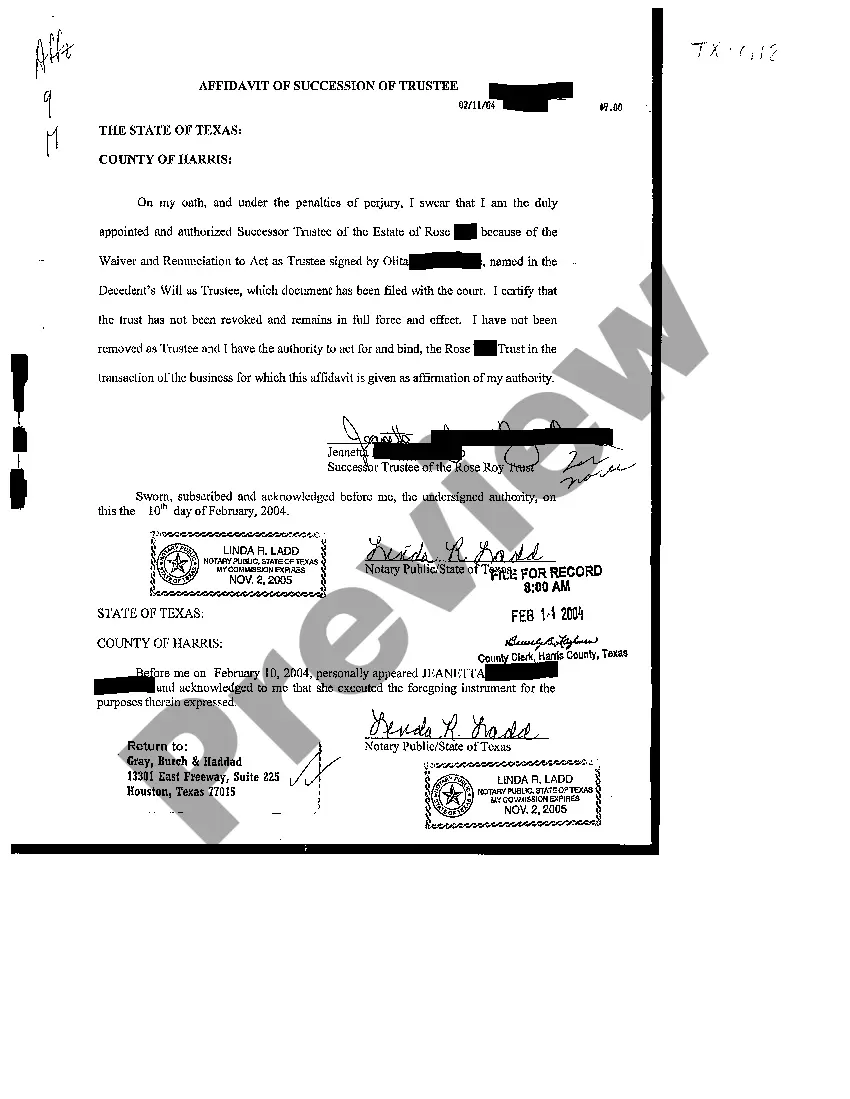

Texas Affidavit of Succession of Trustee

Description Affidavit Of Trust Form

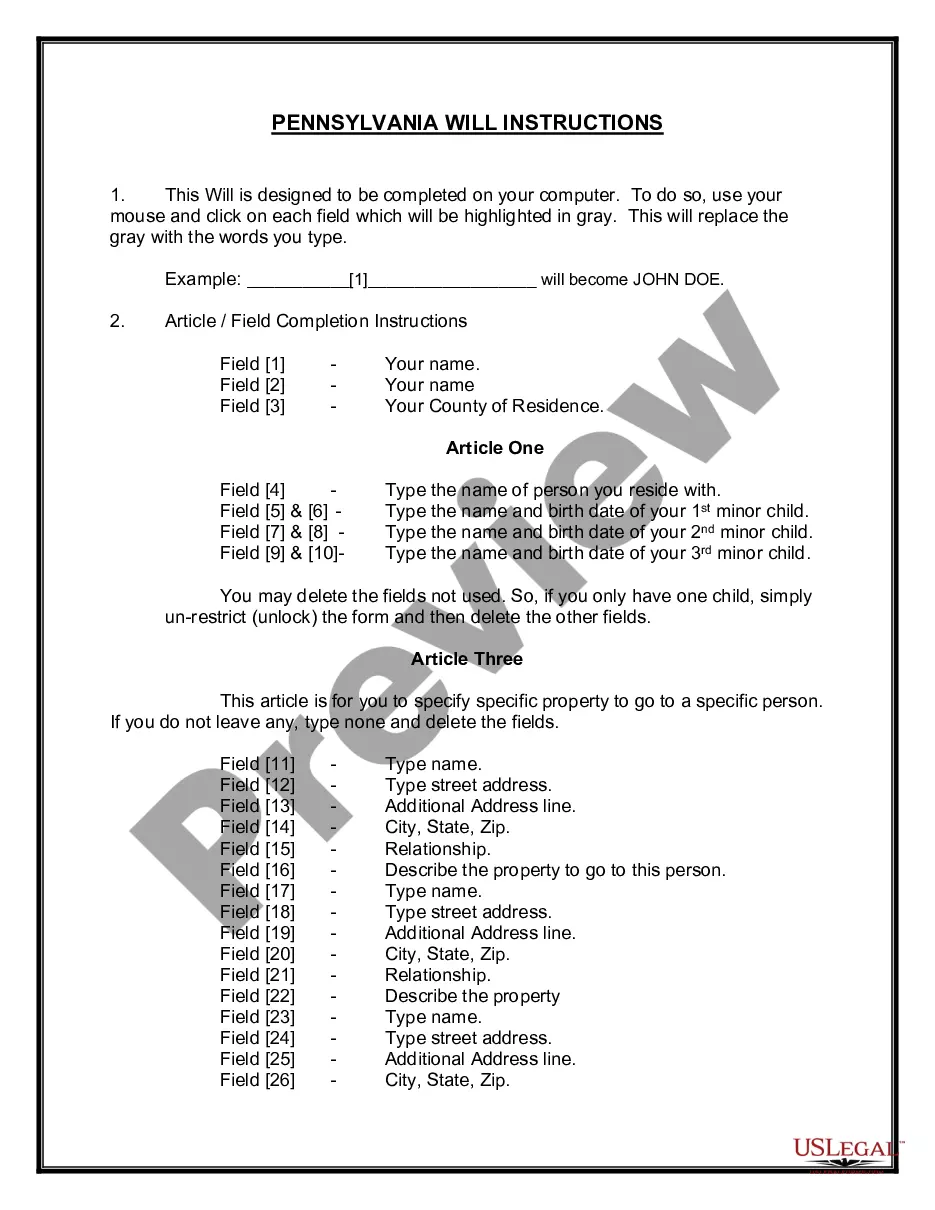

How to fill out Texas Affidavit Of Succession Of Trustee?

Access to top quality Texas Affidavit of Succession of Trustee templates online with US Legal Forms. Steer clear of hours of misused time seeking the internet and lost money on files that aren’t updated. US Legal Forms provides you with a solution to exactly that. Get around 85,000 state-specific authorized and tax templates that you could download and submit in clicks within the Forms library.

To receive the sample, log in to your account and click on Download button. The file will be saved in two places: on your device and in the My Forms folder.

For people who don’t have a subscription yet, check out our how-guide below to make getting started simpler:

- Check if the Texas Affidavit of Succession of Trustee you’re considering is suitable for your state.

- See the form using the Preview function and read its description.

- Check out the subscription page by simply clicking Buy Now.

- Select the subscription plan to continue on to sign up.

- Pay out by card or PayPal to finish making an account.

- Pick a favored file format to save the document (.pdf or .docx).

You can now open up the Texas Affidavit of Succession of Trustee example and fill it out online or print it out and get it done by hand. Think about sending the document to your legal counsel to make certain everything is completed appropriately. If you make a mistake, print and complete application again (once you’ve created an account all documents you download is reusable). Create your US Legal Forms account now and access a lot more forms.

Successor Trustee Form Form popularity

Affidavit Of Successor Trustee Other Form Names

FAQ

When you use a small estate affidavit , you have to pay the decedent's bills before paying money to anyone else. For example, the decedent might have owed money to a credit card company when they died. If you use the small estate affidavit, you must give money from the estate to pay the credit card company.

In most states, however, there is the option to use a small estate affidavit when the assets of the estate are under a certain dollar amount, which varies by state. An attorney is not required to file a small estate affidavit, although it may be helpful to consult with one prior to filing the small estate affidavit.

The Illinois small estate affidavit provides a streamlined way for an heir-at-law of a decedent to gather and distribute the assets of the estate of a person who died, provided that no other petition to open an estate in probate court has been filed and that the assets of the person who died do not exceed $100,000.

Small estate administration is a simplified court procedure that is an alternative to the longer probate process. It is available when the person who dies did not own that much in assets. There is often a limit to the value of the property, such as $25,000 or $100,000.

Generally, if you are a trustee you should identify yourself as the trustee on all trust-related paperwork by signing your name followed by the words as trustee." As an alternative, you can also state your name followed by as trustee and not individually." Doing so will help ensure separation between you in your

A successor trustee is named to step in and manage the trust when the trustee is no longer able to continue (usually due to incapacity or death).The beneficiaries are the persons or organizations who will receive the trust assets after the grantor dies.

Generally, a successor trustee cannot change or amend a trust.But after their passing, a successor trustee must step in to take legal title to assets and administer the trust according to its terms.

A simple estate with just a few, easy-to-find assets may be all wrapped up in six to eight months. A more complicated affair may take three years or more to fully settle.

Your successor trustee is tasked with managing the assets in your trust as he or she sees fit. The successor trustee will do so until the time comes to transfer the assets to your beneficiaries. This responsibility only kicks in, however, once you can no longer effectively serve as your own trustee.