Texas Adversary Proceeding Cover Sheet

Description

How to fill out Texas Adversary Proceeding Cover Sheet?

How much time and resources do you usually spend on composing official documentation? There’s a greater way to get such forms than hiring legal experts or spending hours browsing the web for a suitable blank. US Legal Forms is the premier online library that provides professionally drafted and verified state-specific legal documents for any purpose, like the Texas Adversary Proceeding Cover Sheet.

To acquire and complete a suitable Texas Adversary Proceeding Cover Sheet blank, adhere to these simple instructions:

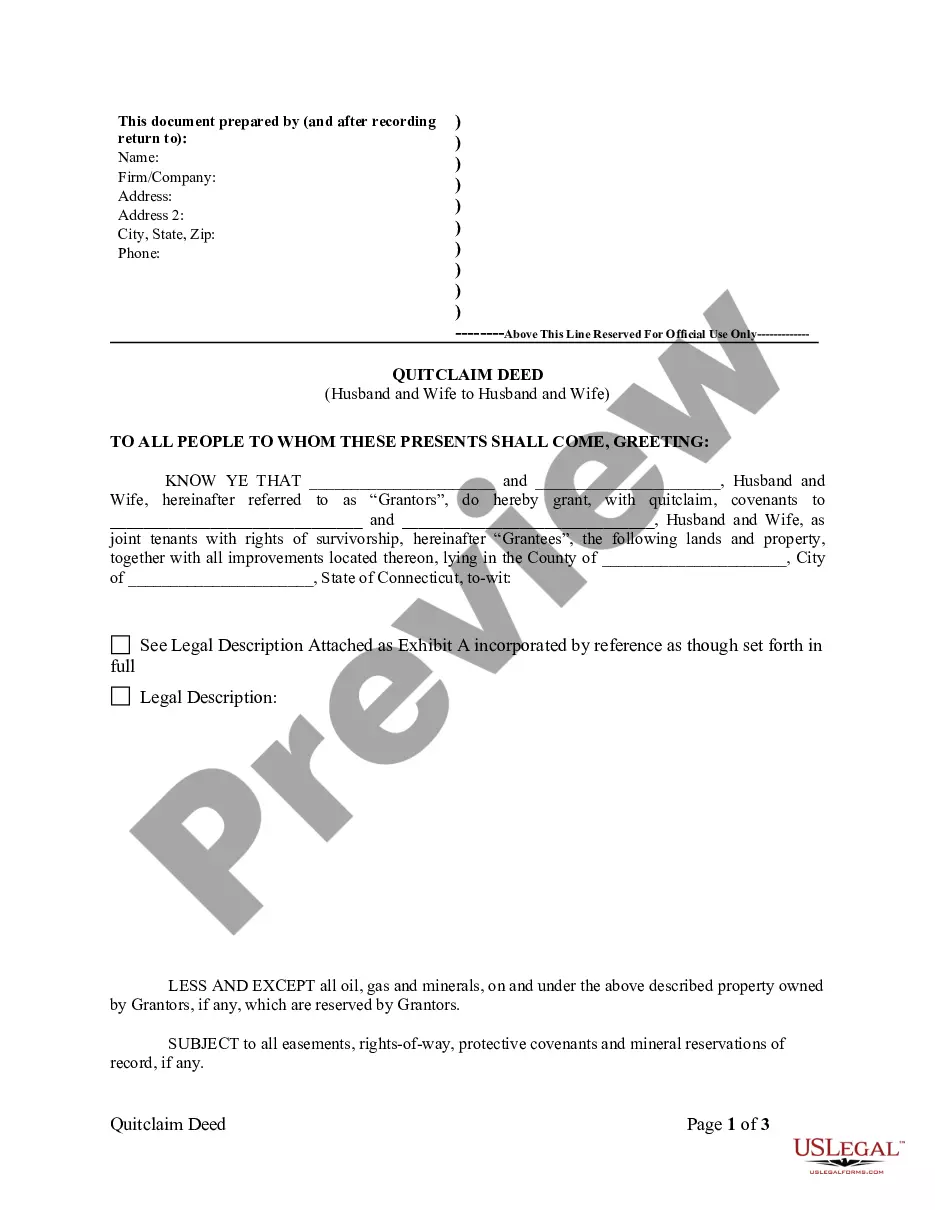

- Examine the form content to ensure it meets your state laws. To do so, check the form description or utilize the Preview option.

- If your legal template doesn’t meet your needs, find another one using the search tab at the top of the page.

- If you are already registered with our service, log in and download the Texas Adversary Proceeding Cover Sheet. If not, proceed to the next steps.

- Click Buy now once you find the right blank. Select the subscription plan that suits you best to access our library’s full service.

- Create an account and pay for your subscription. You can make a payment with your credit card or through PayPal - our service is totally reliable for that.

- Download your Texas Adversary Proceeding Cover Sheet on your device and complete it on a printed-out hard copy or electronically.

Another advantage of our service is that you can access previously acquired documents that you safely store in your profile in the My Forms tab. Pick them up at any moment and re-complete your paperwork as frequently as you need.

Save time and effort preparing official paperwork with US Legal Forms, one of the most trusted web solutions. Join us now!

Form popularity

FAQ

Once an adversarial proceeding has begun, a court may refuse to discharge debts if a creditor can show that those debts are the result of the debtor's fraud or the debtor failed to properly disclose information as per USC 27 §727.

An "Adversary Proceeding" in bankruptcy court has the same meaning as a lawsuit in other courts. This means that one or more "plaintiff(s)" file a "complaint" against one or more "defendant(s)." In many situations an adversary proceeding is required if a plaintiff wants to obtain a particular type of relief.

An adversary proceeding is the bankruptcy court's version of a civil action (a lawsuit). An adversary proceeding is opened by filing a complaint asking the court to rule on an issue related to a bankruptcy case.

For example, they might want to object to a discharge, get an injunction, obtain a ruling on whether a debt can be discharged, or pursue money from a party not in the bankruptcy proceeding. A party involved in a bankruptcy case can start an adversary proceeding by filing a complaint.

A party filing an adversary proceeding must also must complete and file Form 1040, the Adversary Proceeding Cover Sheet, unless the party files the adversary proceeding electronically through the court's Case Management/Electronic Case Filing system (CM/ECF).

A defendant can respond to an adversary proceeding by filing an answer or a motion (e.g., a motion to dismiss the complaint) within 30 days from the date of the summons. If the defendant fails to file a responsive pleading, the bankruptcy judge can enter a default judgment against the defendant.