Texas Monthly Operating Report for Small Business Under Chapter 11

Description

How to fill out Texas Monthly Operating Report For Small Business Under Chapter 11?

How much time and resources do you often spend on drafting formal documentation? There’s a better way to get such forms than hiring legal experts or spending hours searching the web for an appropriate blank. US Legal Forms is the leading online library that provides professionally designed and verified state-specific legal documents for any purpose, such as the Texas Monthly Operating Report for Small Business Under Chapter 11.

To obtain and complete an appropriate Texas Monthly Operating Report for Small Business Under Chapter 11 blank, follow these simple instructions:

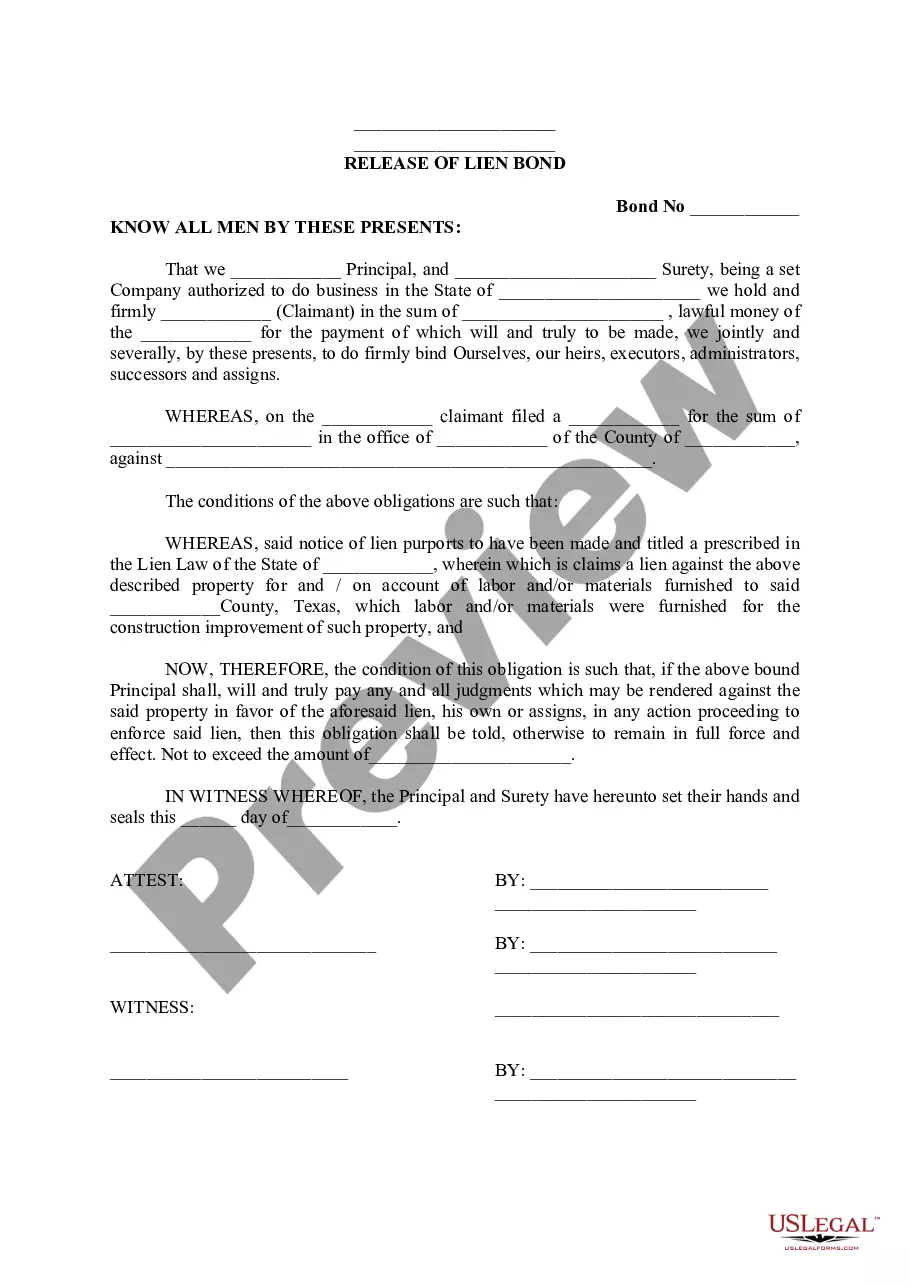

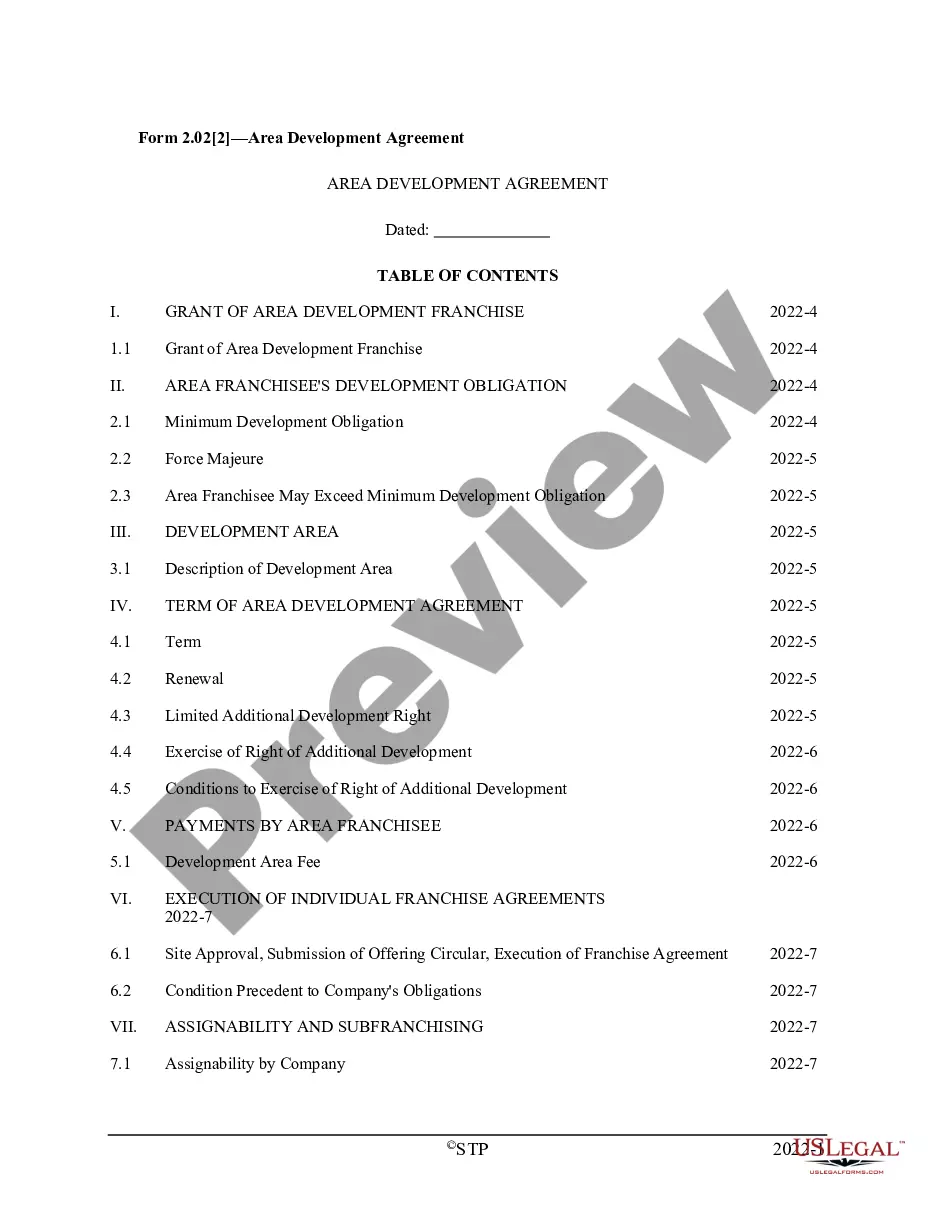

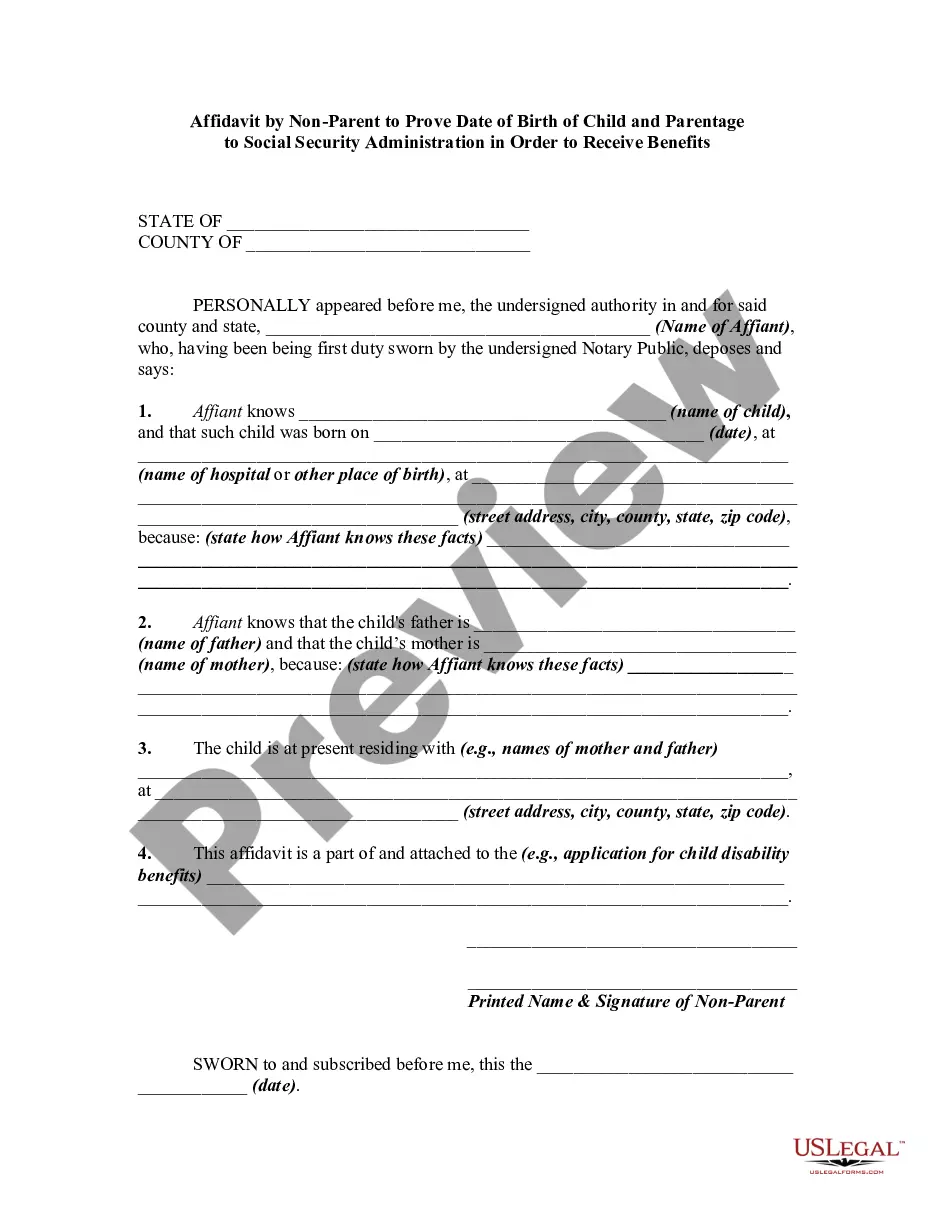

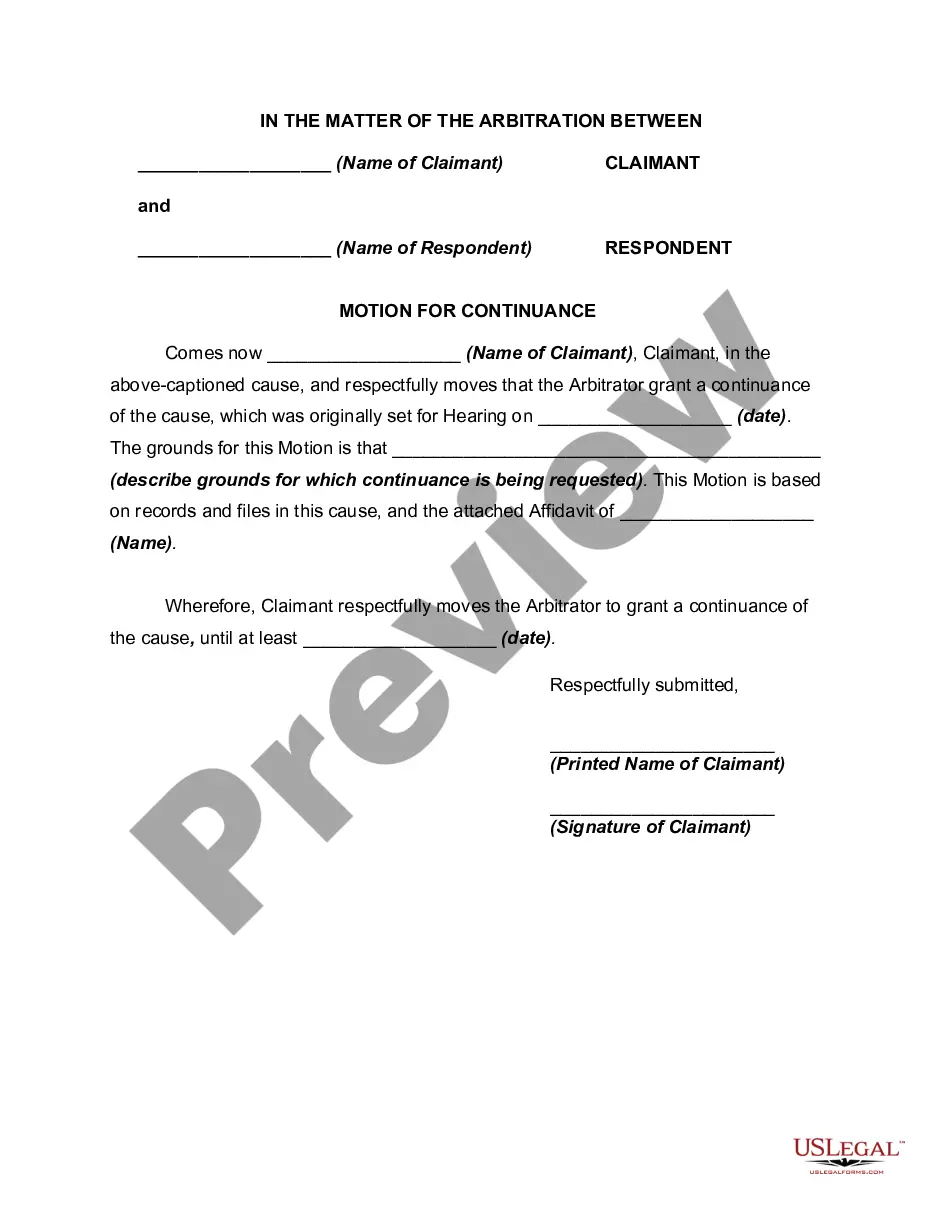

- Look through the form content to make sure it meets your state requirements. To do so, read the form description or take advantage of the Preview option.

- In case your legal template doesn’t meet your needs, find another one using the search tab at the top of the page.

- If you already have an account with us, log in and download the Texas Monthly Operating Report for Small Business Under Chapter 11. Otherwise, proceed to the next steps.

- Click Buy now once you find the right document. Select the subscription plan that suits you best to access our library’s full opportunities.

- Create an account and pay for your subscription. You can make a transaction with your credit card or through PayPal - our service is absolutely safe for that.

- Download your Texas Monthly Operating Report for Small Business Under Chapter 11 on your device and fill it out on a printed-out hard copy or electronically.

Another benefit of our service is that you can access previously purchased documents that you safely keep in your profile in the My Forms tab. Obtain them at any moment and re-complete your paperwork as frequently as you need.

Save time and effort preparing official paperwork with US Legal Forms, one of the most trusted web services. Sign up for us now!

Form popularity

FAQ

The discharge received by an individual debtor in a Chapter 11 case discharges the debtor from all pre-confirmation debts except those that would not be dischargeable in a Chapter 7 case filed by the same debtor.

Under Ch. 11, these Creditors are lawfully entitled to repayment, and thus have a Bankruptcy Claim against the Debtor in the case. The Bankruptcy Court, the Debtor, and the Creditors all play a part in the process to determine the outcome of the case.

Examples Of Chapter 11 Bankruptcy While Chapter 11 bankruptcies may appear to be a lot more successful than Chapter 7 situations, history shows that most companies entering Chapter 11 don't survive either. Less than 10% of Chapter 11 filings have actually been successful.

Monthly Operating Report or ?MOR? means a report form provided or approved by the Commissioner for use by a permittee in submitting data to the Department related to the operation of a facility.

Most Chapter 11 debtors receive a moratorium on the payment of most of their general unsecured debts for the period between the filing of the case and the confirmation of a plan. This period usually lasts for six to twelve months.

Once the debtor has fulfilled the obligations in the plan, the remaining debts are discharged. That means that the debtor no longer owes the debt, and creditors cannot make an effort to collect them. With the debts wiped out, the debtor can begin to recover their financial and credit health.

The MOR is a mandatory, data-enabled form which facilitates reporting, analysis, and. public access to chapter 11 financial information. This form does not apply to small business. debtors as defined in 11 U.S.C.

Does a Chapter 11 bankruptcy erase a business's debts? Not exactly. Creditors often have to accept less under a court-approved reorganization plan. But the idea is for the business to keep earning money so it can pay back as much as possible.