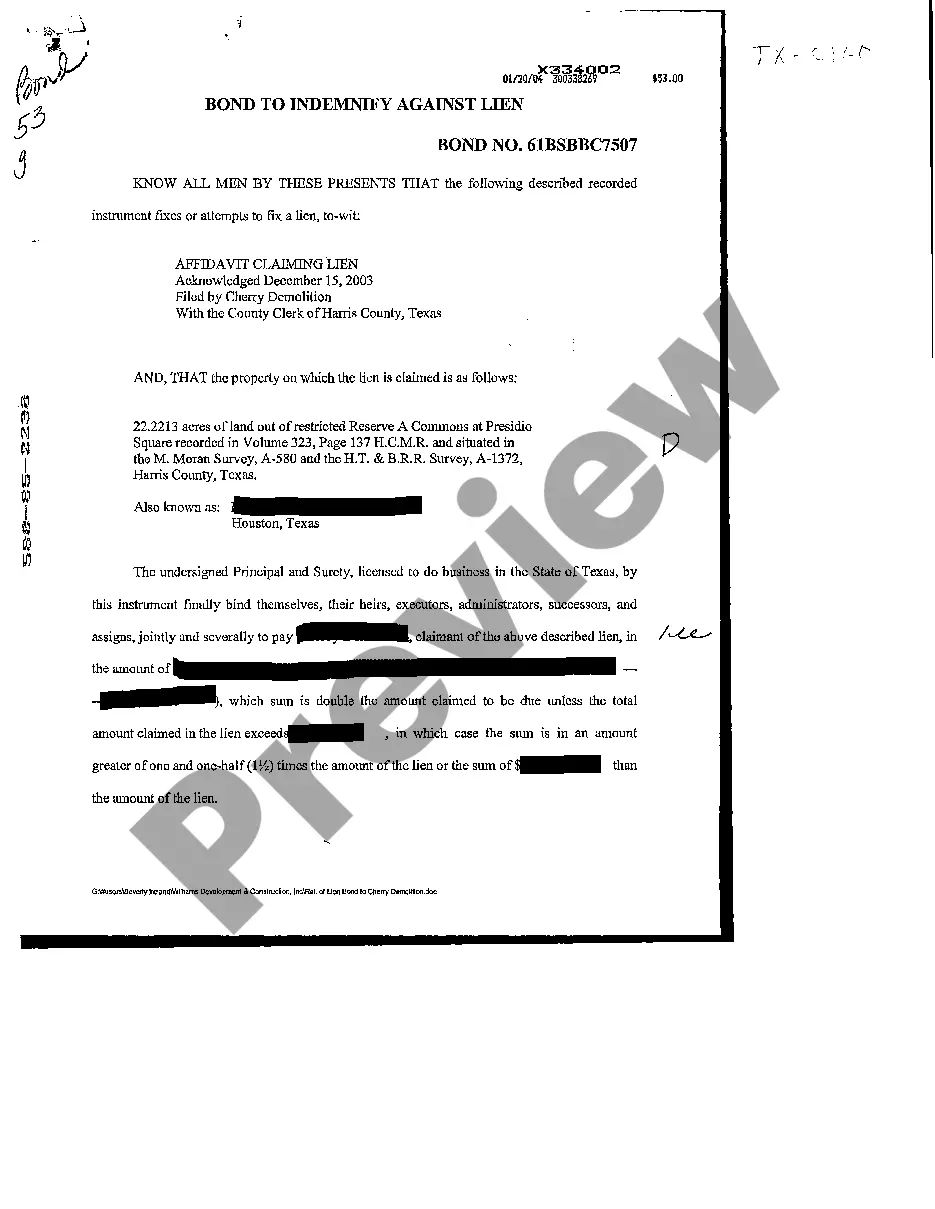

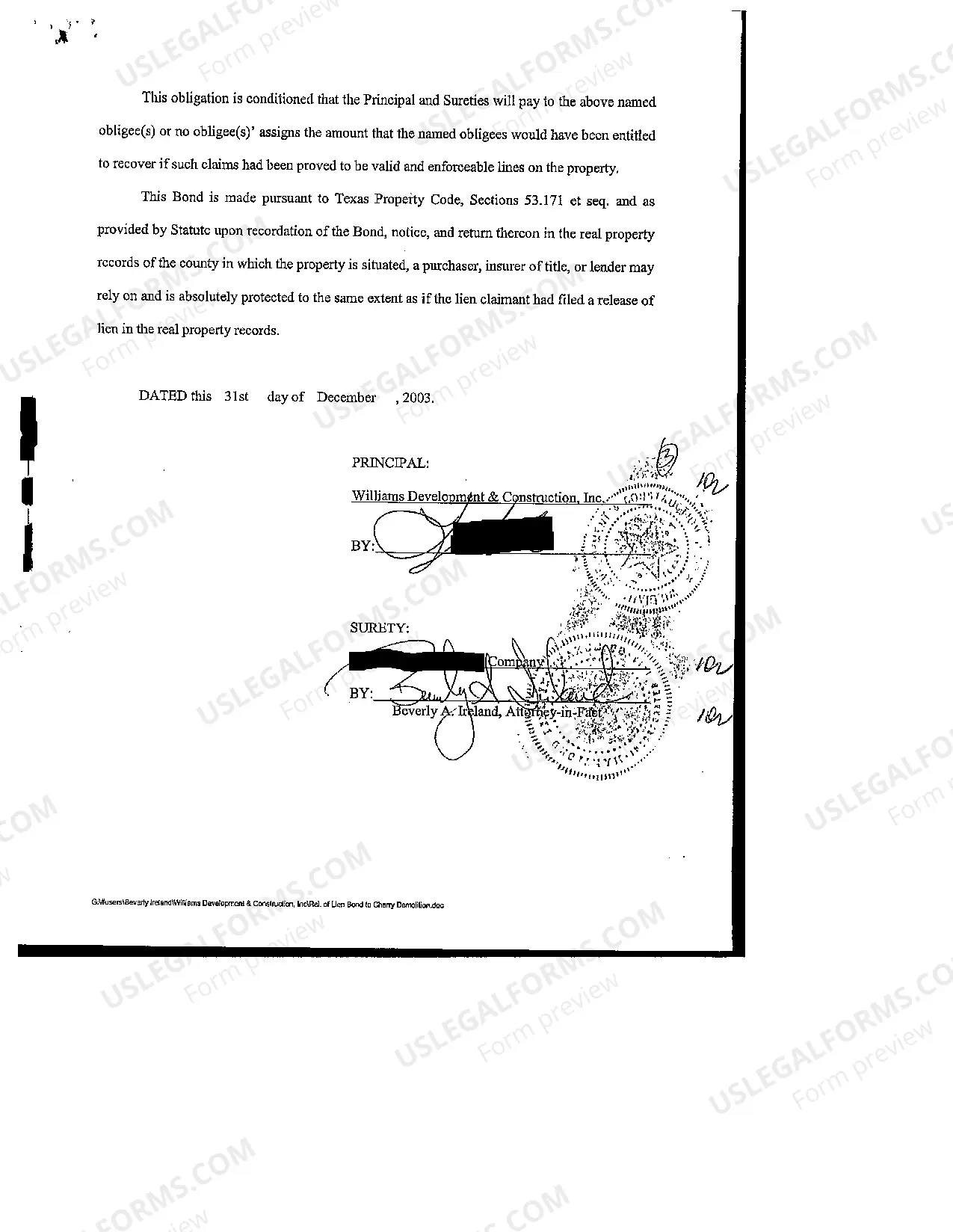

Texas Bond to Indemnify Against Lien

Description

How to fill out Texas Bond To Indemnify Against Lien?

Get access to high quality Texas Bond to Indemnify Against Lien templates online with US Legal Forms. Prevent hours of wasted time browsing the internet and lost money on documents that aren’t up-to-date. US Legal Forms provides you with a solution to exactly that. Find above 85,000 state-specific authorized and tax samples that you can download and fill out in clicks in the Forms library.

To find the sample, log in to your account and click on Download button. The file will be stored in two places: on your device and in the My Forms folder.

For those who don’t have a subscription yet, check out our how-guide below to make getting started simpler:

- Find out if the Texas Bond to Indemnify Against Lien you’re looking at is appropriate for your state.

- Look at the form using the Preview function and browse its description.

- Check out the subscription page by clicking on Buy Now button.

- Select the subscription plan to keep on to sign up.

- Pay by card or PayPal to finish creating an account.

- Select a preferred file format to download the document (.pdf or .docx).

You can now open up the Texas Bond to Indemnify Against Lien sample and fill it out online or print it out and get it done by hand. Think about sending the document to your legal counsel to make sure things are completed appropriately. If you make a error, print out and complete sample again (once you’ve made an account every document you save is reusable). Make your US Legal Forms account now and access more templates.

Form popularity

FAQ

The vehicle title. a release of lien letter and/or other notifications from the lienholder(s) currently named on the vehicle title. a completed Application for Texas Title and/or Registration (Form 130-U)

The simplest way to prevent liens and ensure that subcontractors and suppliers are paid is to pay with joint checks. This is when both parties endorse the check. Compare the contractor's materials or labor bill to the schedule of payments in your contract and the Preliminary Notices.

Maximize the Homestead Exemption. Protect the Home with Tenancy by the Entirety. Implement an Equity Stripping Plan. Create a Domestic Asset Protection Trust (DAPT) Put the Home Title in the Low-Risk Spouse's Name. Purchase Umbrella Insurance.

When the lien is bonded off, the surety company (or, in the case of a general contractor bonding off the lien itself, the general contractor) is guaranteeing payment of a claim if the claimant prevails in court enforcing the claim.

In the event that the contract is breached and payment is not received, an affidavit for mechanics' lien may be filed to place a lien on the project.

The process of bonding off a mechanics lien starts after a claimant has filed a mechanics lien. After the claim is made, a general contractor or a property owner can contact a surety bond company to purchase a surety bond that replaces the value of the lien that was filed against the property.

Fill out the appropriate mechanics lien form. (Lien form for Original Contractors Lien form for Subcontractors & Suppliers) Deliver your lien form to the county recorder office. Serve your lien on the property owner.

Fill out your lien form with complete, accurate details. Bring your Affidavit of Lien to the county recorder's office in the county where the property is located, and pay the lien recording fee. After recording a Texas mechanics lien, claimants must provide notice to the property owner and GC within 5 days of filing.

In Texas, the notice of intent to lien must be sent by USPS via Return Receipt Requested (RRR), which will provide a receipt for your mailing (keep the receipt for your records). The notice must go to both the owner of the property and the general contractor.