Texas Deed of Trust to Secure Assumption

Description Deed Of Trust

How to fill out What Is A Deed Of Trust To Secure Assumption?

Get access to high quality Texas Deed of Trust to Secure Assumption samples online with US Legal Forms. Avoid hours of lost time browsing the internet and dropped money on documents that aren’t up-to-date. US Legal Forms offers you a solution to exactly that. Get above 85,000 state-specific legal and tax templates you can download and submit in clicks in the Forms library.

To receive the example, log in to your account and click Download. The file is going to be stored in two places: on your device and in the My Forms folder.

For people who don’t have a subscription yet, check out our how-guide listed below to make getting started simpler:

- See if the Texas Deed of Trust to Secure Assumption you’re looking at is suitable for your state.

- See the sample making use of the Preview option and browse its description.

- Check out the subscription page by clicking Buy Now.

- Choose the subscription plan to keep on to sign up.

- Pay by card or PayPal to complete creating an account.

- Select a favored format to download the file (.pdf or .docx).

Now you can open up the Texas Deed of Trust to Secure Assumption example and fill it out online or print it and do it by hand. Consider sending the document to your legal counsel to make certain everything is completed correctly. If you make a mistake, print and fill sample again (once you’ve registered an account every document you save is reusable). Create your US Legal Forms account now and access far more templates.

Texas Deed Of Trust Form popularity

Deed Of Assumption Sample Other Form Names

How To Make A Trust In Texas FAQ

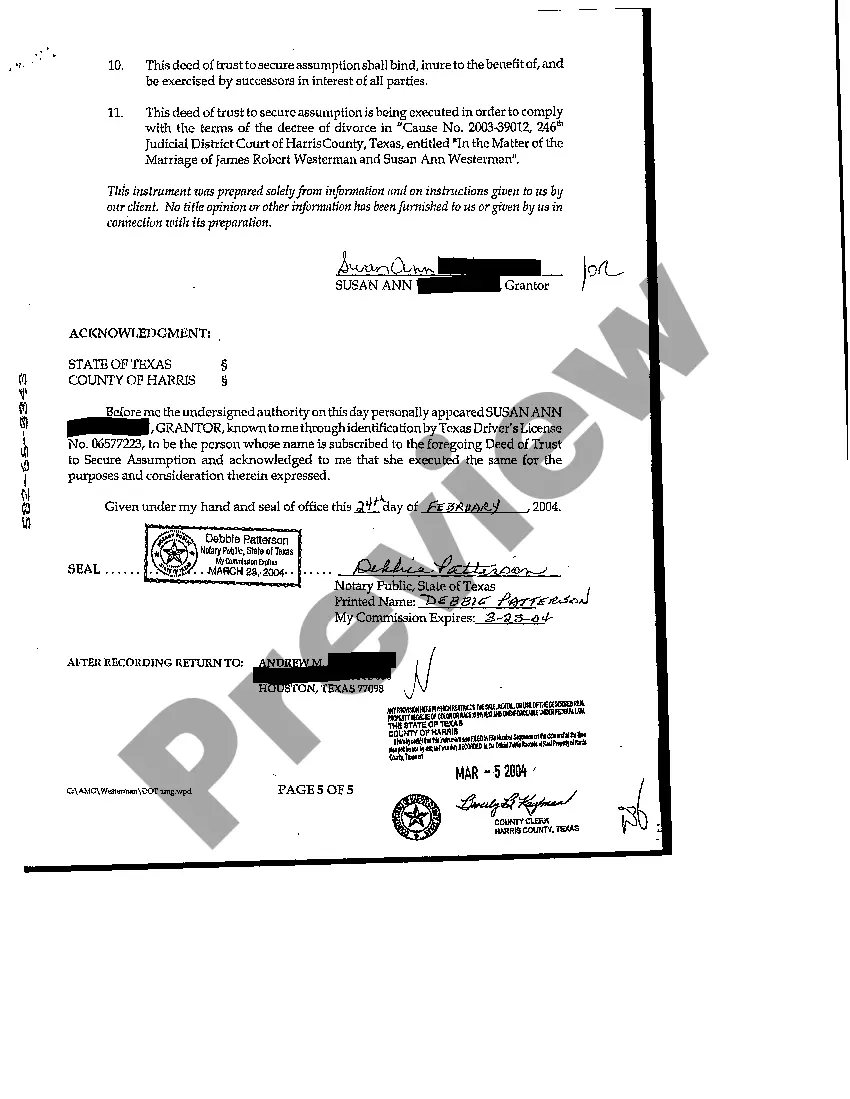

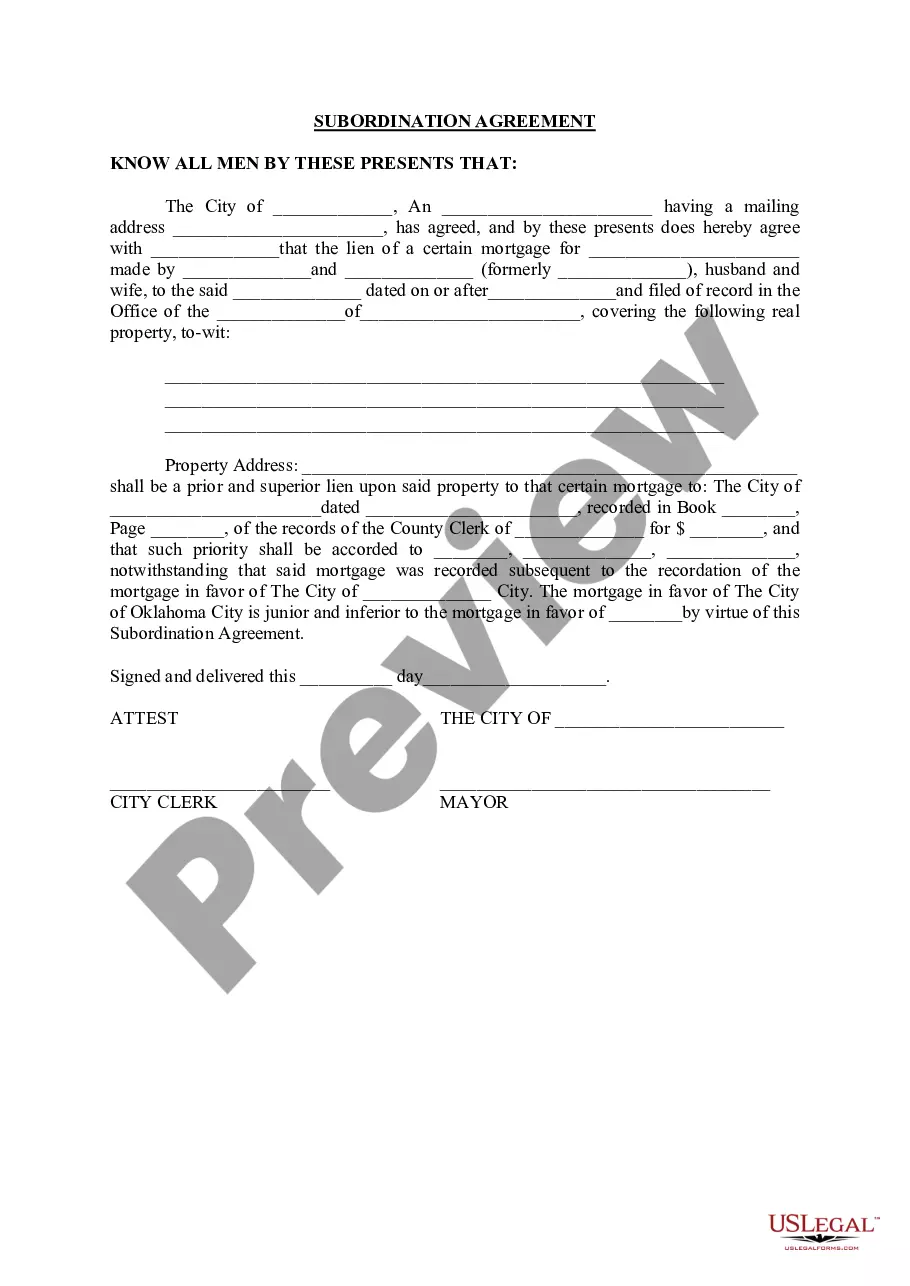

Party information: names and addresses of the trustor(s), trustee(s), beneficiary(ies), and guarantor(s) (if applicable) Property details: full address of the property and its legal description (which can be obtained from the County Recorder's Office)

An assumption warranty deed is a general or special warranty deed that has an additional provision.This provision differs from the mortgage assumption in that the assumption deed obligates the buyer to the seller, whereas the mortgage assumption obligates the buyer to the lender.

The deed of trust to secure assumption is a document that names the spouse who did not receive the house as the beneficiary.If the spouse receiving the house fails to repay the mortgage lender, then the spouse who did not get the house can foreclose on the property just like any other creditor.

In a deed of trust, the borrower is called the trustor and the lender is the beneficiary. The trustee holds title to the property until the trustor has fully repaid the loan to the beneficiary, at which time the lender notifies the trustee, who then transfers full title of the property to the trustor.

The trustee's primary function is to hold and maintain a property title for the borrower and the lender for the duration of the loan. Therefore, it is the trustee who retains factual ownership and control of the property in question, not the lender.

The one major difference in some areas between the two is that the security deed is held by the lender whereas a trust deed is usually held by a third party.The mortgage requires a judicial action for foreclosure to take place; while the security or trust deed is a nonjudicial action where no court is involved.

A deed of trust is a written instrument with three parties: The trustor, who is the borrower and homeowner. The beneficiary, who is the lender. The trustee, who is a third party such as an insurance company or escrow management agency that holds actual title to the property in trust for the beneficiary.

The Deed of Trust (or Mortgage or Security Instrument) is a legal document that grants the lender the rights to take the property if the borrower goes into default and does not pay under the terms of the Note. The lender holds title to the property until the borrower has repaid the debt in full.

Key Takeaways. A deed of trust is a type of security for a loan that names a third party called the trustee to hold the legal title until you pay it off. The trustee is typically an entity such as a title company with "power of sale" in the event that you default on your loan payment.