Texas Bill of Cost

Description

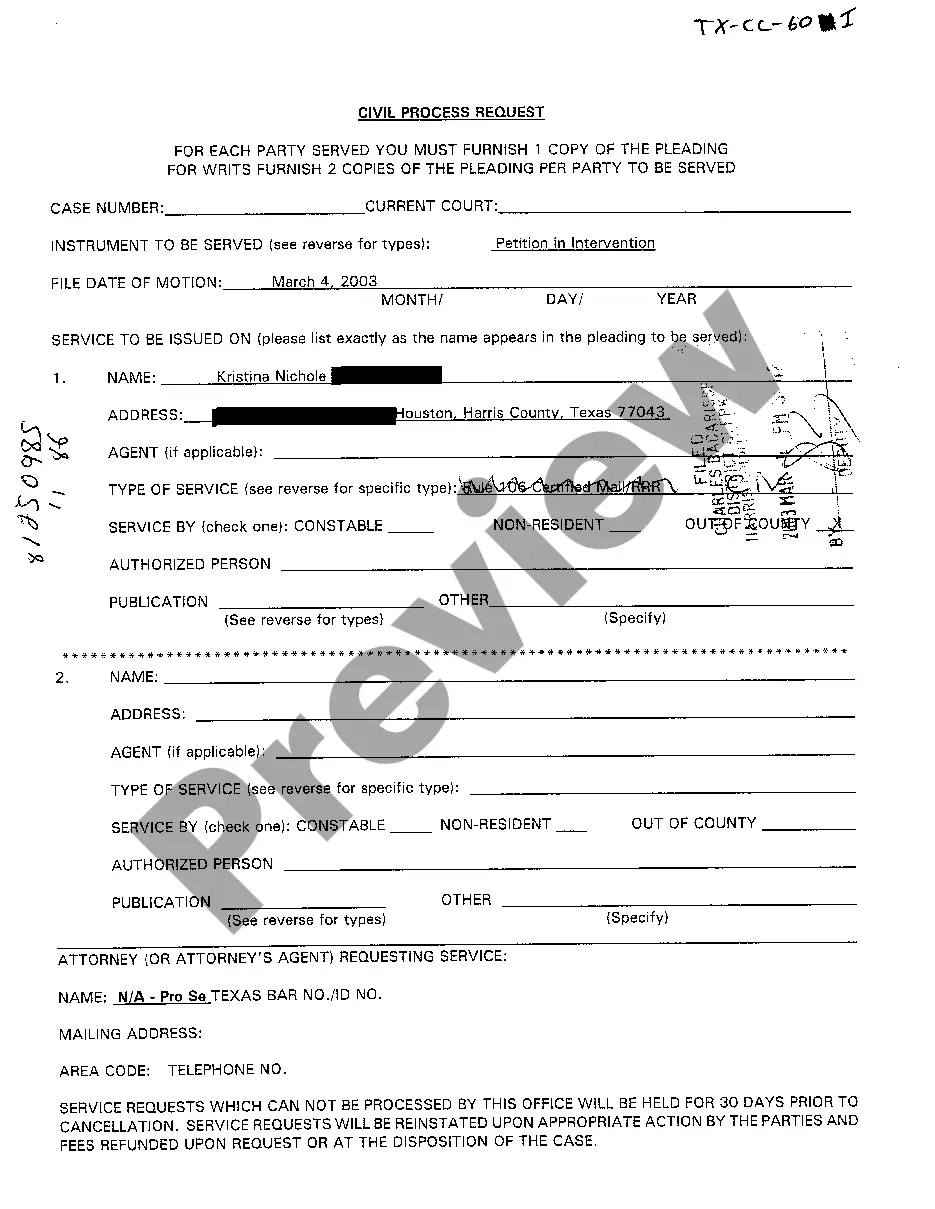

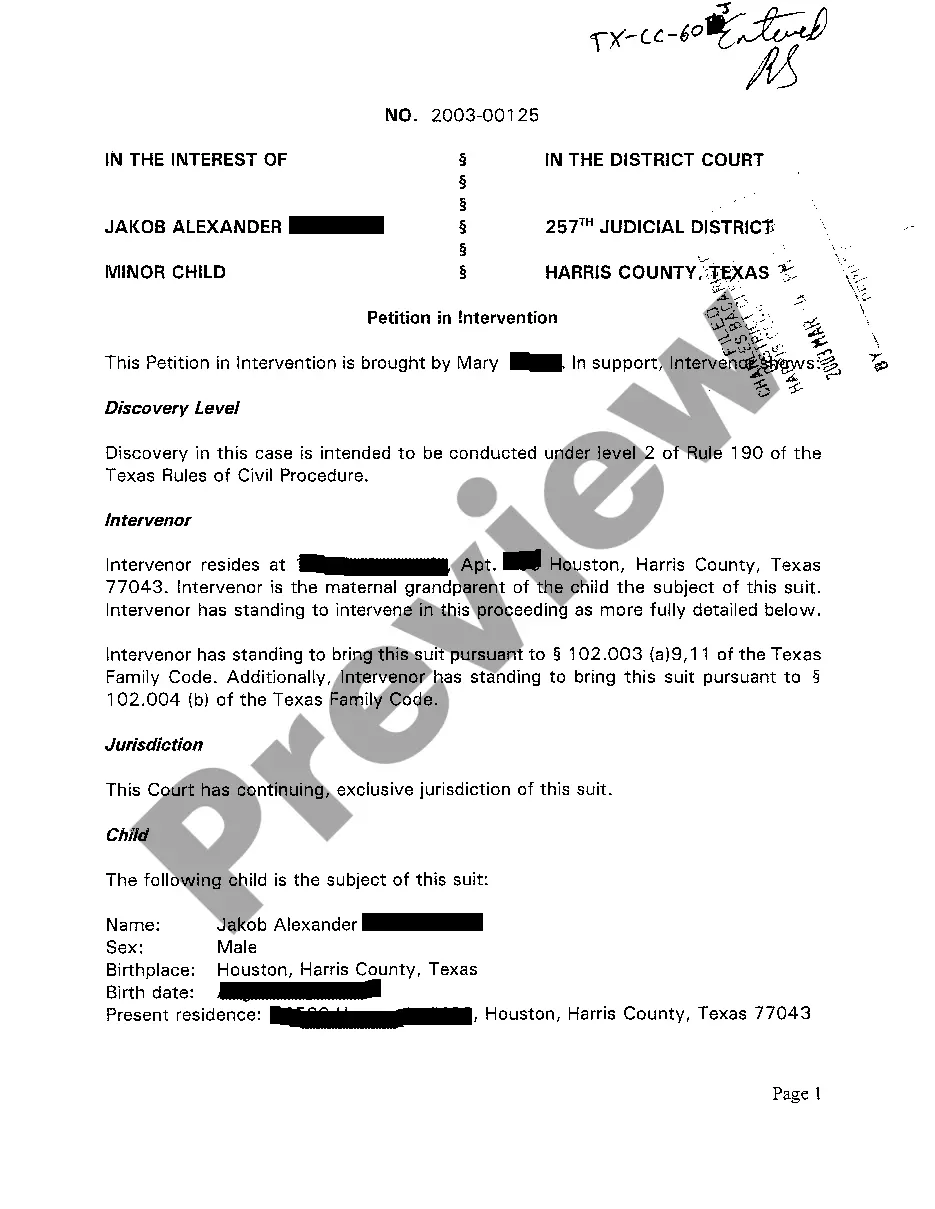

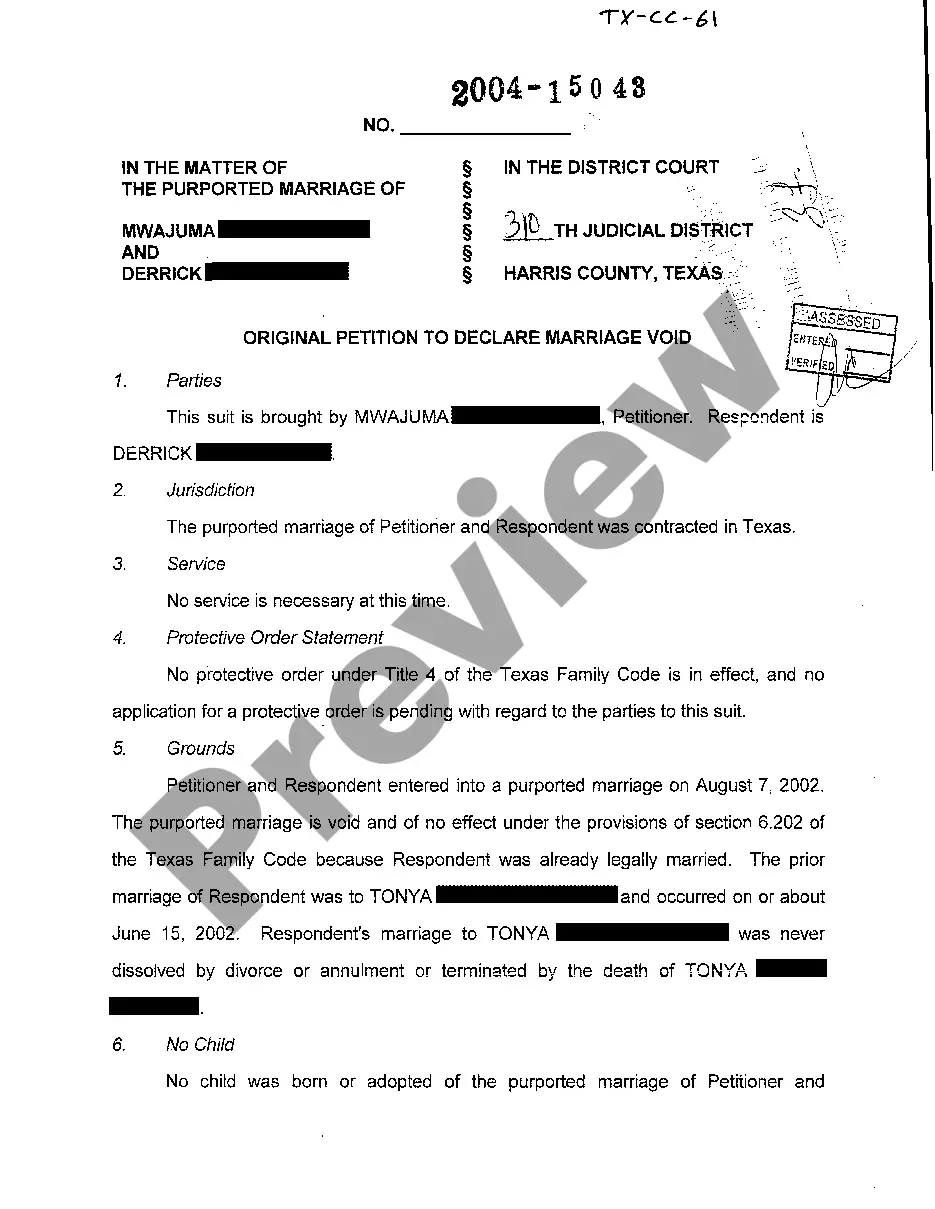

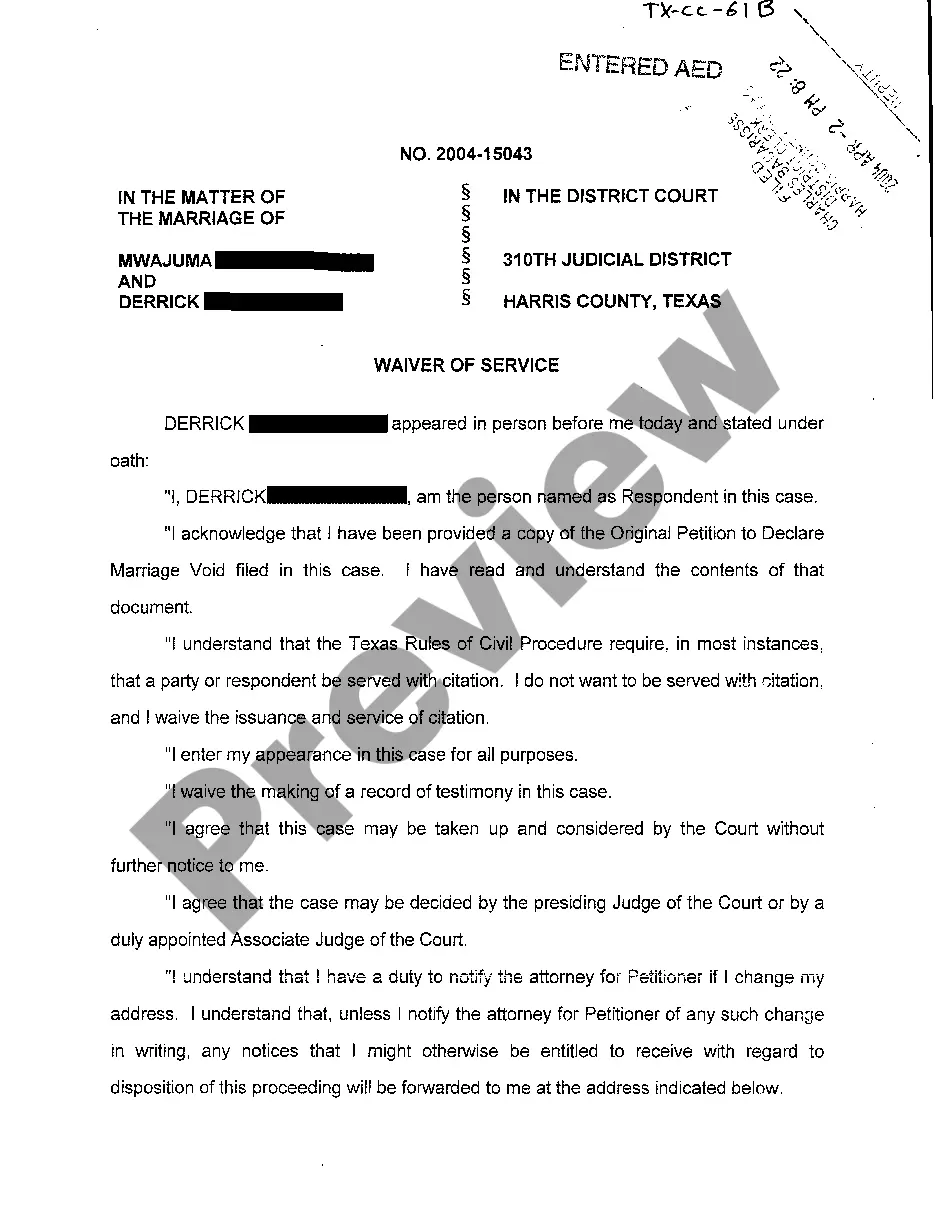

How to fill out Texas Bill Of Cost?

Coping with official documentation requires attention, accuracy, and using properly-drafted blanks. US Legal Forms has been helping people nationwide do just that for 25 years, so when you pick your Texas Bill of Cost template from our service, you can be sure it meets federal and state regulations.

Working with our service is straightforward and fast. To get the necessary document, all you’ll need is an account with a valid subscription. Here’s a brief guide for you to obtain your Texas Bill of Cost within minutes:

- Make sure to carefully examine the form content and its correspondence with general and law requirements by previewing it or reading its description.

- Look for another formal blank if the previously opened one doesn’t match your situation or state regulations (the tab for that is on the top page corner).

- Log in to your account and download the Texas Bill of Cost in the format you prefer. If it’s your first time with our service, click Buy now to proceed.

- Register for an account, choose your subscription plan, and pay with your credit card or PayPal account.

- Choose in what format you want to obtain your form and click Download. Print the blank or add it to a professional PDF editor to prepare it electronically.

All documents are drafted for multi-usage, like the Texas Bill of Cost you see on this page. If you need them one more time, you can fill them out without re-payment - just open the My Forms tab in your profile and complete your document any time you need it. Try US Legal Forms and accomplish your business and personal paperwork quickly and in full legal compliance!

Form popularity

FAQ

P. 133. The court may give or refuse costs on motions at its discretion, except where otherwise provided by law or these rules.

Rule 120a, TRCP, the procedure under which a nonresident defendant may appear in a Texas court for the sole purpose of contesting personal jurisdiction, authorizes a trial court to order a continuance to allow an opposing party to obtain jurisdictional discovery if it does not appear that the party has insufficient

The bill of costs (1) lists the ?costs on appeal,? such as the costs which were incurred for the appellate record and the court of appeals filing fees and (2) notes whether those costs have been paid and, if so, by whom. See Texas Rule of Appellate Procedure 51.1(a).

After you sign the complaint, hand-deliver or mail it to the appropriate Clerk's office for filing. Filing Fee: A filing fee of $402.00 is required to file a civil complaint.

At any time in its discretion and upon such notice and on such terms as it deems just, the court may allow any process or proof of service thereof to be amended, unless it clearly appears that material prejudice would result to the substantial rights of the party against whom the process issued. Source: Art.

Rule 121. Answer Is Appearance (1941) An answer shall constitute an appearance of the defendant so as to dispense with the necessity for the issuance or service of citation upon him. Source: R. C. S.

If any party responsible for costs fails or refuses to pay the same within ten days after demand for payment, the clerk or justice of the peace may make certified copy of the bill of costs then due, and place the same in the hands of the sheriff or constable for collection.