Texas Loan Assumption Addendum

Description

How to fill out Texas Loan Assumption Addendum?

Handling legal documentation requires attention, precision, and using properly-drafted blanks. US Legal Forms has been helping people nationwide do just that for 25 years, so when you pick your Texas Loan Assumption Addendum template from our library, you can be sure it complies with federal and state regulations.

Dealing with our service is simple and quick. To get the necessary paperwork, all you’ll need is an account with a valid subscription. Here’s a quick guideline for you to obtain your Texas Loan Assumption Addendum within minutes:

- Make sure to carefully look through the form content and its correspondence with general and law requirements by previewing it or reading its description.

- Look for an alternative formal blank if the previously opened one doesn’t match your situation or state regulations (the tab for that is on the top page corner).

- Log in to your account and save the Texas Loan Assumption Addendum in the format you need. If it’s your first time with our service, click Buy now to continue.

- Register for an account, select your subscription plan, and pay with your credit card or PayPal account.

- Choose in what format you want to obtain your form and click Download. Print the blank or upload it to a professional PDF editor to prepare it electronically.

All documents are drafted for multi-usage, like the Texas Loan Assumption Addendum you see on this page. If you need them in the future, you can fill them out without re-payment - just open the My Forms tab in your profile and complete your document any time you need it. Try US Legal Forms and accomplish your business and personal paperwork quickly and in total legal compliance!

Form popularity

FAQ

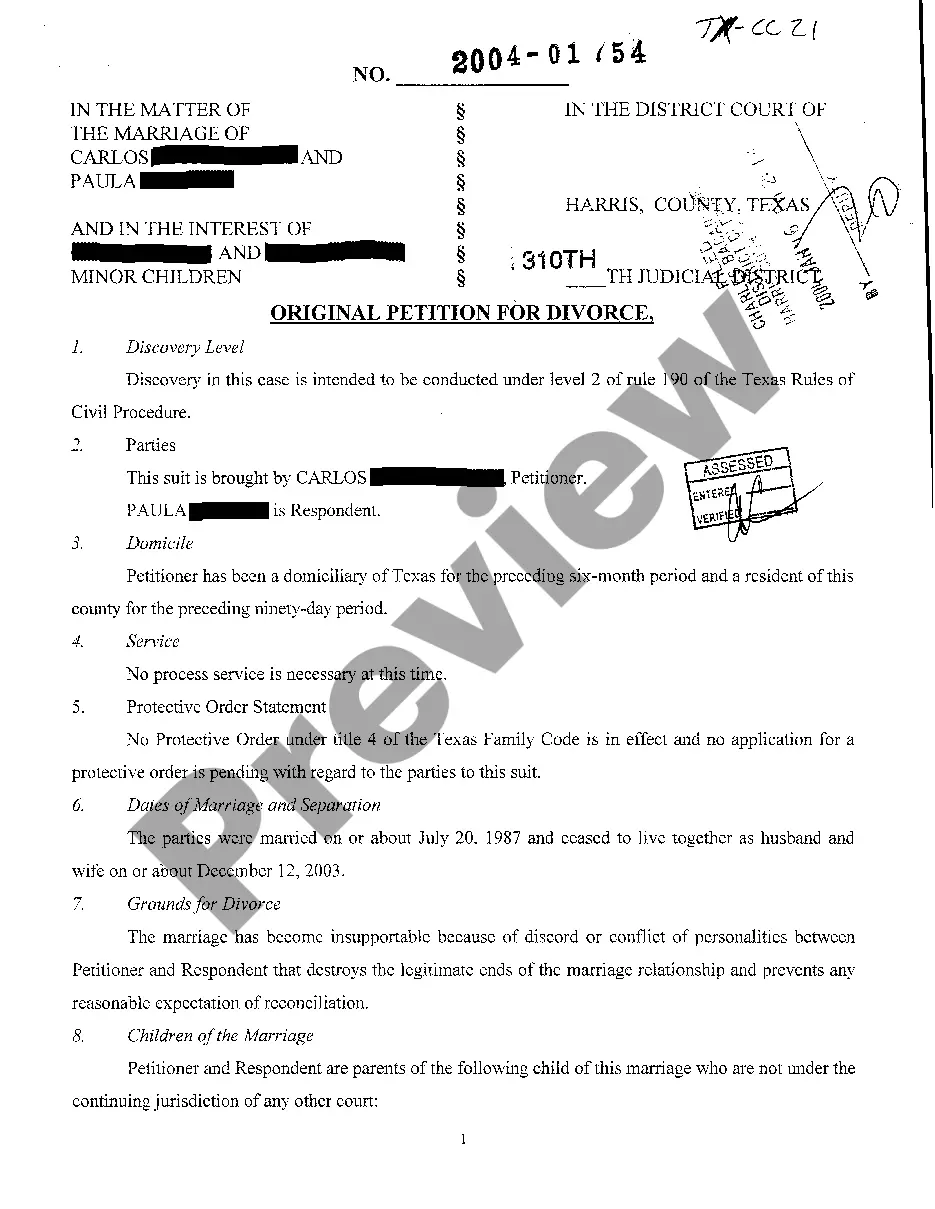

An executed original of this Assumption Agreement will be recorded in the Land Records as a modification to the Security Instrument.

An assumption clause is a provision in a mortgage contract that allows the seller of a home to pass responsibility for the existing mortgage to the buyer of the property. In other words, the new homeowner assumes the existing mortgage and?along with it?ownership of the property that secures the loan.

To assume a loan, the buyer must qualify with the lender. If the price of the house exceeds the remaining mortgage, the buyer must remit a down payment that is the difference between the sale price and the mortgage. If the difference is substantial, the buyer may need to secure a second mortgage.

Texas Assumption Deed of Trust As the title indicates, in a deed of trust to secure assumption, another person assumes the note already in place, guaranteeing payment to the grantor in the deed. The agreement means that the buyer or grantee in the deed takes the property, assuming the debt currently on the property.

An assumable mortgage is a home loan that can be transferred from the original borrower to the next homeowner. The interest rate and payment period stay the same. For example, if a 30-year mortgage is three years old, the person assuming the loan has 27 years to pay it off.

The most important document in the loan assumption process is the deed of trust, which adds your name to the mortgage and absolves the original borrower of any obligations under the agreement, assuming a novation. All parties will be required to sign the final documents.

A loan assumption agreement is an agreement between a lender, original borrower, and a new borrower, where the new borrower agrees to assume responsibility for the debt owed by original borrower. These agreements are commonly seen in mortgages and real estate.

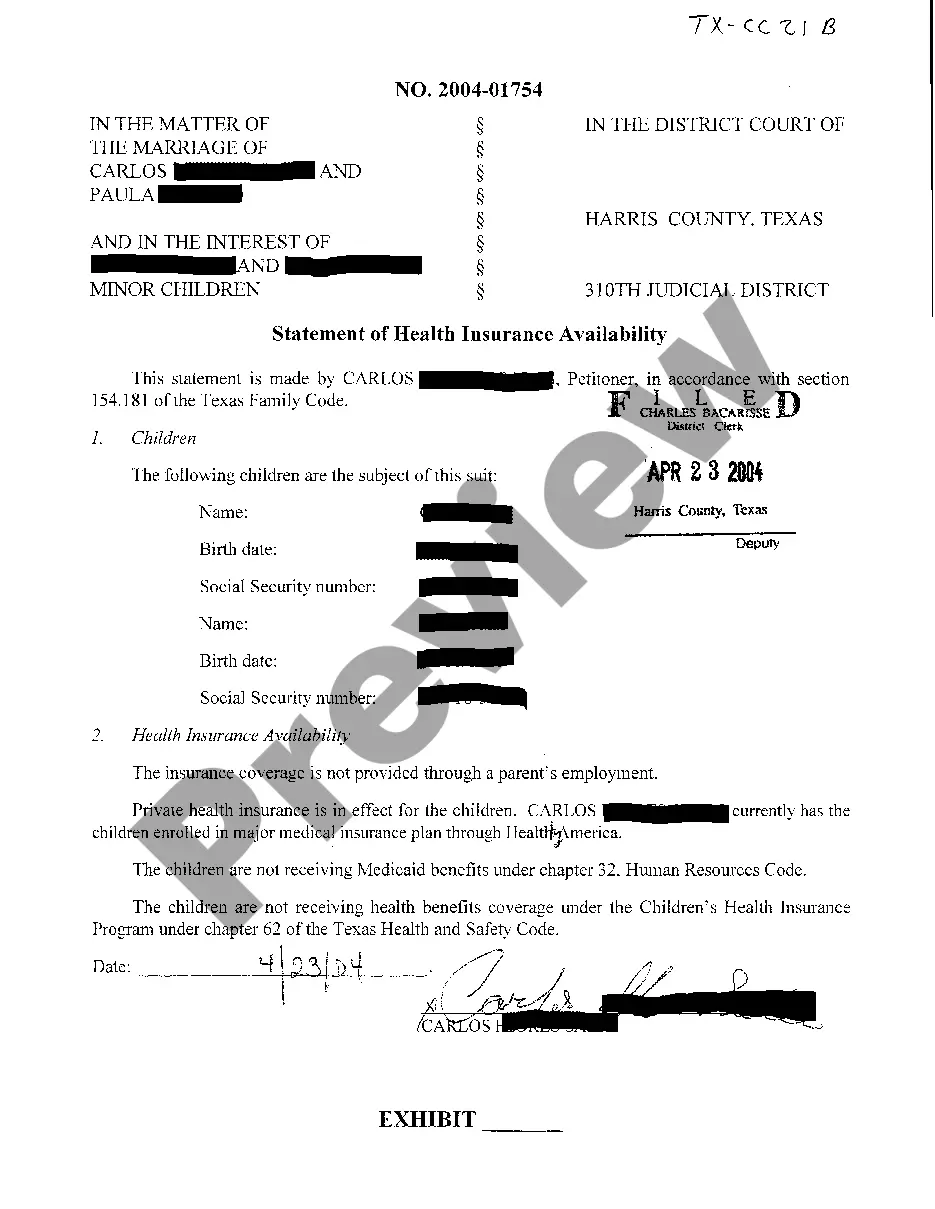

You can use an assumable loan to keep the family home after a divorce. The party awarded the house will need to qualify for the loan on their own. This means that they will need to have good credit and income. If they are eligible, they can assume the mortgage and make the payments.