This Quitclaim Deed from Husband and Wife to Corporation form is a Quitclaim Deed where the grantors are husband and wife and the grantee is a corporation. Grantors convey and quitclaim the described property to grantees less and except all oil, gas and minerals, on and under the property owned by Grantors, if any, which are reserved by Grantors.

Texas Quitclaim Deed from Husband and Wife to Corporation

Description

How to fill out Texas Quitclaim Deed From Husband And Wife To Corporation?

Access to top quality Texas Quitclaim Deed from Husband and Wife to Corporation samples online with US Legal Forms. Prevent days of lost time seeking the internet and dropped money on files that aren’t up-to-date. US Legal Forms gives you a solution to exactly that. Get above 85,000 state-specific authorized and tax samples that you can download and fill out in clicks within the Forms library.

To receive the sample, log in to your account and click Download. The file is going to be stored in two places: on the device and in the My Forms folder.

For people who don’t have a subscription yet, look at our how-guide below to make getting started easier:

- Verify that the Texas Quitclaim Deed from Husband and Wife to Corporation you’re looking at is appropriate for your state.

- View the form using the Preview option and browse its description.

- Go to the subscription page by clicking Buy Now.

- Choose the subscription plan to continue on to register.

- Pay by card or PayPal to complete creating an account.

- Select a preferred format to save the file (.pdf or .docx).

You can now open the Texas Quitclaim Deed from Husband and Wife to Corporation example and fill it out online or print it and do it by hand. Consider sending the file to your legal counsel to make certain all things are filled out appropriately. If you make a error, print out and complete application once again (once you’ve created an account all documents you save is reusable). Create your US Legal Forms account now and access a lot more templates.

Form popularity

FAQ

Step 1: Download the TX quitclaim deed form. Step 2: In the upper left-hand corner, add the name and address of the person preparing the form. Under this, add the name and address of the person who will receive the form after the recorder's office is finished with it. Step 3: Write the county in the appropriate blank.

First, so long as you own the property you purchased, you are obligated to pay its property taxes. One way to get a warranty deed to the property you acquired via a foreclosure where you got a quit claim deed for it is to simply deed the property to yourself or a trust that you created as a grant (warranty) deed.

Rates vary by state and law office but typically fall in the range of $200 to $400 per hour. Title companies routinely prepare quitclaim deeds in many states.

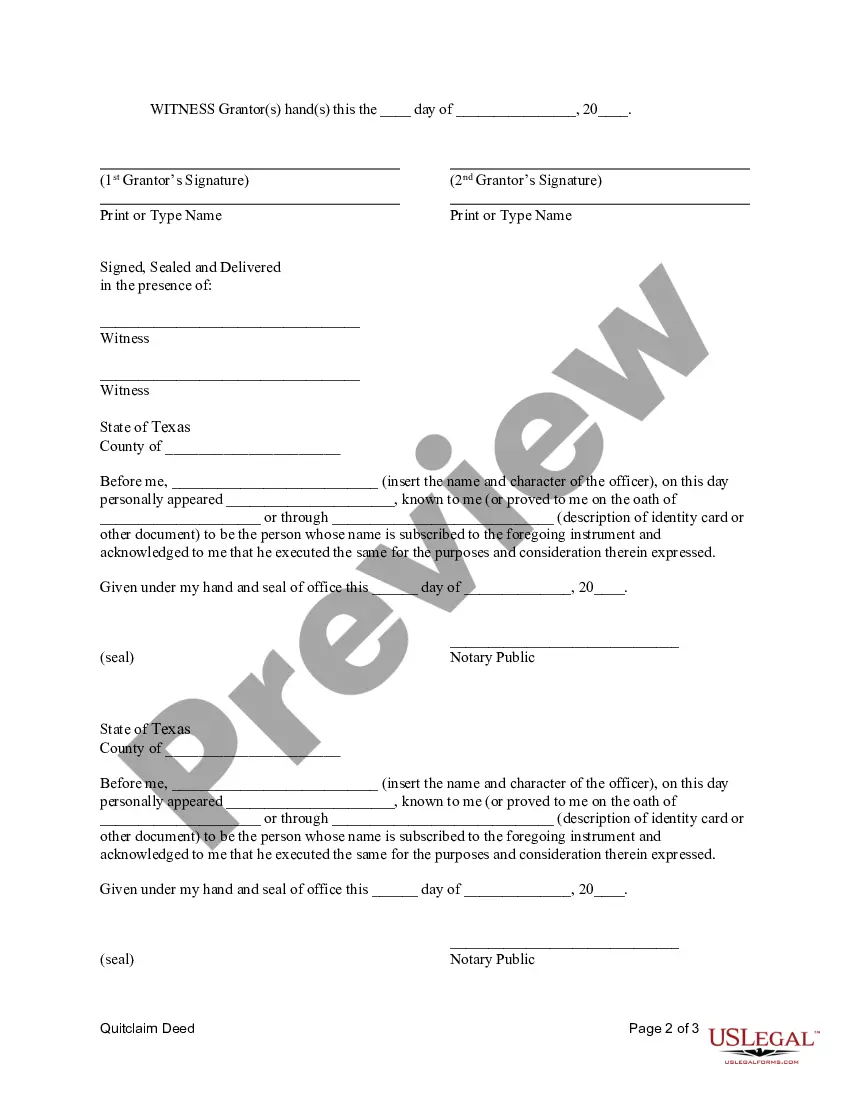

Laws Section 13.002. Recording This form must be filed at the Recorder's Office in the County Clerk's Office. Signing (Section 11.002(c)) The Grantor(s) has the choice of authorizing this form in the presence of Two (2) Witnesses or a Notary Public.

But you might be wondering if an owner can transfer a deed to another person without a real estate lawyer. The answer is yes. Parties to a transaction are always free to prepare their own deeds.A quitclaim deed, for example, is far simpler than a warranty deed.

A person who signs a quitclaim deed to transfer property they do not own results in no title at all being transferred since there is no actual ownership interest. The quitclaim deed only transfers the type of title you own.

The Quit Claim Deed form uses the terms of Grantor (Seller or Owner of said property) and Grantee (Buyer of said property) for the two parties involved. First, the parties must fill in the date. Then, write in the name of the county and state in which the property is located.

A quitclaim deed affects ownership and the name on the deed, not the mortgage. Because quitclaim deeds expose the grantee to certain risks, they are most often used between family members and where there is no exchange of money.Quitclaim deeds transfer title but do not affect mortgages.

You can use a simple form, called a quitclaim deed, to transfer your joint property ownership to either yourself, a family member, a former spouse, or even a trust. Many utilize this deed to make property title transfers without the time and expense of legal fees.