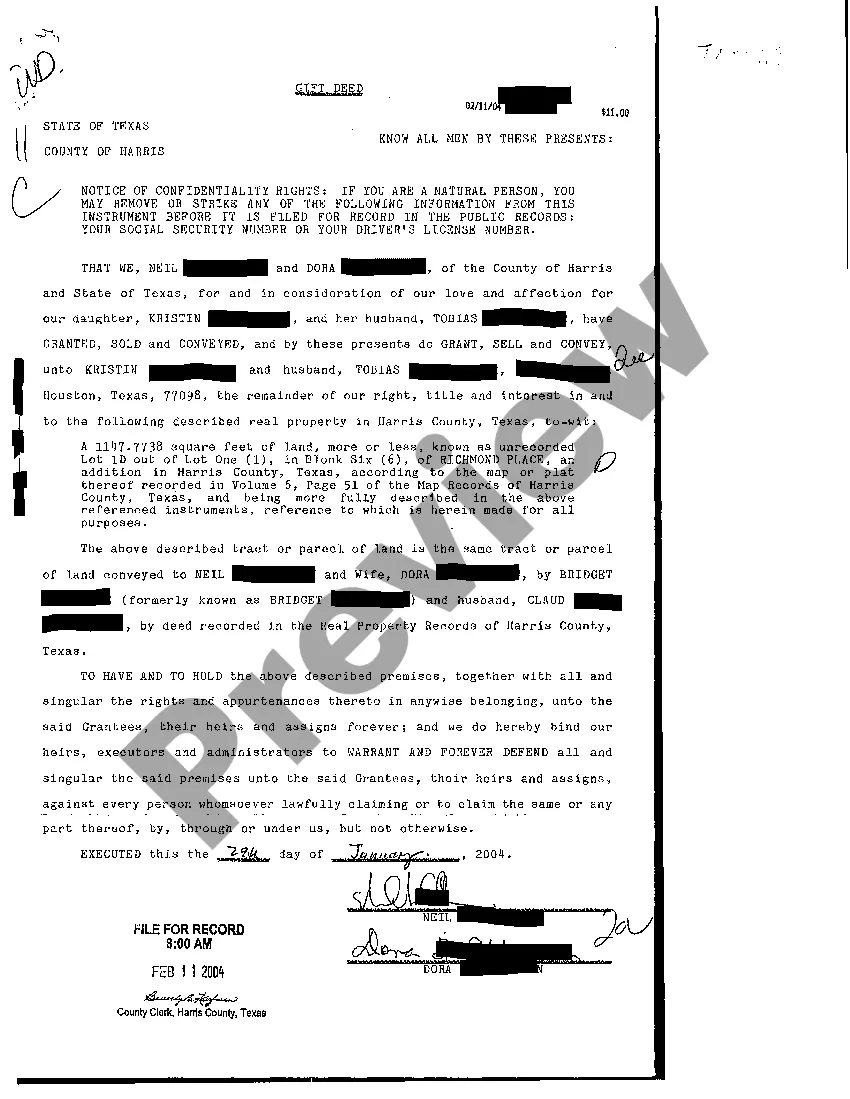

Texas Gift Deed

Description

How to fill out Texas Gift Deed?

Access to quality Texas Gift Deed samples online with US Legal Forms. Steer clear of days of misused time searching the internet and dropped money on documents that aren’t updated. US Legal Forms offers you a solution to just that. Find over 85,000 state-specific legal and tax templates you can download and complete in clicks within the Forms library.

To find the sample, log in to your account and then click Download. The file will be saved in two places: on the device and in the My Forms folder.

For people who don’t have a subscription yet, have a look at our how-guide below to make getting started easier:

- Verify that the Texas Gift Deed you’re considering is suitable for your state.

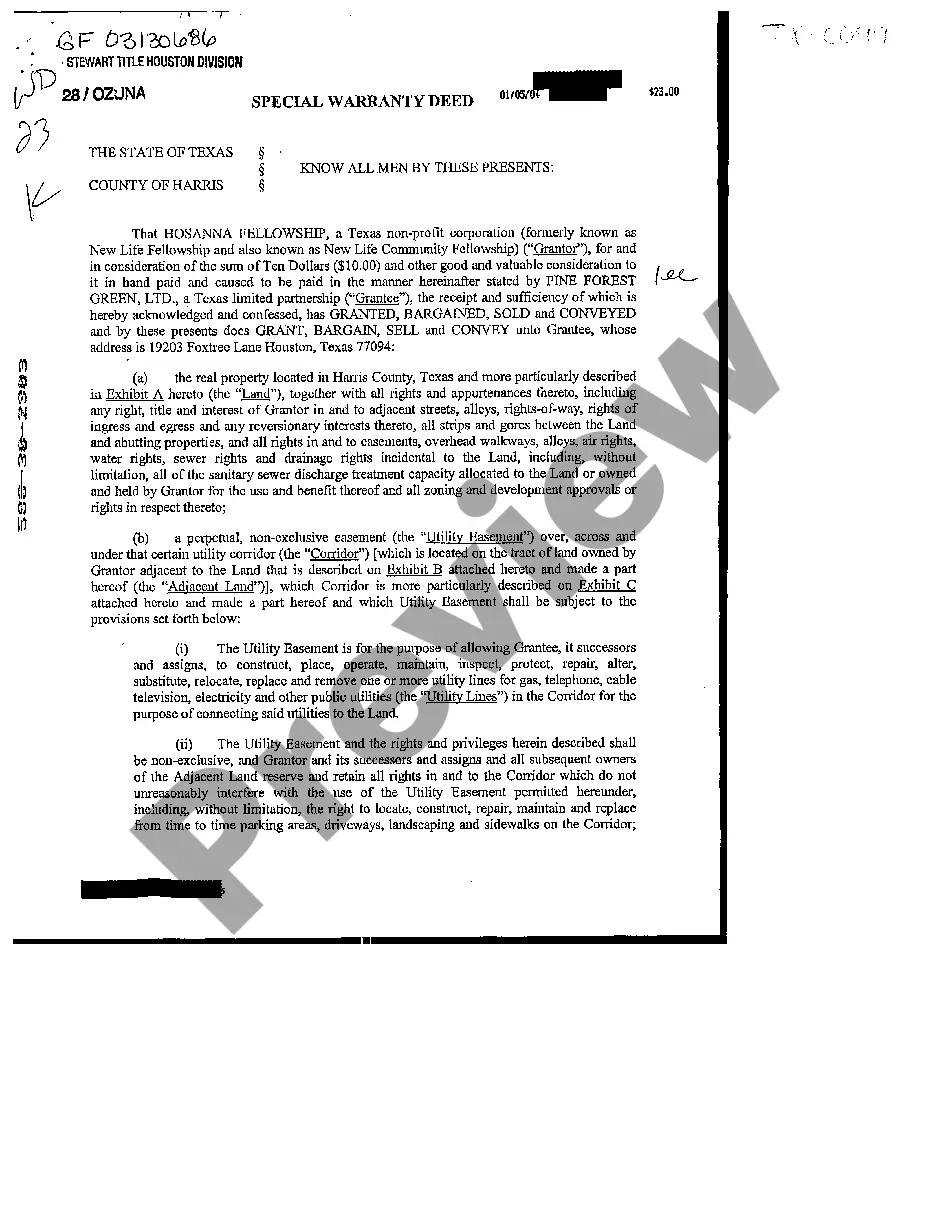

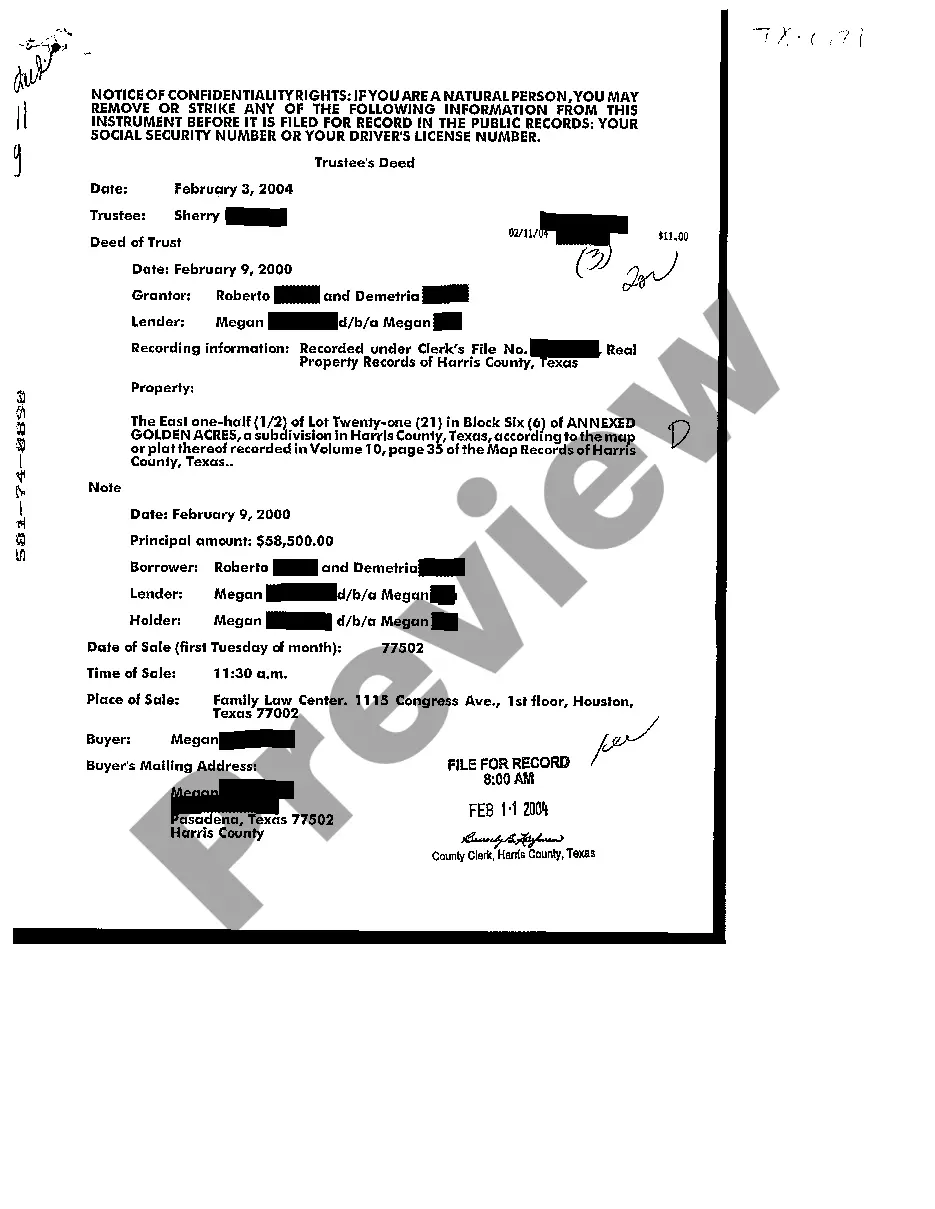

- See the sample utilizing the Preview option and read its description.

- Visit the subscription page by clicking Buy Now.

- Select the subscription plan to keep on to register.

- Pay out by credit card or PayPal to complete creating an account.

- Choose a favored file format to save the document (.pdf or .docx).

You can now open up the Texas Gift Deed sample and fill it out online or print it and do it yourself. Take into account sending the papers to your legal counsel to make sure all things are completed appropriately. If you make a error, print out and fill application again (once you’ve made an account every document you save is reusable). Make your US Legal Forms account now and get access to far more templates.

Form popularity

FAQ

The gift cannot ever be revoked nor can you later ask for financial compensation. Disadvantages of a Gift Deed? Usually a Gift Deed is used to transfer property between family members. As a result, the transaction may be subject to coercion or fraud.

Gift deeds transfer title to real property from one party to another with no exchange of consideration, monetary or otherwise. Often used to transfer property between family members or to transfer property as a charitable act or donation, these transfers occur during the grantor's lifetime.

Gift made by way of movable property is required to be made in stamp paper and stamped by the notary or court. Registration of gift deed is not required in case of transfer of moveable property.Gift of immovable property which is not registered is not a valid as per law and cannot pass any title to the donee.

To be valid, gift deeds in Texas further require the document set forth (1) the intent of the grantor, (2) the delivery of the property to the grantee, and (3) the gift to be accepted by the grantee. The one claiming the gift bears the burden to establish each of the elements.

Sign the Deed (both the Donor and the Donee) in the presence of 2 witnesses and take the signed document to the nearest Sub-registrar Office. Calculate the Registration charges with the help of lawyers or consult LegalDesk.com to get an accurate measure.

Find the most recent deed to the property. It is best to begin with a copy of the most recent deed to the property (the deed that transferred the property to the current grantor). Create a new deed. Sign and notarize the deed. File the documents in the county land records.