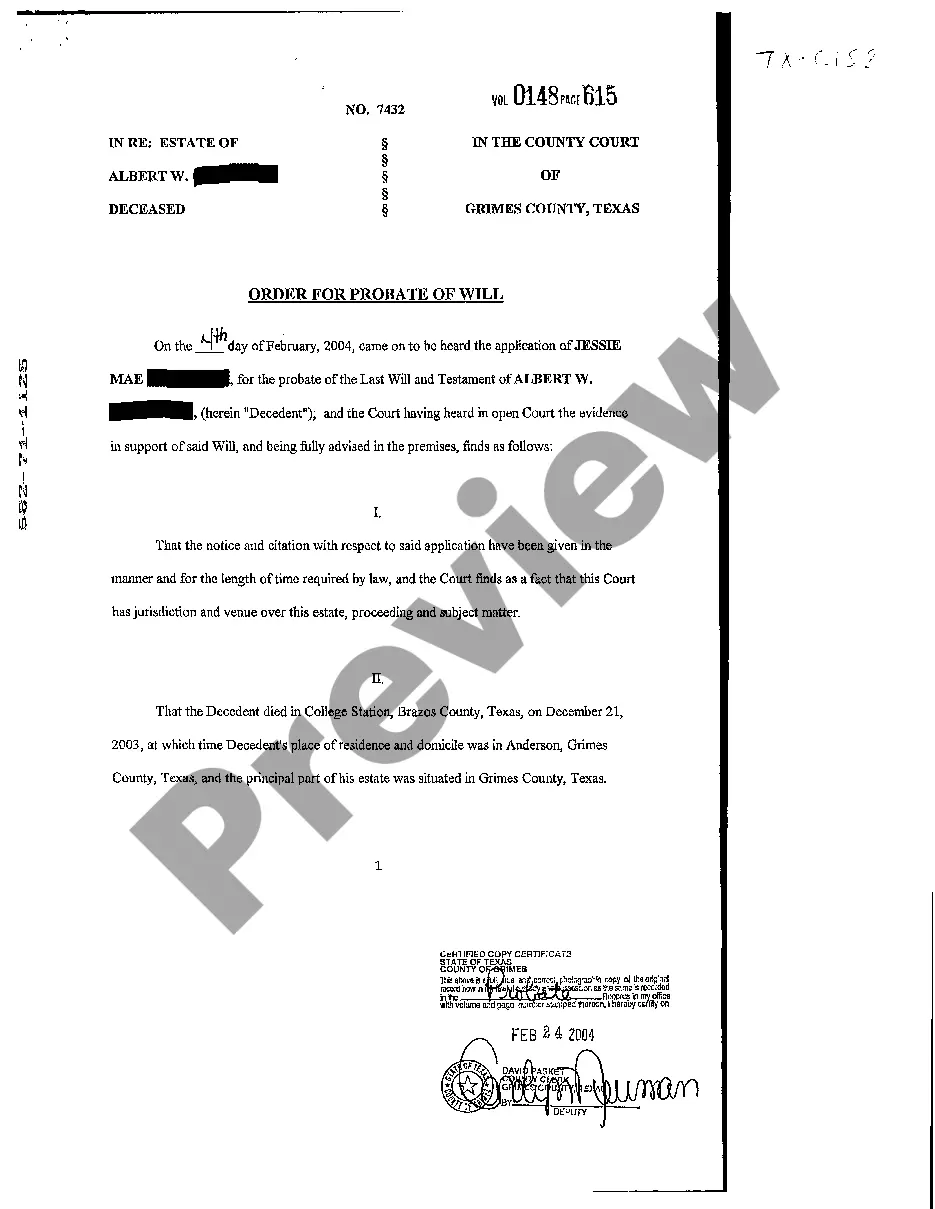

Texas Order for Probate of Will

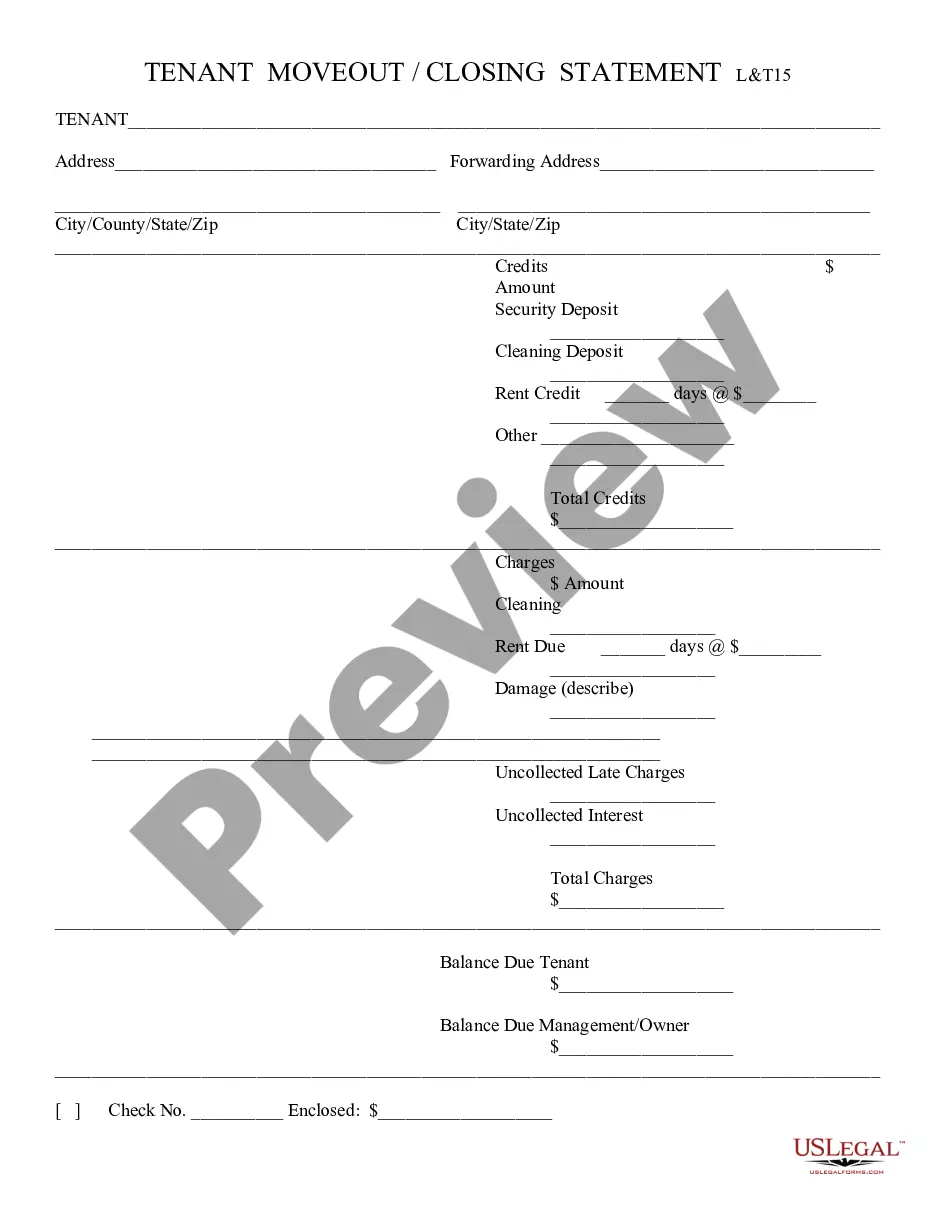

Description Example Of Probate Inventory List

How to fill out Texas Order For Probate Of Will?

Get access to top quality Texas Order for Probate of Will samples online with US Legal Forms. Avoid hours of misused time searching the internet and dropped money on files that aren’t up-to-date. US Legal Forms gives you a solution to just that. Find more than 85,000 state-specific legal and tax samples that you could save and submit in clicks in the Forms library.

To receive the example, log in to your account and click Download. The document will be stored in two places: on your device and in the My Forms folder.

For individuals who don’t have a subscription yet, have a look at our how-guide listed below to make getting started simpler:

- Check if the Texas Order for Probate of Will you’re looking at is appropriate for your state.

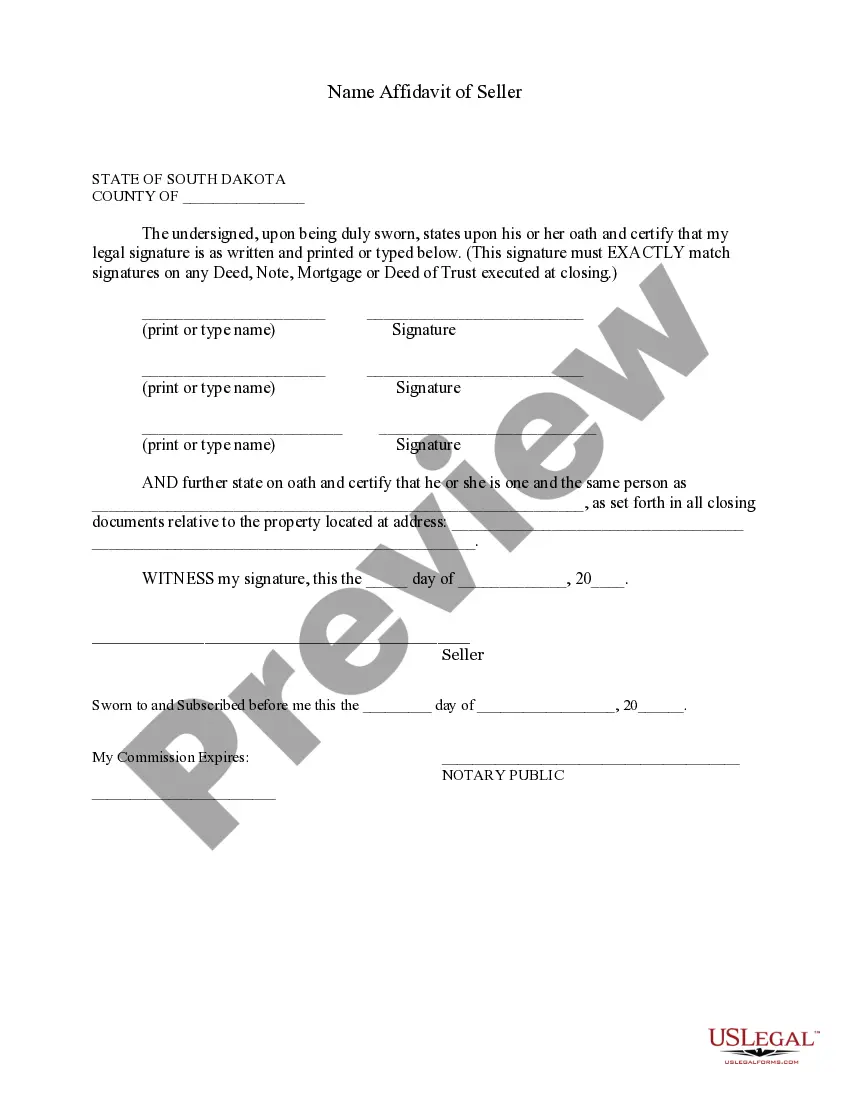

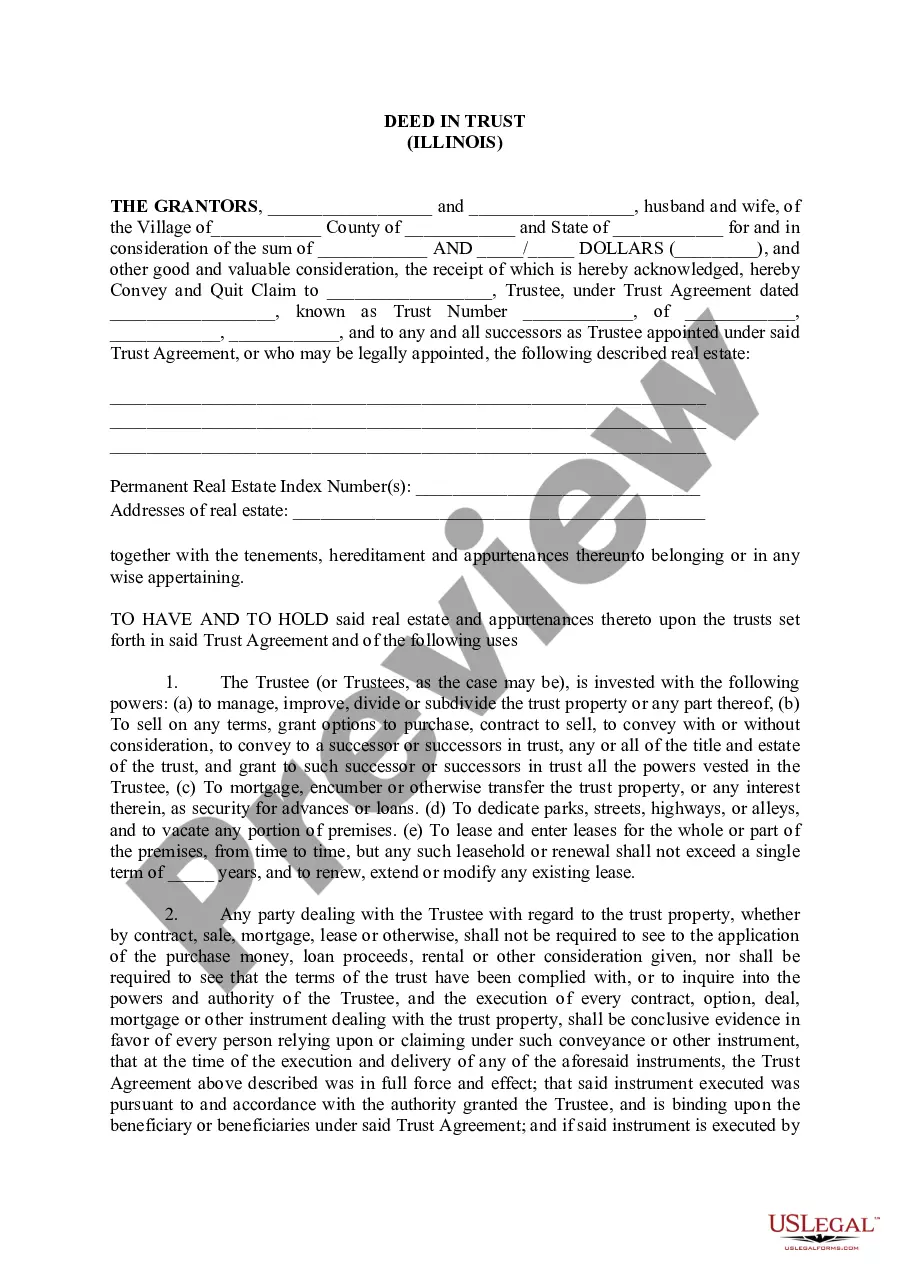

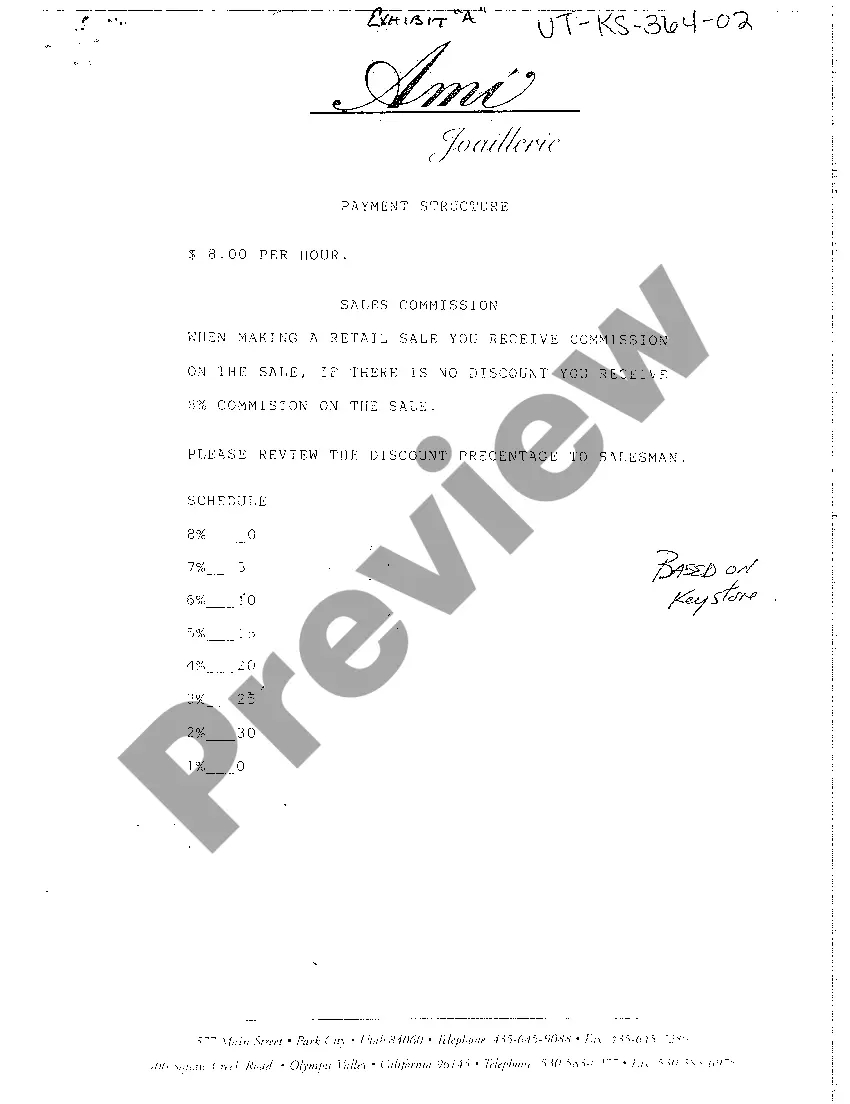

- View the form utilizing the Preview option and read its description.

- Check out the subscription page by simply clicking Buy Now.

- Select the subscription plan to continue on to sign up.

- Pay out by card or PayPal to finish making an account.

- Select a favored file format to save the document (.pdf or .docx).

You can now open the Texas Order for Probate of Will example and fill it out online or print it and do it by hand. Think about mailing the document to your legal counsel to ensure things are filled in properly. If you make a mistake, print and complete application again (once you’ve created an account all documents you download is reusable). Make your US Legal Forms account now and get more forms.

Probate Of Will Form popularity

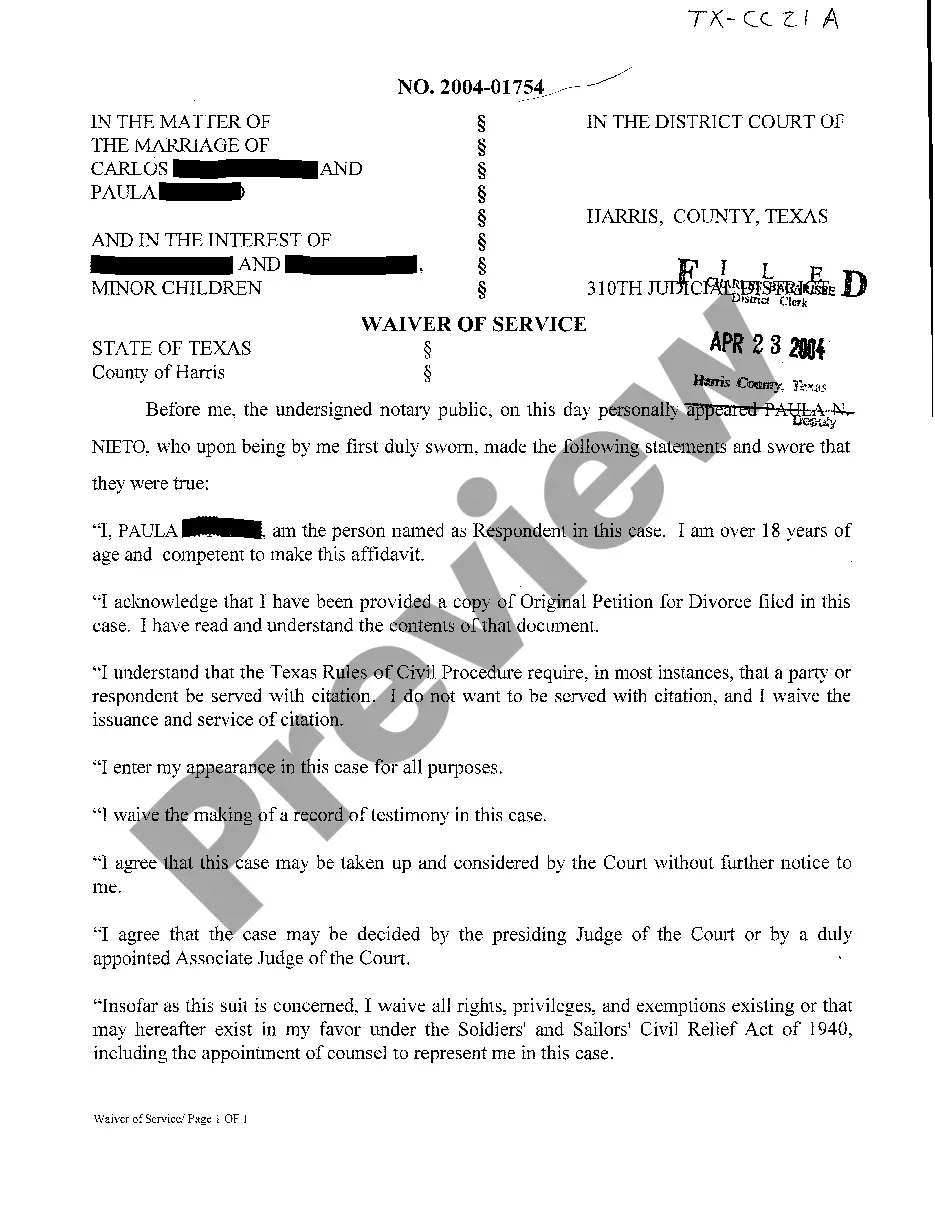

What Is Probate Of A Will Other Form Names

FAQ

In Texas, you can make a living trust to avoid probate for virtually any asset you ownreal estate, bank accounts, vehicles, and so on. You need to create a trust document (it's similar to a will), naming someone to take over as trustee after your death (called a successor trustee).

Texas has a probate process similar to many other states, but before we go any further, let's ask an important question: Do you even need to probate the estate? Not all assets go through probate. Assets that automatically transfer to another person without a court order will avoid probate.

Meet the Legal Requirements for Will Creation in Texas. The underlying lost will must itself be valid under Texas law. Show Why Original Will Can't Be Produced. Explain to the probate court why you can't bring the original Will to court. Establish the Contents of the Will.

Estate: In the state of Texas, an estate consists of all the decedent's assets. These include, but aren't limited to, cash, real estate holdings (homes, land, etc.), stocks and bonds, life insurance policies, retirement accounts, vehicles and personal belongings.

Most Texas estates need to go through probate after a person dies.If there is no valid Will, the assets will be distributed to relatives as provided in the Texas Estates Code. Probate may be necessary for possessions with a title or deed, such as cars and real estate.

Texas probate law requires that all estate assets are gathered and that the deceased person's remaining debts get paid out of those assets. Only after all debts have been paid can the estate's assets be distributed according to a will or, if there is no will, according to Texas intestate succession laws.

For example, the court costs for filing certain applications, such as an Application for Probate of Will and for Issuance of Letters Testamentary or an Application for Appointment of Independent/Dependent Administrator and Determination of Heirship can range from approximately $300.00 to $800.00.

For an estate to be administered in accordance with the terms of the final Will of the deceased, the original Will is sent to the Probate Registry who will then issue a Grant of Probate to the executors.In all these cases you can apply to Probate to prove a Copy Will.