Texas Debtor's Sworn Statement for 341 Meeting

Description

How to fill out Texas Debtor's Sworn Statement For 341 Meeting?

Handling official documentation requires attention, accuracy, and using well-drafted blanks. US Legal Forms has been helping people countrywide do just that for 25 years, so when you pick your Texas Debtor's Sworn Statement for 341 Meeting template from our library, you can be sure it complies with federal and state regulations.

Working with our service is easy and fast. To get the required paperwork, all you’ll need is an account with a valid subscription. Here’s a brief guideline for you to obtain your Texas Debtor's Sworn Statement for 341 Meeting within minutes:

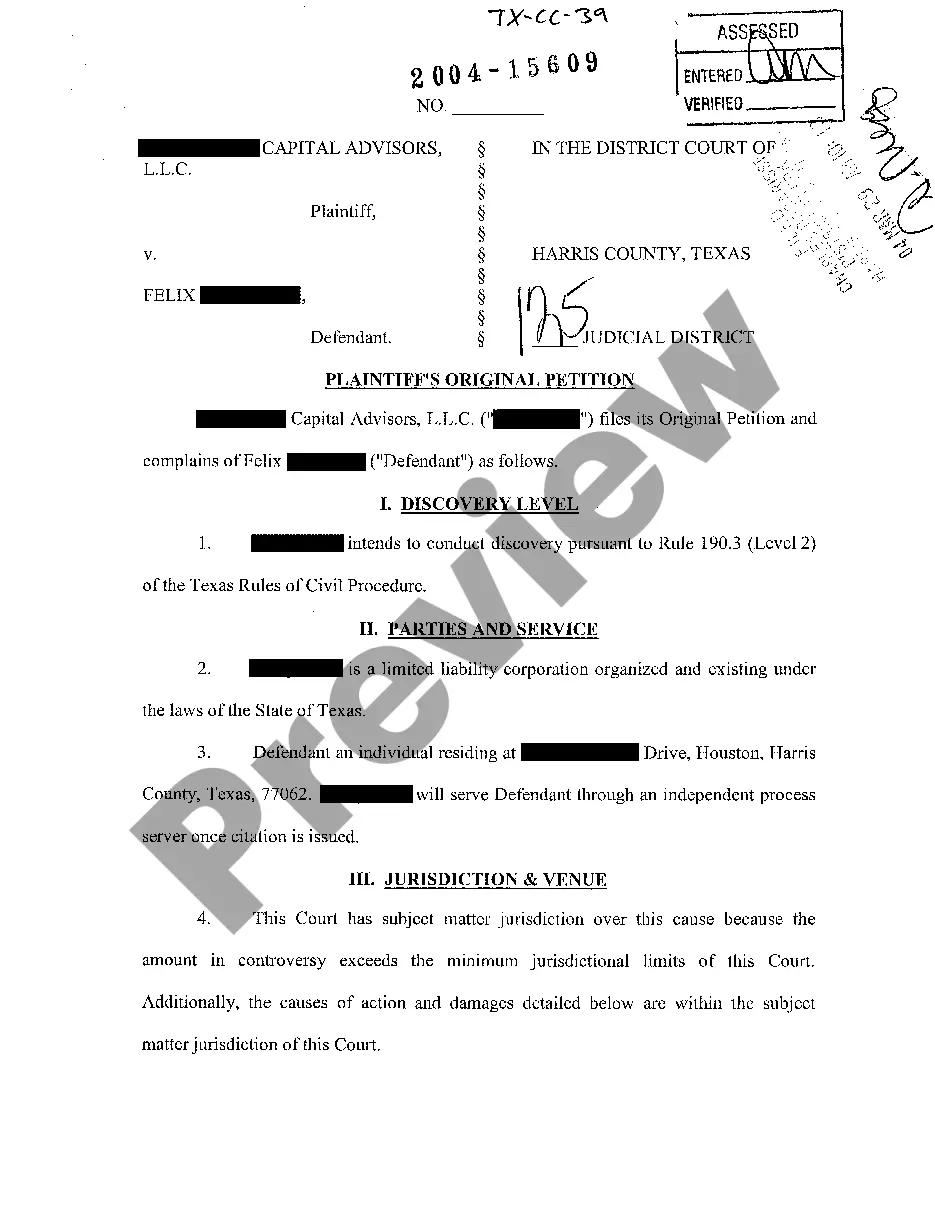

- Remember to carefully check the form content and its correspondence with general and legal requirements by previewing it or reading its description.

- Search for another formal template if the previously opened one doesn’t match your situation or state regulations (the tab for that is on the top page corner).

- Log in to your account and download the Texas Debtor's Sworn Statement for 341 Meeting in the format you need. If it’s your first experience with our service, click Buy now to continue.

- Register for an account, choose your subscription plan, and pay with your credit card or PayPal account.

- Choose in what format you want to obtain your form and click Download. Print the blank or add it to a professional PDF editor to submit it electronically.

All documents are created for multi-usage, like the Texas Debtor's Sworn Statement for 341 Meeting you see on this page. If you need them one more time, you can fill them out without re-payment - simply open the My Forms tab in your profile and complete your document whenever you need it. Try US Legal Forms and prepare your business and personal paperwork quickly and in total legal compliance!

Form popularity

FAQ

Tips for Attending Your 341 Meeting On the day of the meeting, dress professionally and not too casually, as if you're attending a job interview. There are only a few things you'll need to bring, but they're essential to the meeting: Driver's license or government-issued ID card. Government issued social security card.

If any creditors do attend the 341 meeting, it is typically out of curiosity, to ask whether their debt will be reaffirmed, or to ask about the location and condition of their collateral. In most cases, the meeting of creditors is not attended by any of the debtor's creditors.

Now, in most consumer cases, creditors don't attend the 341 meeting, even though it's called the meeting of creditors. In probably 95, if not 98% of cases, no creditors actually attend. It's only going to be the trustee that will be asked some questions to verify your financial situation.

At the meeting of creditors?also called the 341 hearing?the debtor meets with the trustee appointed to oversee the case. The trustee will check identification and ask a series of questions about the bankruptcy paperwork. Creditors can attend and ask about financial matters as well, although few appear.

Creditors usually do not show up for this meeting. Any of your testimony will be recorded and used against you if there is a dispute. Your answers must be brief and direct.

The meeting of creditors is a hearing all debtors must attend in any bankruptcy proceeding. The meeting of creditors is held outside of the presence of the judge and, depending upon the case chapter, usually occurs between 21 and 50 days after the filing of the petition.

341 Meeting Questions the Bankruptcy Trustee Might Ask Along with the mandatory questions, trustees typically ask about your property and other assets, income, expenses, and debts. Other areas will include discrepancies in your bankruptcy forms and how you came up with a value for various property items.

Failure to attend the Section 341 meeting without the prior agreement of the Chapter 13 Trustee or the Bankruptcy Administrator, as applicable, may result in the filing of a Motion to Dismiss the case by the Trustee or the Bankruptcy Administrator.