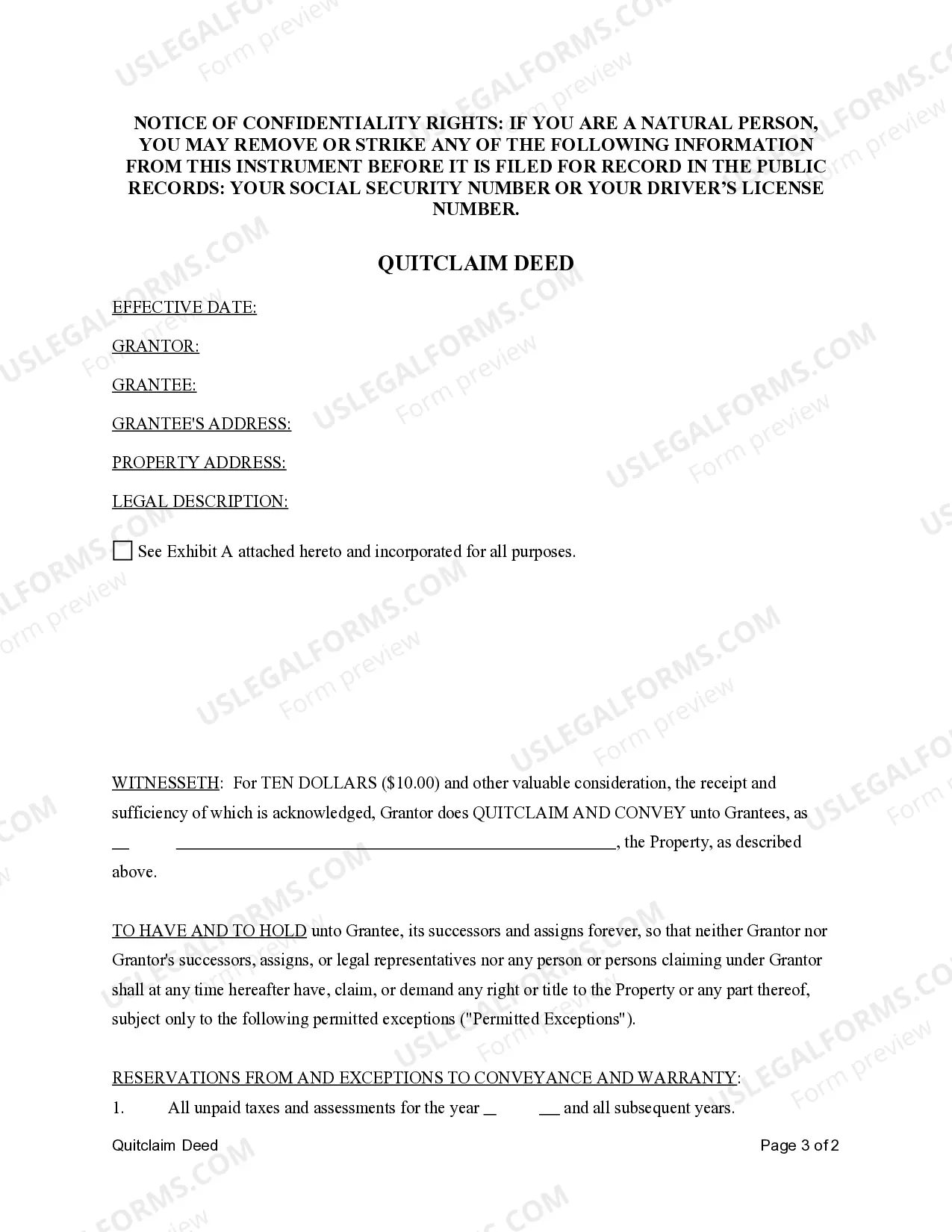

This form is a Quitclaim Deed where the grantor is a limited liability company and the grantee is also a limited liability company. Grantor conveys and quitclaims the described property to grantee. This deed complies with all state statutory laws.

Texas Quitclaim Deed from Limited Liability Company to Limited Liability Company

Description

How to fill out Texas Quitclaim Deed From Limited Liability Company To Limited Liability Company?

Get access to top quality Texas Quitclaim Deed from Limited Liability Company to Limited Liability Company samples online with US Legal Forms. Steer clear of hours of lost time seeking the internet and lost money on forms that aren’t updated. US Legal Forms offers you a solution to exactly that. Get more than 85,000 state-specific legal and tax samples that you could download and complete in clicks in the Forms library.

To get the sample, log in to your account and click Download. The file is going to be stored in two places: on the device and in the My Forms folder.

For individuals who don’t have a subscription yet, look at our how-guide listed below to make getting started easier:

- See if the Texas Quitclaim Deed from Limited Liability Company to Limited Liability Company you’re considering is appropriate for your state.

- See the form utilizing the Preview option and browse its description.

- Go to the subscription page by clicking on Buy Now button.

- Select the subscription plan to keep on to sign up.

- Pay out by credit card or PayPal to finish creating an account.

- Select a favored file format to save the file (.pdf or .docx).

Now you can open the Texas Quitclaim Deed from Limited Liability Company to Limited Liability Company sample and fill it out online or print it and get it done by hand. Think about sending the document to your legal counsel to make sure all things are filled out properly. If you make a mistake, print and fill application once again (once you’ve created an account all documents you download is reusable). Create your US Legal Forms account now and access much more samples.

Form popularity

FAQ

Step 1: Form an LLC or Corporation. You can't transfer your real estate property, or any other personal property, into your LLC or corporation until you've actually formed a new legal entity. Step 2: Complete a Quitclaim Deed. Step 3: Record Your Quitclaim Deed.

The transfer process itself can take the form of a contract for transfer/purchase of business assets. In the case of money transfers, these can be done as a loan or by purchasing shares in the other company, or through dividend payments if shares in the transferor company are owned by the recipient company.

You can't transfer your real estate property, or any other personal property, into your LLC or corporation until you've actually formed a new legal entity.Typically you'll need to register a business name and file the LLC or corporation paperwork with your secretary of state's office.

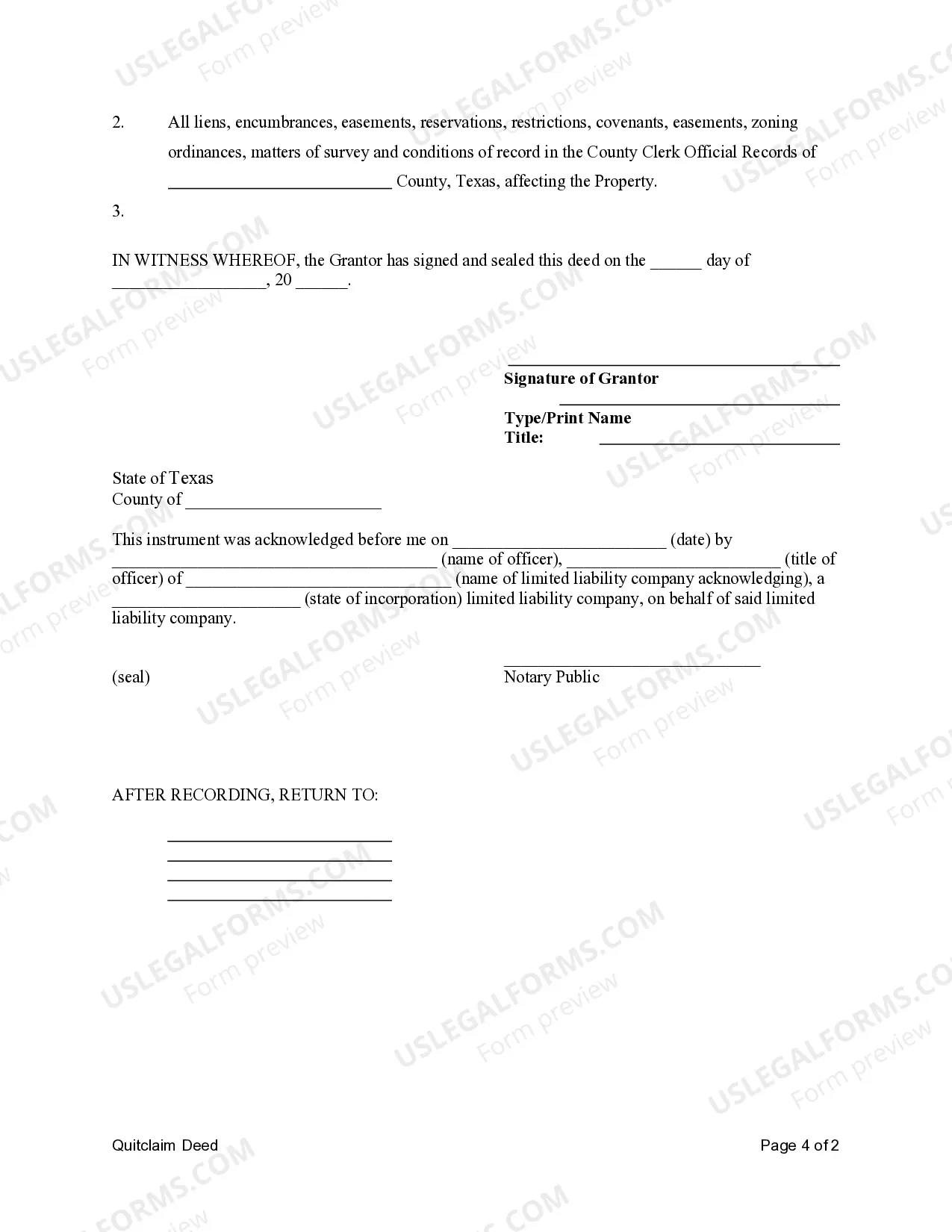

Laws Section 13.002. Recording This form must be filed at the Recorder's Office in the County Clerk's Office. Signing (Section 11.002(c)) The Grantor(s) has the choice of authorizing this form in the presence of Two (2) Witnesses or a Notary Public.

Since LLCs are more like partnerships, you cannot force partnerships between people without their agreement. You can only transfer an LLC's ownership interests if all the other LLC owners agree, and even then, only if the state law allows for it.

Quitclaim deeds are most often used to transfer property between family members. Examples include when an owner gets married and wants to add a spouse's name to the title or deed, or when the owners get divorced and one spouse's name is removed from the title or deed.

How to Quitclaim Deed to LLC. A quitclaim deed to LLC is actually a very simple process. You will need a deed form and a copy of the existing deed to make sure you identify titles properly and get the legal description of the property.

No you can't. A single member LLC is just you as far as the IRS is concerned. You're just living in your own property. You can't rent your own house to yourself.

Quitclaim Does Not Release Debts Signing a quitclaim deed and giving up all rights to the property doesn't release you from any financial obligations you may have. It only removes you from the title, not from the mortgage, and you are still responsible for making payments.