Texas Cover Sheet for Reaffirmation Agreement

Description

How to fill out Texas Cover Sheet For Reaffirmation Agreement?

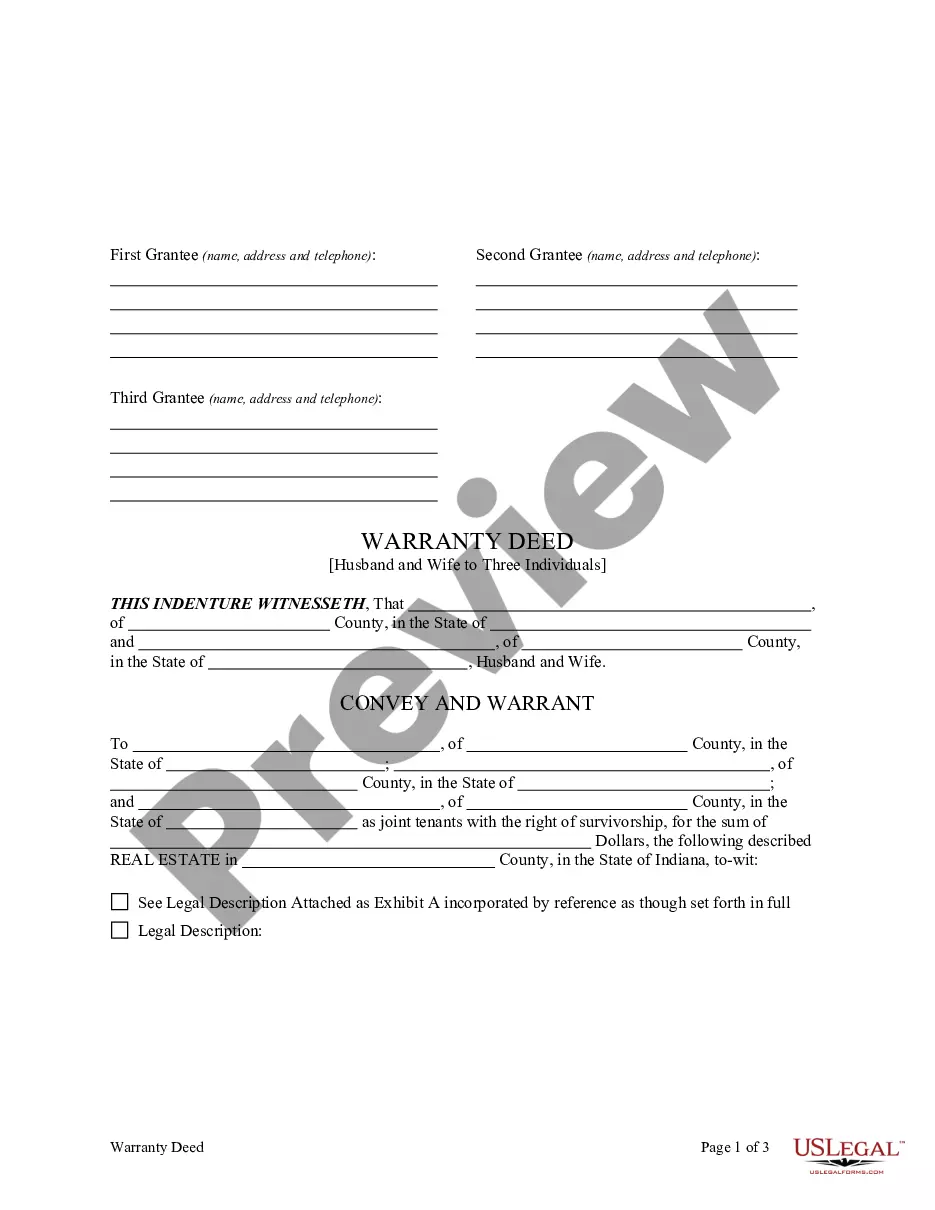

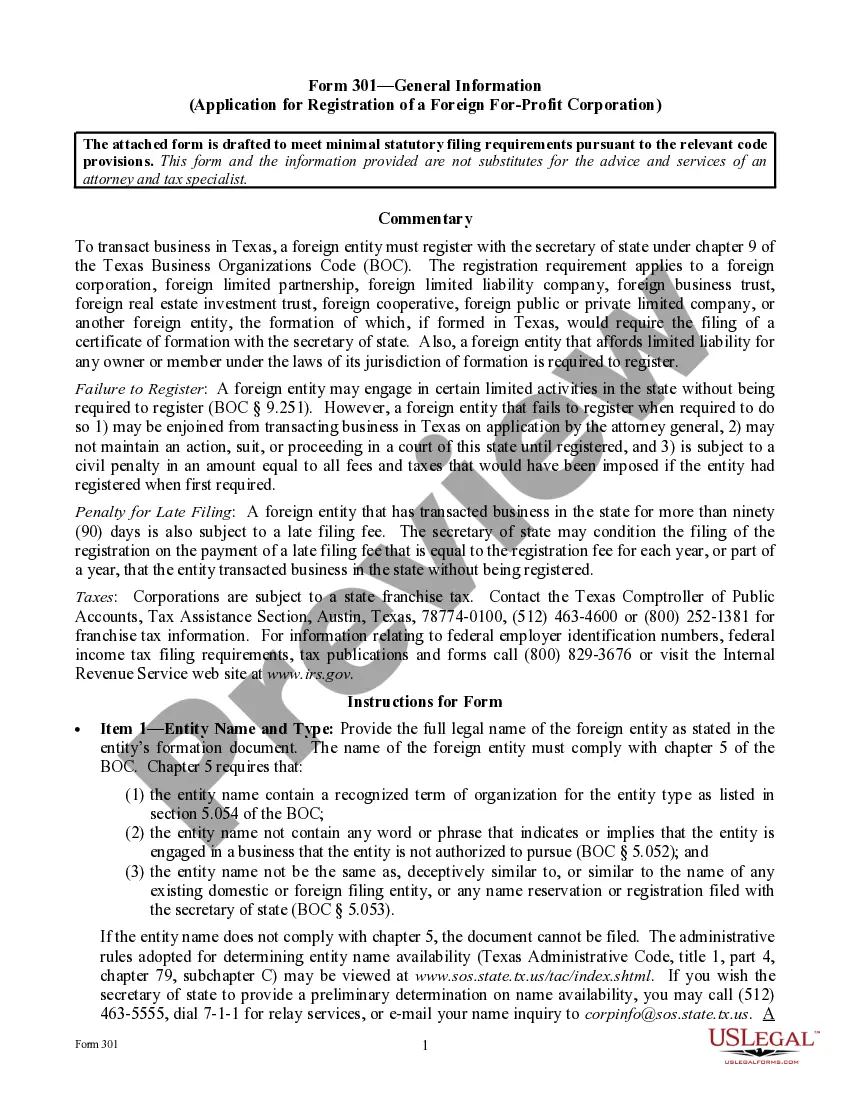

Preparing legal paperwork can be a real burden if you don’t have ready-to-use fillable templates. With the US Legal Forms online library of formal documentation, you can be certain in the blanks you find, as all of them correspond with federal and state regulations and are examined by our experts. So if you need to fill out Texas Cover Sheet for Reaffirmation Agreement, our service is the perfect place to download it.

Getting your Texas Cover Sheet for Reaffirmation Agreement from our catalog is as simple as ABC. Previously authorized users with a valid subscription need only sign in and click the Download button once they locate the proper template. Afterwards, if they need to, users can take the same blank from the My Forms tab of their profile. However, even if you are new to our service, registering with a valid subscription will take only a few minutes. Here’s a quick guide for you:

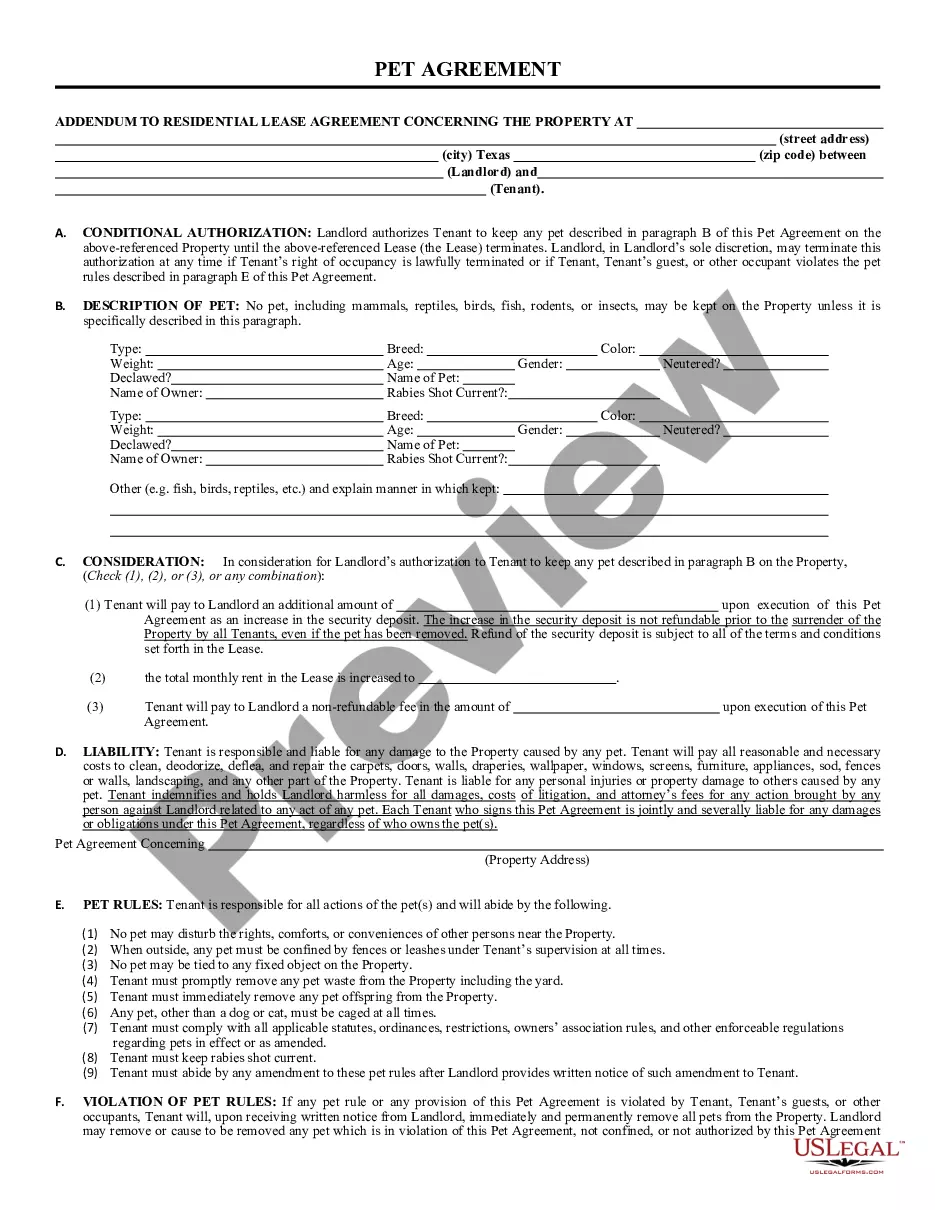

- Document compliance verification. You should carefully review the content of the form you want and make sure whether it satisfies your needs and fulfills your state law regulations. Previewing your document and reviewing its general description will help you do just that.

- Alternative search (optional). If there are any inconsistencies, browse the library through the Search tab above until you find a suitable template, and click Buy Now once you see the one you need.

- Account registration and form purchase. Create an account with US Legal Forms. After account verification, log in and choose your preferred subscription plan. Make a payment to proceed (PayPal and credit card options are available).

- Template download and further usage. Choose the file format for your Texas Cover Sheet for Reaffirmation Agreement and click Download to save it on your device. Print it to complete your paperwork manually, or take advantage of a multi-featured online editor to prepare an electronic copy faster and more efficiently.

Haven’t you tried US Legal Forms yet? Sign up for our service now to obtain any official document quickly and easily every time you need to, and keep your paperwork in order!

Form popularity

FAQ

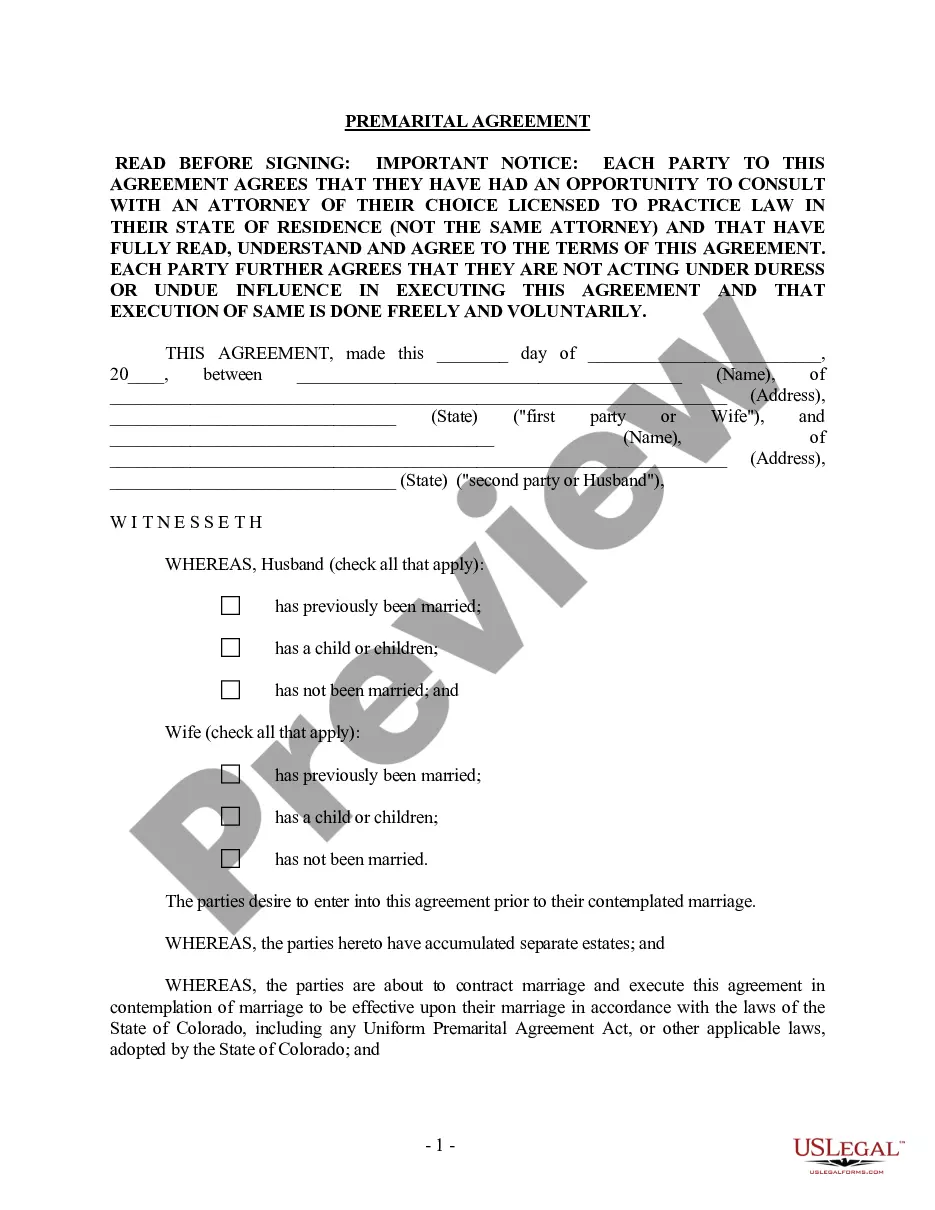

To ensure that creditors do not defraud their debtors, reaffirmation agreements must be: In writing; Filed with the court; and. Certified by the debtor's attorney.

No creditor can make you reaffirm a debt. This is because a reaffirmation goes against the most basic upside of filing bankruptcy: the fresh start. You cannot be sent to collections, sued, or garnished on a debt that was discharged in bankruptcy.

If the reaffirmation agreement is not filed with the bankruptcy court prior to the discharge date, it may be ineffective and the bankruptcy court can deny approval of the reaffirmation agreement altogether.

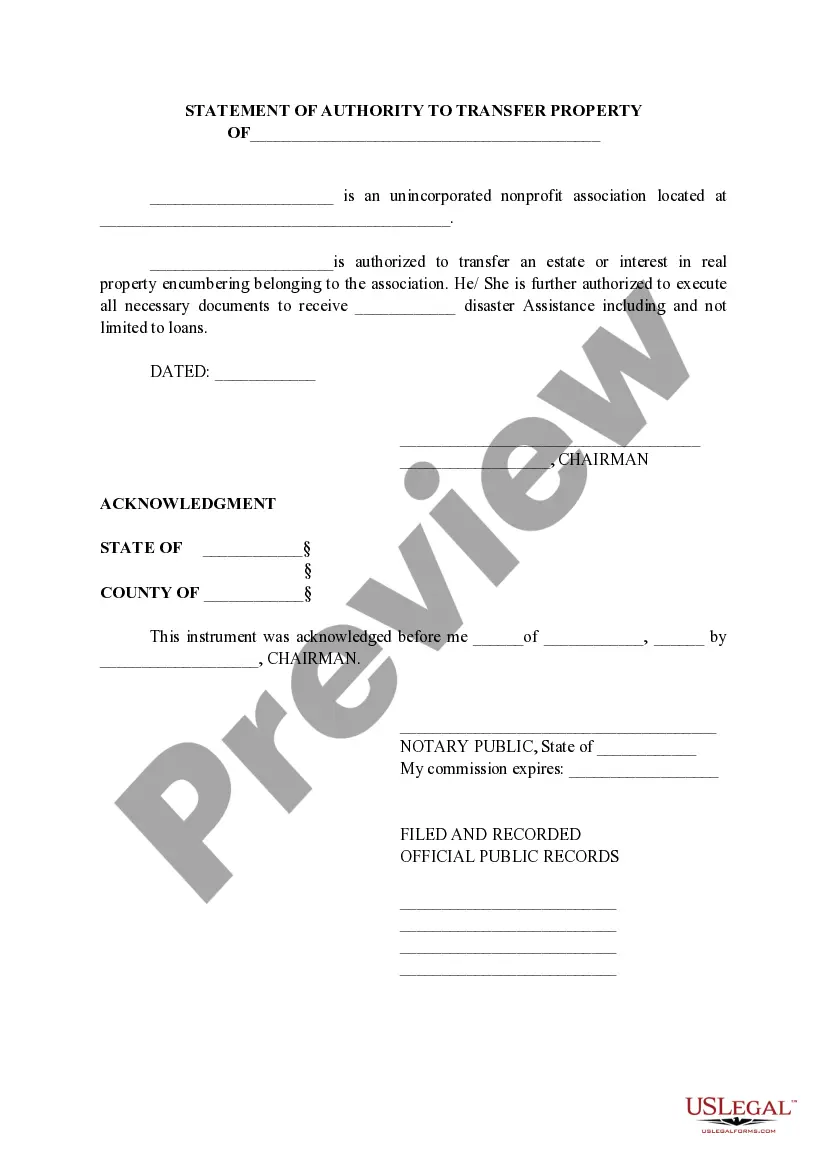

You or your creditor must file with the court the original of this Reaffirmation Documents packet and a completed Reaffirmation Agreement Cover Sheet (Official Bankruptcy Form 27).

If you want to request a reaffirmation agreement, you must agree after filing for bankruptcy but before any collateral is discharged to the lender. An agreement is filed by submitting a Statement of Intent to the court. Then, you must also send the Statement of Intent to the lender.

Reaffirming a mortgage debt requires a comprehensive multi-page reaffirmation agreement that must be filed with the court. The reaffirmation agreement also requires the debtor's bankruptcy attorney to indicate that he or she has read the agreement and that it does not impose any undue hardship on the client.

If a debtor signs a reaffirmation agreement, the debtor agrees to pay a debt that otherwise might be discharged in his or her bankruptcy case.

Creditors frequently do not automatically generate reaffirmation agreements. Sometimes creditors may not even file a reaffirmation agreement even after you have signed and returned the agreement to them.