Texas Development Loan Deed of Trust, Security Agreement and Financing Statement

Description

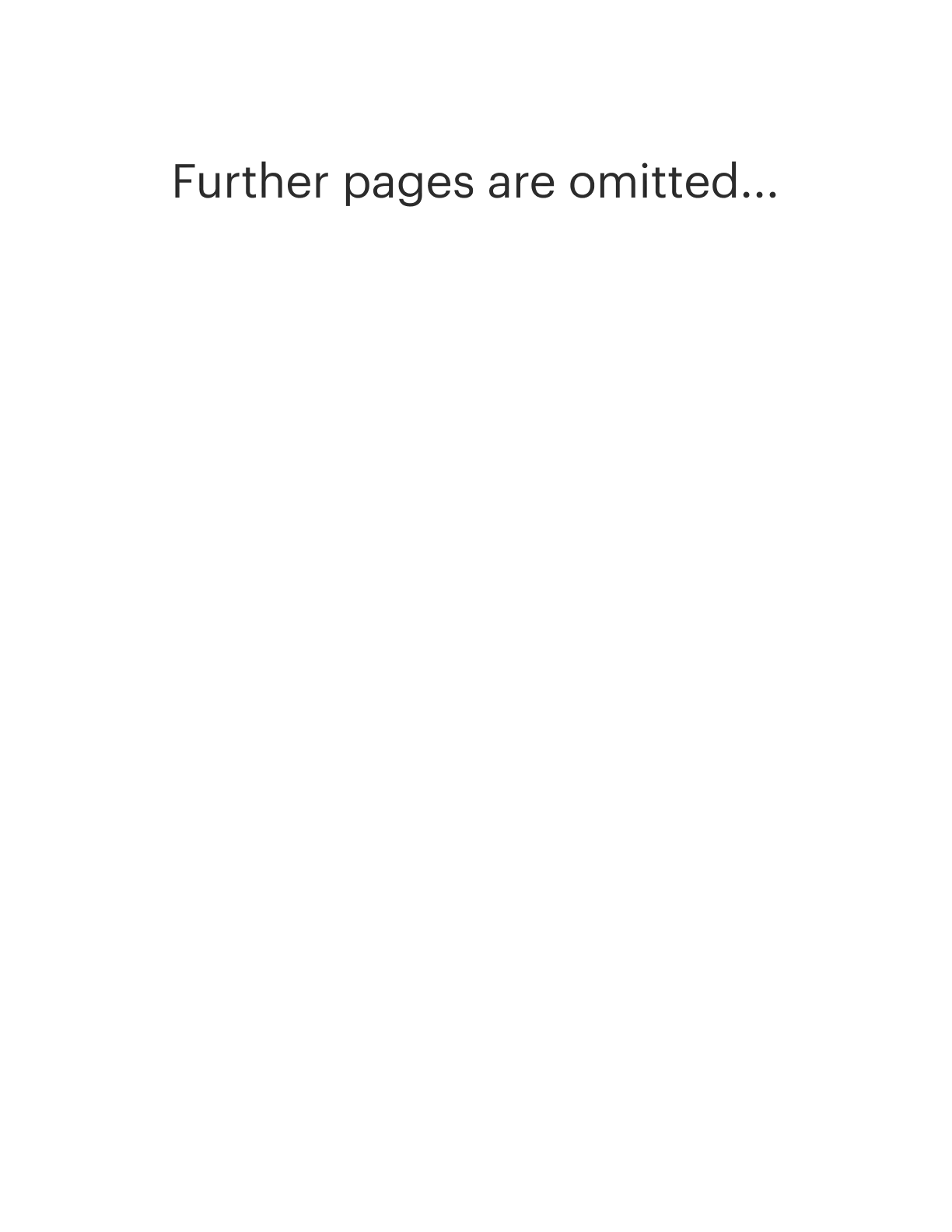

How to fill out Texas Development Loan Deed Of Trust, Security Agreement And Financing Statement?

Get access to high quality Texas Development Loan Deed of Trust, Security Agreement and Financing Statement forms online with US Legal Forms. Avoid hours of lost time seeking the internet and lost money on forms that aren’t updated. US Legal Forms offers you a solution to exactly that. Get above 85,000 state-specific authorized and tax templates that you can save and submit in clicks within the Forms library.

To get the example, log in to your account and click Download. The document is going to be stored in two places: on the device and in the My Forms folder.

For people who don’t have a subscription yet, check out our how-guide below to make getting started easier:

- Find out if the Texas Development Loan Deed of Trust, Security Agreement and Financing Statement you’re considering is suitable for your state.

- View the form making use of the Preview option and read its description.

- Check out the subscription page by clicking Buy Now.

- Select the subscription plan to continue on to sign up.

- Pay out by credit card or PayPal to complete creating an account.

- Choose a preferred file format to save the document (.pdf or .docx).

Now you can open the Texas Development Loan Deed of Trust, Security Agreement and Financing Statement sample and fill it out online or print it and get it done by hand. Take into account sending the document to your legal counsel to make sure everything is completed correctly. If you make a error, print and complete sample again (once you’ve registered an account every document you save is reusable). Make your US Legal Forms account now and get access to a lot more templates.

Form popularity

FAQ

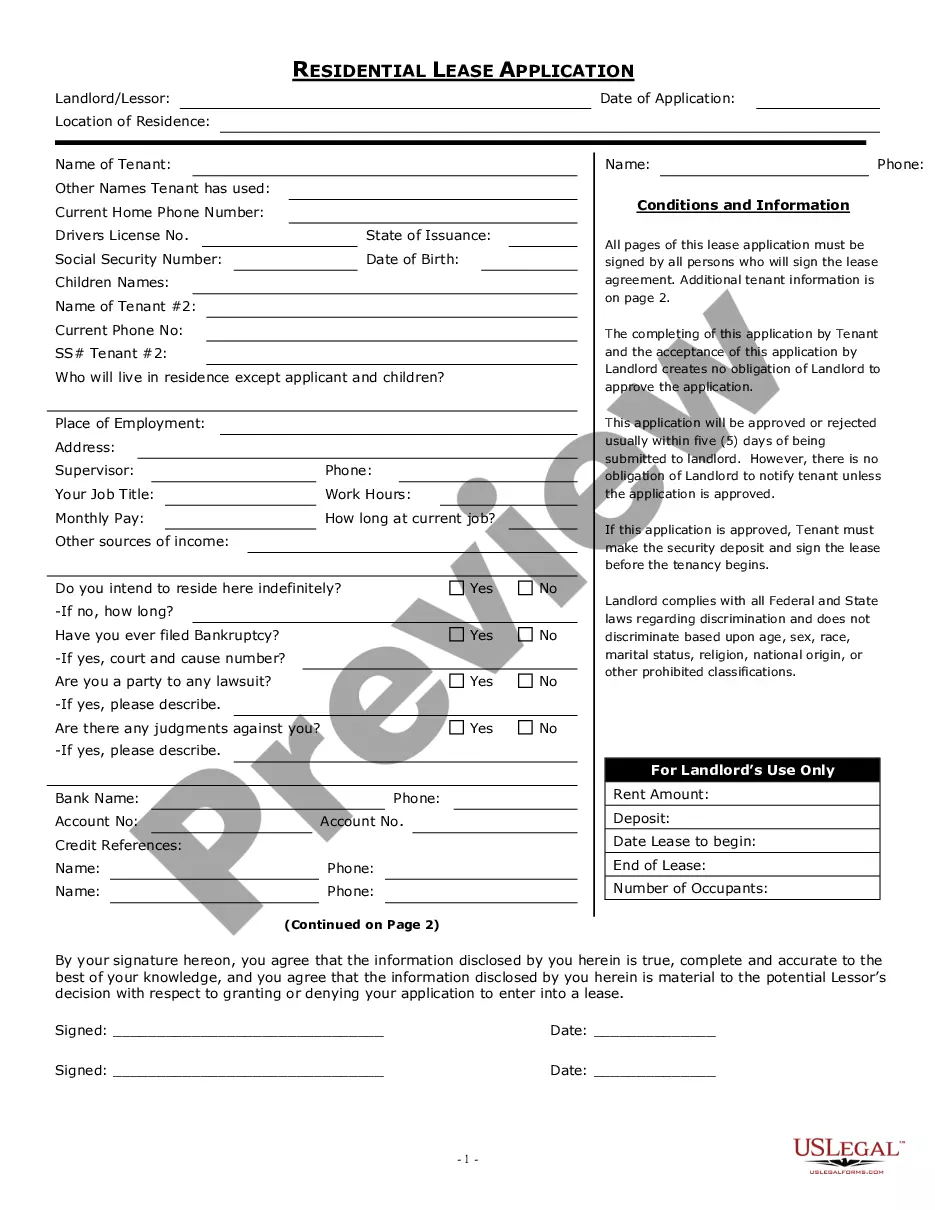

A UCC-1 financing statement (an abbreviation for Uniform Commercial Code-1) is a legal form that a creditor files to give notice that it has or may have an interest in the personal property of a debtor (a person who owes a debt to the creditor as typically specified in the agreement creating the debt).

The person who owns the property usually signs a promissory note and a deed of trust. The deed of trust does not have to be recorded to be valid.

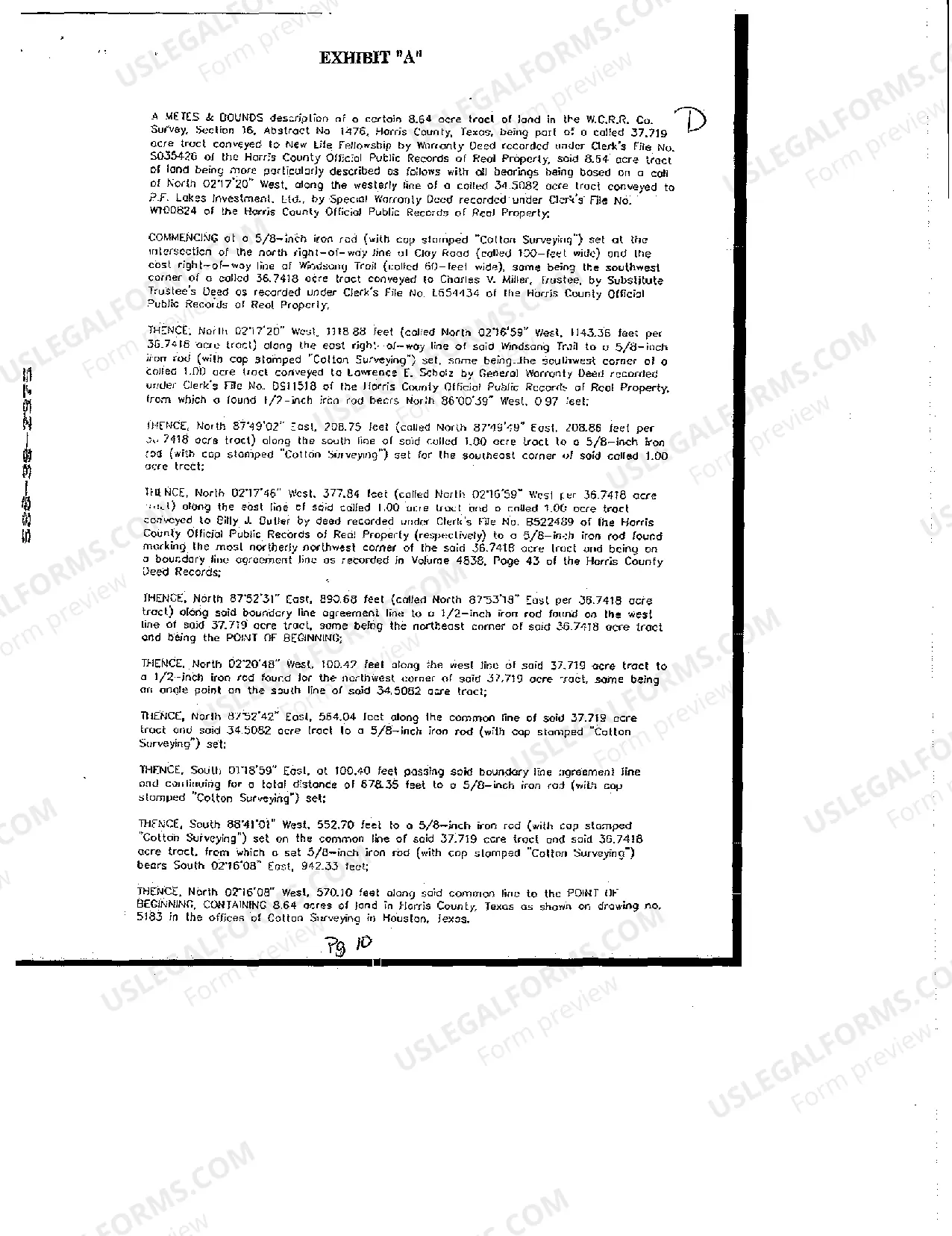

Party information: names and addresses of the trustor(s), trustee(s), beneficiary(ies), and guarantor(s) (if applicable) Property details: full address of the property and its legal description (which can be obtained from the County Recorder's Office)

Visit the land records division in the county clerk's office in the county where the land at issue in the deed of trust is located. Ask the clerk to record the deed of trust. Pay the required filing fee.

Some owners are put off using solicitors duke to the deed of trust cost. Individuals can write out their own, and use someone else as a witness. However, this may have errors or not be a legally binding document. The investment of getting a deed of trust when buying a property is often worth it in the long term.

Yes, there are key differences between the two. With a deed, you transfer the ownership of the property to one party. In contrast, a deed of trust does not mean the holder owns the property. In an arrangement involving a deed of trust, the borrower signs a contract with the lender with details regarding the loan.

A deed of trust includes most of the same information as a mortgage, including: The original loan amount. A legal description of the property that's used as security or collateral for the mortgage. The names of parties: trustee, trustor, and beneficiary.

When you are ready to sign a deed of trust, the parties will need to sign in the presence of a notary public.The deed of trust must then be recorded with the county where the property is located, and each of the parties (the trustor, trustee, and lender) should keep a copy of the recorded document.

Party information: names and addresses of the trustor(s), trustee(s), beneficiary(ies), and guarantor(s) (if applicable) Property details: full address of the property and its legal description (which can be obtained from the County Recorder's Office)