This detailed sample Financing Agreementcomplies with Texas law. Adapt the language to fit your facts and circumstances. Available in Word and Rich Text formats.

Texas Financing

Description

How to fill out Texas Financing?

Access to high quality Texas Financing templates online with US Legal Forms. Steer clear of hours of lost time searching the internet and dropped money on files that aren’t up-to-date. US Legal Forms offers you a solution to exactly that. Get over 85,000 state-specific authorized and tax samples that you can download and submit in clicks in the Forms library.

To receive the sample, log in to your account and click Download. The document will be saved in two places: on the device and in the My Forms folder.

For people who don’t have a subscription yet, take a look at our how-guide listed below to make getting started easier:

- Check if the Texas Financing you’re considering is suitable for your state.

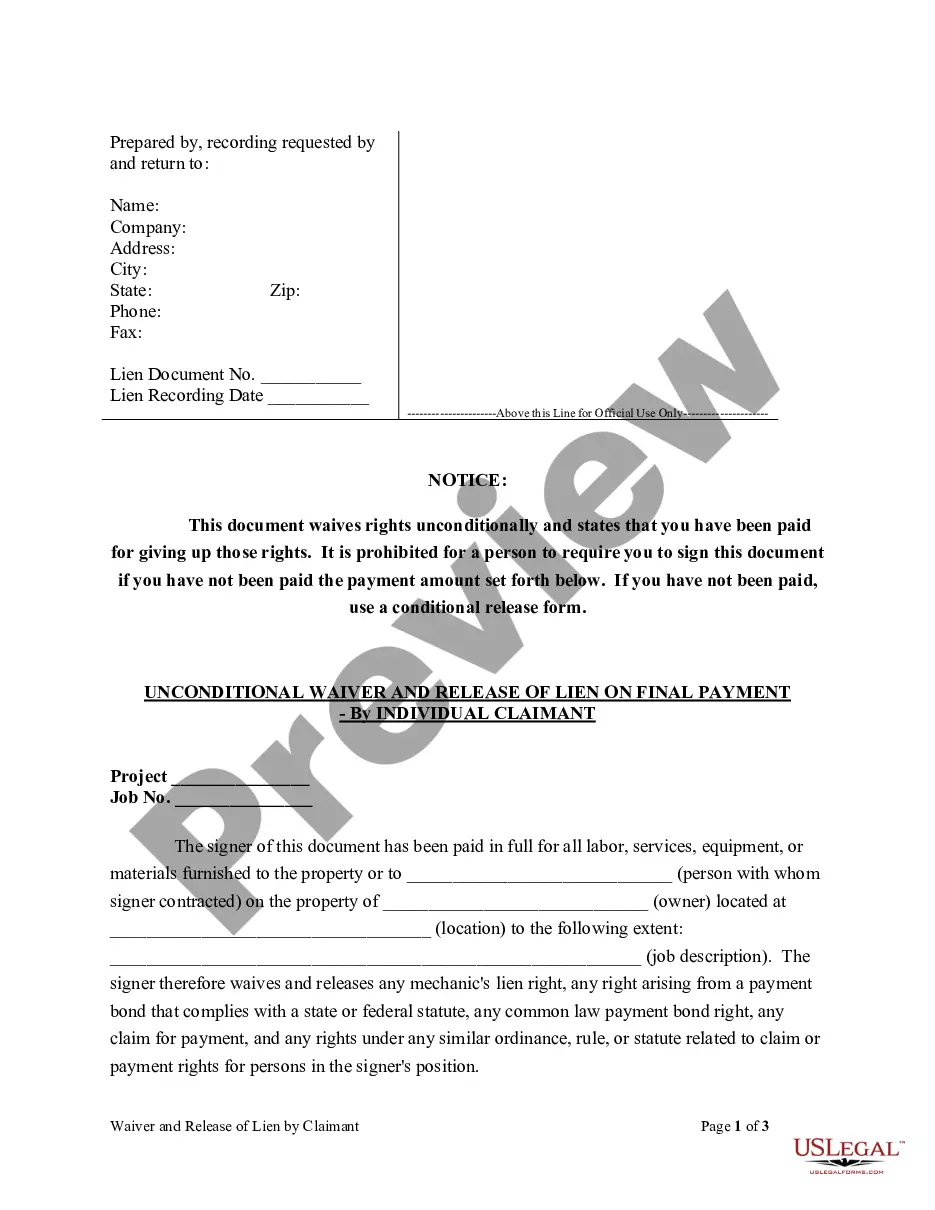

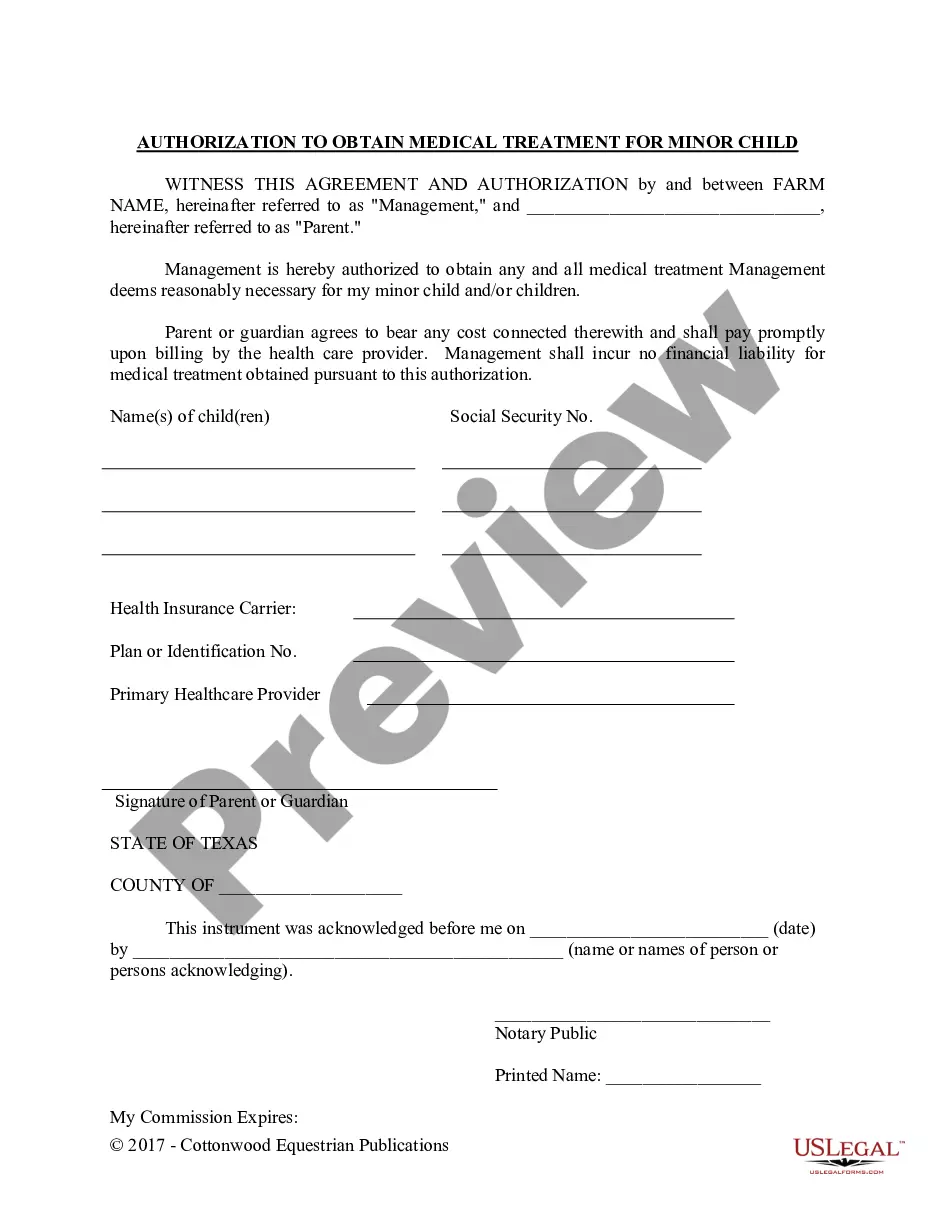

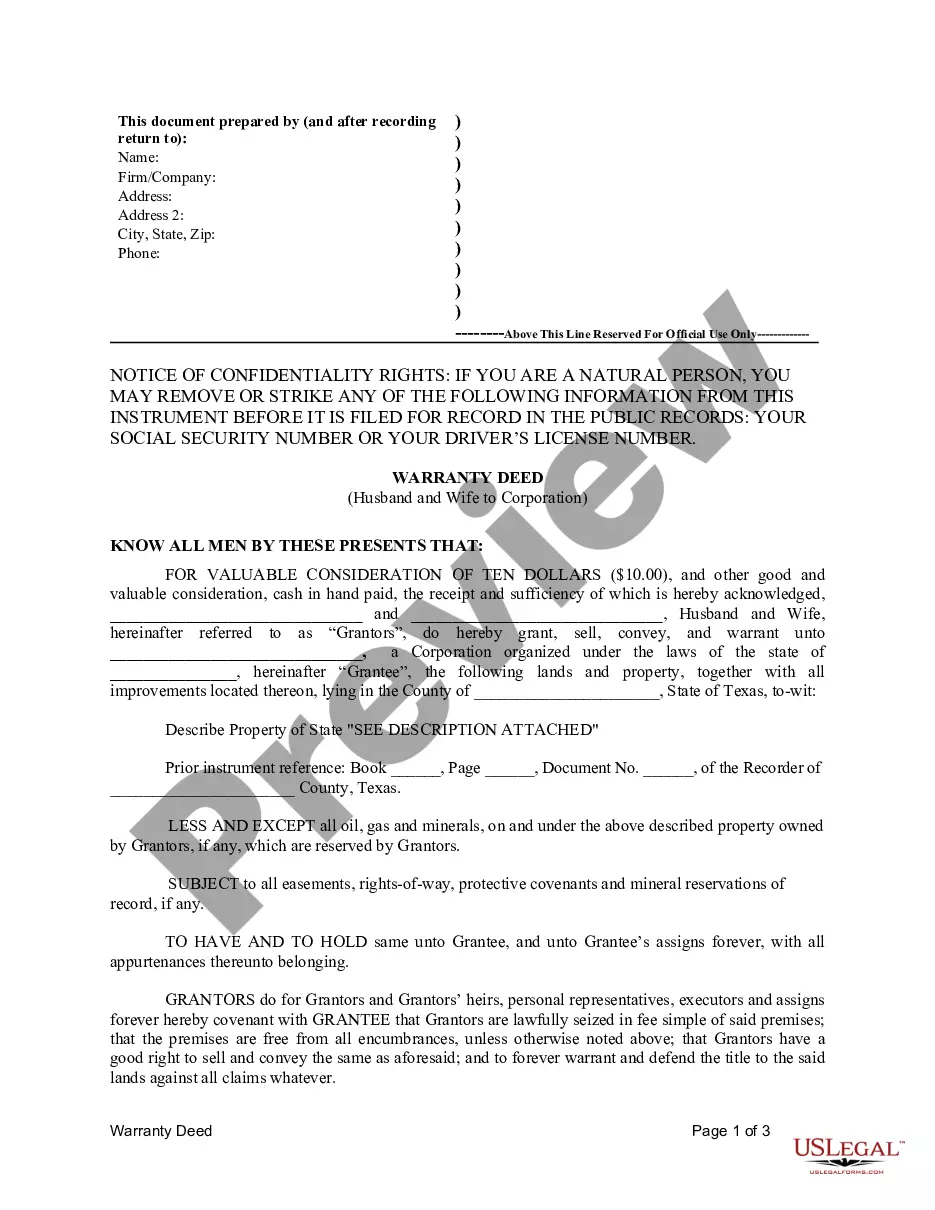

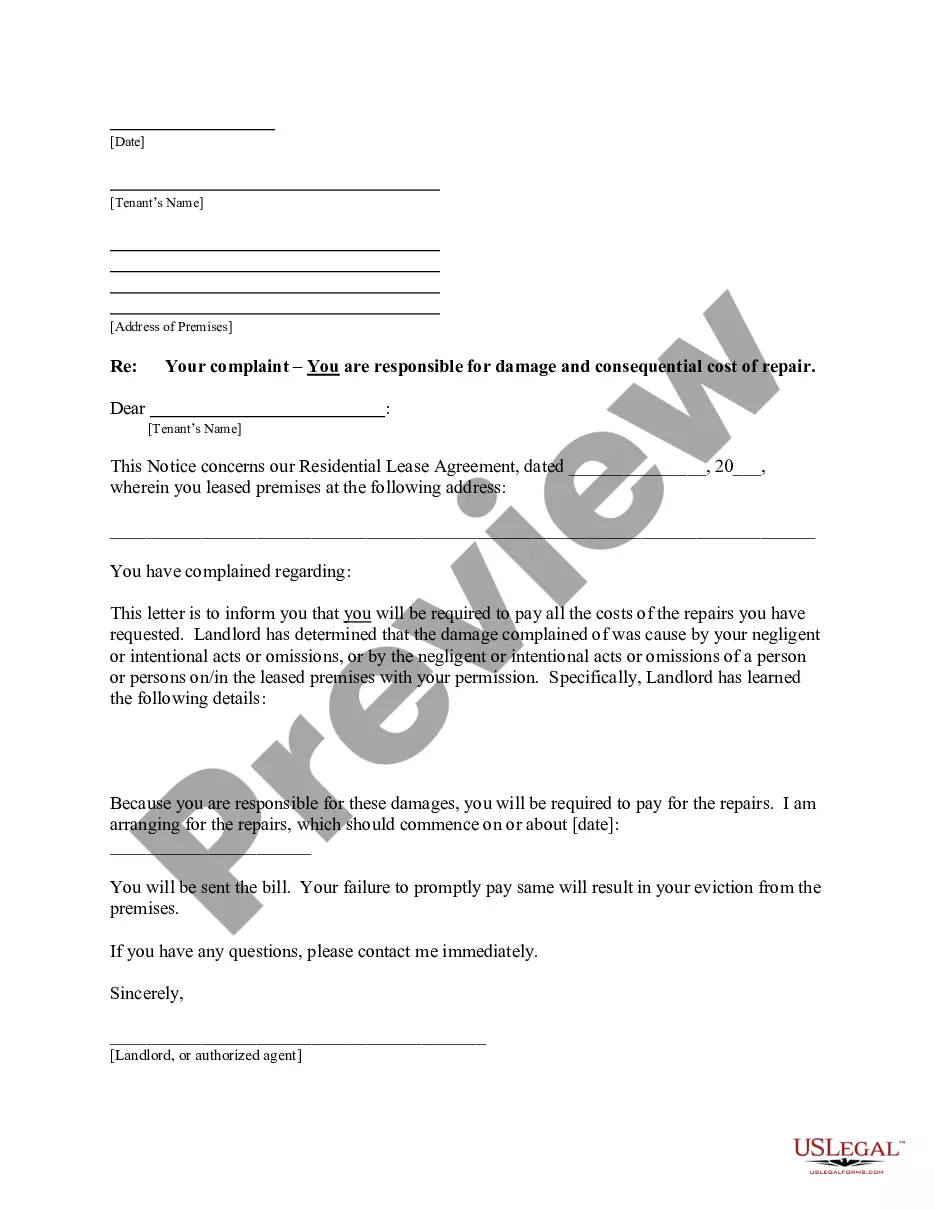

- Look at the sample making use of the Preview function and browse its description.

- Check out the subscription page by clicking on Buy Now button.

- Select the subscription plan to go on to sign up.

- Pay out by credit card or PayPal to complete creating an account.

- Select a preferred format to download the file (.pdf or .docx).

You can now open the Texas Financing template and fill it out online or print it and do it by hand. Take into account mailing the document to your legal counsel to make sure things are completed appropriately. If you make a mistake, print and complete sample again (once you’ve made an account all documents you download is reusable). Create your US Legal Forms account now and get more forms.

Form popularity

FAQ

640 to 700: Business loan providers generally consider a credit score that falls somewhere between 640 and 700 to be goodbut not excellent. Generally, the minimum credit score for SBA and term loans is around 680.

What credit score do I need to get a business loan? You will usually need a score of at least 500 to secure a business loan, such as a short-term loan or line of credit.

Bad credit small-business loans are available from alternative sources, like online lenders. If your credit isn't great, getting a loan from a bank or credit union may be difficult. Borrowers with poor credit are considered riskier, so available loans will likely be more expensive as a result.

Lender land loans. Community banks and credit unions are more likely to offer land loans than large national banks. USDA Rural Housing Site loans. SBA 504 loans. Home equity loan. Seller financing.

Do I need to be licensed by the Department? Yes, the Texas SAFE Act requires an individual to be licensed prior to taking a residential mortgage loan application or offering or negotiating the terms of a residential mortgage loan.

A: Land loans will typically have a shorter term than home loans. Instead of a 30-year term like you would see for a mortgage, the loan could be as little as a few years.This is calculated by dividing the amount of the loan by the property's value or purchase price, whichever is lower.

A land loan is financing that allows you to purchase a plot of land. As with a home mortgage, you can obtain a land loan through a bank or a lender, who will evaluate your credit history and the value of the land to determine if you're an eligible buyer.That makes land loans a riskier transaction for a lender.

Invoice financing. Online Loans. Equipment Financing. SBA loans. Merchant Cash Advance. Business line of credit. Commercial Real Estate Loans. Microloans.

The Heritage Difference. If you're looking to buy land for hunting, recreation, an ag operation or just a place to retire on, there's one name in Texas to know. Heritage Land Bank is the right financing partner for anyone buying rural land in Texas. In fact, nobody knows Texas better.