Texas Notice of Change in Monthly Mortgage Amount

Description

How to fill out Texas Notice Of Change In Monthly Mortgage Amount?

Preparing legal paperwork can be a real burden unless you have ready-to-use fillable templates. With the US Legal Forms online library of formal documentation, you can be certain in the blanks you find, as all of them correspond with federal and state laws and are verified by our specialists. So if you need to fill out Texas Notice of Change in Monthly Mortgage Amount, our service is the perfect place to download it.

Getting your Texas Notice of Change in Monthly Mortgage Amount from our service is as simple as ABC. Previously authorized users with a valid subscription need only log in and click the Download button once they locate the correct template. Later, if they need to, users can pick the same blank from the My Forms tab of their profile. However, even if you are new to our service, signing up with a valid subscription will take only a few moments. Here’s a brief instruction for you:

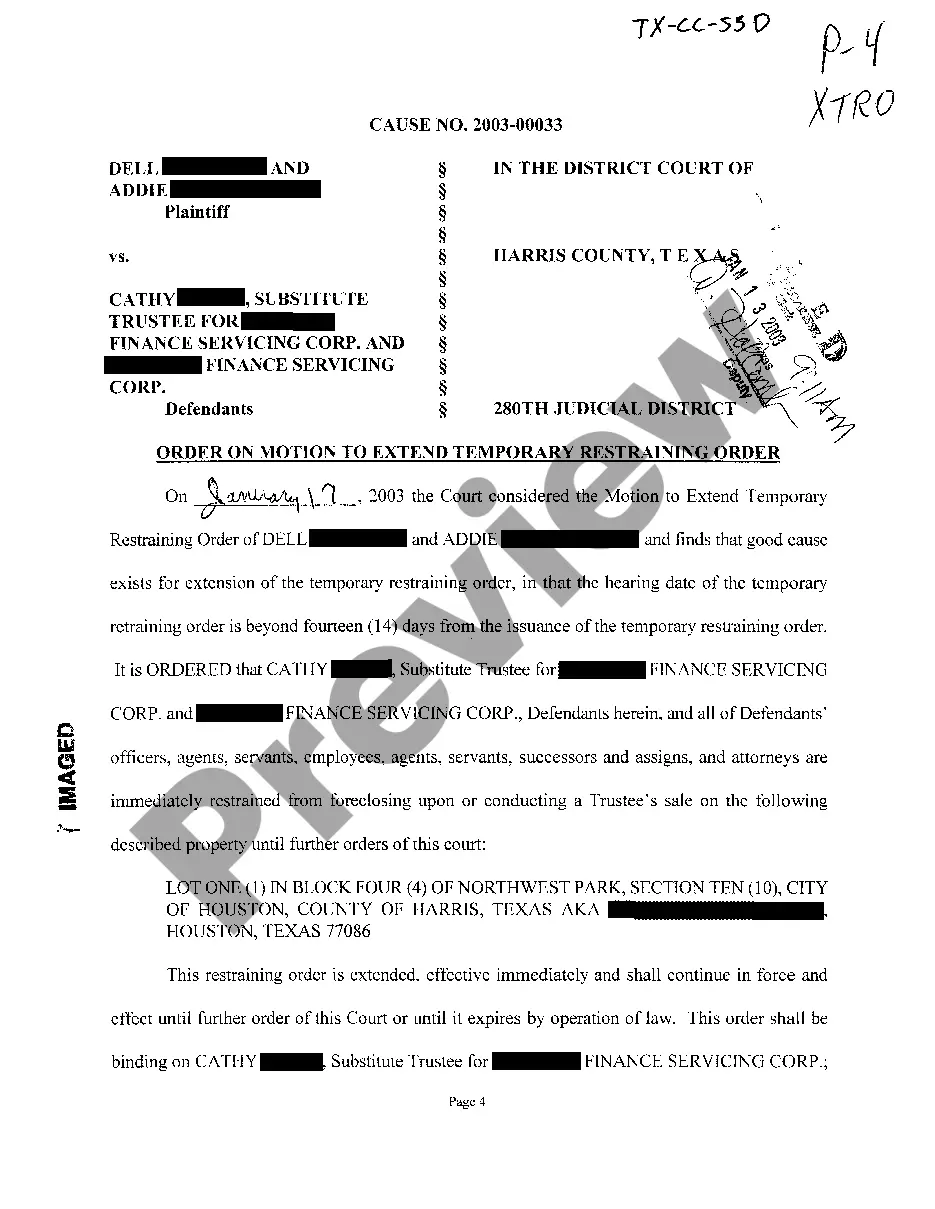

- Document compliance check. You should carefully review the content of the form you want and check whether it suits your needs and meets your state law regulations. Previewing your document and looking through its general description will help you do just that.

- Alternative search (optional). If there are any inconsistencies, browse the library through the Search tab above until you find an appropriate blank, and click Buy Now once you see the one you want.

- Account creation and form purchase. Register for an account with US Legal Forms. After account verification, log in and select your most suitable subscription plan. Make a payment to continue (PayPal and credit card options are available).

- Template download and further usage. Choose the file format for your Texas Notice of Change in Monthly Mortgage Amount and click Download to save it on your device. Print it to fill out your paperwork manually, or use a multi-featured online editor to prepare an electronic version faster and more efficiently.

Haven’t you tried US Legal Forms yet? Sign up for our service now to obtain any formal document quickly and easily whenever you need to, and keep your paperwork in order!

Form popularity

FAQ

It's true that your mortgage payment can go up. You may be surprised to learn this, especially if you have a fixed-rate mortgage. But the truth is, it's possible for your monthly mortgage payment amount to fluctuate several times throughout the term of the loan.

A bridge loan is a short-term loan used to bridge the gap between buying a home and selling your previous one. Sometimes you want to buy before you sell, meaning you don't have the profit from the sale to apply to your new home's down payment.

Why did my mortgage payment increase? Mortgage payments can fluctuate because of changes in the economy like interest rates rising, but can also change for other reasons, such as if your property tax or homeowners insurance premiums increase.

A bridge loan's interest rate usually starts at 1-2% but can go as high as 25-30%. The interest rate on a bridge loan is the fee the borrower pays to the lender to cover its processing costs and enables the lender to make money from the transaction.

This Official Form 410S1 is a supplement to a proof of claim to be filed in an individual debtor's Chapter 13 bankruptcy case where the claim is secured by a security interest in the debtor's principal residence.

A bridge loan is a form of short-term financing that can serve as a source of funding and capital until a person or company secures permanent financing or removes an existing debt obligation.

Section 1601 et seq.) or other federal law, a bank has a right of set-off, without further agreement or action, against all accounts owned by a depositor to whom or on whose behalf the bank has made an advance of money by loan, overdraft, or otherwise if the bank has previously disclosed this right to the depositor.

Sec. 343.105. NOTICE OF PENALTIES FOR MAKING FALSE OR MISLEADING WRITTEN STATEMENT. (a) A lender, mortgage banker, or licensed mortgage broker shall provide to each applicant for a home loan a written notice at closing.