This detailed sample Deed in Lieu of Foreclosure complies with Texas law. Adapt the language to fit your facts and circumstances. Available in Word and Rich Text formats.

Texas Deed in Lieu of Foreclosure

Description

How to fill out Texas Deed In Lieu Of Foreclosure?

Get access to high quality Texas Deed in Lieu of Foreclosure templates online with US Legal Forms. Prevent days of wasted time browsing the internet and dropped money on files that aren’t updated. US Legal Forms gives you a solution to exactly that. Get over 85,000 state-specific legal and tax forms you can download and fill out in clicks in the Forms library.

To receive the example, log in to your account and click on Download button. The document will be saved in two places: on the device and in the My Forms folder.

For those who don’t have a subscription yet, check out our how-guide below to make getting started simpler:

- Verify that the Texas Deed in Lieu of Foreclosure you’re considering is appropriate for your state.

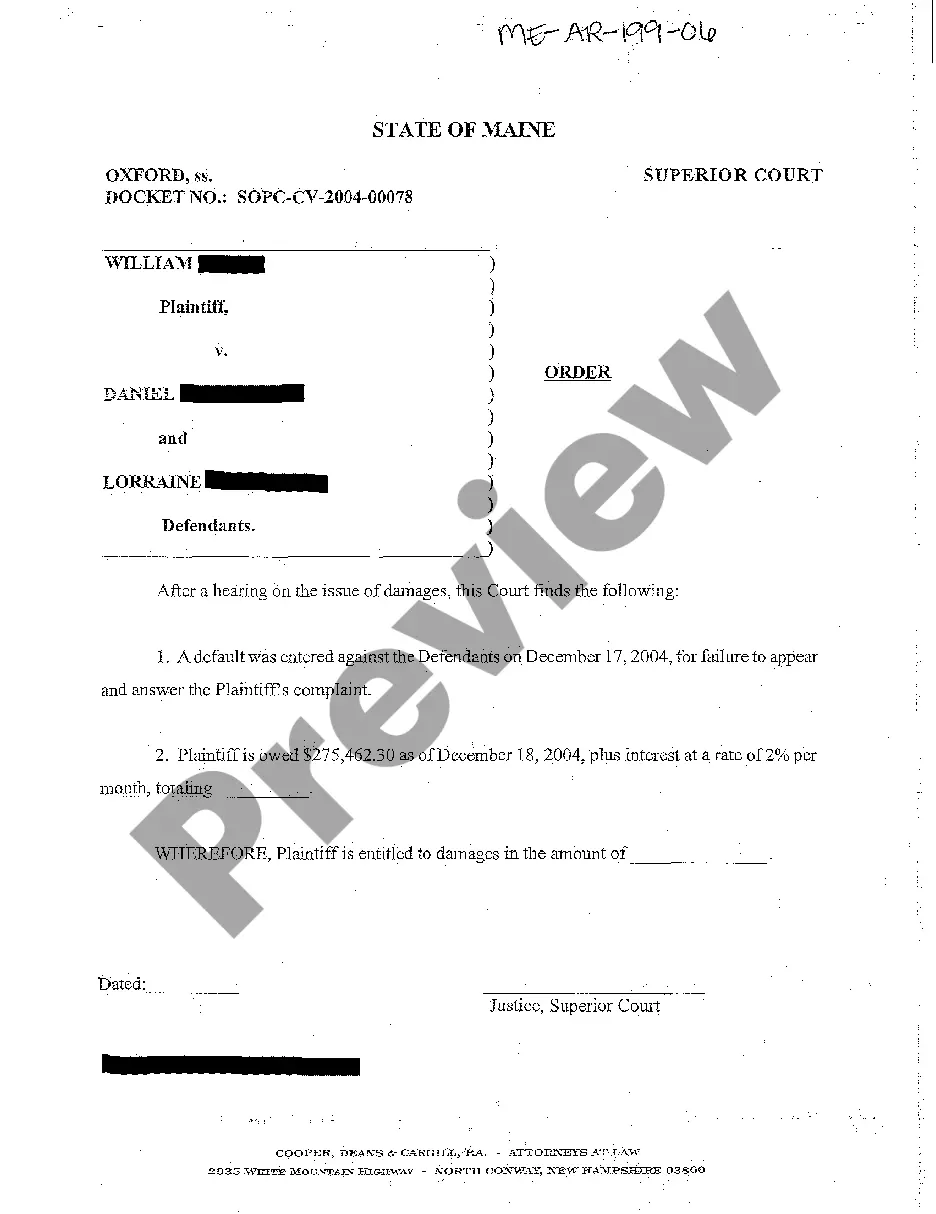

- See the form utilizing the Preview function and read its description.

- Go to the subscription page by clicking on Buy Now button.

- Choose the subscription plan to keep on to sign up.

- Pay out by credit card or PayPal to finish creating an account.

- Select a favored file format to save the file (.pdf or .docx).

Now you can open the Texas Deed in Lieu of Foreclosure template and fill it out online or print it and get it done by hand. Consider sending the document to your legal counsel to make sure things are completed properly. If you make a mistake, print out and complete sample again (once you’ve made an account all documents you save is reusable). Create your US Legal Forms account now and access more templates.

Form popularity

FAQ

The impact that a deed in lieu has on your score depends primarily on your credit history.According to FICO, if you start with a score of around 780, a deed in lieu (without a deficiency balance) shaves 105 to 125 points off your score; but if you start with a score of 680, you'll lose 50 to 70 points.

Rather than deal with the foreclosure process, I would like to give you the deed to my home, in exchange for forgiveness on the loan. I do not have a second mortgage, and there are no other liens on the property. I have attached all relevant documents for the house and for my current economic situation.

Disadvantages of a Deed in Lieu of Foreclosure. Perhaps the biggest disadvantage of a deed in lieu is that the Lender takes subject to all other encumbrances and interests in the Property. Therefore if there is a second mortgage, for example, a deed in lieu would likely not be a viable strategy.

If your lender agrees to a short sale or to accept a deed in lieu of foreclosure, you might owe federal income tax on any forgiven deficiency. The IRS learns of the deficiency when the lender sends it a Form 1099-C, which reports the forgiven debt as income to you.

The waiting period on a conventional loan after a deed in lieu is 4 years, compared to 7 years on a conventional loan.

Final Thoughts On Deed In Lieu Of Foreclosure When you take a deed in lieu agreement, you transfer your home's deed to your lender voluntarily. In exchange, the lender agrees to forgive the amount left on your loan. A deed in lieu agreement won't stay on your credit report if a foreclosure will.

The deed in lieu of foreclosure offers several advantages to both the borrower and the lender. The principal advantage to the borrower is that it immediately releases him/her from most or all of the personal indebtedness associated with the defaulted loan.