Texas General Warranty Deed from Individual to Five (5) Individuals

What is this form?

The General Warranty Deed from Individual to Five Individuals is a legal document used to transfer property ownership from one individual (the Grantor) to five individuals (the Grantees). This form ensures that the Grantor provides a full warranty of title, meaning they guarantee that they own the property and have the right to transfer it. It is distinct from other types of deeds, such as quitclaim deeds, in that it includes greater protection for the Grantees regarding the title's validity.

Key components of this form

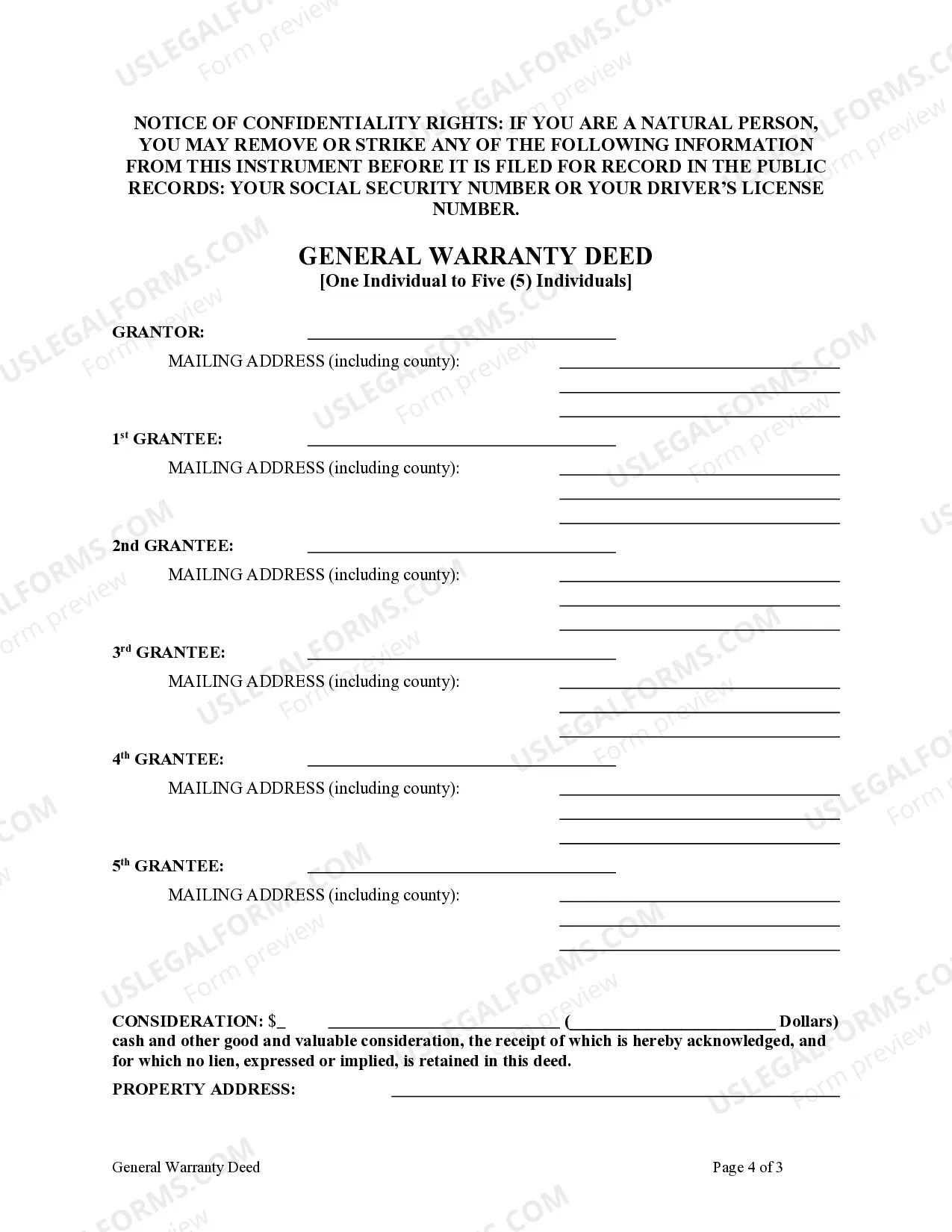

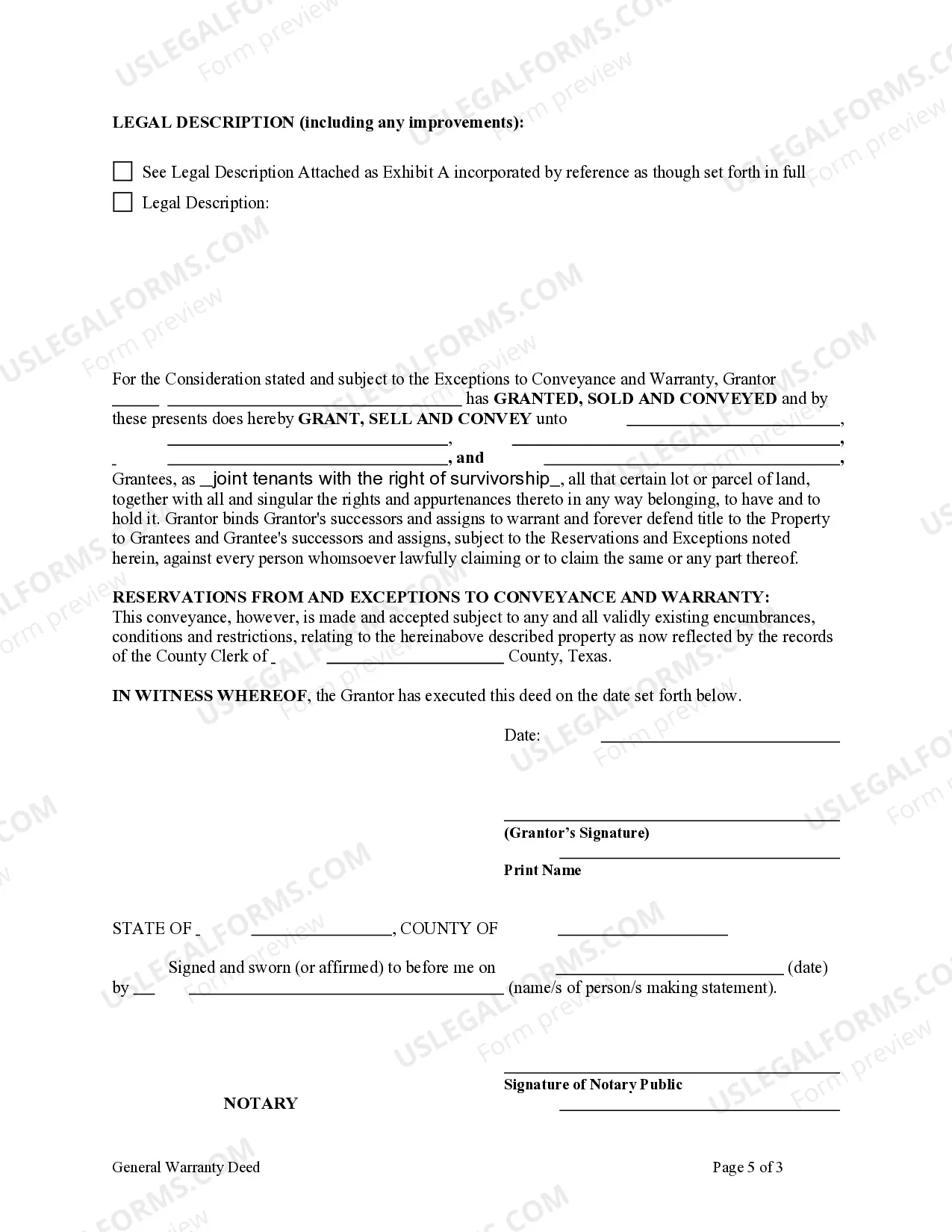

- Identification of the Grantor and Grantees, including legal names.

- Legal description of the property being transferred.

- Statement of the Grantor's warranty of title.

- Designation of how the Grantees will hold the property (e.g., tenants in common, joint tenants with right of survivorship).

- Signatures of the Grantor and any necessary witnesses or notaries.

When this form is needed

This form is appropriate to use when an individual wishes to transfer ownership of property to five persons. Scenarios could include gift transfers among family members, property sales, or distribution of property in partnership arrangements. Using a General Warranty Deed provides assurance to the Grantees about the integrity of the title and protects their interests in the property.

Who should use this form

This form is suitable for:

- Individuals (Grantors) who own property and wish to transfer it to multiple parties.

- Five individuals (Grantees) who are acquiring property together.

- Parties in transactions that require a formal assurance of ownership rights.

Completing this form step by step

- Identify the Grantor and the five Grantees, entering their full legal names.

- Provide a clear legal description of the property being conveyed.

- Indicate how the Grantees will hold the property (e.g., tenants in common or joint tenants with right of survivorship).

- Include the date of the transfer and the Grantor's signature, along with any required witness or notary signatures.

- File the completed deed with the appropriate local government office to finalize the transfer.

Does this form need to be notarized?

To make this form legally binding, it must be notarized. Our online notarization service, powered by Notarize, lets you verify and sign documents remotely through an encrypted video session.

Typical mistakes to avoid

- Failing to include the correct legal description of the property.

- Not properly designating how the Grantees will hold the property.

- Missing required signatures or failing to notarize if required by local law.

- Using outdated forms that may not comply with current legal standards.

Why complete this form online

- Convenient access to legal documents anytime and anywhere.

- Editability allows for quick adjustments and personalized entries.

- Reliable templates drafted by licensed attorneys ensure compliance with legal standards.

- Secure download options that keep your information private.

Form popularity

FAQ

Find the most recent deed to the property. It is best to begin with a copy of the most recent deed to the property (the deed that transferred the property to the current grantor). Create a new deed. Sign and notarize the deed. File the documents in the county land records.

The deed must be presented to and accepted by the grantee, and it should be filed of record in the county clerk's office to put the public on notice of the transfer. Failure to file the deed can subject the property to future claims by other parties. Most commonly, a grantor provides a general warranty deed.

Retrieve your original deed. Get the appropriate deed form. Draft the deed. Sign the deed before a notary. Record the deed with the county recorder. Obtain the new original deed.

A warranty deed, also known as a general warranty deed, is a legal real estate document between the seller (grantor) and the buyer (grantee). The deed protects the buyer by pledging that the seller holds clear title to the property and there are no encumbrances, outstanding liens, or mortgages against it.

A warranty deed guarantees that: The grantor is the rightful owner of the property and has the legal right to transfer the title.The title would withstand third-party claims to ownership of the property. The grantor will do anything to ensure the grantee's title to the property.

The deed must be presented to and accepted by the grantee, and it should be filed of record in the county clerk's office to put the public on notice of the transfer. Failure to file the deed can subject the property to future claims by other parties. Most commonly, a grantor provides a general warranty deed.

Typically, the lender will provide you with a copy of the deed of trust after the closing. The original warranty deeds are often mailed to the grantee after they are recorded. These are your original copies and should be kept in a safe place, such as a fireproof lockbox or a safe deposit box at a financial institution.

As a property owner and grantor, you can obtain a warranty deed for the transfer of real estate through a local realtor's office, or with an online search for a template. To make the form legally binding, you must sign it in front of a notary public.

It's important to note that a warranty deed does not actually prove the grantor has ownership (a title search is the best way to prove that), but it is a promise by the grantor that they are transferring ownership and if it turns out they don't actually own the property, the grantor will be responsible for compensating