Texas Notice of Lien

Description

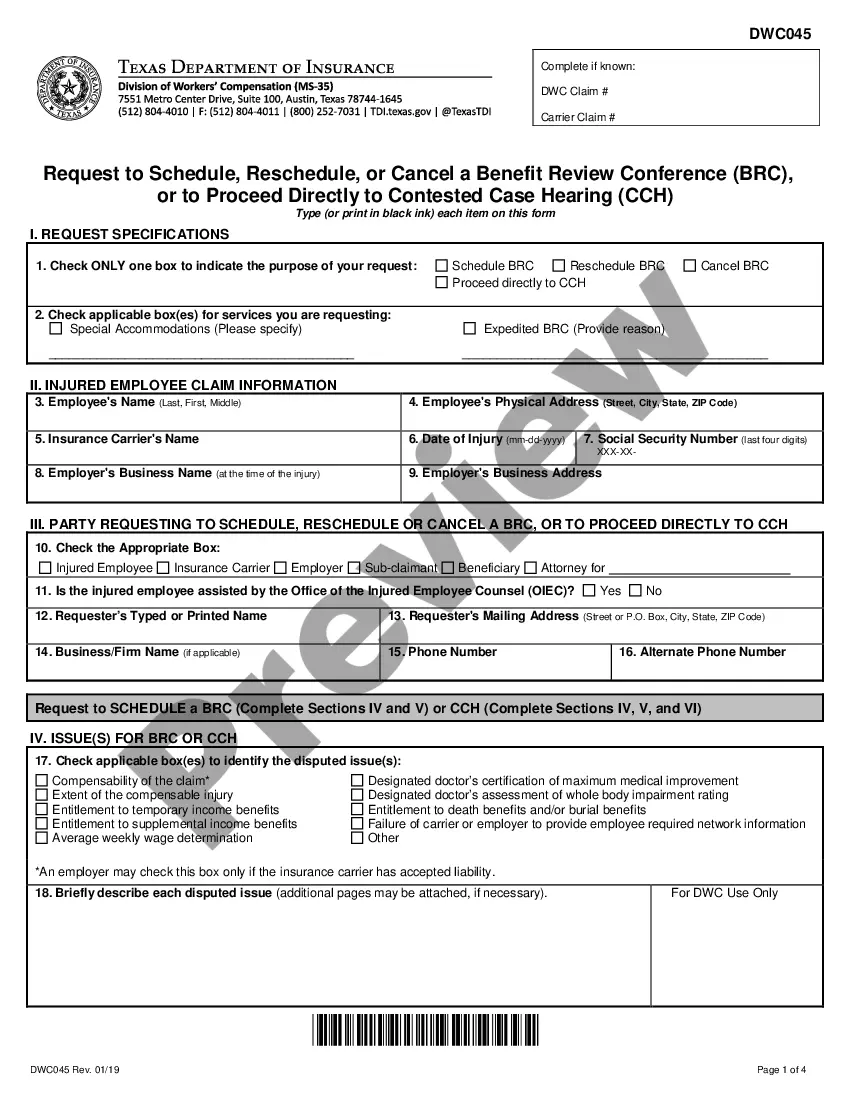

How to fill out Texas Notice Of Lien?

Access to top quality Texas Notice of Lien forms online with US Legal Forms. Avoid hours of misused time searching the internet and dropped money on documents that aren’t updated. US Legal Forms offers you a solution to exactly that. Get over 85,000 state-specific legal and tax samples that you can save and fill out in clicks in the Forms library.

To receive the example, log in to your account and click Download. The file will be saved in two places: on your device and in the My Forms folder.

For individuals who don’t have a subscription yet, have a look at our how-guide listed below to make getting started simpler:

- Verify that the Texas Notice of Lien you’re considering is appropriate for your state.

- Look at the form using the Preview option and browse its description.

- Check out the subscription page by simply clicking Buy Now.

- Select the subscription plan to go on to sign up.

- Pay by card or PayPal to complete making an account.

- Select a favored format to save the file (.pdf or .docx).

You can now open the Texas Notice of Lien template and fill it out online or print it out and get it done yourself. Think about sending the file to your legal counsel to ensure everything is filled out correctly. If you make a mistake, print out and complete sample once again (once you’ve made an account all documents you download is reusable). Create your US Legal Forms account now and access more forms.

Form popularity

FAQ

Here are additional options: Search the county recorder, clerk, or assessor's office online. All you need is the name of the property owner or its address. If your county does not have the data online, then visit the county recorder, clerk, or assessor's office in person.

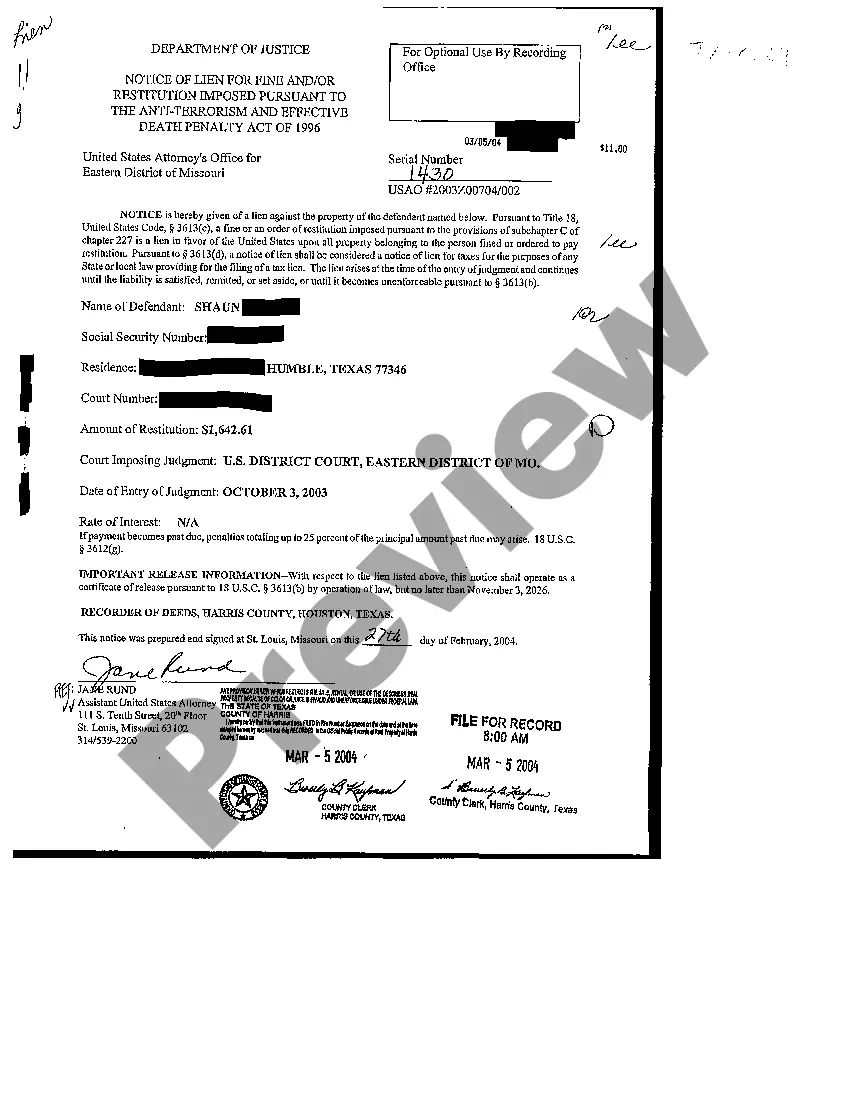

About the release form This form should be filed with the recorder's office in the Texas county where the lien was originally recorded. Texas law requires claimants to file a lien release within 10 days after the lien is satisfied, or upon request from the property owner.

Search the county recorder, clerk, or assessor's office website. All you need is the name of the owner and/or address to access the property records. Visit the recorder, assessor's, or county clerk's office in person. Contact a title company.

Pay off your debt. Fill out a release-of-lien form and have the lien holder sign it. Run out the statute of limitations. Get a court order. Make a claim with your title insurance company. Learn more:

The IRS files a public document, the Notice of Federal Tax Lien, to alert creditors that the government has a legal right to your property.An IRS levy is not a public record and should not affect your credit report. To learn more about liens see Understanding a Federal Tax Lien.

On residential projects, the deadline to file a Texas mechanics lien is the 15th day of the 3rd month after the month in which the claimant last provided labor or materials.

Once filed and perfected, a mechanic's lien creates a security interest in the property for the amount the creditor is owed. The lien is not against the owner, it is against the owner's property.If there is more than one lien against the same property, the law determines the order in which each lien is paid.

Judgment liens in Texas expire after ten years, as do federal tax liens, and both stay attached to the property even it if changes owners. A mortgage lien remains valid on a property until the debt is paid in full. Also, many liens may be renewed before they expire.

To check department records for tax liens, you may view homeownership records online or call our office at 1-800-500-7074, ext. 64471. Please be prepared to provide the complete serial number and HUD Label or Texas Seal number of the home.