This form is a Gift Deed where the Grantors are five individuals and the Grantee is an individual. Grantors grant and convey the described property to Grantee. This deed complies with all state statutory laws.

Texas Gift Deed from Five Grantors to One Grantee

Description

How to fill out Texas Gift Deed From Five Grantors To One Grantee?

Get access to high quality Texas Gift Deed from Five Grantors to One Grantee forms online with US Legal Forms. Prevent hours of wasted time looking the internet and lost money on files that aren’t updated. US Legal Forms offers you a solution to exactly that. Find over 85,000 state-specific legal and tax samples that you could save and fill out in clicks within the Forms library.

To get the example, log in to your account and click on Download button. The file is going to be saved in two places: on your device and in the My Forms folder.

For individuals who don’t have a subscription yet, look at our how-guide below to make getting started easier:

- Verify that the Texas Gift Deed from Five Grantors to One Grantee you’re considering is appropriate for your state.

- See the sample making use of the Preview option and browse its description.

- Check out the subscription page by clicking Buy Now.

- Select the subscription plan to go on to sign up.

- Pay out by credit card or PayPal to complete creating an account.

- Select a favored file format to save the document (.pdf or .docx).

You can now open up the Texas Gift Deed from Five Grantors to One Grantee template and fill it out online or print it and get it done by hand. Think about sending the file to your legal counsel to make sure everything is completed properly. If you make a error, print out and fill sample again (once you’ve registered an account every document you download is reusable). Make your US Legal Forms account now and access more templates.

Form popularity

FAQ

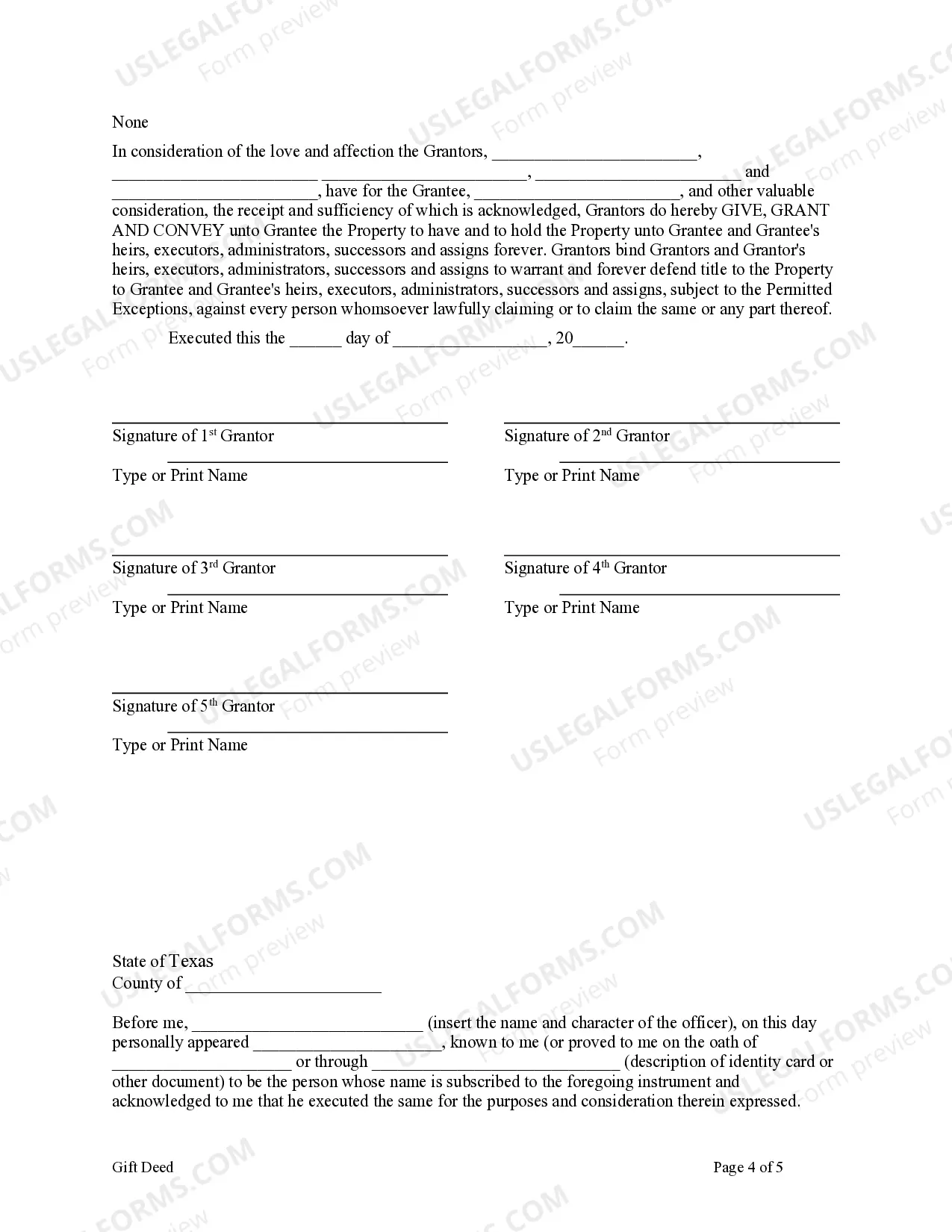

Sign the Deed (both the Donor and the Donee) in the presence of 2 witnesses and take the signed document to the nearest Sub-registrar Office. Calculate the Registration charges with the help of lawyers or consult LegalDesk.com to get an accurate measure.

Think about IHT implications potentially exempt transfer Be aware of the rules on gifts with reservation of benefit You will no longer be the legal owner of the property. Risk from outside parties. Don't forget capital gains tax.

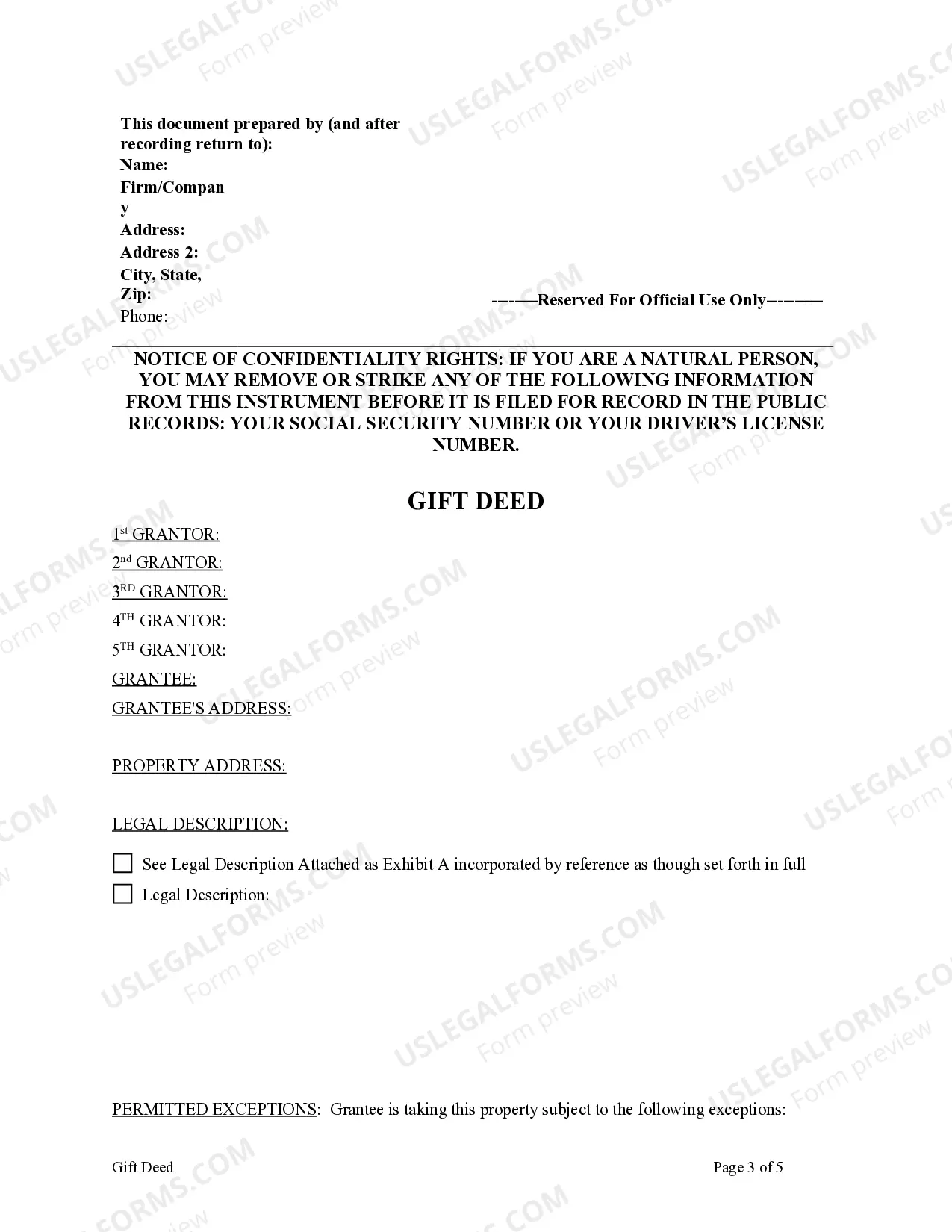

To be valid, gift deeds in Texas further require the document set forth (1) the intent of the grantor, (2) the delivery of the property to the grantee, and (3) the gift to be accepted by the grantee. The one claiming the gift bears the burden to establish each of the elements.

Find the most recent deed to the property. It is best to begin with a copy of the most recent deed to the property (the deed that transferred the property to the current grantor). Create a new deed. Sign and notarize the deed. File the documents in the county land records.

You can arrange to legally transfer the deed to your house to your children before you die. To do so, you sign a deed transfer and record it with the county recorder's office.

To transfer a property as a gift, you need to fill in a TR1 form and send it to the Land Registry, along with an AP1 form. If either side is not using a Solicitor or Conveyancer, an ID1 form will also be needed.

The Grantee in a Quitclaim Deed is the person who is being given interest in a property from the Grantor. It is possible for someone to be both a Grantor and a Grantee in a Quitclaim Deed.Most real estate deeds are notarized by attorneys.