Texas Addendum Concerning Right to Terminate Due to Lender's Appraisal

Description Addendum Concerning Right To Terminate Due To Lender's Appraisal

How to fill out Texas Addendum Concerning Right To Terminate Due To Lender's Appraisal?

If you’re looking for a way to properly prepare the Texas Addendum Concerning Right to Terminate Due to Lender's Appraisal without hiring a legal professional, then you’re just in the right place. US Legal Forms has proven itself as the most extensive and reliable library of formal templates for every private and business situation. Every piece of documentation you find on our web service is drafted in accordance with nationwide and state regulations, so you can be sure that your documents are in order.

Adhere to these straightforward guidelines on how to obtain the ready-to-use Texas Addendum Concerning Right to Terminate Due to Lender's Appraisal:

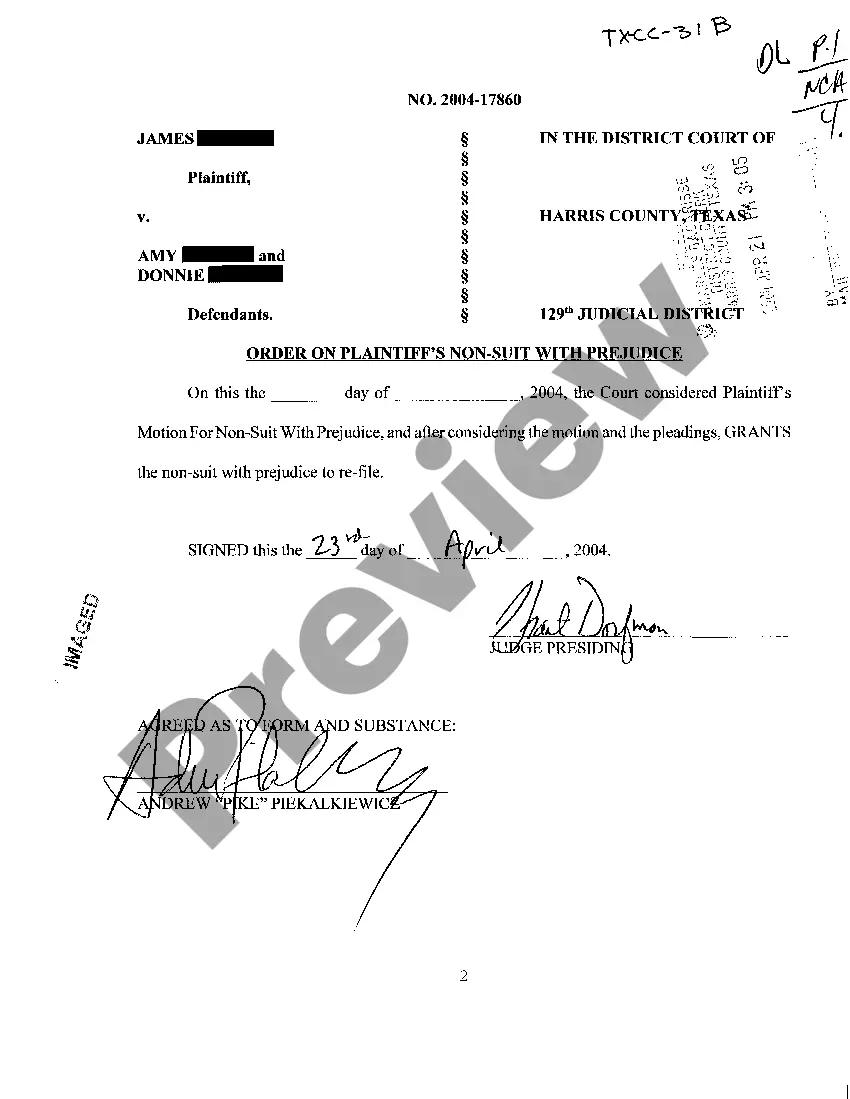

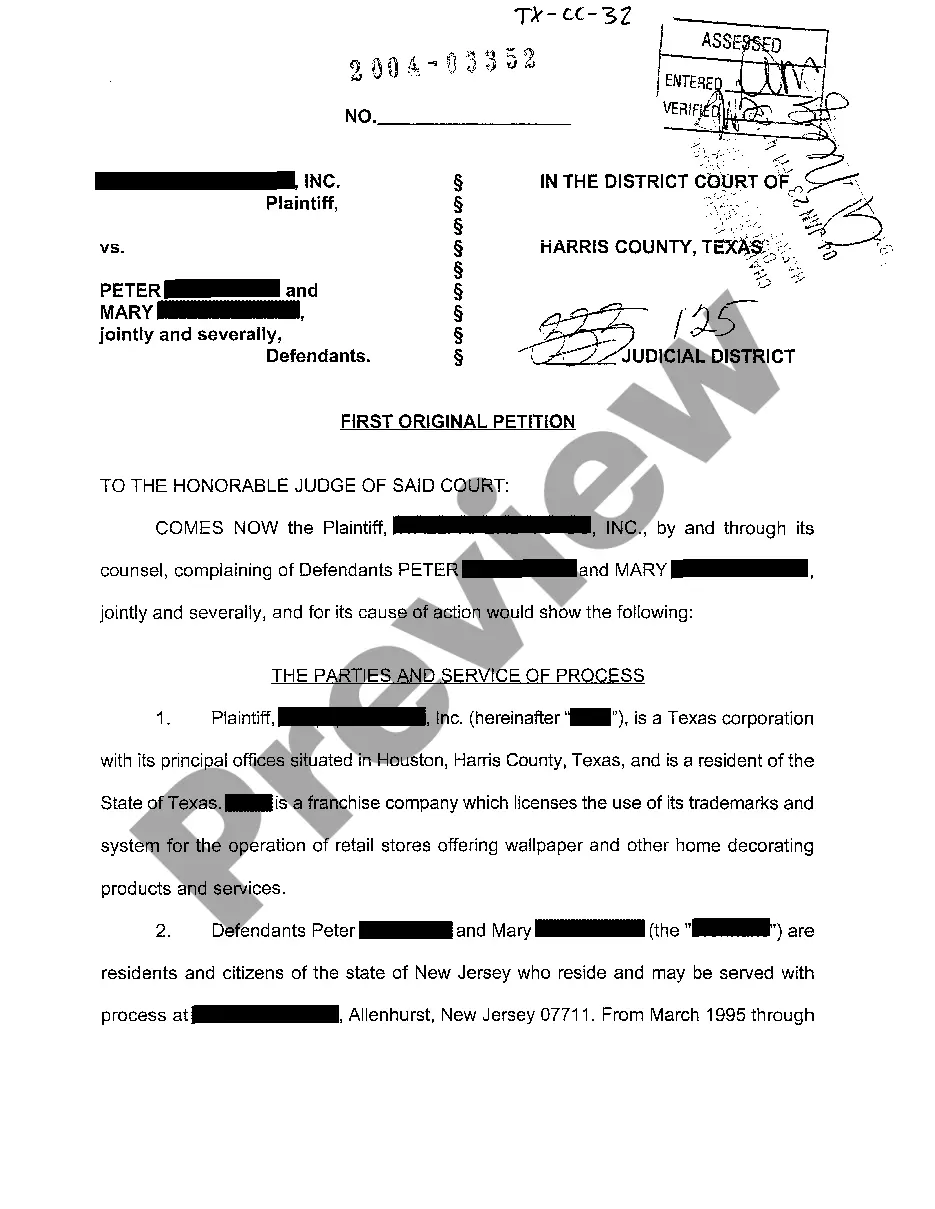

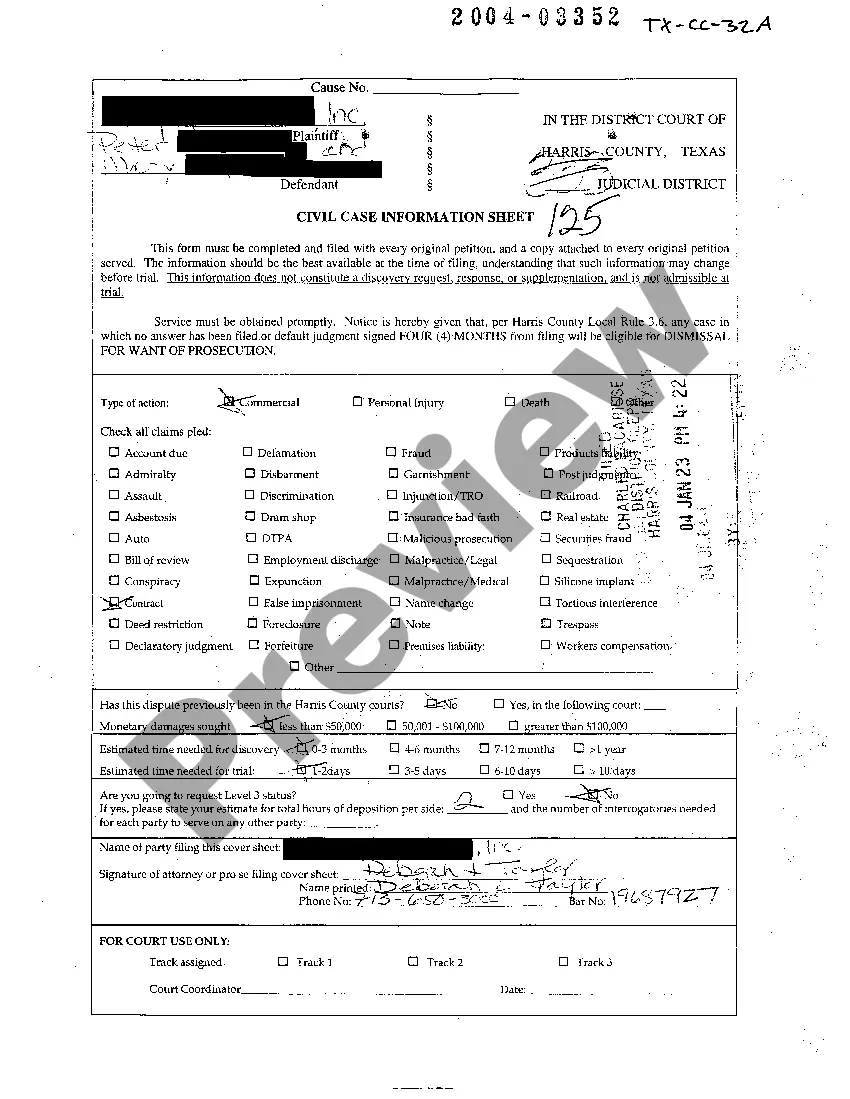

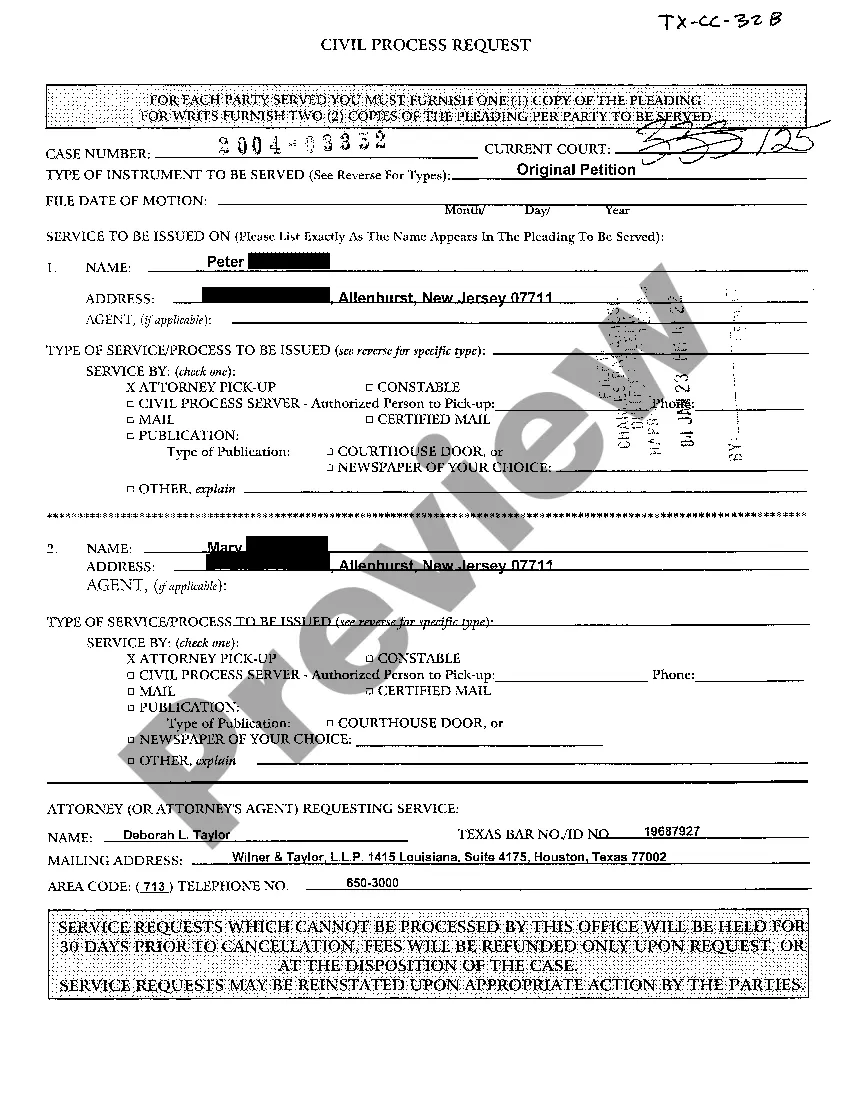

- Make sure the document you see on the page complies with your legal situation and state regulations by checking its text description or looking through the Preview mode.

- Enter the form title in the Search tab on the top of the page and select your state from the dropdown to find an alternative template in case of any inconsistencies.

- Repeat with the content check and click Buy now when you are confident with the paperwork compliance with all the demands.

- Log in to your account and click Download. Create an account with the service and opt for the subscription plan if you still don’t have one.

- Use your credit card or the PayPal option to pay for your US Legal Forms subscription. The document will be available to download right after.

- Decide in what format you want to save your Texas Addendum Concerning Right to Terminate Due to Lender's Appraisal and download it by clicking the appropriate button.

- Add your template to an online editor to complete and sign it quickly or print it out to prepare your paper copy manually.

Another great advantage of US Legal Forms is that you never lose the paperwork you purchased - you can pick any of your downloaded templates in the My Forms tab of your profile whenever you need it.

Partial Appraisal Waiver Texas Form popularity

FAQ

The appraisal contingency addendum consists of the buyer's right to terminate the contract if the appraised value is less than the purchase price. In this case, the buyer will have to provide the seller with a written notice.

Which two TREC addenda both give the seller the ability to terminate the contract? The answer is Seller Financing Addendum and Loan Assumption Addendum.

What is an appraisal contingency addendum? An addendum is a separate form that, once signed by the buyer and seller, becomes part of the sales contract. Appraisal contingency addendums are state-specific and allow buyers to move forward with their purchase under certain agreed-upon conditions.

Waiving an appraisal contingency can be a smart tactic for standing out in an extremely competitive seller's market. Doing so could eliminate a seller's fear that the deal might fall through if the property doesn't appraise for the initial asking price.

Description: This Addendum is used when any type of financing for all or part of the purchase price will be provided by a third-party (not the Seller or Buyer).

By waiving an appraisal contingency, the buyer is able to appeal to the seller by eliminating the chance that the deal would fall through if the property doesn't appraise for the elevated sale price.

An appraisal waiver does come with some benefits for buyers. An appraisal waiver will save buyers money. The costs of these in-person visits vary, but they typically run from $300 ? $450. An appraisal waiver can also reduce the amount of time it takes to close on a home.

An appraisal waiver allows qualified home buyers to skip the in-person appraisal process when buying a home. Instead, lenders use data generated by an automated underwriting system to determine the value of the home based on the information it has collected from other recent home sales in the area.