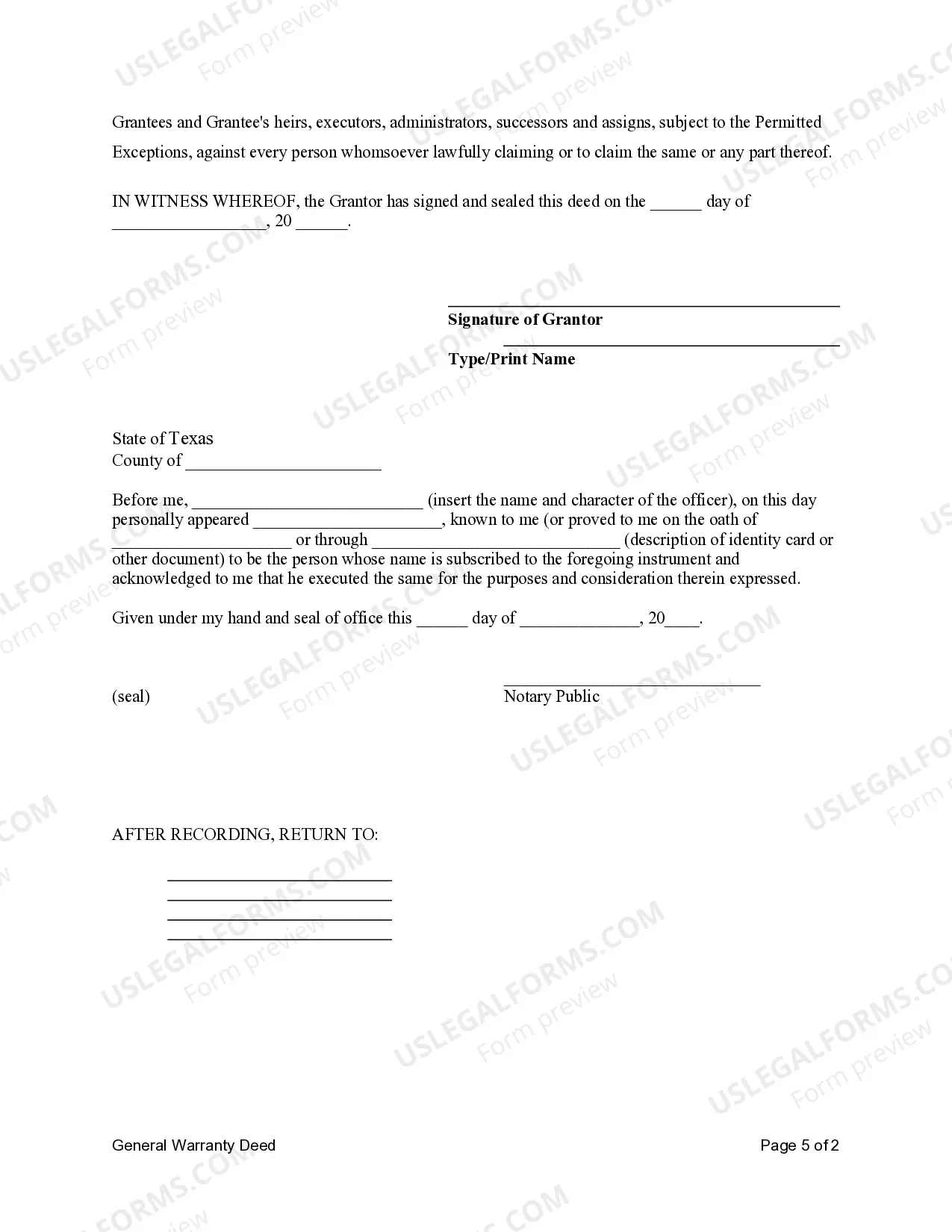

This form is a General Warranty Deed where the grantor is an individual and the grantees are husband and wife. Grantor conveys and warrants the described property to the grantees. This deed complies with all state statutory laws.

Texas General Warranty Deed - Individual to Husband and Wife

Description

How to fill out Texas General Warranty Deed - Individual To Husband And Wife?

Get access to quality Texas General Warranty Deed - Individual to Husband and Wife samples online with US Legal Forms. Steer clear of days of wasted time browsing the internet and dropped money on files that aren’t up-to-date. US Legal Forms provides you with a solution to just that. Get above 85,000 state-specific legal and tax samples that you could save and submit in clicks within the Forms library.

To receive the example, log in to your account and click on Download button. The document will be saved in two places: on your device and in the My Forms folder.

For people who don’t have a subscription yet, have a look at our how-guide below to make getting started simpler:

- Check if the Texas General Warranty Deed - Individual to Husband and Wife you’re looking at is suitable for your state.

- View the form making use of the Preview function and read its description.

- Visit the subscription page by simply clicking Buy Now.

- Choose the subscription plan to keep on to sign up.

- Pay by credit card or PayPal to complete creating an account.

- Choose a favored file format to download the file (.pdf or .docx).

Now you can open up the Texas General Warranty Deed - Individual to Husband and Wife template and fill it out online or print it and do it by hand. Take into account mailing the file to your legal counsel to be certain all things are filled in correctly. If you make a mistake, print out and fill sample again (once you’ve created an account every document you save is reusable). Make your US Legal Forms account now and get far more samples.

Form popularity

FAQ

If you've recently married and already own a home or other real estate, you may want to add your new spouse to the deed for your property so the two of you own it jointly. To add a spouse to a deed, all you have to do is literally fill out, sign and record a new deed in your county recorder's office.

Find the most recent deed to the property. It is best to begin with a copy of the most recent deed to the property (the deed that transferred the property to the current grantor). Create a new deed. Sign and notarize the deed. File the documents in the county land records.

When it comes to reasons why you shouldn't add your new spouse to the Deed, the answer is simple divorce and equitable distribution. If you choose not to put your spouse on the Deed and the two of you divorce, the entire value of the home is not subject to equitable distribution.

In California, all property bought during the marriage with income that was earned during the marriage is deemed "community property." The law implies that both spouses own this property equally, regardless of which name is on the title deed.

Adding someone to your house deed requires the filing of a legal form known as a quitclaim deed. When executed and notarized, the quitclaim deed legally overrides the current deed to your home. By filing the quitclaim deed, you can add someone to the title of your home, in effect transferring a share of ownership.

The easiest way to grant your spouse title to your home is via a quitclaim deed (Californians generally use an interspousal grant deed). With a quitclaim deed, you can name your spouse as the property's joint owner. The quitclaim deed must include the property's description, including its boundary lines.

How do I add my spouse to the deed? In Texas, you can't add your spouse's name to an existing deed, but you can create a new deed by transferring the property from yourself to you and your spouse jointly. You can do this by using either a deed without warranty or a quit claim deed.

If you live in a common-law state, you can keep your spouse's name off the title the document that says who owns the property.You can put your spouse on the title without putting them on the mortgage; this would mean that they share ownership of the home but aren't legally responsible for making mortgage payments.

A In order to make your partner a joint owner you will need to add his name at the Land Registry, for which there is a fee of £280 (assuming you transfer half the house to him). You won't, however, have to pay capital gains tax, as gifts between civil partners (and spouses) are tax free.