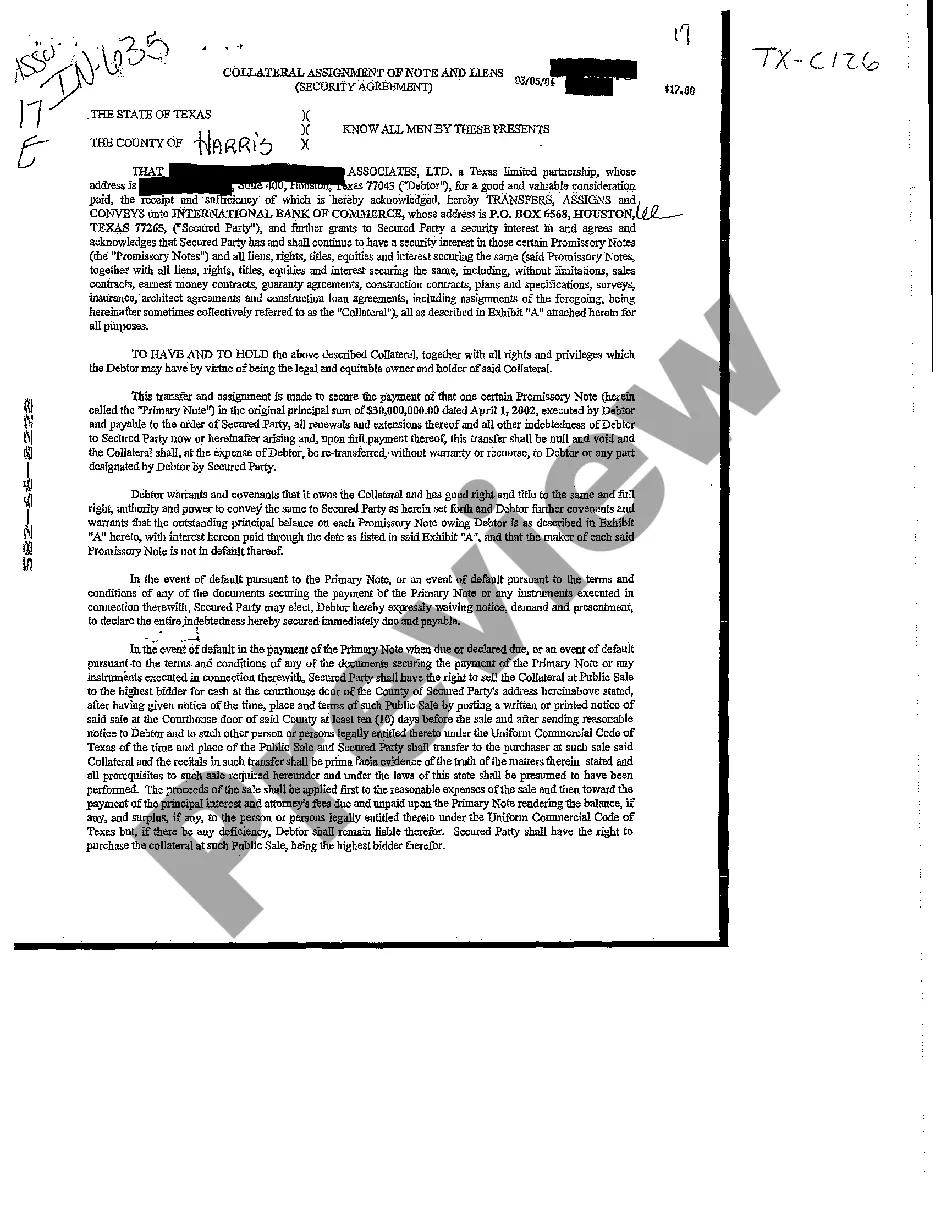

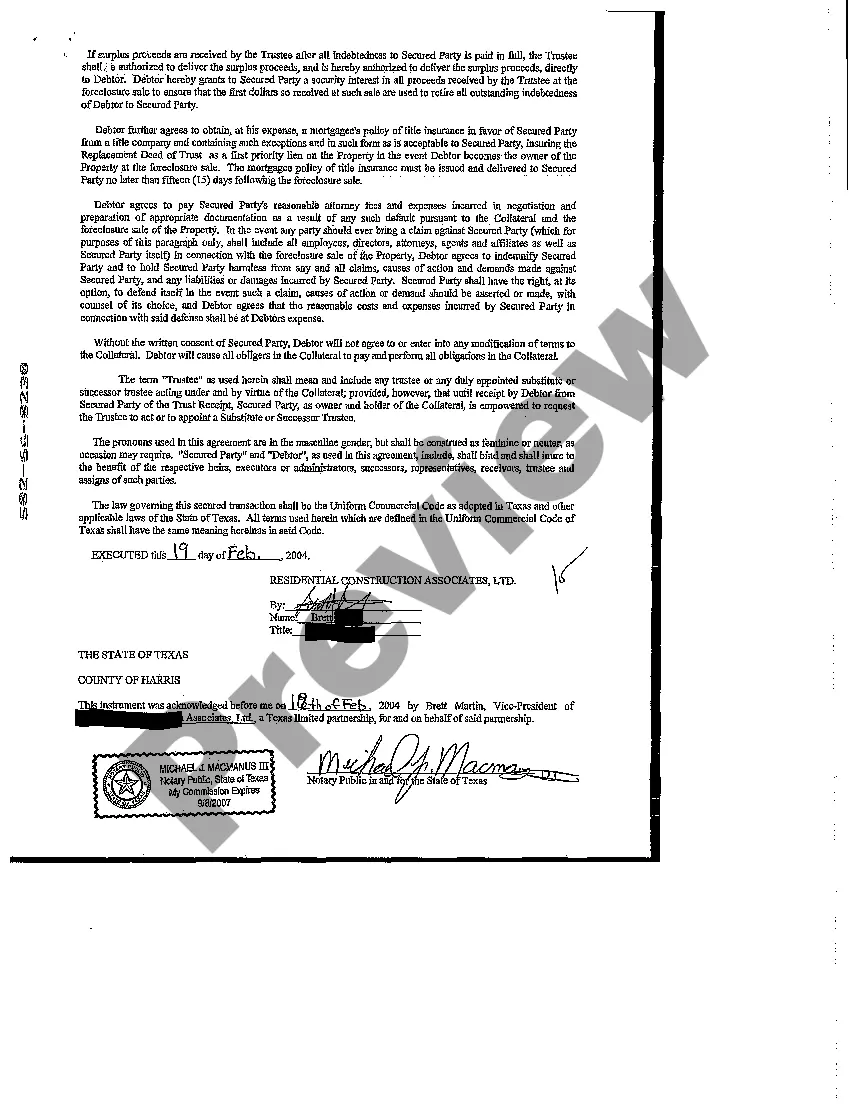

Texas Collateral Assignment of Note and Liens

Description Collateral Assignment Of Mortgage

How to fill out Texas Collateral Assignment Of Note And Liens?

Access to top quality Texas Collateral Assignment of Note and Liens templates online with US Legal Forms. Steer clear of days of wasted time seeking the internet and dropped money on documents that aren’t up-to-date. US Legal Forms gives you a solution to just that. Get above 85,000 state-specific legal and tax templates you can download and submit in clicks within the Forms library.

To find the example, log in to your account and click on Download button. The document will be saved in two places: on your device and in the My Forms folder.

For people who don’t have a subscription yet, check out our how-guide below to make getting started easier:

- Check if the Texas Collateral Assignment of Note and Liens you’re looking at is appropriate for your state.

- See the sample making use of the Preview function and read its description.

- Visit the subscription page by clicking on Buy Now button.

- Select the subscription plan to keep on to sign up.

- Pay by credit card or PayPal to complete making an account.

- Choose a preferred format to save the file (.pdf or .docx).

You can now open up the Texas Collateral Assignment of Note and Liens sample and fill it out online or print it and do it by hand. Take into account sending the file to your legal counsel to make certain all things are filled out correctly. If you make a error, print out and complete application again (once you’ve registered an account every document you download is reusable). Create your US Legal Forms account now and access a lot more templates.

Collateral Assignment Of Note And Lien Form popularity

FAQ

A collateral assignment refers to the transfer of ownership rights of an asset. When you borrow money, or when someone spends money on your behalf, often they will require you to pledge collateral in the form of an asset in order to protect them from loss.

A: The short answer is "no. The tax lien shouldn't prevent you from buying a home, unless the IRS is required to be in a first-lien position against your prospective home. While the FHA program will probably be the easiest avenue available to you, you could also consider a loan guaranteed by Fannie Mae or Freddie Mac.

The mortgage note is part of your closing papers and you will receive a copy at closing. If you lose your closing papers or they get destroyed, you can obtain a copy of your mortgage note by searching the county's records or contacting the registry of deeds.

A lien is a claim or legal right against assets that are typically used as collateral to satisfy a debt.A lien serves to guarantee an underlying obligation, such as the repayment of a loan. If the underlying obligation is not satisfied, the creditor may be able to seize the asset that is the subject of the lien.

2 Answers. Lien is a record that can be put on your asset, meaning that any sale proceeds of the asset will go to a lien holder/lien holder must approve any transfer of ownership. The asset continues to belong to you though. Loan is when someone gives you money and you promise to pay it back.

Fill out the appropriate mechanics lien form. (Lien form for Original Contractors Lien form for Subcontractors & Suppliers) Deliver your lien form to the county recorder office. Serve your lien on the property owner.

"Collateral" and "lien" are terms that go together, but they're essentially different parts of the same machine. A lien is an interest that a lender has on a piece of property that you give to secure a loan; the property itself is the collateral.

A collateral assignment of life insurance is a conditional assignment appointing a lender as the primary beneficiary of a death benefit to use as collateral for a loan. If the borrower is unable to pay, the lender can cash in the life insurance policy and recover what is owed.

If you owe money to a creditor and don't pay, that party may sue you for the balance. If the court rules against you, the creditor can file a judgment lien against you.In a few states, if a court enters a judgment against a debtor, a lien is automatically created on any real estate the debtor owns in that county.