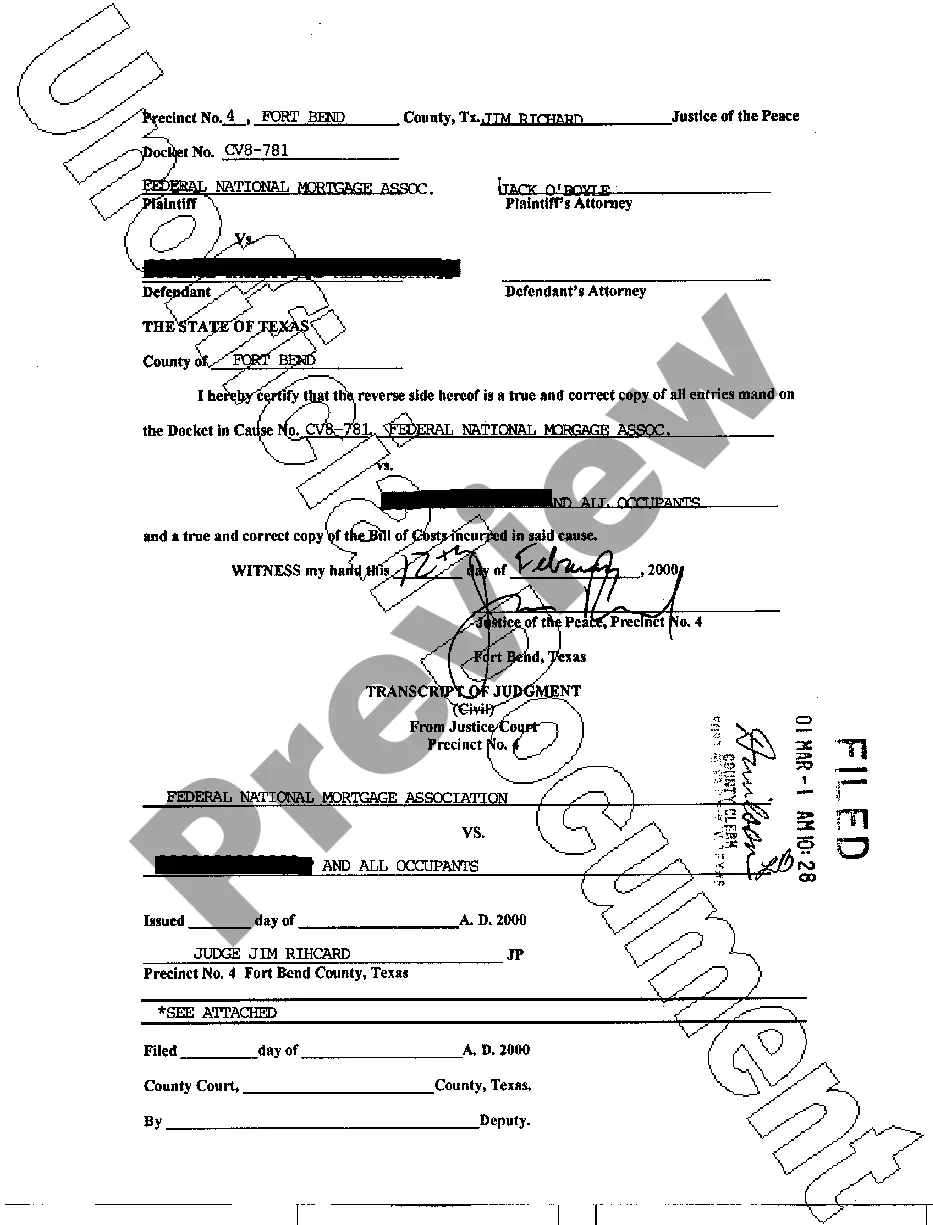

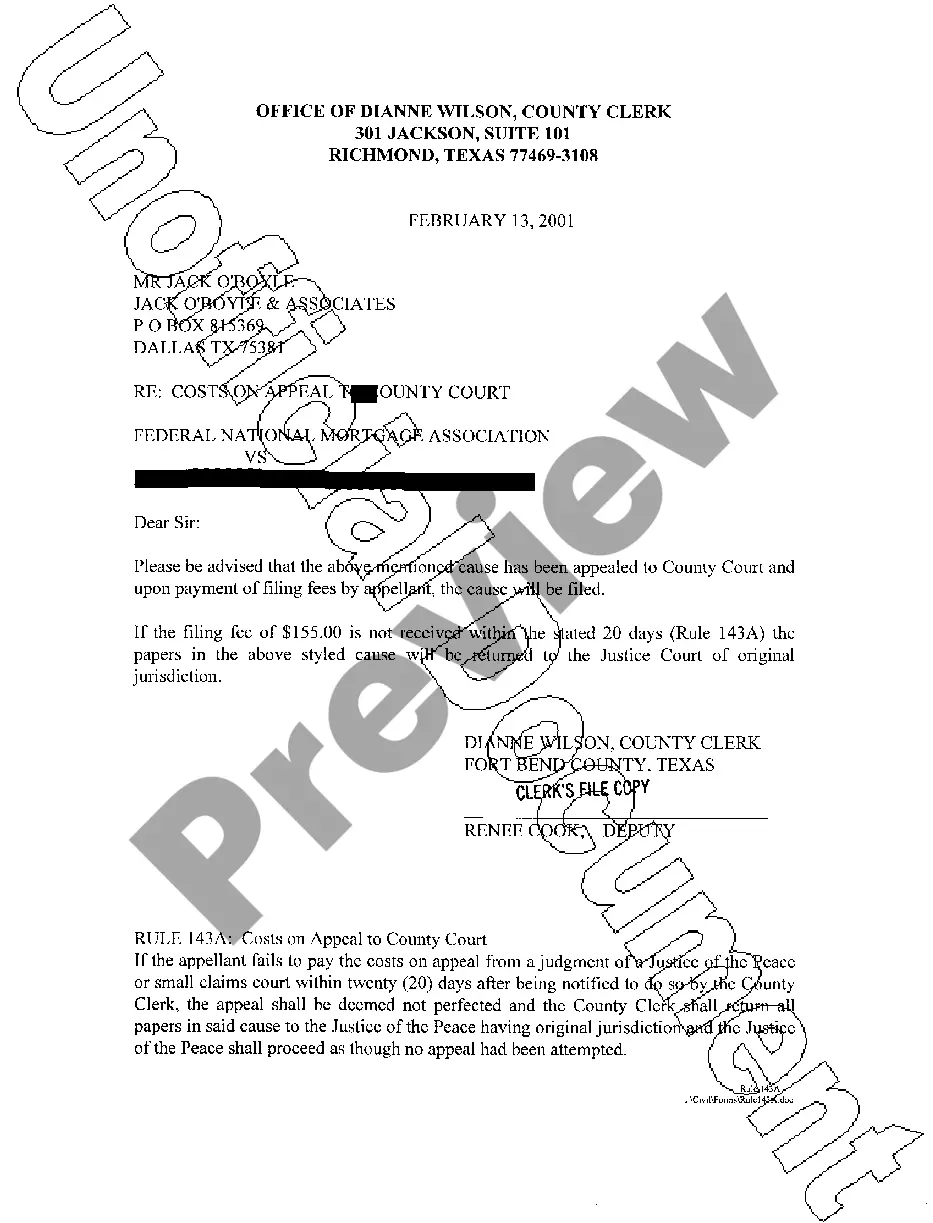

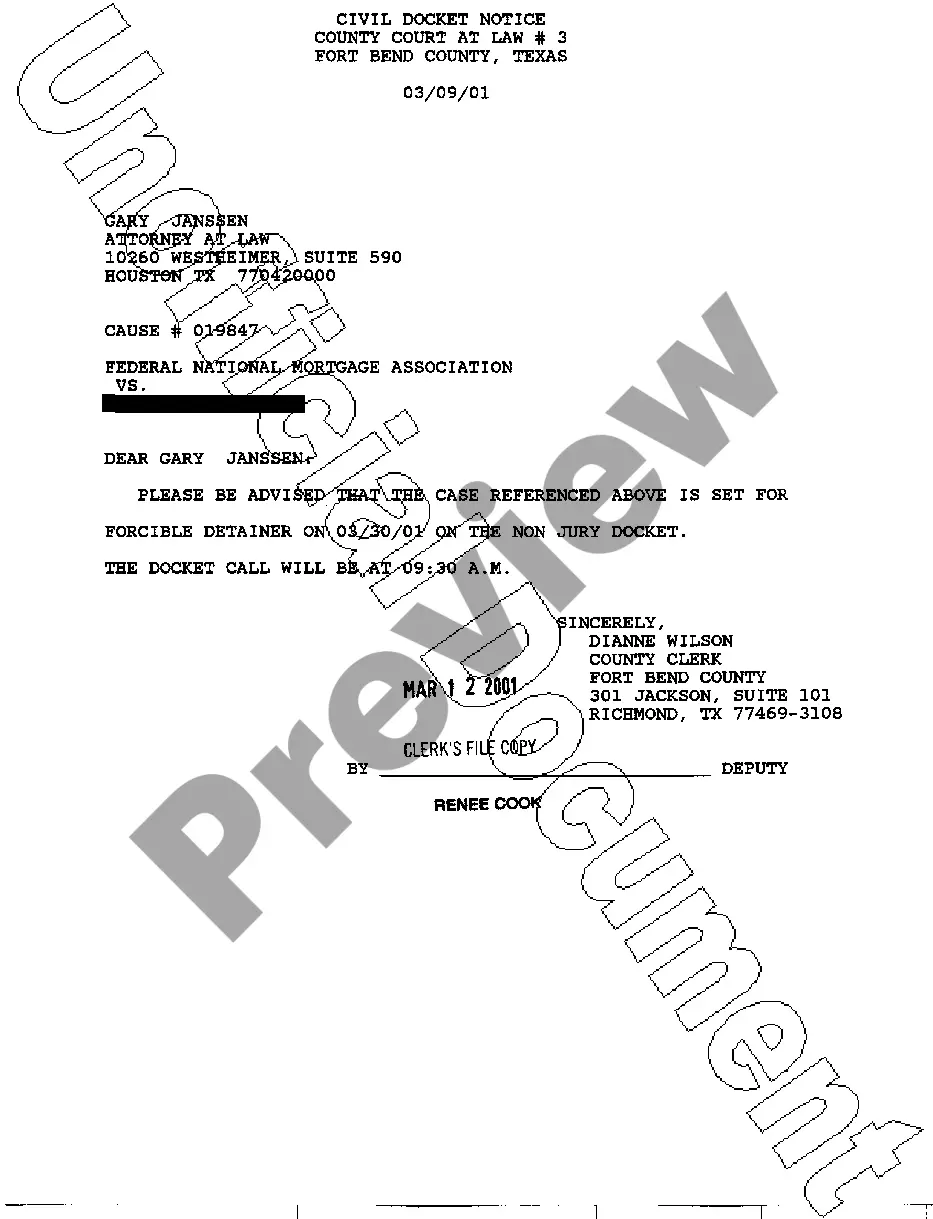

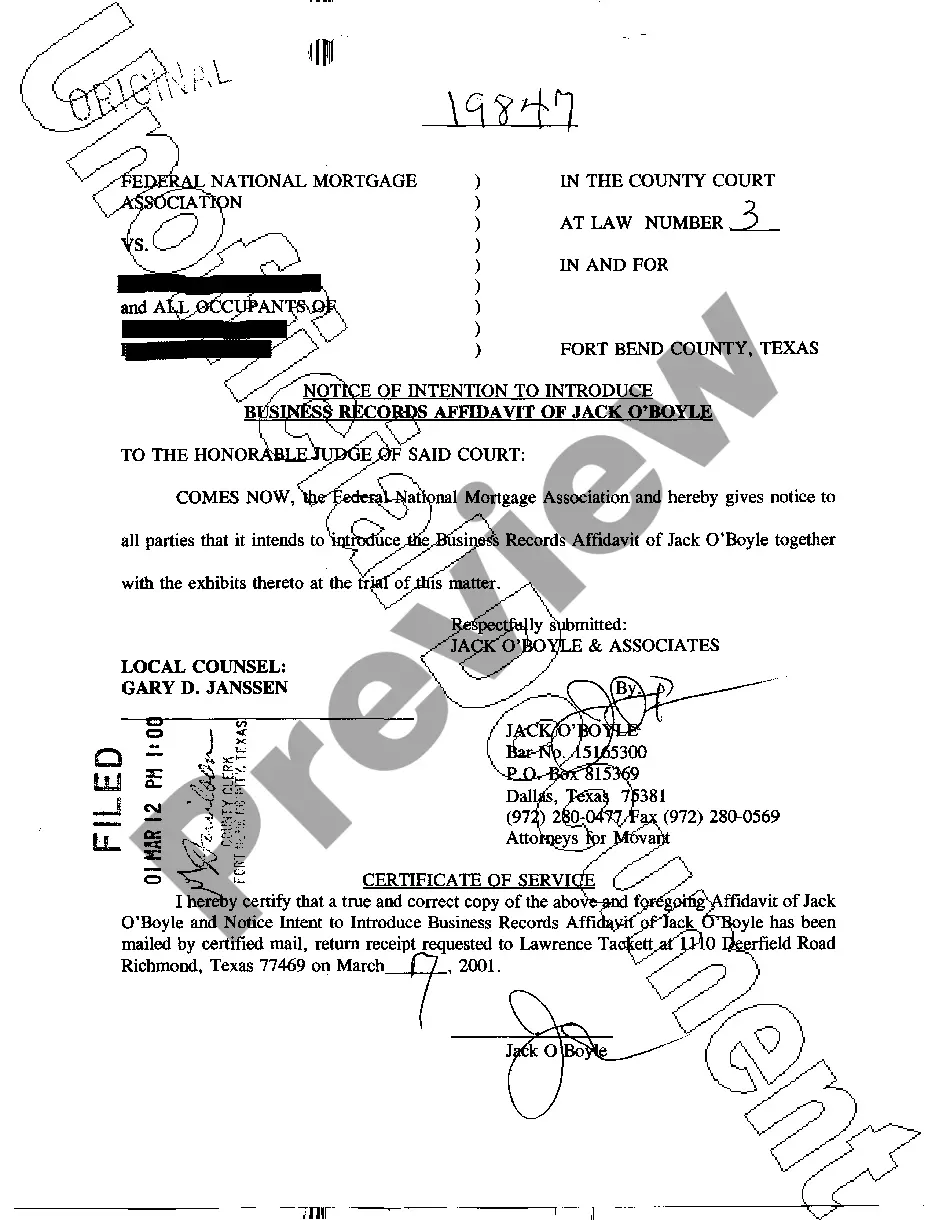

A Texas Summons to Debtor in Involuntary Case is a legal document issued by the court to notify a debtor of an involuntary bankruptcy proceeding against them. The summons will include the petition number, petition date, case number, court name, and debtor’s name, address, and date of birth. It will also include the date and time of the hearing, the place of the hearing, and instructions for the debtor to answer or appear in court. There are two types of Texas Summons to Debtor in Involuntary Case. The first is a Rule 2004 Summons, which is issued when a creditor files a petition for relief under Chapter 7 or 11 of the U.S. Bankruptcy Code. The second is a Rule 7001 Summons, which is issued when a debtor files an involuntary petition for relief under Chapter 7, 11, or 13 of the U.S. Bankruptcy Code. In either case, the summons will instruct the debtor to appear in court and answer the petition or otherwise respond within twenty-one days of receiving the summons. If the debtor fails to respond or appear, the court may enter a default judgment against them.

Texas Summons to Debtor in Involuntary Case

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Texas Summons To Debtor In Involuntary Case?

How much time and resources do you usually spend on composing formal paperwork? There’s a greater option to get such forms than hiring legal specialists or spending hours searching the web for an appropriate blank. US Legal Forms is the leading online library that offers professionally drafted and verified state-specific legal documents for any purpose, like the Texas Summons to Debtor in Involuntary Case.

To obtain and complete an appropriate Texas Summons to Debtor in Involuntary Case blank, adhere to these simple instructions:

- Look through the form content to make sure it complies with your state regulations. To do so, check the form description or utilize the Preview option.

- In case your legal template doesn’t meet your needs, locate a different one using the search tab at the top of the page.

- If you are already registered with our service, log in and download the Texas Summons to Debtor in Involuntary Case. If not, proceed to the next steps.

- Click Buy now once you find the right blank. Select the subscription plan that suits you best to access our library’s full service.

- Sign up for an account and pay for your subscription. You can make a payment with your credit card or through PayPal - our service is totally safe for that.

- Download your Texas Summons to Debtor in Involuntary Case on your device and complete it on a printed-out hard copy or electronically.

Another benefit of our library is that you can access previously downloaded documents that you securely store in your profile in the My Forms tab. Obtain them at any moment and re-complete your paperwork as often as you need.

Save time and effort preparing legal paperwork with US Legal Forms, one of the most trustworthy web solutions. Join us now!

Form popularity

FAQ

As the critical moment of filing for bankruptcy approaches, owners often ask themselves if creditors have the legal capacity of forcing them to file. The answer is yes, creditors benefit from a certain degree of protection under the bankruptcy law and they are allowed to require debtors to file for bankruptcy.

The primary purpose of a Chapter 11 bankruptcy is to give business entities and individuals with large amounts of debt time to reorganize their financial affairs. Chapter 11 reorganizations may be voluntary, filed by the debtor, or involuntary, filed by creditors of a potential debtor.

Does a Chapter 11 bankruptcy erase a business's debts? Not exactly. Creditors often have to accept less under a court-approved reorganization plan. But the idea is for the business to keep earning money so it can pay back as much as possible.

A voluntary petition is a more common filing and allows the debtor to choose the type of bankruptcy and the applicable chapter. In contrast, an involuntary petition is filed when the debtor is unable to pay its debts, and its creditors seek to force the debtor into bankruptcy.

Involuntary proceeding means a child-custody proceeding in which the parent does not consent of his or her free will to the foster-care, preadoptive, or adoptive placement or termination of parental rights or in which the parent consents to the foster-care, preadoptive, or adoptive placement under threat of removal of

Voluntary Dismissal. The right for the debtor to dismiss his own case is not absolute under Chapter 7 and 11, or under a chapter converted from 7 or 11, unless the debtor can show cause. This requirement to show cause is to dissuade debtors from using the bankruptcy process for other than what it was intended for.

A voluntary bankruptcy is the most common type of bankruptcy proceeding. It is initiated by a debtor who wishes to seek relief from their debt burden. Involuntary bankruptcies are very rare. They are initiated by creditors who want to receive payment for what they are owed from a debtor.

Chapter 11 Many employees may remain at work and continue to be paid and receive benefits. However, some may be laid off. If the laid-off employees are owed wages and benefits they become creditors of the company.