Texas Sales Report For Non-Continuous Offerings

Description

How to fill out Texas Sales Report For Non-Continuous Offerings?

How much time and resources do you normally spend on composing official documentation? There’s a greater way to get such forms than hiring legal specialists or wasting hours browsing the web for a proper template. US Legal Forms is the premier online library that offers professionally designed and verified state-specific legal documents for any purpose, including the Texas Sales Report For Non-Continuous Offerings.

To obtain and complete an appropriate Texas Sales Report For Non-Continuous Offerings template, follow these simple instructions:

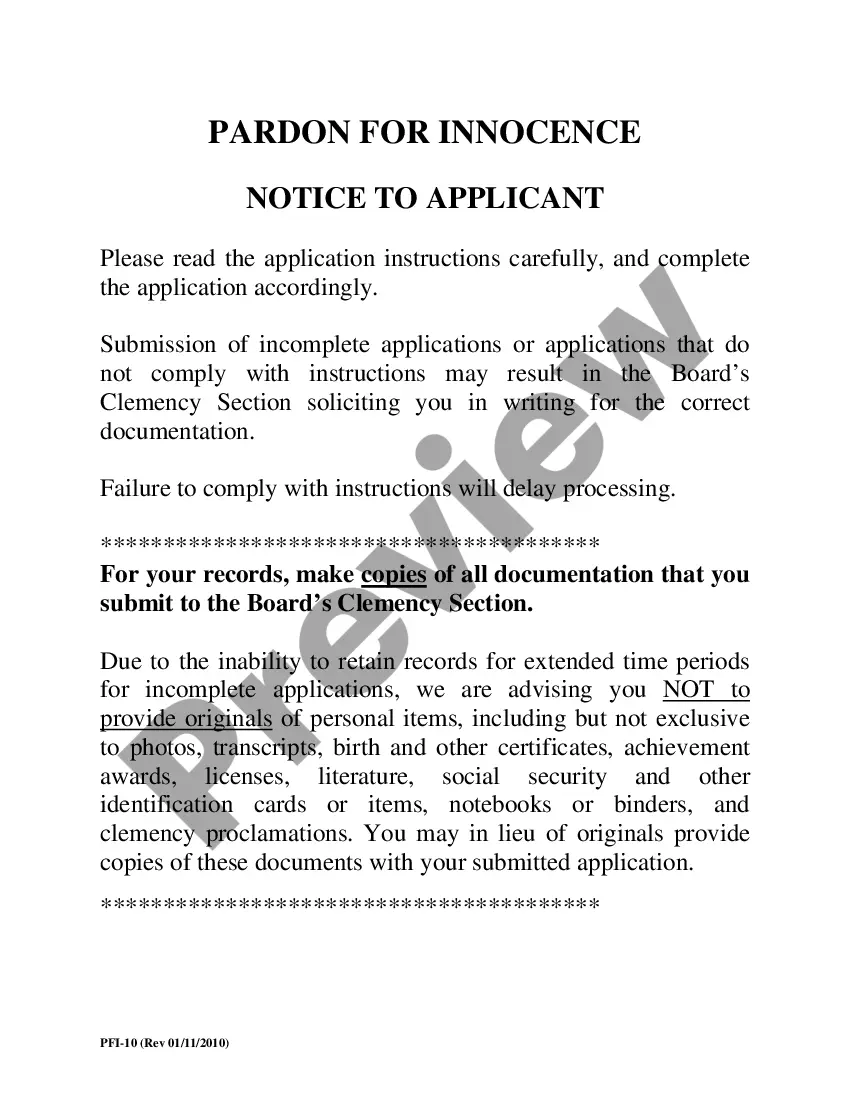

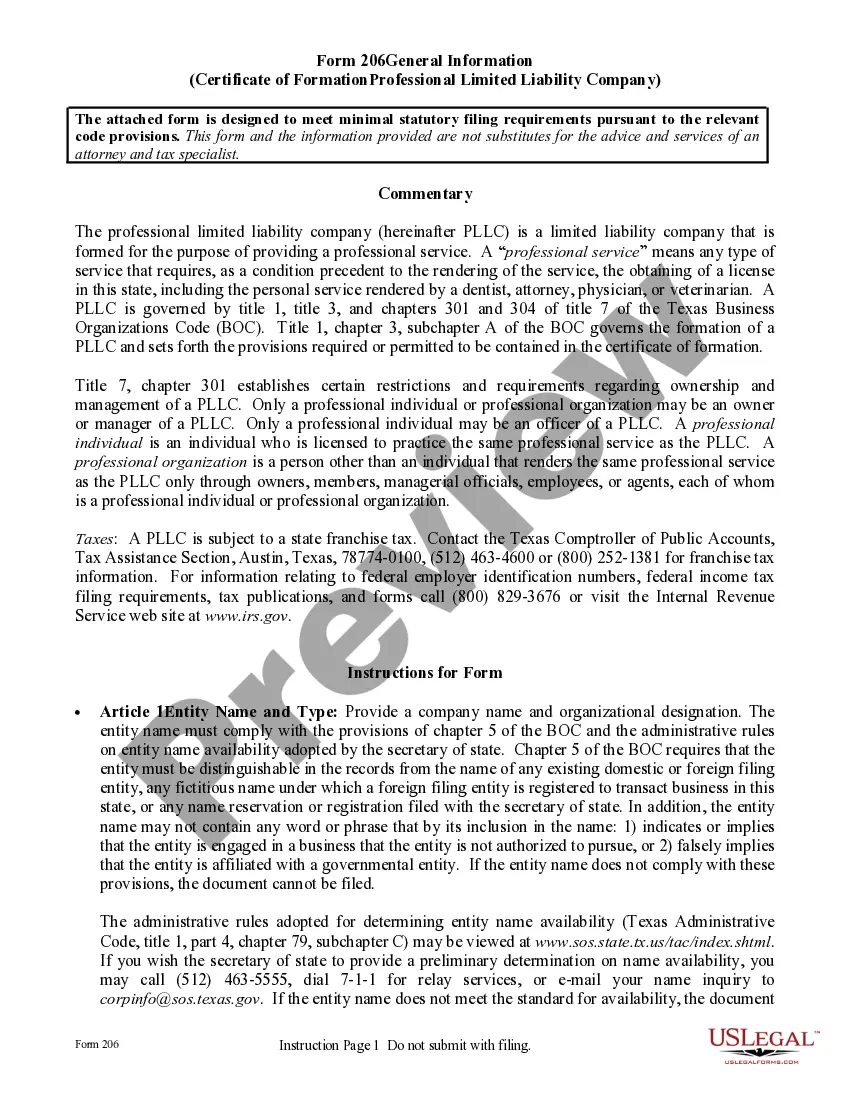

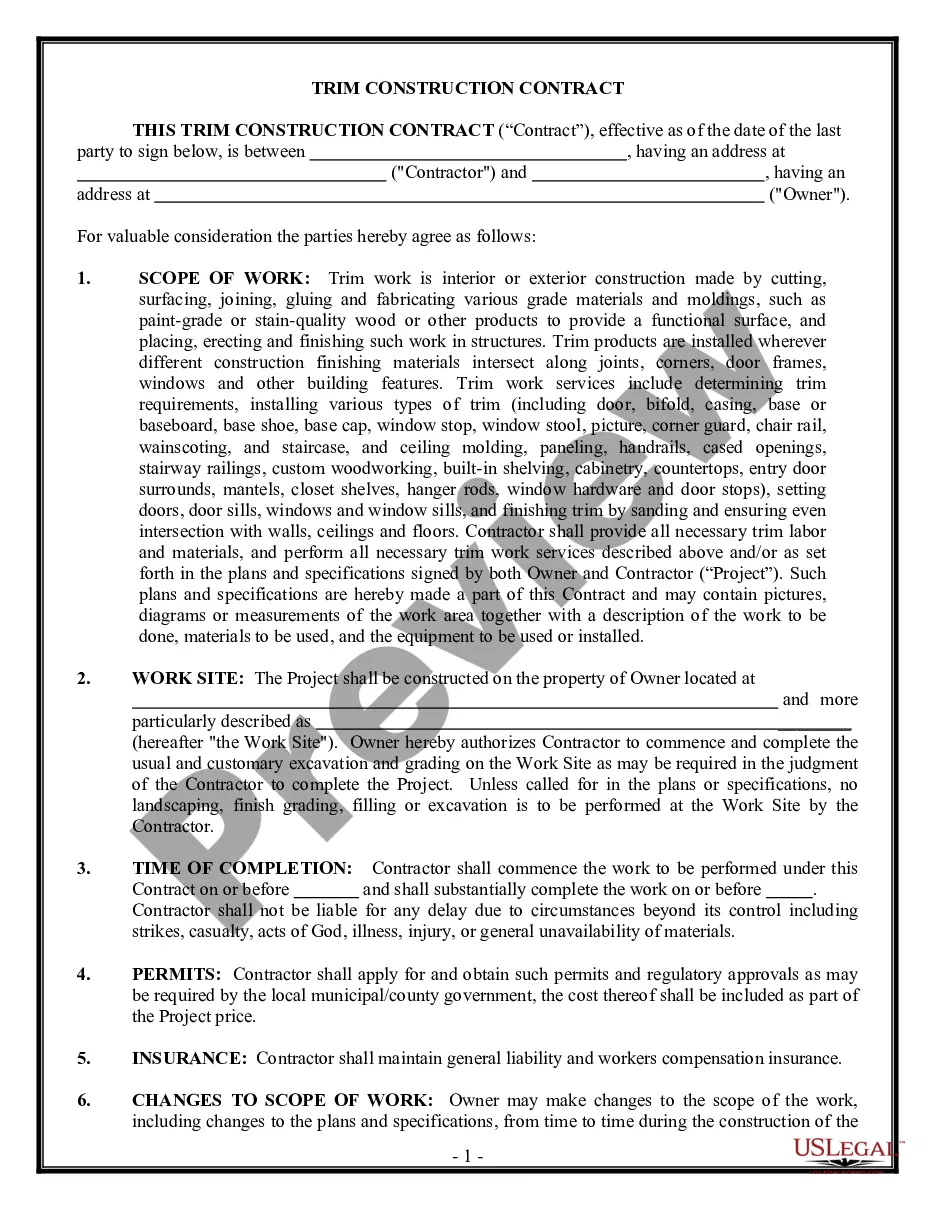

- Look through the form content to make sure it complies with your state requirements. To do so, read the form description or use the Preview option.

- In case your legal template doesn’t meet your needs, locate another one using the search bar at the top of the page.

- If you are already registered with our service, log in and download the Texas Sales Report For Non-Continuous Offerings. Otherwise, proceed to the next steps.

- Click Buy now once you find the right document. Opt for the subscription plan that suits you best to access our library’s full service.

- Create an account and pay for your subscription. You can make a payment with your credit card or through PayPal - our service is absolutely safe for that.

- Download your Texas Sales Report For Non-Continuous Offerings on your device and fill it out on a printed-out hard copy or electronically.

Another advantage of our service is that you can access previously downloaded documents that you safely keep in your profile in the My Forms tab. Obtain them anytime and re-complete your paperwork as often as you need.

Save time and effort completing legal paperwork with US Legal Forms, one of the most trusted web solutions. Sign up for us today!

Form popularity

FAQ

Other tax-exempt items in Texas CategoryExemption StatusFood and MealsMedical ServicesEXEMPTMedicinesEXEMPTNewspapers and Magazines19 more rows

You have three options for filing and paying your Texas sales tax: File online ? File online at the ?TxComptroller eSystems? site. You can remit your payment through their online system.File by mail ? You can also download a Texas Sales and Use tax return here. AutoFile ? Let TaxJar file your sales tax for you.

Admissions, Booth Rentals and Parking Fees Admission fees are taxable. The event promoter must collect sales tax on admission fees.

An exemption certificate must show: (1) the name and address of the purchaser; (2) a description of the item to be purchased; (3) the reason the purchase is exempt from tax; (4) the signature of the purchaser and the date; and. (5) the name and address of the seller.

That's because, in general, when you make a purchase in the US you pay for the price of the item plus the sales tax rate. However, some vendors have good reason to include the sales tax in the posted price of the item.

Total sales (also known as gross sales) is the sum of all of your sales, regardless if you collected sales tax on a transaction or not. Taxable sales (displayed as Taxed Sales in your TaxJar Reports) is the total of only the transactions where you collected sales tax.

Total Texas revenue includes taxable, nontaxable, and tax-exempt sales. A sale of an item for delivery in this state is presumed to be a sale for storage, use, or other consumption in this state.

Texas imposes a 6.25 percent state sales and use tax on all retail sales, leases and rentals of most goods, as well as taxable services.