Texas Model Individual Chapter 11 Plan (modified 03/18/2016)

Description

How to fill out Texas Model Individual Chapter 11 Plan (modified 03/18/2016)?

Handling legal documentation requires attention, precision, and using well-drafted templates. US Legal Forms has been helping people across the country do just that for 25 years, so when you pick your Texas Model Individual Chapter 11 Plan (modified 03/18/2016) template from our library, you can be sure it complies with federal and state regulations.

Working with our service is simple and quick. To obtain the required document, all you’ll need is an account with a valid subscription. Here’s a brief guideline for you to find your Texas Model Individual Chapter 11 Plan (modified 03/18/2016) within minutes:

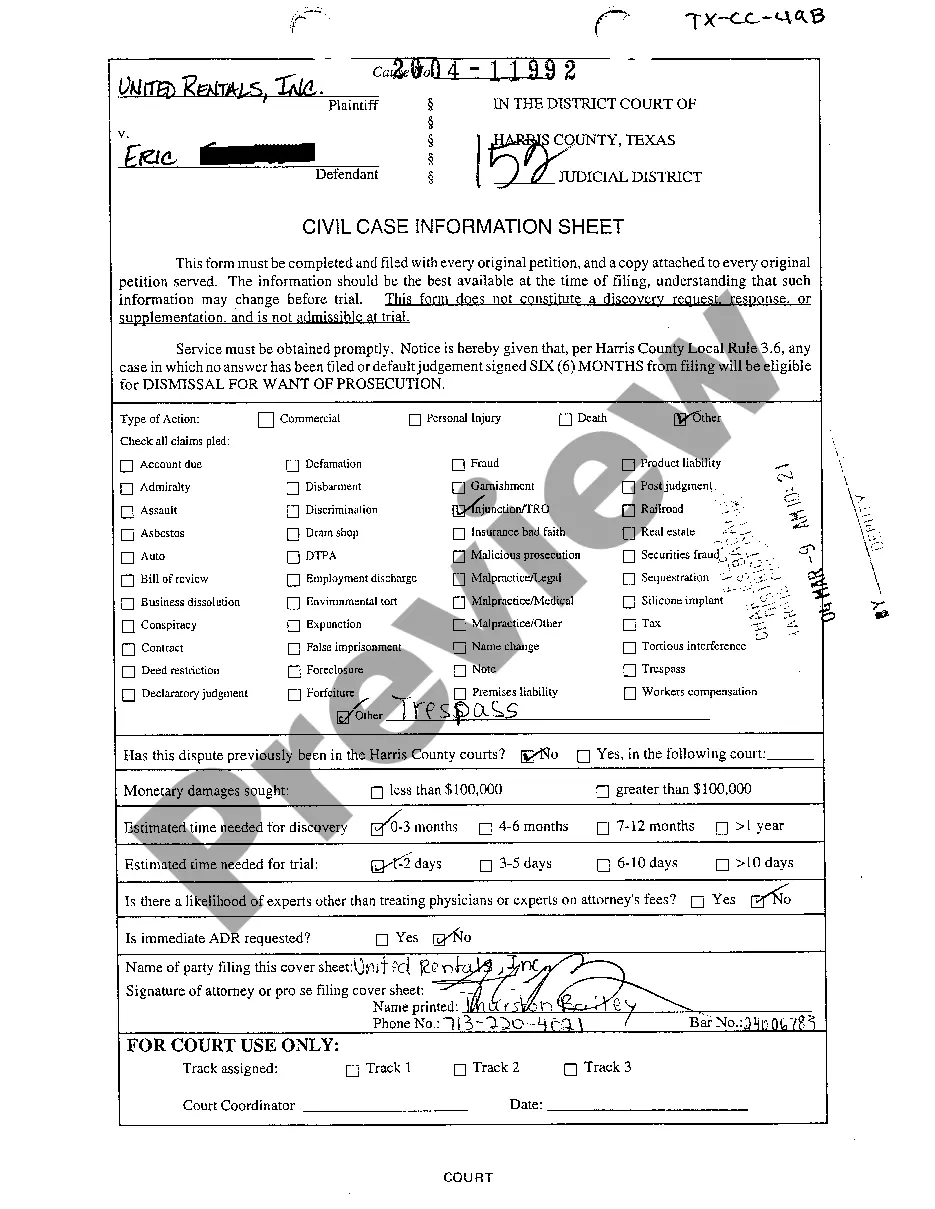

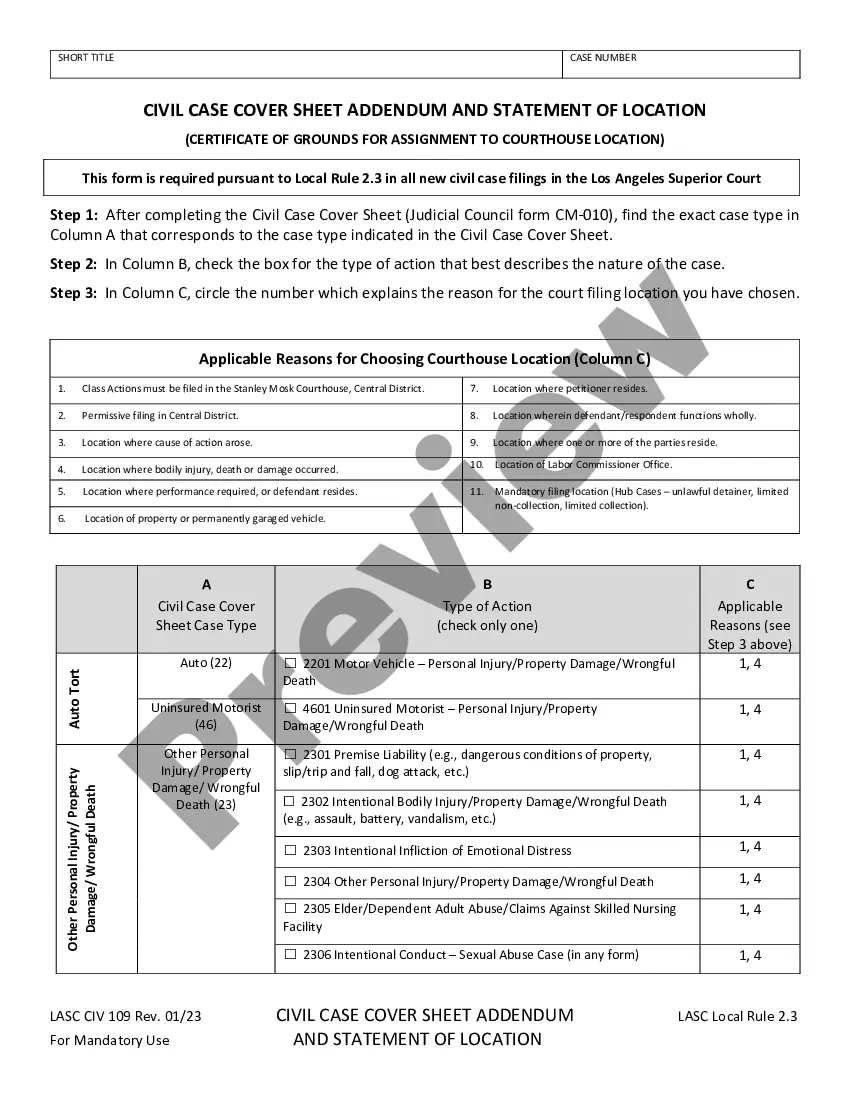

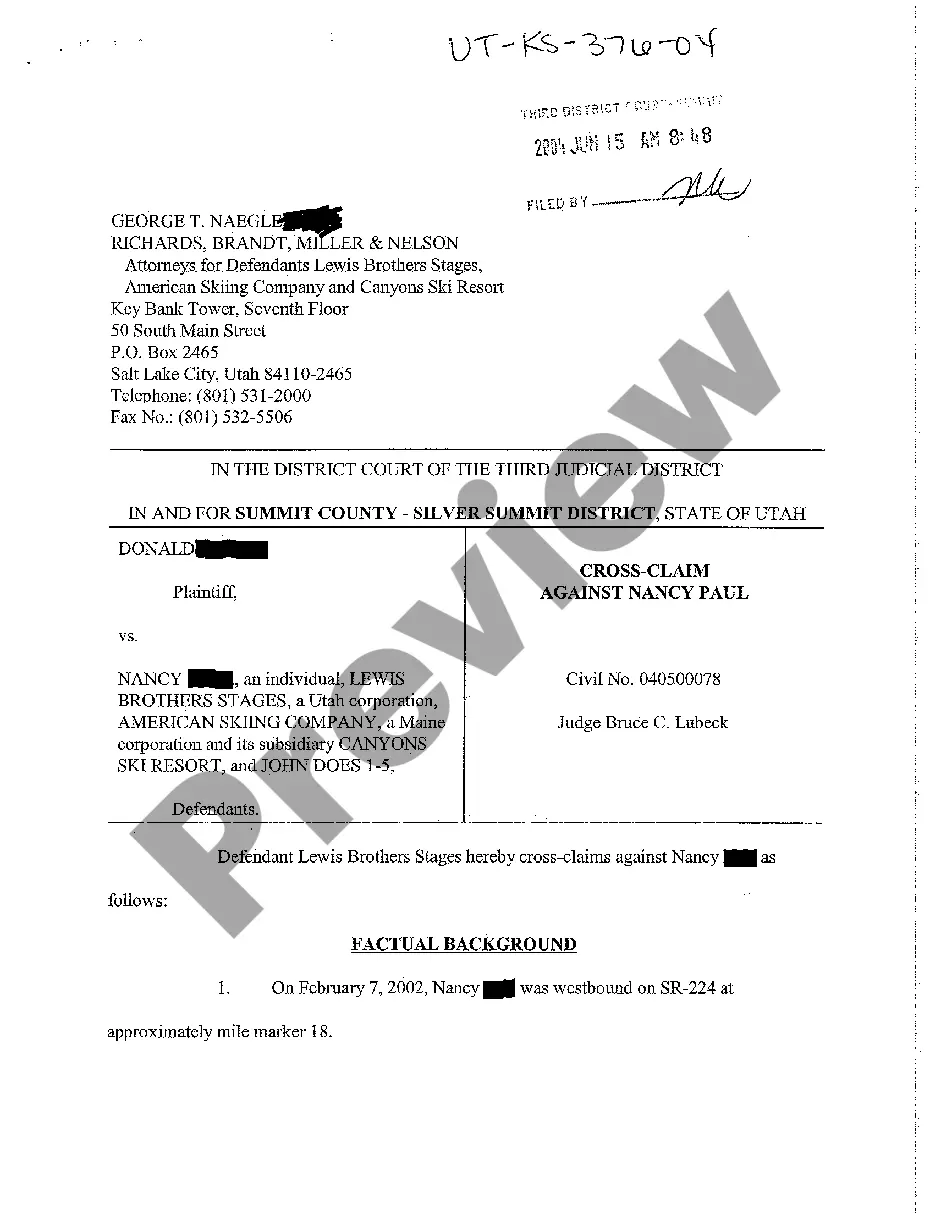

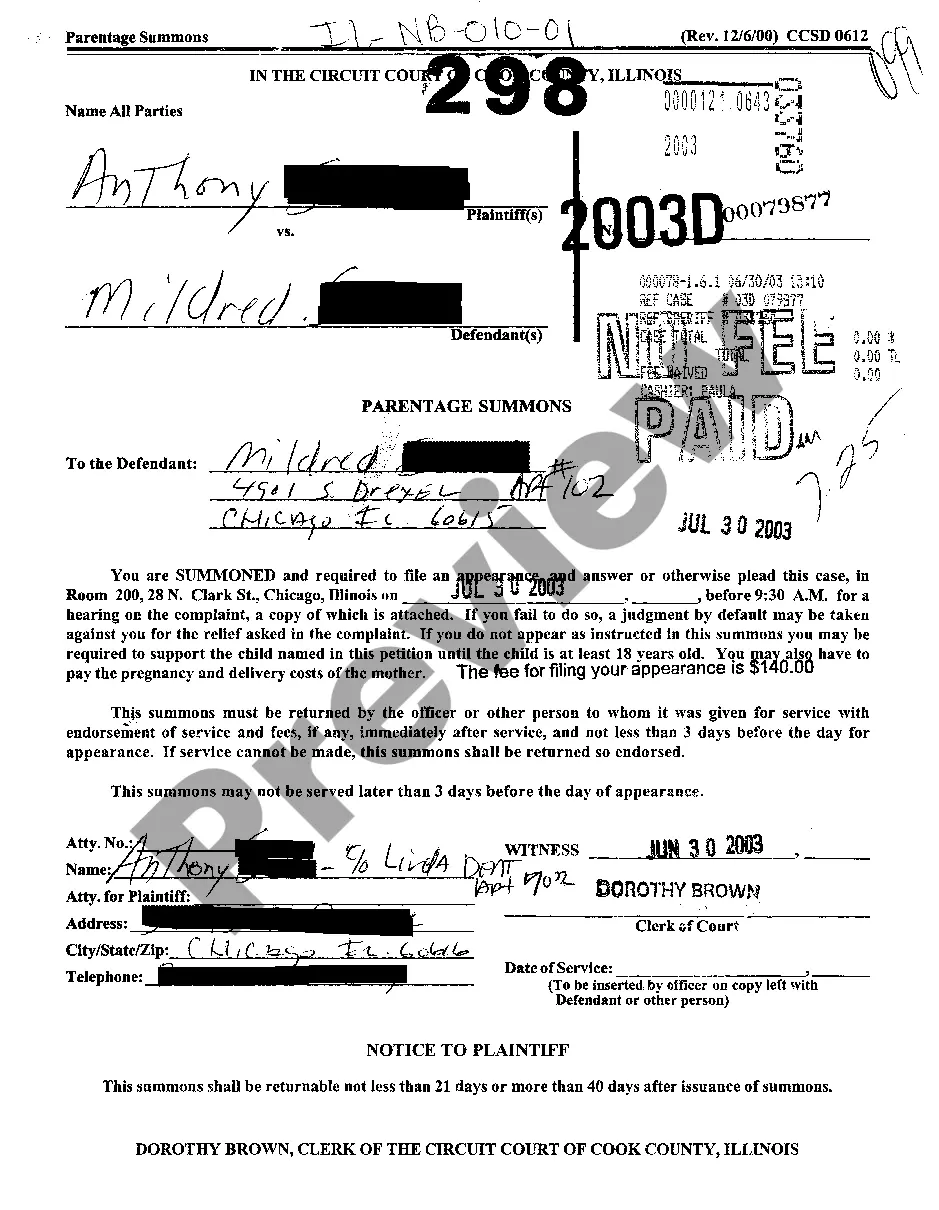

- Make sure to attentively examine the form content and its correspondence with general and legal requirements by previewing it or reading its description.

- Look for an alternative official template if the previously opened one doesn’t match your situation or state regulations (the tab for that is on the top page corner).

- Log in to your account and download the Texas Model Individual Chapter 11 Plan (modified 03/18/2016) in the format you prefer. If it’s your first experience with our website, click Buy now to continue.

- Create an account, choose your subscription plan, and pay with your credit card or PayPal account.

- Choose in what format you want to save your form and click Download. Print the blank or upload it to a professional PDF editor to prepare it electronically.

All documents are drafted for multi-usage, like the Texas Model Individual Chapter 11 Plan (modified 03/18/2016) you see on this page. If you need them in the future, you can fill them out without re-payment - simply open the My Forms tab in your profile and complete your document whenever you need it. Try US Legal Forms and prepare your business and personal paperwork quickly and in full legal compliance!

Form popularity

FAQ

There is a 120-day period, from the time of filing the Chapter 11, during which the customer has the exclusive right to file a reorganization plan. Once this period has expired, a creditor or the case trustee may file a competing plan.

Does a Chapter 11 bankruptcy erase a business's debts? Not exactly. Creditors often have to accept less under a court-approved reorganization plan. But the idea is for the business to keep earning money so it can pay back as much as possible.

This chapter of the Bankruptcy Code generally provides for reorganization, usually involving a corporation or partnership. A chapter 11 debtor usually proposes a plan of reorganization to keep its business alive and pay creditors over time. People in business or individuals can also seek relief in chapter 11.

Generally, and subject to various defenses, the power to avoid transfers is effective against transfers made by the debtor within 90 days before filing the petition. But transfers to "insiders" (i.e., relatives, general partners, and directors or officers of the debtor) made up to a year before filing may be avoided.

In order to confirm the plan, the court must find, among other things, that: (1) the plan is feasible; (2) it is proposed in good faith; and (3) the plan and the proponent of the plan are in compliance with the Bankruptcy Code.

Typically, these debts may be paid back partially or in full over the course of several years, and some may be completely discharged. Repayment plans commonly last five years, but in some rare cases, Chapter 11 bankruptcy can take up to 10 years.

While the average length of a Chapter 11 Bankruptcy case can last 17 months, larger and more complex cases can take up to five years. And following the conclusion of the bankruptcy case, it can still take months for Debtors to begin distributing payouts to the highest priority class of Creditors.

There are no specified limits on the length of a Chapter 11 plan. A Chapter 11 plan must be long enough to convince the court and creditors that the debtor is making a good faith effort to pay as much of its debt as is realistically possible.