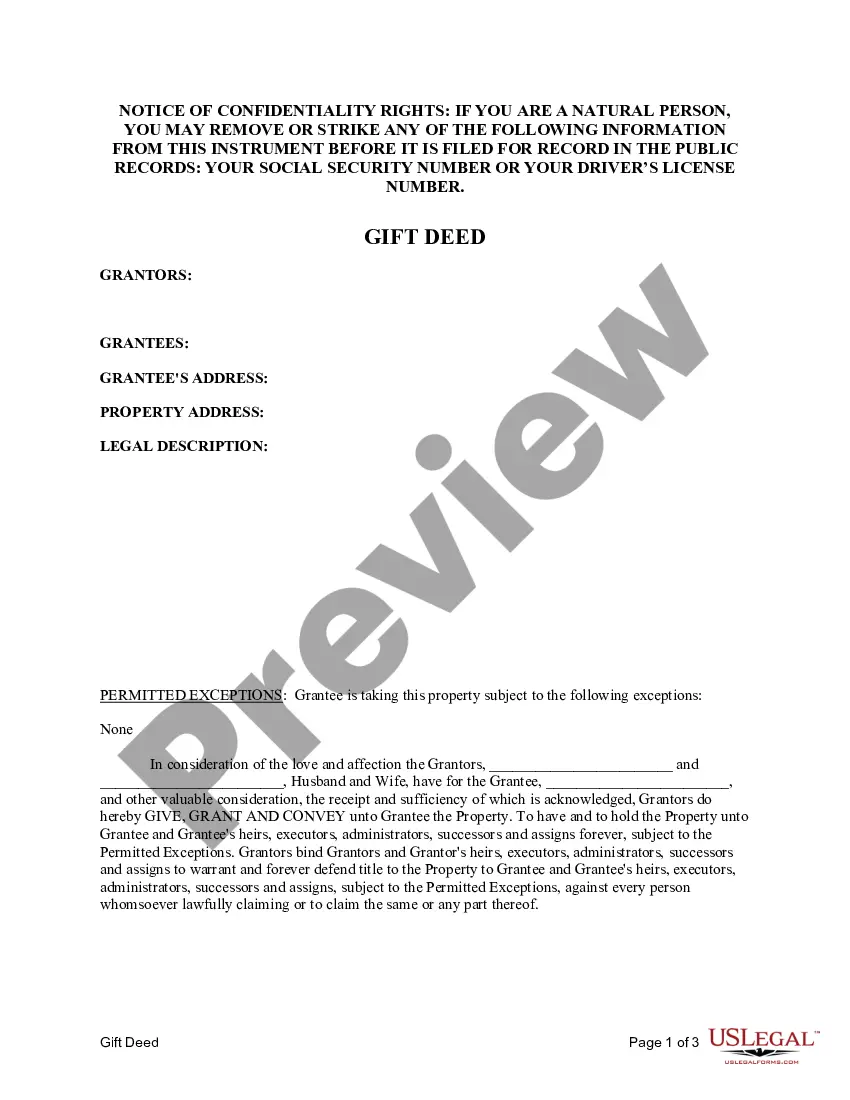

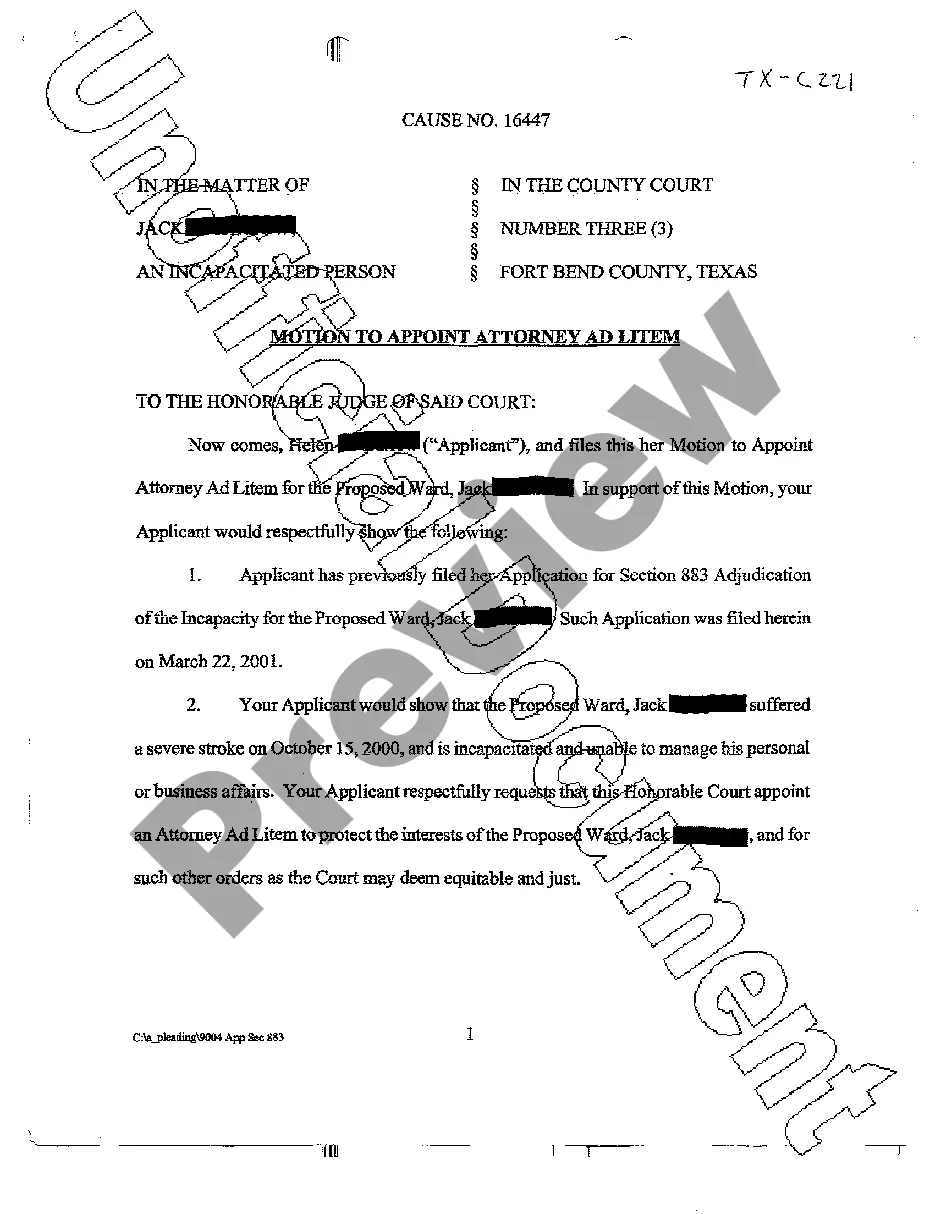

This form is a Gift Deed where the Grantors are Husband and Wife and the Grantee is an Individual. Grantors convey and warrant the described property to the Grantee. This deed complies with all state statutory laws.

Texas Gift Deed - Husband and Wife to an Individual

Description Gift Deed Sample

How to fill out Gift Deed From Wife To Husband?

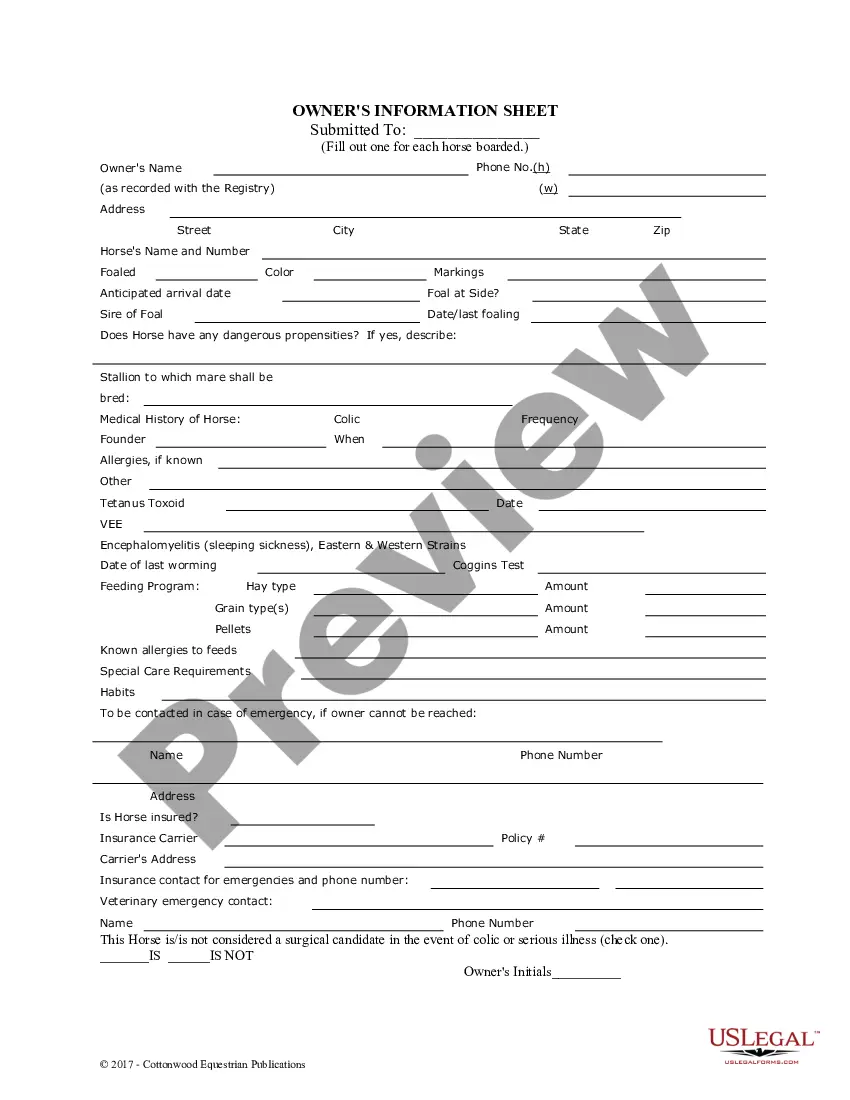

Access to quality Texas Gift Deed - Husband and Wife to an Individual samples online with US Legal Forms. Avoid days of lost time looking the internet and lost money on forms that aren’t up-to-date. US Legal Forms provides you with a solution to exactly that. Find over 85,000 state-specific legal and tax templates that you can save and submit in clicks in the Forms library.

To receive the example, log in to your account and click Download. The file will be stored in two places: on the device and in the My Forms folder.

For individuals who don’t have a subscription yet, have a look at our how-guide listed below to make getting started simpler:

- Verify that the Texas Gift Deed - Husband and Wife to an Individual you’re considering is appropriate for your state.

- View the form utilizing the Preview function and read its description.

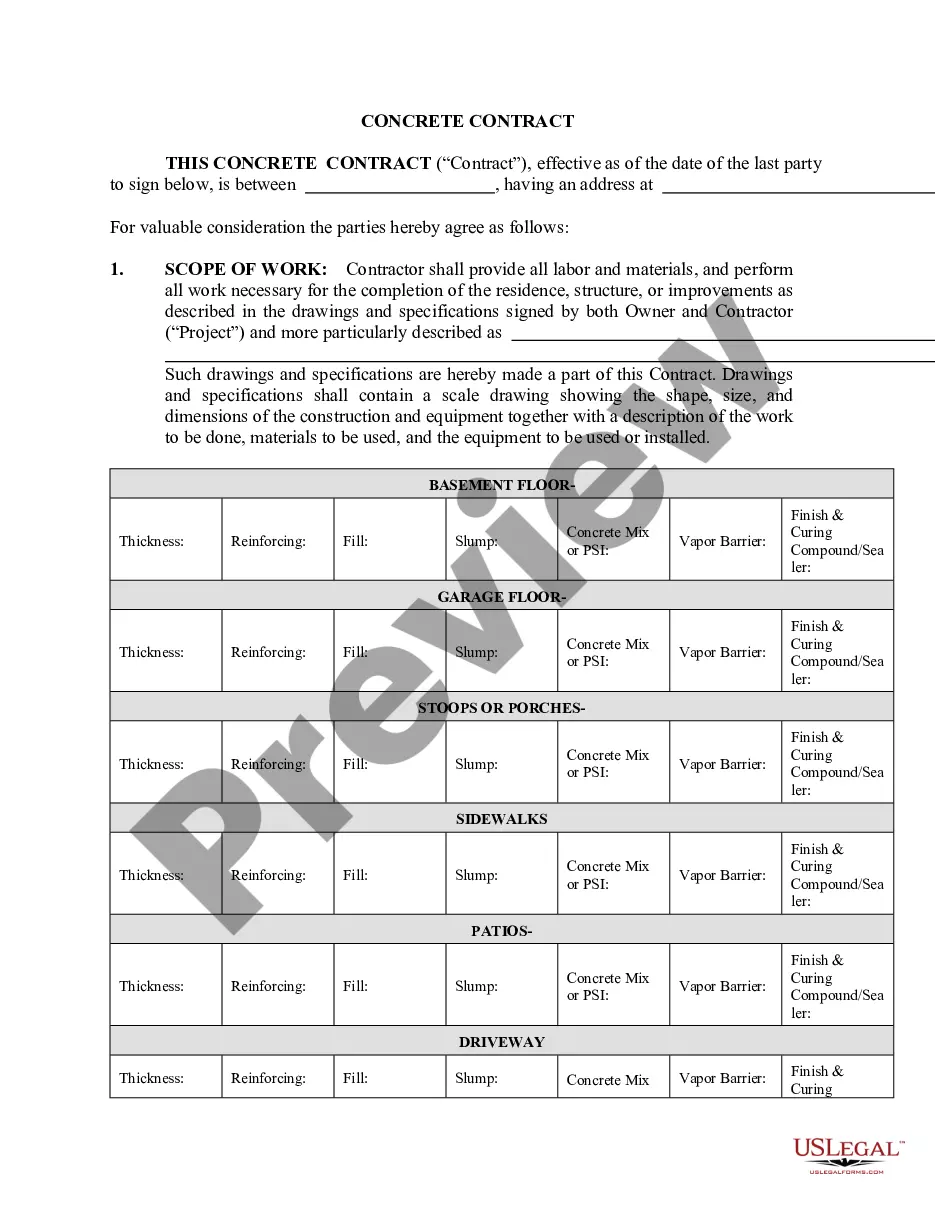

- Go to the subscription page by clicking Buy Now.

- Select the subscription plan to keep on to sign up.

- Pay by credit card or PayPal to finish creating an account.

- Select a favored file format to save the file (.pdf or .docx).

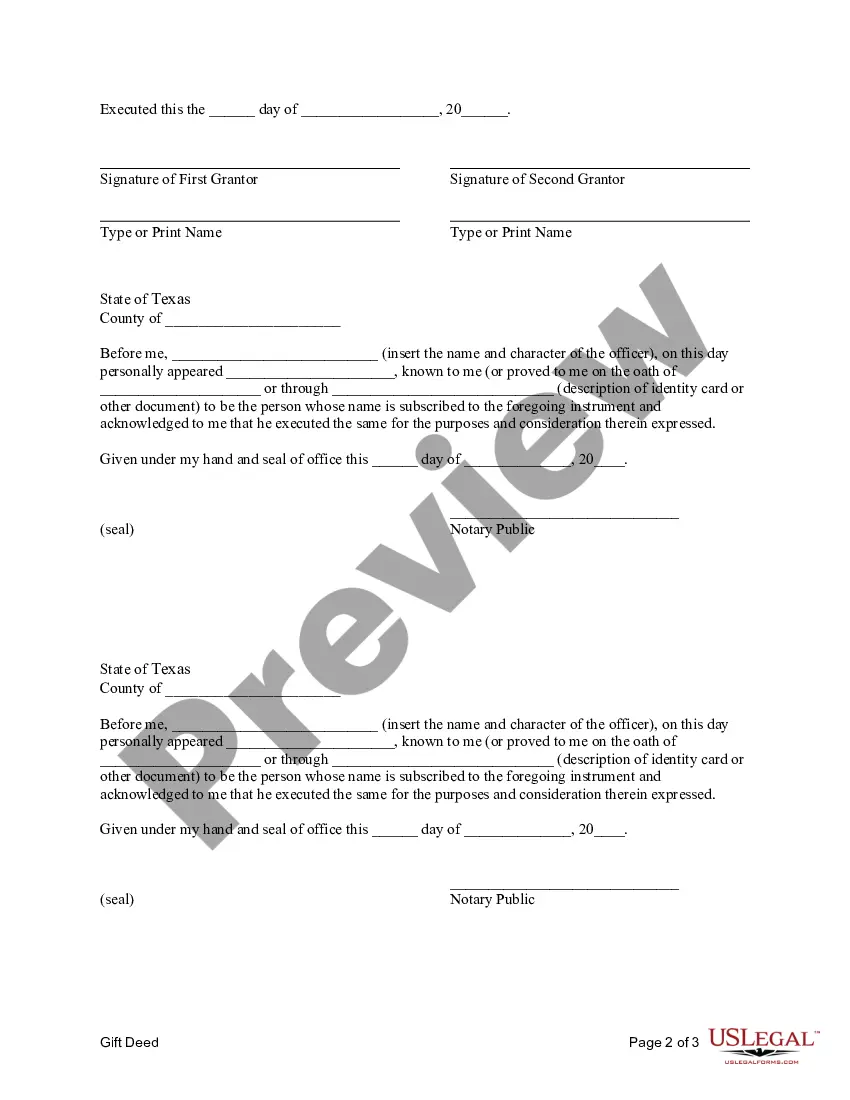

You can now open up the Texas Gift Deed - Husband and Wife to an Individual template and fill it out online or print it and do it by hand. Take into account mailing the document to your legal counsel to make certain things are completed properly. If you make a mistake, print out and complete application again (once you’ve registered an account every document you download is reusable). Create your US Legal Forms account now and get a lot more samples.

Gift Deed Form popularity

Deed Of Gift Agreement Other Form Names

Texas Gift Deed FAQ

Yes the husband can gift property to his wife. In case it is ancestral property devolving on husband and if he gifts to wife it will be conveyance of property and Stamp Duty is playable.In case the property is self acquired and/or in joint name with wife, Relinquishment Deed can be made.

If you want to transfer the house in your wife's name, it will involve the stamp duty on the entire value of the property. There are two other methods by which the property can be transferred to your wife name. (1) By giving a gift of the property to your wife through Registered Gift Deed.

Transfer of Equity: Transferring property to your spouse/civil partner. You may want to transfer ownership of a property if you are newly married and want your spouse on the title deeds. You can do this through a transfer of equity.

You can gift property to spouse, child or any relative and register the same. Under section 122 of the Transfer of Property Act, 1882, you can transfer immovable property through a gift deed. The deed should contain your details as well as those of the recipient.