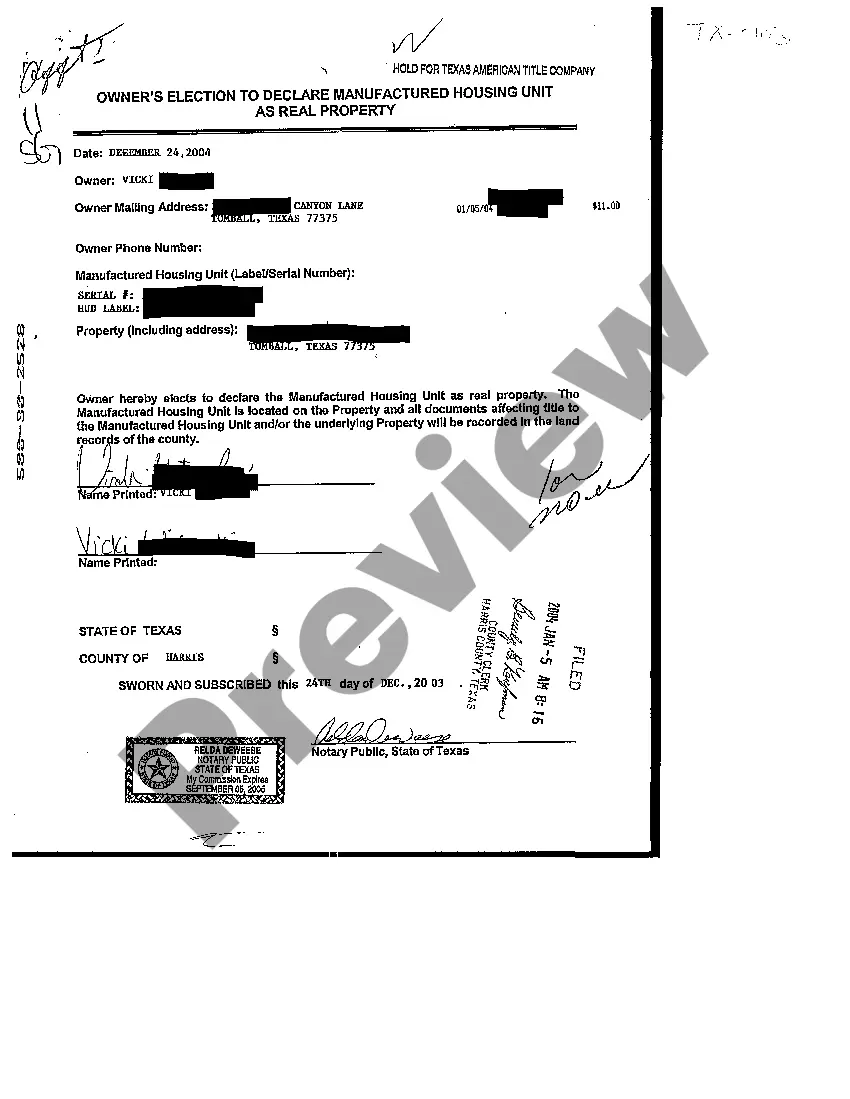

Texas Owners Election to Declare Manufactured Housing Unit as Real Property

Description

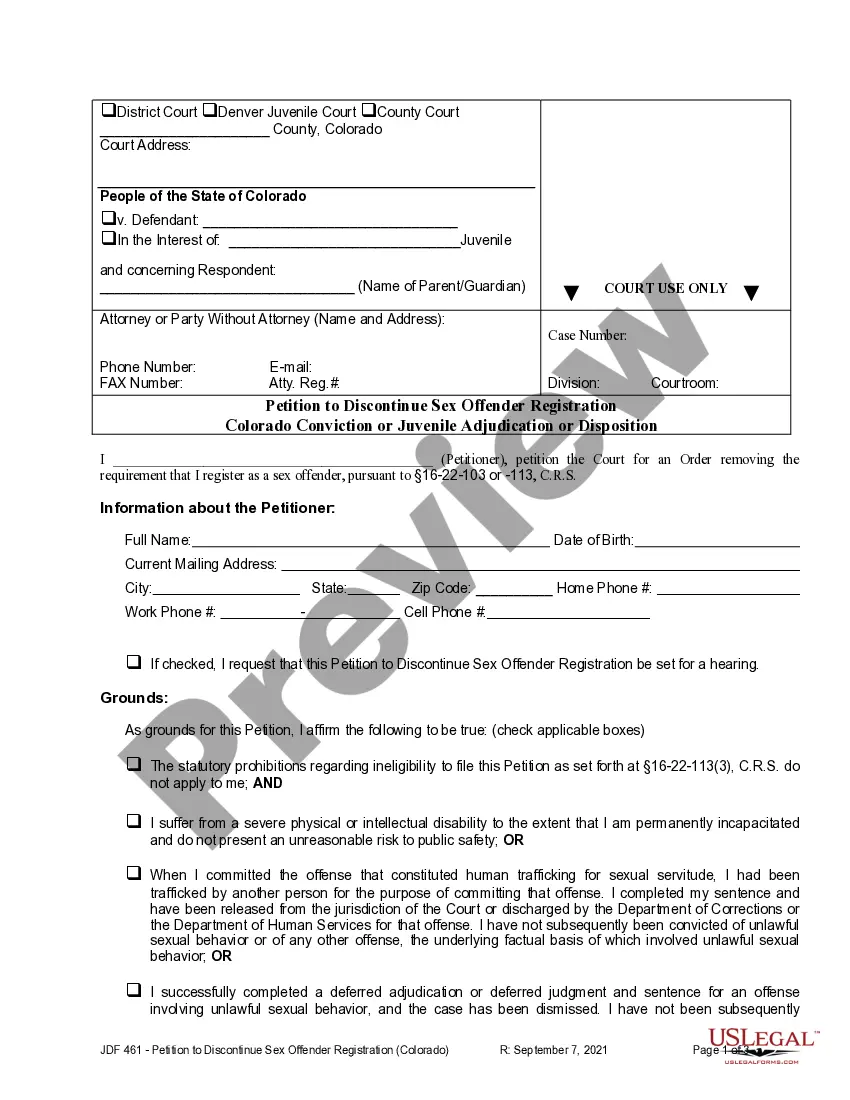

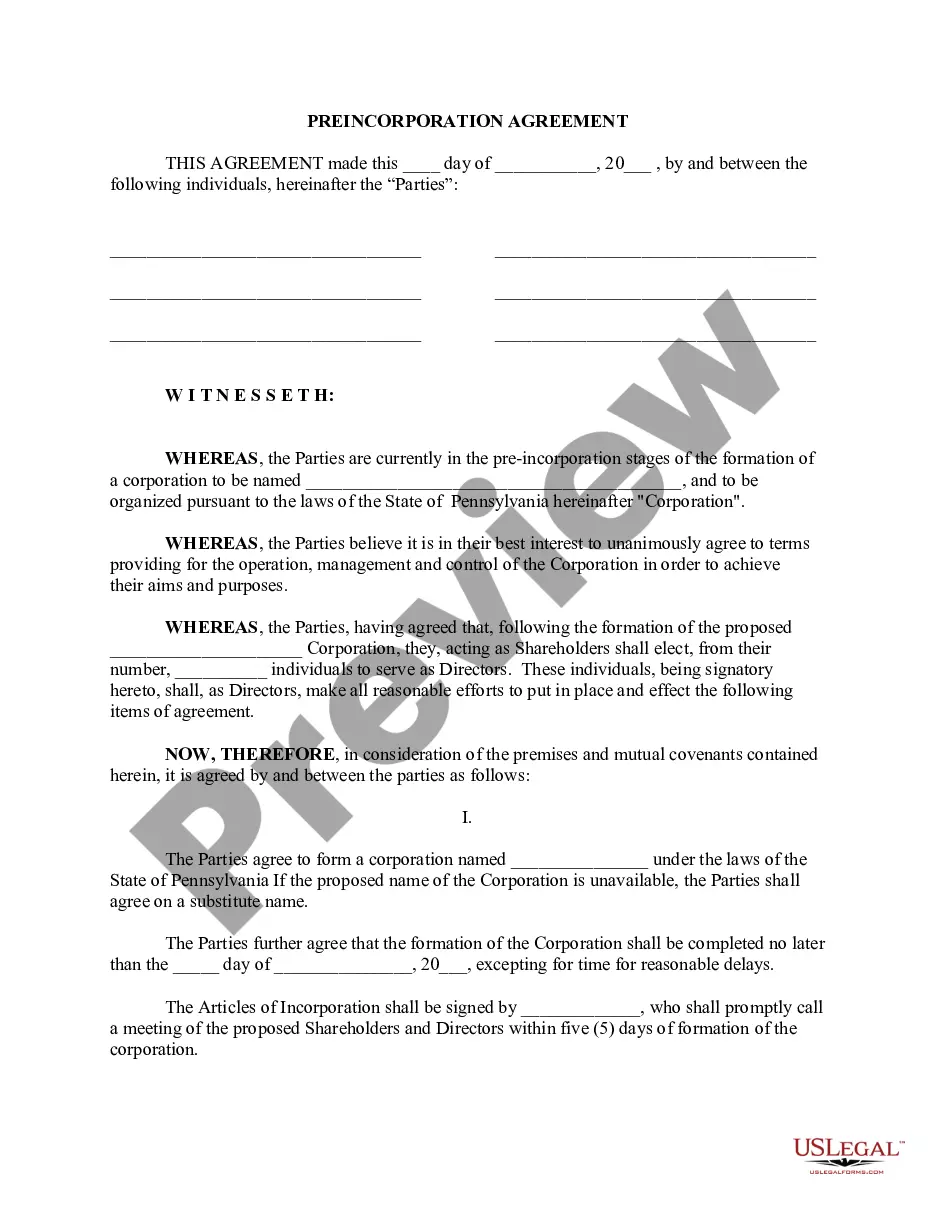

How to fill out Texas Owners Election To Declare Manufactured Housing Unit As Real Property?

Get access to quality Texas Owners Election to Declare Manufactured Housing Unit as Real Property forms online with US Legal Forms. Steer clear of hours of lost time searching the internet and lost money on files that aren’t updated. US Legal Forms gives you a solution to exactly that. Find above 85,000 state-specific authorized and tax samples that you could save and submit in clicks in the Forms library.

To find the example, log in to your account and click on Download button. The document is going to be saved in two places: on the device and in the My Forms folder.

For those who don’t have a subscription yet, check out our how-guide listed below to make getting started simpler:

- Verify that the Texas Owners Election to Declare Manufactured Housing Unit as Real Property you’re looking at is appropriate for your state.

- See the sample making use of the Preview function and read its description.

- Go to the subscription page by clicking on Buy Now button.

- Choose the subscription plan to keep on to sign up.

- Pay by card or PayPal to complete making an account.

- Pick a favored file format to save the document (.pdf or .docx).

Now you can open up the Texas Owners Election to Declare Manufactured Housing Unit as Real Property example and fill it out online or print it and do it yourself. Consider sending the papers to your legal counsel to be certain everything is filled out properly. If you make a error, print and complete application once again (once you’ve registered an account all documents you download is reusable). Make your US Legal Forms account now and get much more samples.

Form popularity

FAQ

General Laws Any Texas city is allowed to decide where mobile homes can be built. All mobile homes built in Texas must be approved by the TDHCA and the federal Department of Housing and Urban Development (HUD).Mobile homes are also subject to zoning laws in the area in which they are set up.

Until permanently affixed to the real estate so as to become real estate, a mobile home is personal property.The home must be permanently affixed to permanent utilities (not plugged in). Second, title must be turned in to the Texas Department of Housing and Community Affairs.

For a new manufactured home to be classified as real property it typically needs to be permanently installed on land that the buyer owns. A permanently placed manufactured home means the structure has been properly anchored to the foundation or ground and meets the manufacturers, state, or HUD minimum requirements.

The manufactured home is classified as real property when it meets the requirements imposed by the state, including but not limited to the permanent attachment of the manufactured home to the land: 2022 The state does not require the owner to obtain a certificate of title for the manufactured home.

Until about 7 years ago, a mobile home was considered a vehicle and had license plates. Why are there special rules for insuring mobile homes? Until permanently affixed to the real estate so as to become real estate, a mobile home is personal property.

Mobile homes affixed to land not owned by the homeowner are taxed as personal property. Mobile homes affixed to land owned by the homeowner are taxed as real property.

Some states require mobile homes that are affixed to the ground to acquire a "real property" decal and have it attached to the mobile home. The county appraiser assesses mobile homes with the sticker and the owner receives an annual property tax bill as the home is considered real property.

The Uniform Manufactured Housing Act requires you to do two things to legally convert a mobile home into a real house Relocate the mobile home onto a particular piece of land and file for a certificate of location with the land records office of where your new home will be located.

A disadvantage of buying a mobile home is that its value will depreciate quickly. Like a new car, once a mobile home leaves the factory, it quickly drops in value. Stick built homes, on the other hand, normally appreciate in value over time because the stick built home owner almost always owns the underlying land.