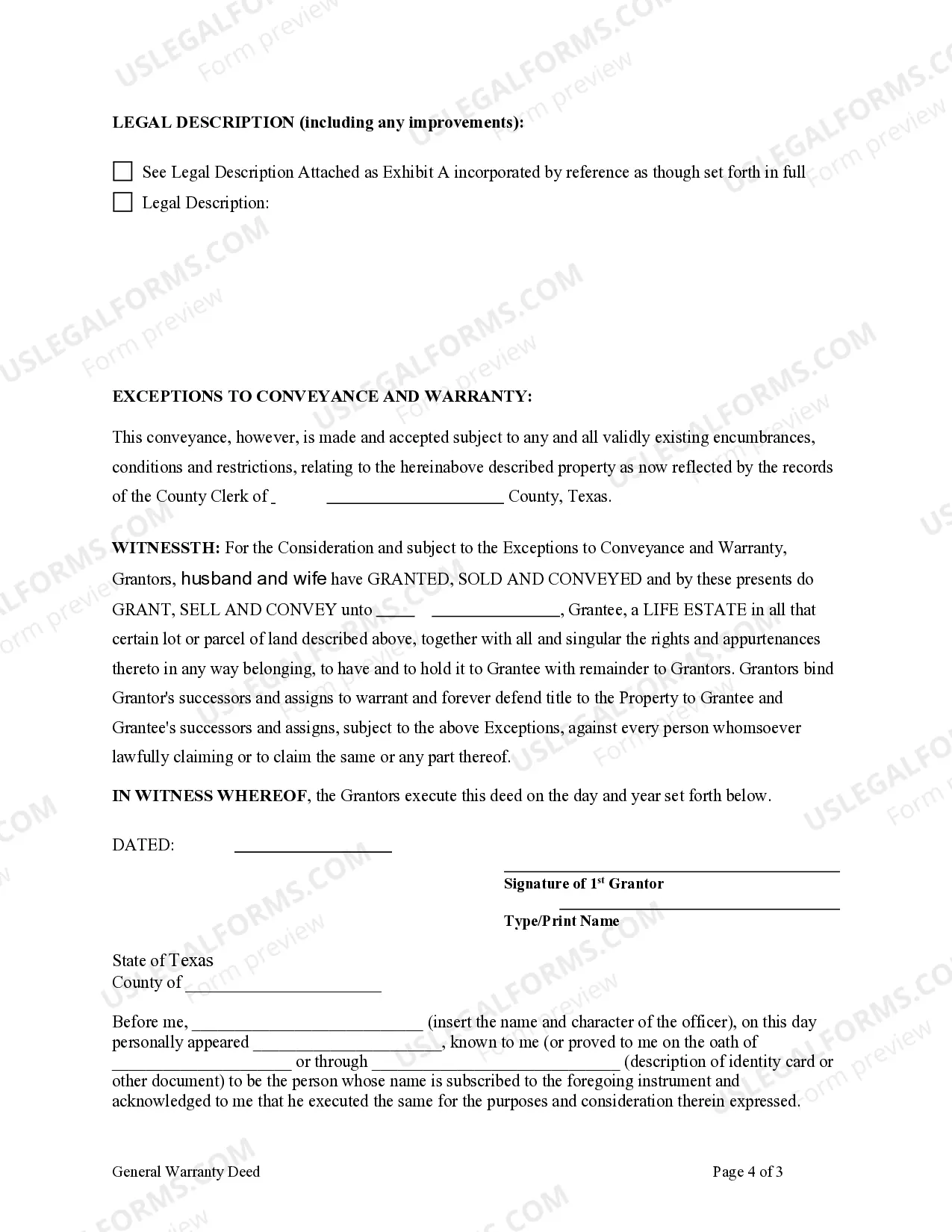

- Consult with Real Estate or Estate Planning Professionals: It's essential to ensure all actions comply with local laws, which can vary widely across the United States.

- Identify the Parties: The grantor (current owner) and the grantee (or life tenant) must be clearly defined.

- Prepare the Deed: Include clear descriptions of the property and terms under which the life estate is handled.

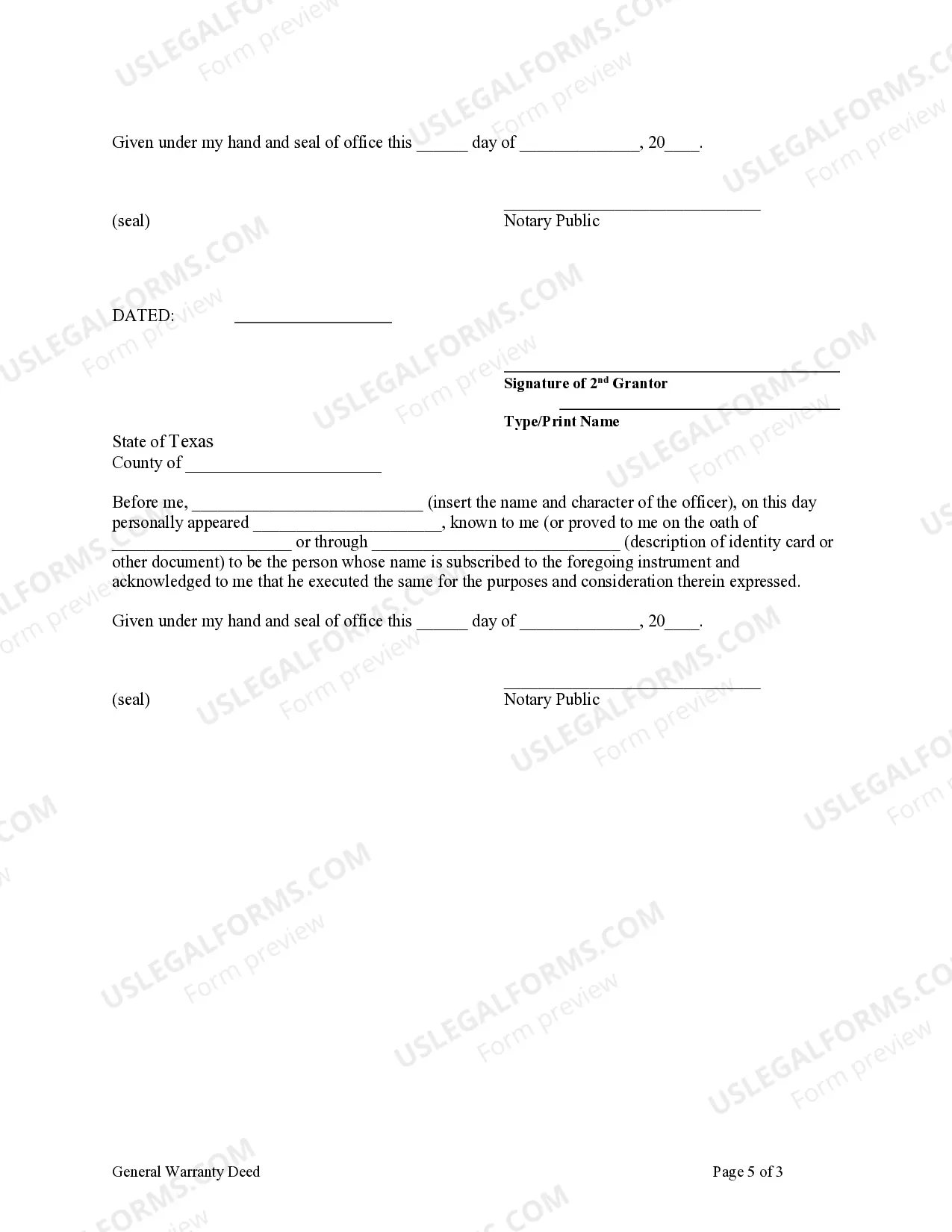

- Sign in the Presence of a Notary: To make the deed legally binding, it needs to be notarized according to the state's regulations.

- Record the Deed: File the deed at the local county recorder's office to officially document the transaction and avoid future legal complications.

Risk Analysis

Using a warranty deed conveying a life estate deed offers protection against claims on the property but also poses unique risks:

- Irrevocability: Once granted, changing terms of a life estate can be very complex, often requiring new legal documents and sometimes the consent of the life tenant.

- Property Management: Disputes can arise over responsibilities for property taxes, maintenance, and improvements between the life tenant and the remainderman.

- Impact on Probate: Though beneficial for avoiding probate, it complicates estate planning if not aligned with other estate instruments like wills or trusts.

Best Practices

- Always verify the exact legal requirements and documentation in the state where the property is located, as these can significantly impact the process.

- Consider potential conflicts between the life tenant and remaindermen regarding property use and responsibilities before completing a life estate deed.

- Use clauses like the 'Lady Bird provision' (common in states like California) to retain control for the grantor, allowing them to maintain management of the property during their lifetime.

Common Mistakes & How to Avoid Them

- Ignoring State-Specific Laws: Each state has different laws regarding real estate transactions, including those for life estates. Consulting with a professional in your state (such as a CA office) is critical.

- Neglecting Future Needs: Consider future needs and potential changes in family dynamics when planning life estates. Being unable to adjust these arrangements easily is a common pitfall.

- Failing to Record the Deed: Failing to record the deed can lead to significant legal headaches and disputes. It's crucial to complete this step promptly.

How to fill out Texas Warranty Deed Conveying Life Estate Deed From Husband And Wife, Or Two Individuals, To A Grantee.?

Access to quality Texas Warranty Deed Conveying Life Estate Deed from Husband and Wife, or Two Individuals, to a Grantee. templates online with US Legal Forms. Prevent hours of lost time searching the internet and dropped money on forms that aren’t up-to-date. US Legal Forms gives you a solution to exactly that. Get around 85,000 state-specific authorized and tax forms that you can save and complete in clicks within the Forms library.

To find the sample, log in to your account and click Download. The file is going to be saved in two places: on the device and in the My Forms folder.

For individuals who don’t have a subscription yet, check out our how-guide listed below to make getting started simpler:

- Check if the Texas Warranty Deed Conveying Life Estate Deed from Husband and Wife, or Two Individuals, to a Grantee. you’re considering is appropriate for your state.

- Look at the sample utilizing the Preview function and read its description.

- Go to the subscription page by simply clicking Buy Now.

- Select the subscription plan to continue on to sign up.

- Pay out by credit card or PayPal to complete creating an account.

- Select a favored file format to save the document (.pdf or .docx).

You can now open the Texas Warranty Deed Conveying Life Estate Deed from Husband and Wife, or Two Individuals, to a Grantee. example and fill it out online or print it out and get it done yourself. Consider sending the file to your legal counsel to be certain things are completed appropriately. If you make a mistake, print out and fill application once again (once you’ve made an account all documents you save is reusable). Create your US Legal Forms account now and get much more templates.

Form popularity

FAQ

A life estate deed permits the property owner to have full use of their property until their death, at which point the ownership of the property is automatically transferred to the beneficiary.In the right situations, it can be a streamlined and easy way to transfer ownership.

To be valid, gift deeds in Texas further require the document set forth (1) the intent of the grantor, (2) the delivery of the property to the grantee, and (3) the gift to be accepted by the grantee. The one claiming the gift bears the burden to establish each of the elements.

Find the most recent deed to the property. It is best to begin with a copy of the most recent deed to the property (the deed that transferred the property to the current grantor). Create a new deed. Sign and notarize the deed. File the documents in the county land records.

Now, people can convey clear title to their property by completing a transfer on death deed form, signing it in front of a notary, and filing it in the deed records office in the county where the property is located before they die at a cost of less than fifty dollars.

In most cases, the surviving owner or heir obtains the title to the home, the former owner's death certificate, a notarized affidavit of death, and a preliminary change of ownership report form. When all these are gathered, the transfer gets recorded, the fees are paid, and the county issues a new title deed.

You can arrange to legally transfer the deed to your house to your children before you die. To do so, you sign a deed transfer and record it with the county recorder's office.

Think about IHT implications potentially exempt transfer Be aware of the rules on gifts with reservation of benefit You will no longer be the legal owner of the property. Risk from outside parties. Don't forget capital gains tax.

To transfer it, you will have to get a succession certificate (for moveable property) and a letter of administration (for Immoveable property). While doing so, get the son and daughter to give no objections in court that they have no objection if all the property is transferred to the widow.

Gift the house When you give anyone other than your spouse property valued at more than $14,000 ($28,000 per couple) in any one year, you have to file a gift tax return. But you can gift a total of $5.49 million (in 2017) over your lifetime without incurring a gift tax.