Texas Notice to Creditors and Other Parties in Interest is a legal document that is used to notify creditors and other interested parties of the death of an individual, as well as of any probate action related to the estate of the deceased. It is typically issued by the executor or administrator of the estate, and must be sent to all creditors and interested parties. There are two types of Texas Notice to Creditors and Other Parties in Interest: a Notice of Administration and a Notice of Independent Administration. The Notice of Administration is issued when an executor or administrator has been appointed to handle the estate of the deceased, and is used to notify creditors and interested parties of the appointment. The Notice of Independent Administration is issued when an independent administrator has been appointed to handle the estate, and is used to notify creditors and interested parties of the appointment and of their right to object to the proposed independent administration. Both notices contain important information such as the name of the deceased, the name of the executor or administrator, the date of death, the county of the decedent's residence, and the date the notice was published.

Texas Notice to Creditors and Other Parties in Interest

Description

How to fill out Texas Notice To Creditors And Other Parties In Interest?

If you’re looking for a way to properly complete the Texas Notice to Creditors and Other Parties in Interest without hiring a legal representative, then you’re just in the right spot. US Legal Forms has proven itself as the most extensive and reputable library of formal templates for every private and business situation. Every piece of paperwork you find on our web service is drafted in accordance with nationwide and state regulations, so you can be sure that your documents are in order.

Follow these simple instructions on how to get the ready-to-use Texas Notice to Creditors and Other Parties in Interest:

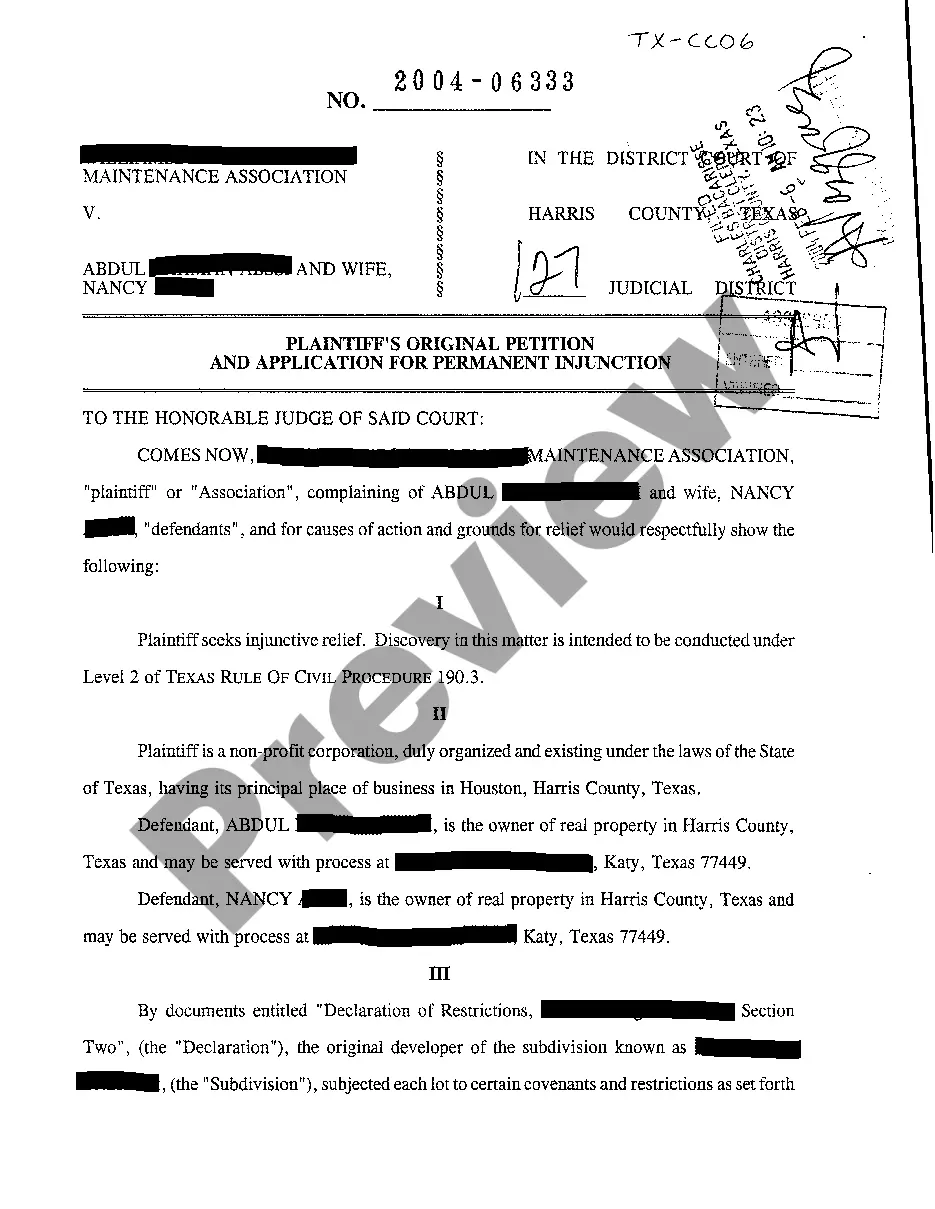

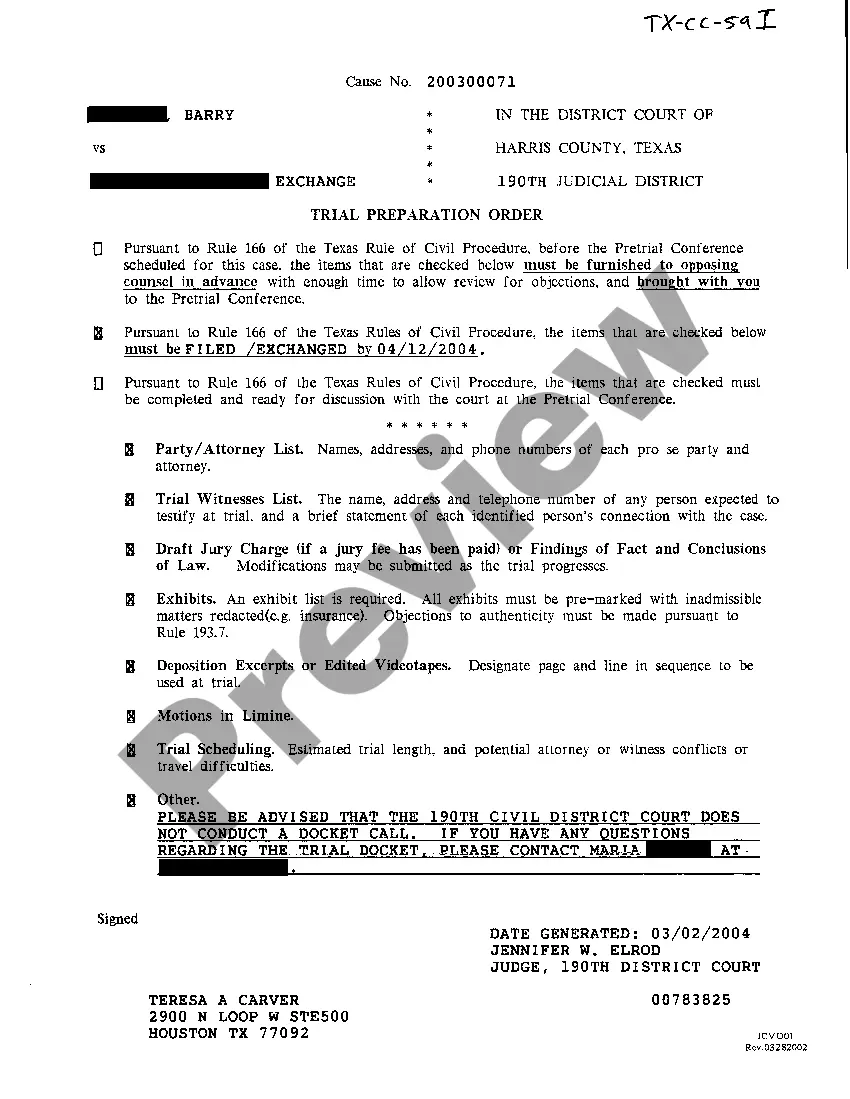

- Make sure the document you see on the page complies with your legal situation and state regulations by checking its text description or looking through the Preview mode.

- Type in the form name in the Search tab on the top of the page and choose your state from the dropdown to locate another template in case of any inconsistencies.

- Repeat with the content check and click Buy now when you are confident with the paperwork compliance with all the demands.

- Log in to your account and click Download. Sign up for the service and select the subscription plan if you still don’t have one.

- Use your credit card or the PayPal option to pay for your US Legal Forms subscription. The blank will be available to download right after.

- Decide in what format you want to get your Texas Notice to Creditors and Other Parties in Interest and download it by clicking the appropriate button.

- Import your template to an online editor to fill out and sign it rapidly or print it out to prepare your paper copy manually.

Another great thing about US Legal Forms is that you never lose the paperwork you purchased - you can find any of your downloaded templates in the My Forms tab of your profile any time you need it.

Form popularity

FAQ

Secured creditors generally have six months from the executor's appointment, or four months after their receipt of the notice from the executor, to file their claim against the estate.

A general notice to creditors must be published within one month of the issuance of letters testamentary. The notice must be in a newspaper ?of general circulation in the county in which the letters were issued.?

The executor generally has three years after their appointment to distribute the remaining assets (after debts and disputes are resolved). The Texas probate process can be fairly simple in most cases.

Texas Estates Code Chapter 308.002 requires personal representatives to provide notice to every beneficiary that is named in the will 60 days after the date of an order admitting a will to probate.

Section 256.156 of the Texas Estates Code provides that ?A will that cannot be produced in court must be proved in the same manner as provided in Section 256.153 for an attested will or Section 256.154 for a holographic will, as applicable.? Holographic wills are wills made in the decedent's handwriting that do not

Texas Estates Code Chapter 308.002 requires personal representatives to provide notice to every beneficiary that is named in the will 60 days after the date of an order admitting a will to probate.

Section 113.151 - Demand for Accounting (a) A beneficiary by written demand may request the trustee to deliver to each beneficiary of the trust a written statement of accounts covering all transactions since the last accounting or since the creation of the trust, whichever is later.

You give notice to unsecured creditors, such as credit card companies, under Texas Estates Code chapter 308.054. This notice will state an unsecured creditor must present their claim before the 121st day after it gets notice.