Texas Application For Payment of Unclaimed Funds - And Order

Description

How to fill out Texas Application For Payment Of Unclaimed Funds - And Order?

Preparing legal paperwork can be a real stress unless you have ready-to-use fillable templates. With the US Legal Forms online library of formal documentation, you can be certain in the blanks you find, as all of them comply with federal and state laws and are checked by our specialists. So if you need to prepare Texas Application For Payment of Unclaimed Funds - And Order, our service is the best place to download it.

Getting your Texas Application For Payment of Unclaimed Funds - And Order from our library is as easy as ABC. Previously registered users with a valid subscription need only sign in and click the Download button once they find the correct template. Later, if they need to, users can use the same document from the My Forms tab of their profile. However, even if you are unfamiliar with our service, signing up with a valid subscription will take only a few minutes. Here’s a brief instruction for you:

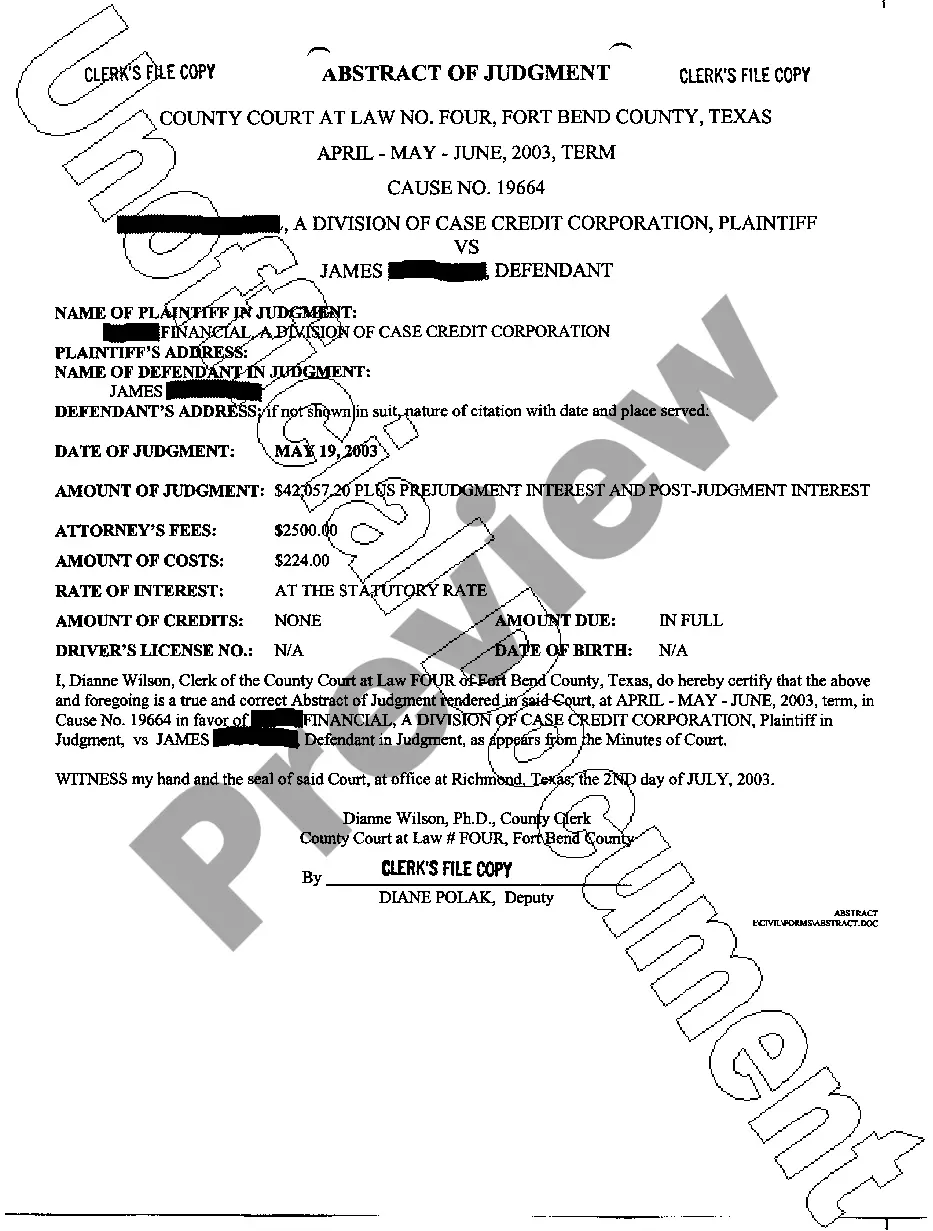

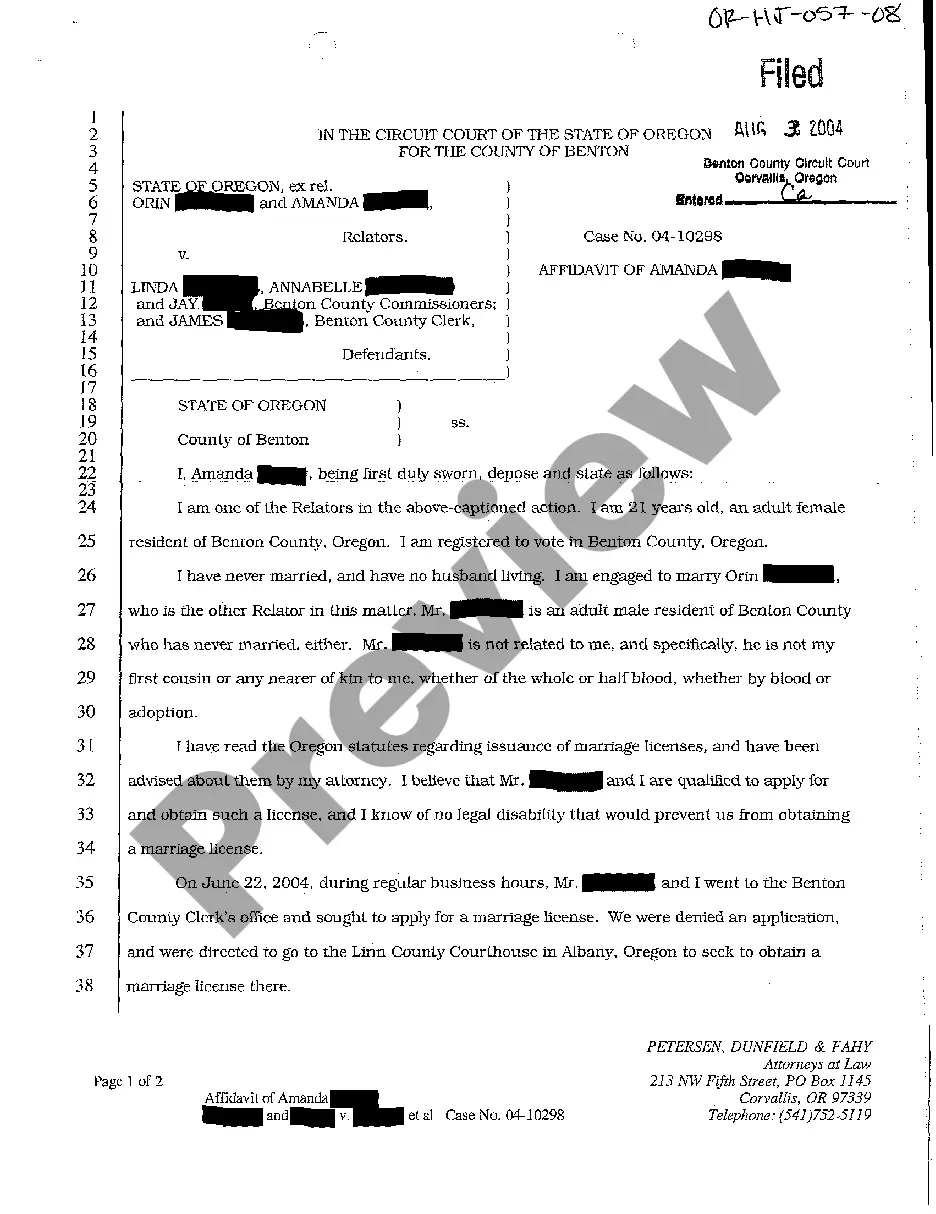

- Document compliance check. You should carefully review the content of the form you want and check whether it satisfies your needs and fulfills your state law requirements. Previewing your document and reviewing its general description will help you do just that.

- Alternative search (optional). Should there be any inconsistencies, browse the library using the Search tab above until you find a suitable blank, and click Buy Now once you see the one you need.

- Account registration and form purchase. Sign up for an account with US Legal Forms. After account verification, log in and choose your most suitable subscription plan. Make a payment to proceed (PayPal and credit card options are available).

- Template download and further usage. Choose the file format for your Texas Application For Payment of Unclaimed Funds - And Order and click Download to save it on your device. Print it to complete your papers manually, or use a multi-featured online editor to prepare an electronic version faster and more efficiently.

Haven’t you tried US Legal Forms yet? Subscribe to our service now to obtain any official document quickly and easily any time you need to, and keep your paperwork in order!

Form popularity

FAQ

Use the IRS Where's My Refund? search tool if you have not received your tax refund. SEC enforcement funds ? Search the Securities and Exchange Commission (SEC) database for money from an investment enforcement case. Bank failures ? Search the FDIC database for unclaimed funds from closed financial institutions.

Remember, you can have unclaimed property more than once. The Texas Comptroller of Public Accounts will process original owner claims in 60 to 90 days after receipt, if no additional information is needed.

How do I search for unclaimed property? Business and individuals can search for their unclaimed property at ClaimItTexas.gov.

Step 1: Go to the Property Search Page.Step 2: Type Name to Search for Property.Step 3: Add Property and Click "CONTINUE TO FILE CLAIM"

Texas law has no statute of limitations on unclaimed property. This property always belongs to its owners or their legal heir(s). You can also search to see if your business has unclaimed property at .ClaimItTexas.org.

How to Claim Excess Tax Funds Gather the Required Documents. There are a number of documents that you'll need to gather and submit along with your claim form.Complete the Claim Form. Once you have your documents gathered, you can fill out the claim form.Submit Your Claim.

There is no statute of limitations for unclaimed property. Funds reported will remain here indefinitely until returned to their rightful owner. The Texas Comptroller has authority to manage the State of Texas Unclaimed Property Program under Title 6 of the Texas Property Code (opens in a new tab).