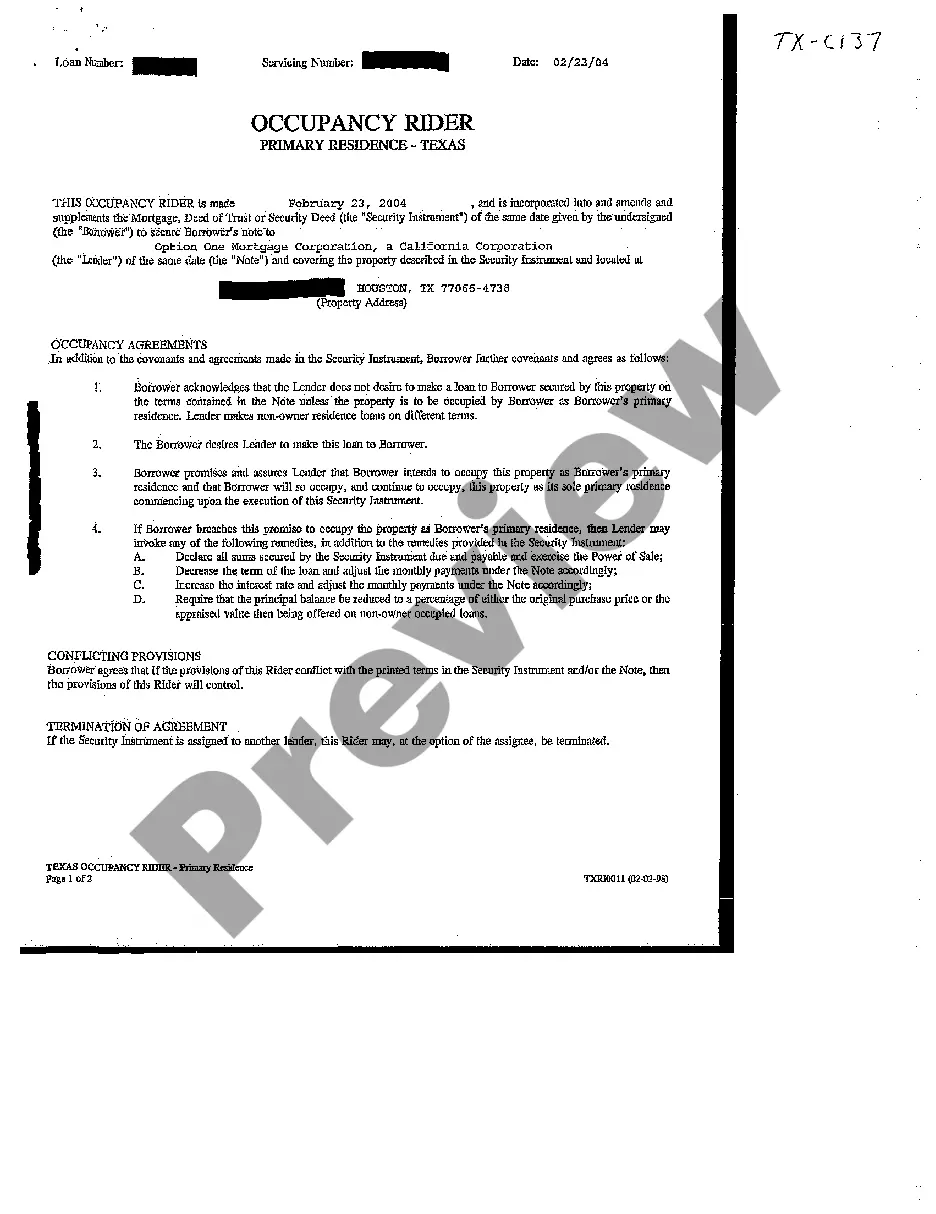

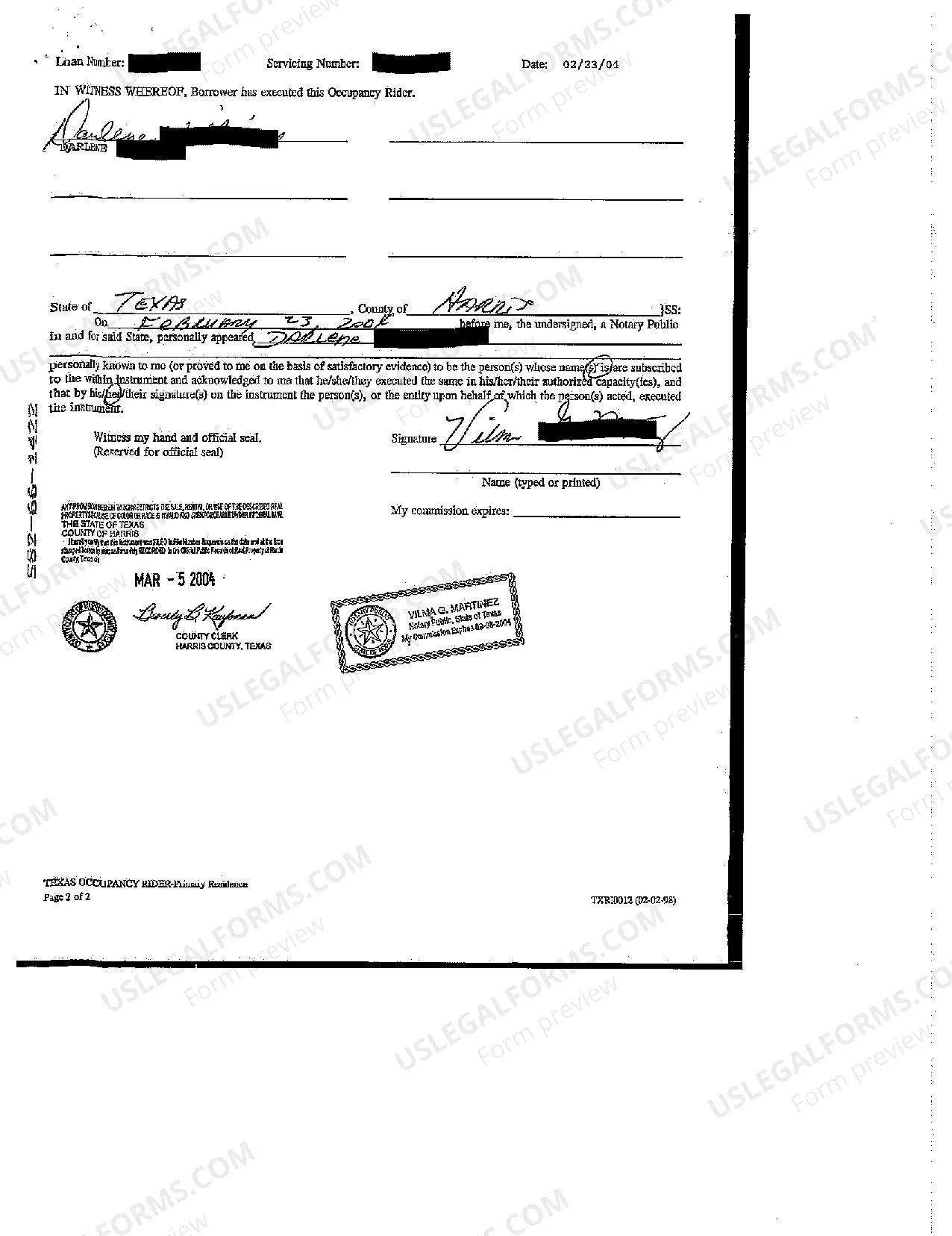

Texas Occupancy Rider

Description

How to fill out Texas Occupancy Rider?

Get access to top quality Texas Occupancy Rider templates online with US Legal Forms. Prevent days of misused time searching the internet and lost money on forms that aren’t up-to-date. US Legal Forms offers you a solution to just that. Find more than 85,000 state-specific legal and tax forms that you could download and submit in clicks in the Forms library.

To get the example, log in to your account and click Download. The file is going to be stored in two places: on the device and in the My Forms folder.

For individuals who don’t have a subscription yet, have a look at our how-guide below to make getting started simpler:

- Verify that the Texas Occupancy Rider you’re considering is appropriate for your state.

- Look at the sample utilizing the Preview function and browse its description.

- Check out the subscription page by clicking on Buy Now button.

- Select the subscription plan to keep on to register.

- Pay by credit card or PayPal to complete making an account.

- Choose a favored file format to save the document (.pdf or .docx).

You can now open the Texas Occupancy Rider template and fill it out online or print it and get it done by hand. Think about mailing the file to your legal counsel to be certain things are completed properly. If you make a mistake, print out and complete sample once again (once you’ve created an account every document you save is reusable). Create your US Legal Forms account now and access more templates.

Form popularity

FAQ

Simply put, a mortgage rider is an addition, also known as an addendum in legal terms, to a standard loan document. Riders are usually used when the mortgage has a non-standard feature.In short, the rider is used to highlight a unique or unusual loan feature to make sure you understand it.

Second-home loans regularly have a lower interest rate than investment-property loans and usually include a Second Home Rider along with the mortgage. This rider usually states that: the borrower will occupy and only use the property as the borrower's second home.

A rider is a smaller sign next to the main For Sale sign that provides additional information about the real estate agent selling the property.Riders may also provide additional information on the property such as the date of the next open house.

Second-home loans regularly have a lower interest rate than investment-property loans and usually include a Second Home Rider along with the mortgage. This rider usually states that: the borrower will occupy and only use the property as the borrower's second home.

This rider, called a 1-4 Family Rider (Assignment of Rents), is used by lenders in every state for properties that have one to four rental units. Its main purpose is to give the lender the right to receive the rent when the buyer has defaulted on the mortgage.

What counts as a second home? Anything other than your main residence it could be a holiday let, a property bought as an investment or somewhere you are helping another family member to buy. This surcharge will also apply even if the main home you currently own is overseas. I plan on buying a second home.

A security instrument is a legal document giving the bank a security interest in the property. It can be a mortgage, giving the lender a lien on the property, or a deed of trust, whereby a trustee holds the deed for the lender until you finish paying off the loan.

The Renewal and Extension is a form only used on rate and term refinance loans secured by the primary residence. Its purpose is to renew and extend the lien that is being refinanced so that the new lender (you) step into the shoes of the prior lien holder and retain lien priority and rights.