Texas Abstract of Judgment - Form | Post-Judgment Interest Rates

Description Abstract Form Fill

How to fill out Texas Abstract Of Judgment - Form | Post-Judgment Interest Rates?

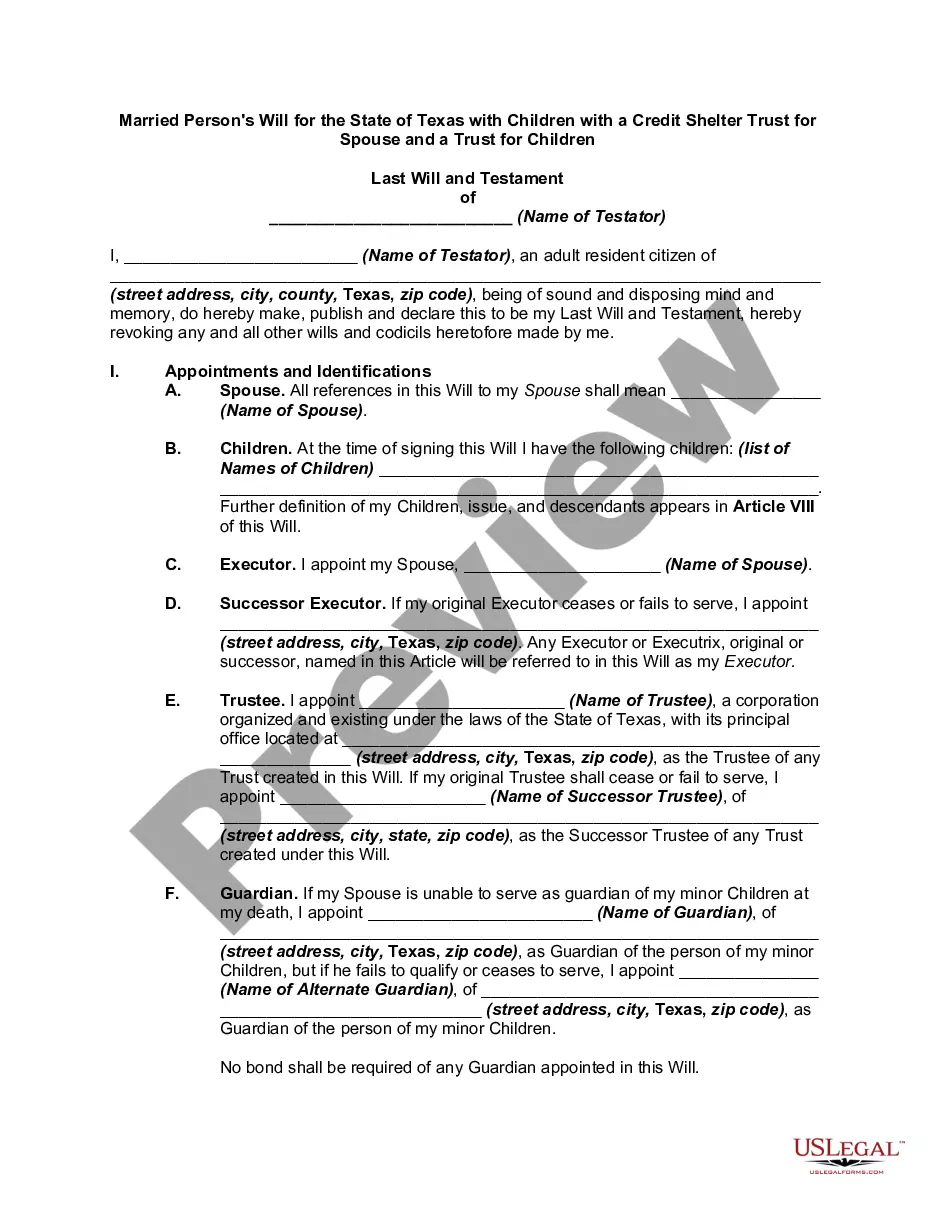

Dealing with official documentation requires attention, precision, and using well-drafted templates. US Legal Forms has been helping people across the country do just that for 25 years, so when you pick your Texas Abstract of Judgment - Form | Post-Judgment Interest Rates template from our library, you can be sure it complies with federal and state regulations.

Dealing with our service is easy and fast. To get the required document, all you’ll need is an account with a valid subscription. Here’s a brief guide for you to find your Texas Abstract of Judgment - Form | Post-Judgment Interest Rates within minutes:

- Remember to carefully look through the form content and its correspondence with general and law requirements by previewing it or reading its description.

- Look for another formal template if the previously opened one doesn’t match your situation or state regulations (the tab for that is on the top page corner).

- Log in to your account and download the Texas Abstract of Judgment - Form | Post-Judgment Interest Rates in the format you need. If it’s your first experience with our website, click Buy now to continue.

- Register for an account, select your subscription plan, and pay with your credit card or PayPal account.

- Decide in what format you want to save your form and click Download. Print the blank or add it to a professional PDF editor to submit it electronically.

All documents are drafted for multi-usage, like the Texas Abstract of Judgment - Form | Post-Judgment Interest Rates you see on this page. If you need them one more time, you can fill them out without re-payment - just open the My Forms tab in your profile and complete your document whenever you need it. Try US Legal Forms and prepare your business and personal paperwork rapidly and in total legal compliance!

Form popularity

FAQ

HOW TO CALCULATE POST JUDGMENT INTEREST Take your judgment amount and multiply it by your post judgment rate (%). Take the total and divide it by 365 (the number of days in a year). You will end up with the amount of post judgment interest per day.

Post-judgment interest does compound annually.

Post-Judgment Interest Rates - 2022 Week EndingRate (%)7/29/20223.018/5/20223.128/12/20223.288/19/20223.2510 more rows

Interest begins to accrue on the amount of costs added to a judgment from the date ordered by the court or from the date costs are allowed following expiration of the time to object. (Code Civ. Proc., § 685.070(d).) Also, upon renewal of a judgment, interest begins to accrue on the day the renewed judgment is entered.

Generally, any unpaid principal balance collects interest at 10%, or 7% if the debtor is a government agency. This general rule applies to any judgment against a business or government agency, or when the debtor owes $200,000 or more.

HOW TO CALCULATE POST JUDGMENT INTEREST Take your judgment amount and multiply it by your post judgment rate (%). Take the total and divide it by 365 (the number of days in a year). You will end up with the amount of post judgment interest per day.

The post-judgment interest rate for judgments entered from May 15 through is: 4.75%. 2023 rates may be found here. Historic rates from 2000 - 2022 can be found here.

In Texas, interest rates are statutorily limited to 6 percent, or 18 percent for interest rates on judgments.