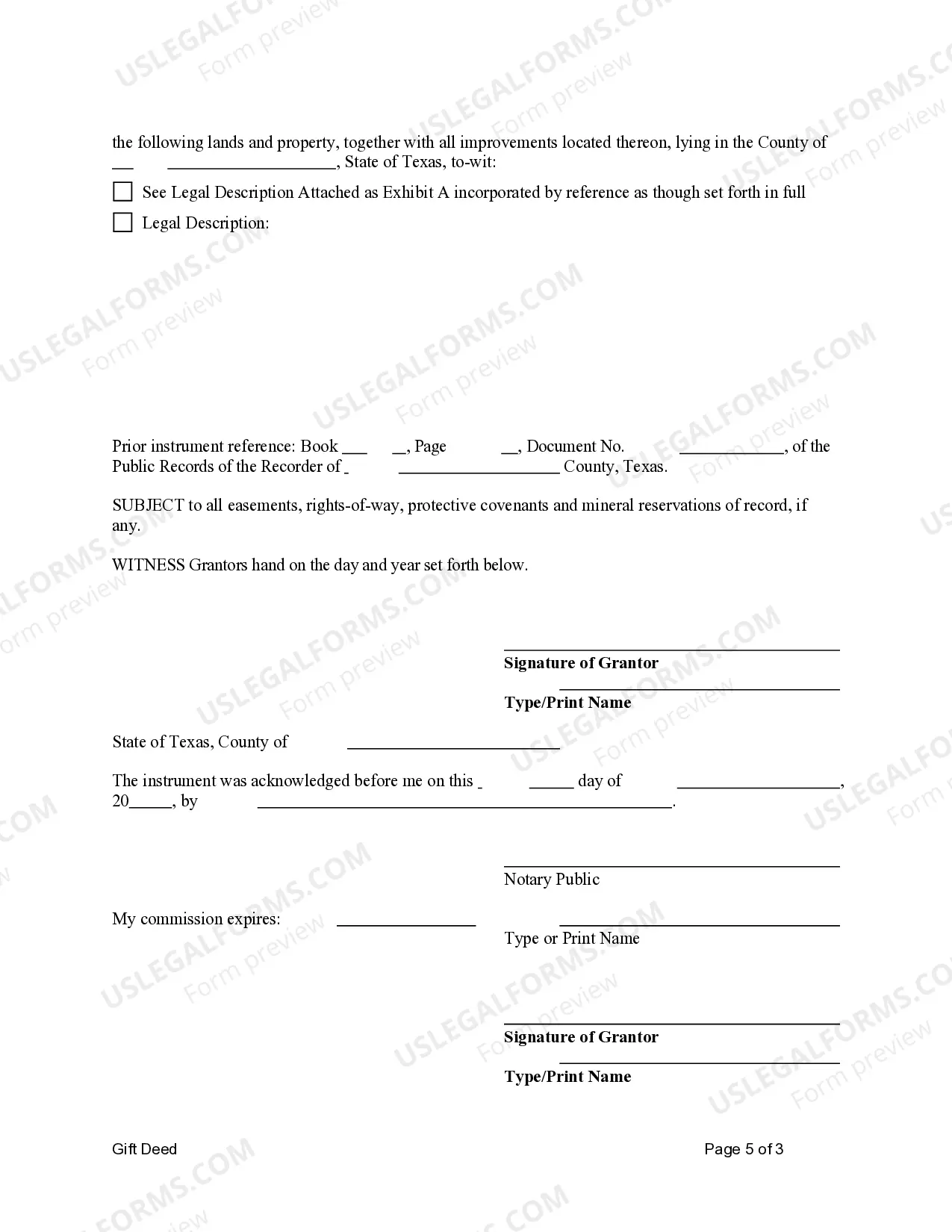

This form is a Gift Deed where the Grantors ate Husband and Wife, or Two Individuals, and the Grantees are Husband and Wife, or Two Individuals. Grantors convey and warrant the described property to the Grantees. This deed complies with all state statutory laws.

Texas Gift Deed Gift Deed from Husband and Wife, or Two Individuals, to Husband and Wife, or Two Individuals.

Description

How to fill out Texas Gift Deed Gift Deed From Husband And Wife, Or Two Individuals, To Husband And Wife, Or Two Individuals.?

Get access to high quality Texas Gift Deed from Husband and Wife, or Two Individuals, to Husband and Wife, or Two Individuals samples online with US Legal Forms. Steer clear of days of misused time browsing the internet and dropped money on documents that aren’t up-to-date. US Legal Forms gives you a solution to just that. Find over 85,000 state-specific legal and tax forms that you can save and fill out in clicks within the Forms library.

To receive the example, log in to your account and click Download. The document is going to be stored in two places: on the device and in the My Forms folder.

For those who don’t have a subscription yet, take a look at our how-guide listed below to make getting started easier:

- See if the Texas Gift Deed from Husband and Wife, or Two Individuals, to Husband and Wife, or Two Individuals you’re looking at is appropriate for your state.

- Look at the sample utilizing the Preview option and read its description.

- Go to the subscription page by clicking Buy Now.

- Select the subscription plan to go on to sign up.

- Pay out by card or PayPal to finish making an account.

- Select a preferred file format to save the document (.pdf or .docx).

Now you can open the Texas Gift Deed from Husband and Wife, or Two Individuals, to Husband and Wife, or Two Individuals template and fill it out online or print it and do it by hand. Consider sending the document to your legal counsel to ensure things are filled in appropriately. If you make a mistake, print and fill sample again (once you’ve registered an account every document you download is reusable). Make your US Legal Forms account now and get access to more samples.

Form popularity

FAQ

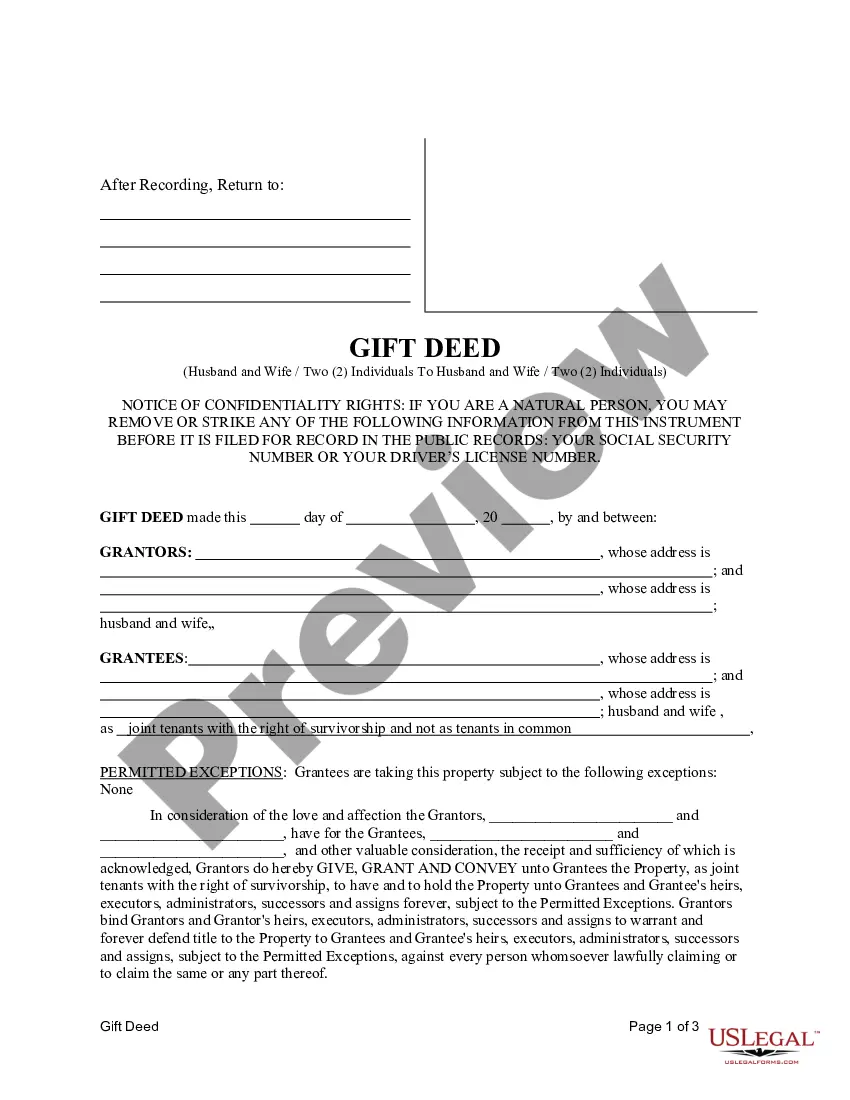

Find the most recent deed to the property. It is best to begin with a copy of the most recent deed to the property (the deed that transferred the property to the current grantor). Create a new deed. Sign and notarize the deed. File the documents in the county land records.

To be valid, gift deeds in Texas further require the document set forth (1) the intent of the grantor, (2) the delivery of the property to the grantee, and (3) the gift to be accepted by the grantee. The one claiming the gift bears the burden to establish each of the elements.

The deed and any related agreements should be filed in the land records of the county where the property is located. The county clerk will require a recording fee. Recording fees can vary, but usually range from $11.00 to $30.00 for the first page and $4.00 for each additional page.

California married couples generally have three options to take title to their community (vs separate) property real estate: community property, joint tenancy or Community Property with Right of Survivorship. The latter coming into play in California July of 2001.

In most states you can file a disclaimer or deed of disclaimer that says specifically you were placed in title without your knowledge or consent and disclaim the deed.

You can arrange to legally transfer the deed to your house to your children before you die. To do so, you sign a deed transfer and record it with the county recorder's office.

Date and Place where the deed is to be executed. Information about Donor and Donee like Name, Residential Address, Relationship among them, Date of Birth, etc. Details about the property. Two Witnesses. Signatures of Donor and Donee along with the witnesses.

Yes you can. This is called a transfer of equity but you will need the permission of your lender. If you are not married or in a civil partnership you may wish to consider creating a deed of trust and a living together agreement which we can explain to you.

In Texas, you can't add your spouse's name to an existing deed, but you can create a new deed by transferring the property from yourself to you and your spouse jointly. You can do this by using either a deed without warranty or a quit claim deed.