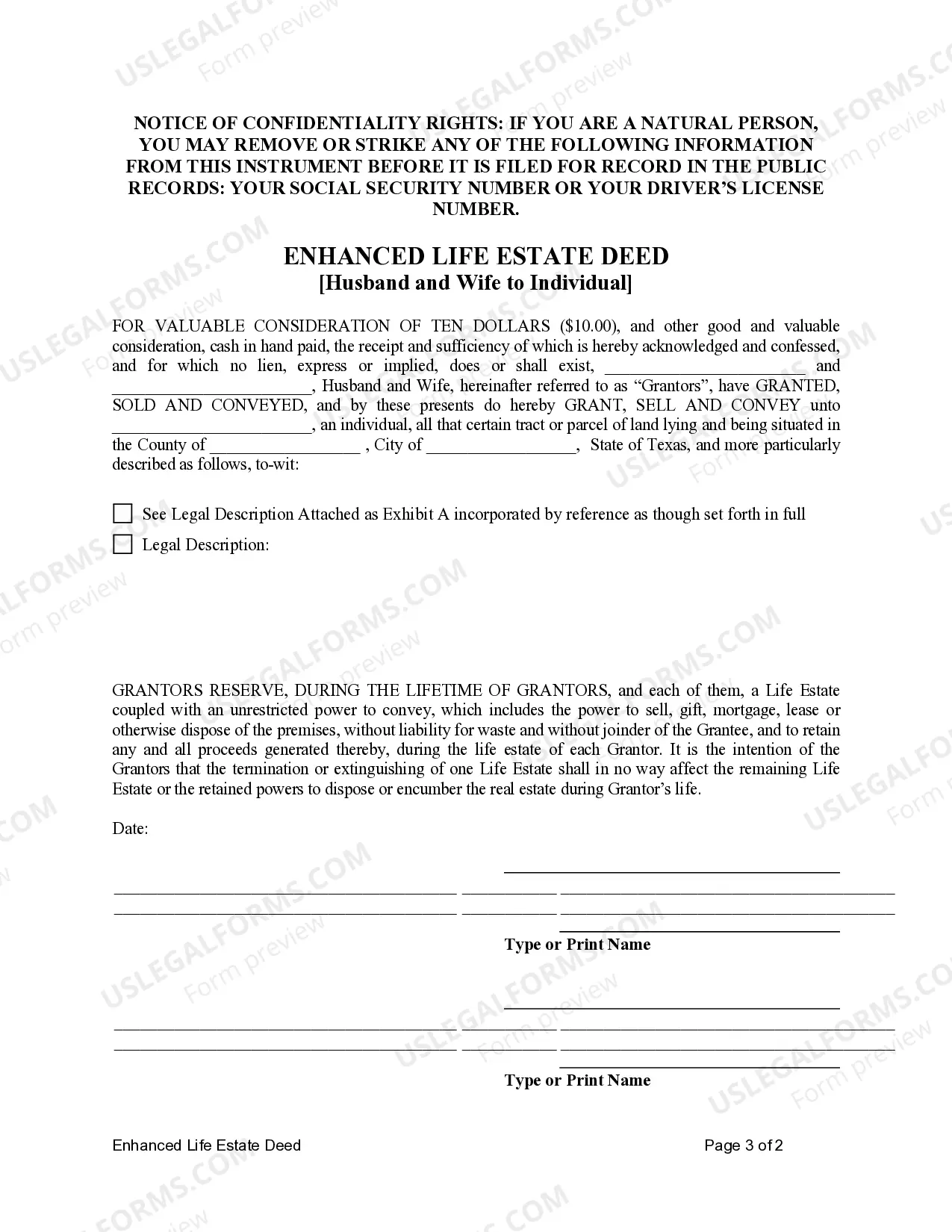

This form is an Enhanced Life Estate Deed, also known as a Lady Bird Deed, where the Grantors are Husband and Wife and the Grantee is an Individual. Grantors convey and warrant the described property to the Grantee subject to a reserved enhanced life estate in each Grantor. Further, the Grantors reserve the right to mortgage, sell, burden, and otherwise use the property and retain all profits without interference from Grantee during the course of the life estates. This deed complies with all state statutory laws.

Texas Enhanced Life Estate or Lady Bird Deed - Husband and Wife to Individual

Description

How to fill out Texas Enhanced Life Estate Or Lady Bird Deed - Husband And Wife To Individual?

Get access to top quality Texas Enhanced Life Estate or Lady Bird Deed - Husband and Wife to Individual forms online with US Legal Forms. Avoid days of misused time looking the internet and lost money on forms that aren’t up-to-date. US Legal Forms gives you a solution to exactly that. Get above 85,000 state-specific authorized and tax samples that you can download and fill out in clicks within the Forms library.

To receive the example, log in to your account and click Download. The document will be saved in two places: on your device and in the My Forms folder.

For individuals who don’t have a subscription yet, have a look at our how-guide listed below to make getting started easier:

- See if the Texas Enhanced Life Estate or Lady Bird Deed - Husband and Wife to Individual you’re looking at is appropriate for your state.

- View the sample making use of the Preview option and read its description.

- Check out the subscription page by simply clicking Buy Now.

- Choose the subscription plan to continue on to sign up.

- Pay out by card or PayPal to complete making an account.

- Pick a favored format to download the document (.pdf or .docx).

Now you can open the Texas Enhanced Life Estate or Lady Bird Deed - Husband and Wife to Individual sample and fill it out online or print it and do it by hand. Consider sending the document to your legal counsel to ensure all things are filled out properly. If you make a mistake, print and complete application once again (once you’ve made an account all documents you download is reusable). Create your US Legal Forms account now and get access to more templates.

Form popularity

FAQ

To be valid, gift deeds in Texas further require the document set forth (1) the intent of the grantor, (2) the delivery of the property to the grantee, and (3) the gift to be accepted by the grantee. The one claiming the gift bears the burden to establish each of the elements.

A Lady Bird deed avoids probate, so the home is not part of the probate estate and Medicaid cannot go after it.

Using an Affidavit of Survivorship to Remove a Deceased Owner from Title. If you are already listed as a co-owner on the prior deedor if you inherited an interest in the property through a life estate deed, transfer-on-death deed, or lady bird deedyou may use an affidavit of survivorship to remove the deceased owner.

This right to rescind is what distinguishes a Lady Bird Deed from a standard Life Estate Deed.A properly written, signed and filed Enhanced Life Estate Deed does supersede the terms of the owner's Will, so long as the grantor has not exercised the retained right to reclaim ownership while living.

Find the most recent deed to the property. It is best to begin with a copy of the most recent deed to the property (the deed that transferred the property to the current grantor). Create a new deed. Sign and notarize the deed. File the documents in the county land records.

The deed and any related agreements should be filed in the land records of the county where the property is located. The county clerk will require a recording fee. Recording fees can vary, but usually range from $11.00 to $30.00 for the first page and $4.00 for each additional page.

Now, people can convey clear title to their property by completing a transfer on death deed form, signing it in front of a notary, and filing it in the deed records office in the county where the property is located before they die at a cost of less than fifty dollars.

In a joint tenancy, when one owner dies, his or her share of the property passes to the decedent's heirs or to the persons named in the decedent's will. In a joint tenancy with right of survivorship, when an owner dies, his or her share of the property goes to the other owners.

To transfer it, you will have to get a succession certificate (for moveable property) and a letter of administration (for Immoveable property). While doing so, get the son and daughter to give no objections in court that they have no objection if all the property is transferred to the widow.