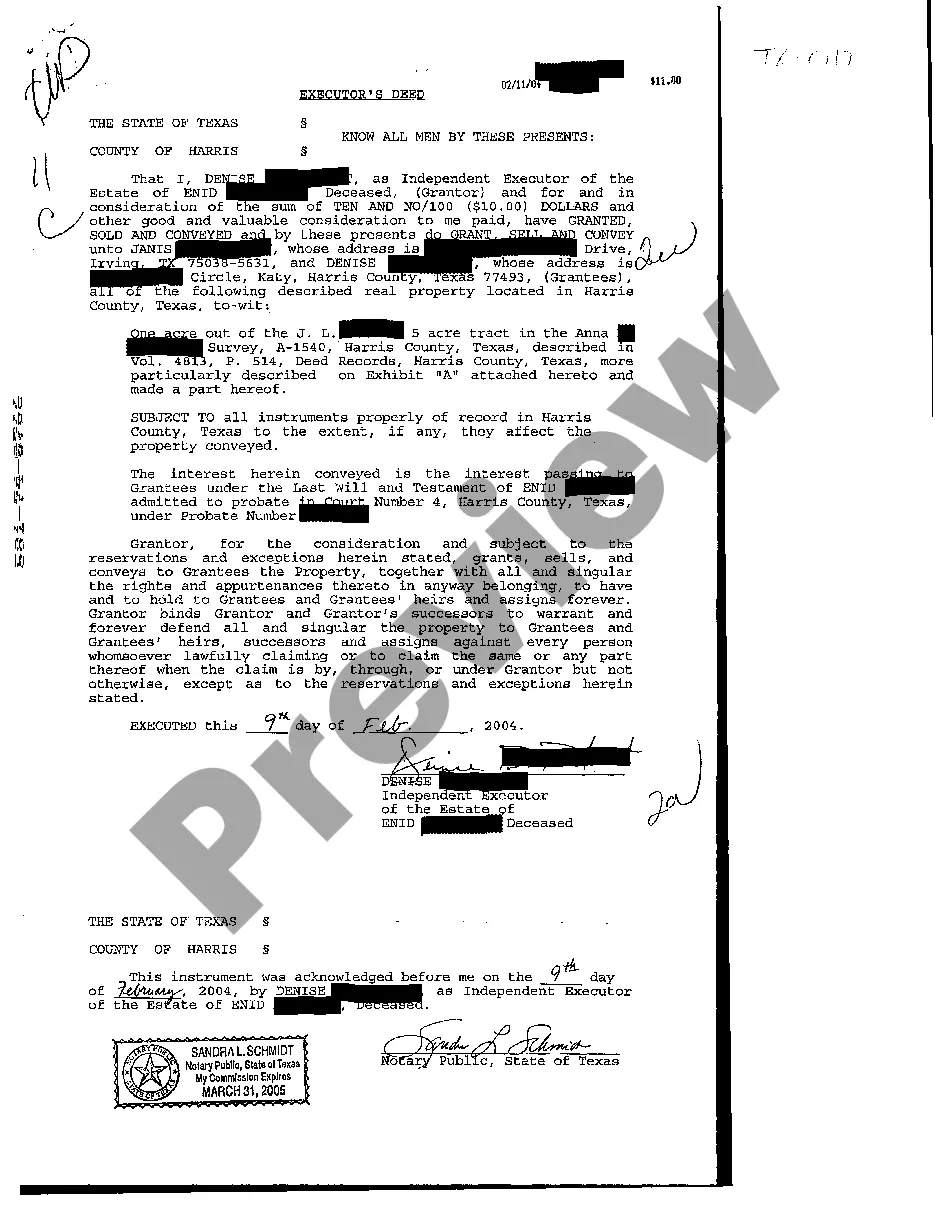

Texas Executor's Deed

Description Executor Of Estate Document

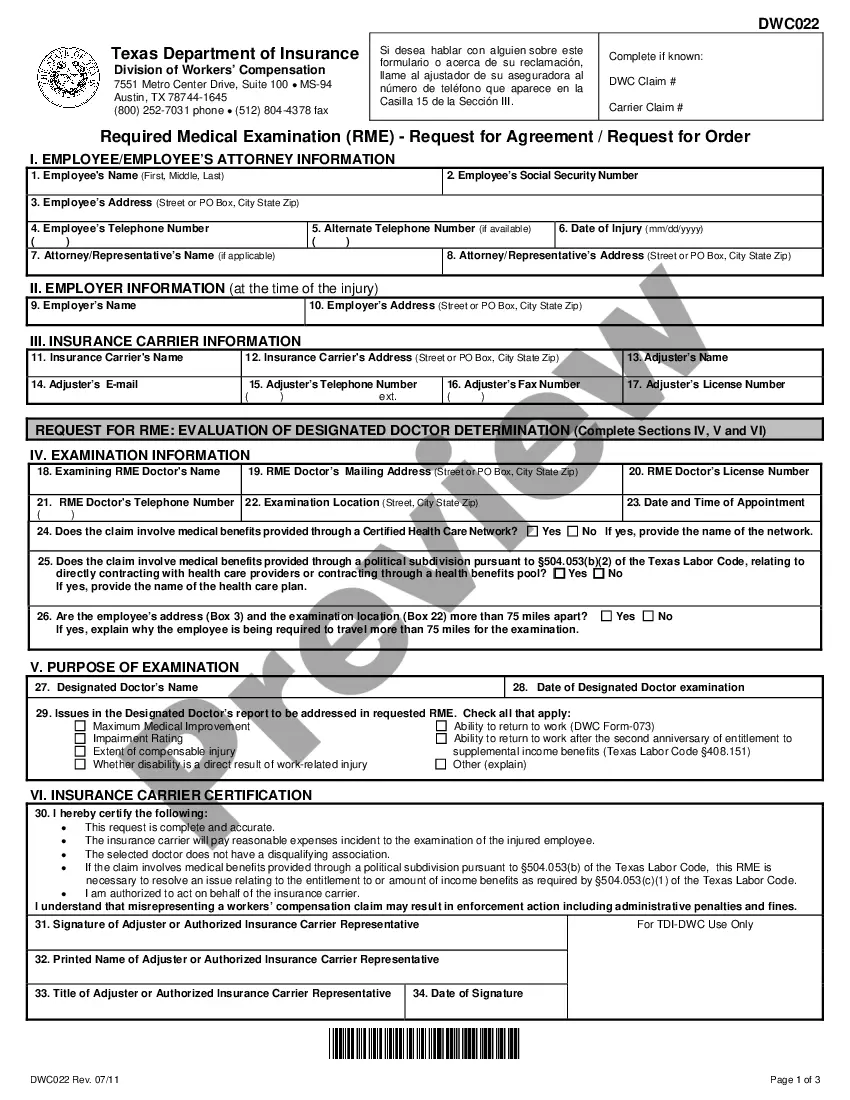

How to fill out Executor Deed Form?

Get access to quality Texas Executor's Deed samples online with US Legal Forms. Avoid days of lost time looking the internet and lost money on forms that aren’t up-to-date. US Legal Forms provides you with a solution to exactly that. Find more than 85,000 state-specific legal and tax samples that you could save and complete in clicks within the Forms library.

To find the example, log in to your account and click on Download button. The file is going to be stored in two places: on your device and in the My Forms folder.

For people who don’t have a subscription yet, look at our how-guide below to make getting started easier:

- Check if the Texas Executor's Deed you’re looking at is suitable for your state.

- Look at the form utilizing the Preview function and browse its description.

- Visit the subscription page by clicking on Buy Now button.

- Select the subscription plan to keep on to sign up.

- Pay out by card or PayPal to finish creating an account.

- Select a favored file format to download the file (.pdf or .docx).

You can now open up the Texas Executor's Deed template and fill it out online or print it and get it done yourself. Take into account giving the papers to your legal counsel to make certain everything is completed correctly. If you make a mistake, print and complete application again (once you’ve registered an account every document you download is reusable). Make your US Legal Forms account now and get much more forms.

Executor Deed Form Texas Form popularity

Executor Deed Texas Other Form Names

Administrators Deed Georgia FAQ

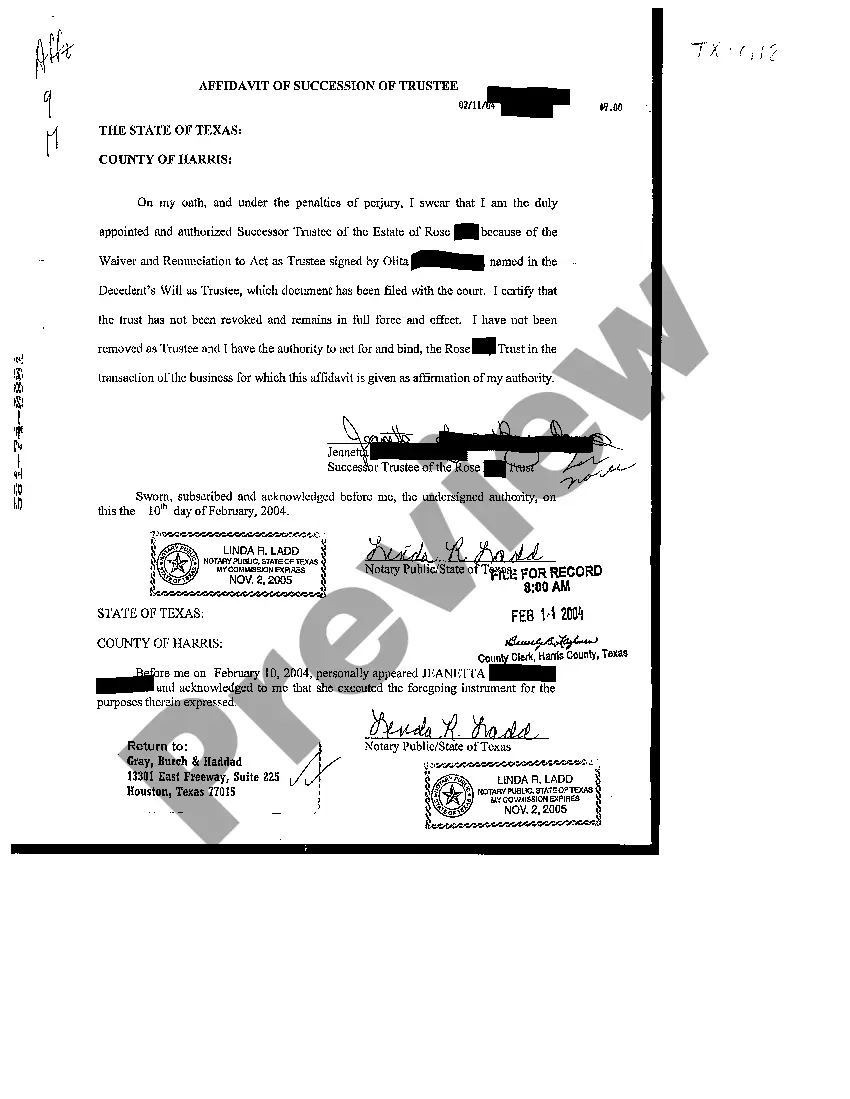

Once the COURT appoints you as executor, you will record an affidavit of death of joint tenant to get your mother's name of the property. Then, when you get an order for final distribution, you will record a certified copy to get the property into the names of the beneficiaries under the will.

During the administration of the estate those Executors who have obtained a Grant of Probate (more of which later) must act jointly. That is to say that they must all agree on a course of action and each sign any documents, etc. Clearly there may be problems if those appointed do not get on.

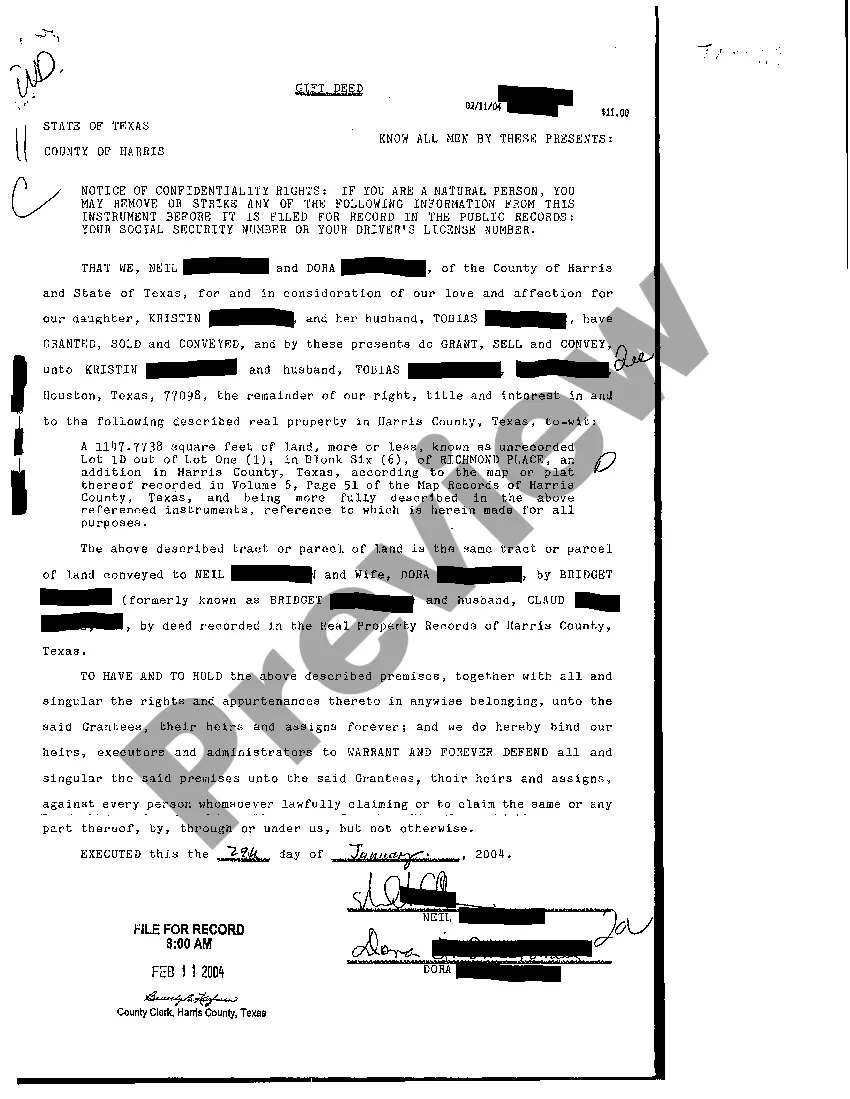

The court will force the executor to return the property to the estate or pay restitution to the beneficiaries of the estate.The executor cannot transfer estate property to himself because the property belongs to someone else unless he pays the full price for it.

The executor can sell property without getting all of the beneficiaries to approve.If the executor can sell the property for more than 90 percent of its appraised value then they do not need to get the permission of the beneficiaries or of the court.

In most states, an executor's deed must be signed by a witness and notarized. An executor's deed should be recorded in the real estate records of the county in which the property being conveyed is located.

Depending on the circumstances, the executor might transfer the title to heirs as directed in the decedent's will or sell the property outright.In any case, the executor must issue a deed for the transfer. Note that executor's deeds do NOT typically include a general warranty on the title.

Now, people can convey clear title to their property by completing a transfer on death deed form, signing it in front of a notary, and filing it in the deed records office in the county where the property is located before they die at a cost of less than fifty dollars.