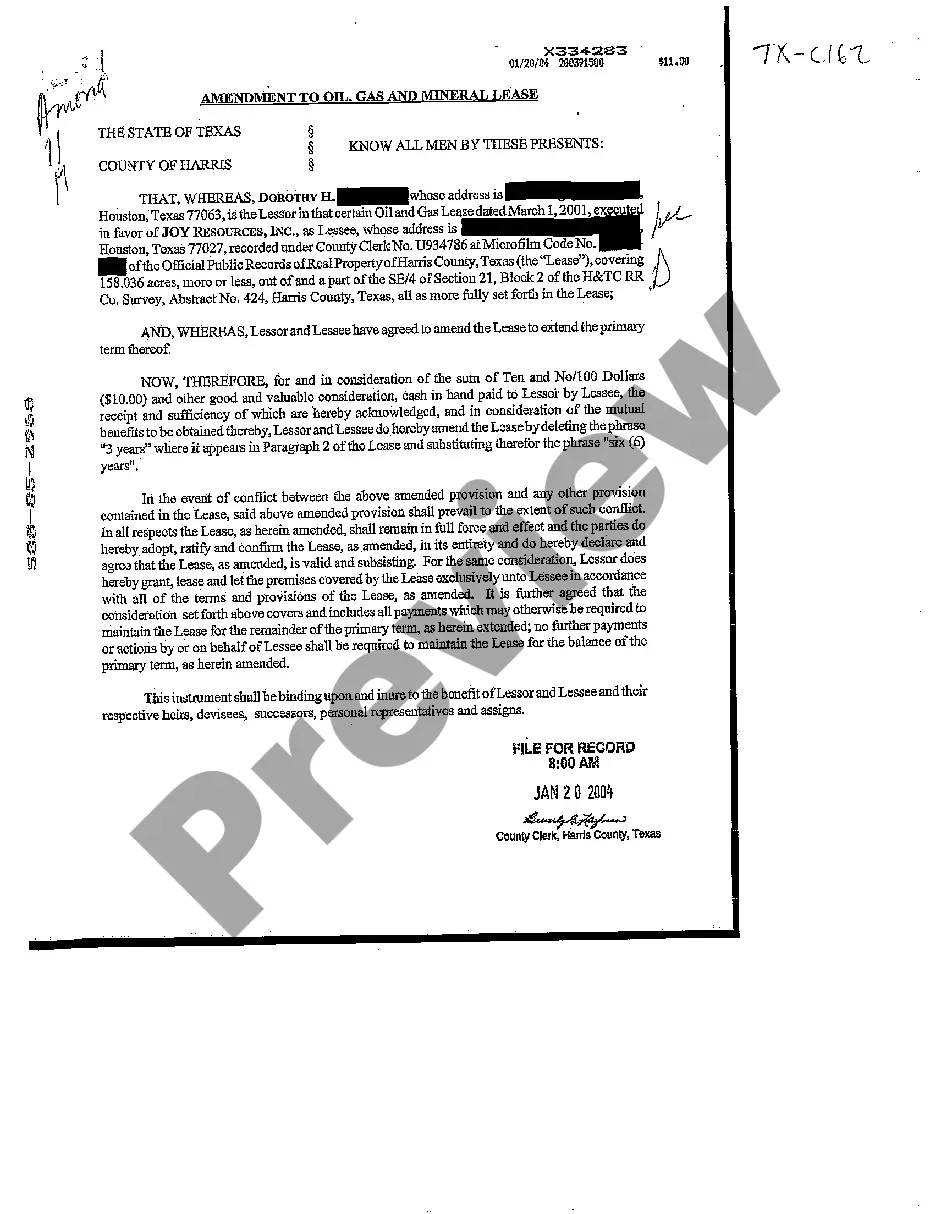

This form is used when the Lessee and the Lessor agree to amend the lease to extend the primary term from three years to six years. The terms and provisions of this amendment of the Lease is binding the the benefit of the Lessor and Lessee and their respecitve heirs, devisees, successors, and personal representatives.

Texas Amendment to Oil, Gas, and Mineral Lease

Description

How to fill out Texas Amendment To Oil, Gas, And Mineral Lease?

Get access to top quality Texas Amendment to Oil, Gas, and Mineral Lease forms online with US Legal Forms. Steer clear of hours of lost time searching the internet and lost money on forms that aren’t updated. US Legal Forms provides you with a solution to exactly that. Get around 85,000 state-specific authorized and tax forms that you could save and complete in clicks in the Forms library.

To receive the sample, log in to your account and click Download. The document is going to be saved in two places: on your device and in the My Forms folder.

For those who don’t have a subscription yet, check out our how-guide listed below to make getting started easier:

- See if the Texas Amendment to Oil, Gas, and Mineral Lease you’re considering is appropriate for your state.

- See the form utilizing the Preview option and browse its description.

- Go to the subscription page by simply clicking Buy Now.

- Select the subscription plan to go on to register.

- Pay by credit card or PayPal to complete making an account.

- Choose a favored file format to download the document (.pdf or .docx).

Now you can open up the Texas Amendment to Oil, Gas, and Mineral Lease template and fill it out online or print it out and get it done yourself. Think about giving the file to your legal counsel to be certain things are filled out correctly. If you make a error, print out and complete sample again (once you’ve registered an account all documents you save is reusable). Make your US Legal Forms account now and get access to more templates.

Form popularity

FAQ

To ratify a lease means that the landowner and oil & gas producer, as current lessor and lessee of the land, agree (or re-agree) to the terms of the existing lease.In all likelihood, the lessee (usually the current producer) believes that you have legitimate grounds to break the existing lease.

If you want to sell the mineral rights to another person, you can transfer them by deed. You will need to create a mineral deed and have it recorded. You should check with the county Recorder of Deeds in the county where the land is located and ask if a printed mineral deed form is available to use.

Not necessarily. Where your royalty is based on volume of production and your lease is for a period of years and as much longer as oil and gas is produced, or similar language is contained in your lease, your lease may not automatically expire at the end of its primary term.

A deed that names the seller/donor and the purchaser/donee. It states and describes the rights being sold or given. Filing of the notarized conveyance in the county government office which is generally the county clerk's office.

Mineral rights are automatically included as a part of the land in a property conveyance, unless and until the ownership gets separated at some point by an owner/seller.Conveying (selling or otherwise transferring) the land but retaining the mineral rights.

Oil and gas lease is an agreement between a mineral owner (lessor) and a company (lessee) in which the owner grants the company the right to explore, drill and produce oil, gas, and other minerals below the surface of the earth.

Mineral rights in Texas are the rights to mineral deposits that exist under the surface of a parcel of property. This right normally belongs to the owner of the surface estate; however, in Texas those rights can be transferred through sale or lease to a second party.

Call the county where the minerals are located and ask how to transfer mineral ownership after death. They will probably advise you to submit a copy of the death certificate, probate documents (if any), and a copy of the will (or affidavit of heirship if there is no will).

IMPLIED RIGHT (automatic right) to enter upon the surface (whether or not owned by the mineral owner) without securing the permission of the surface owner, without paying surface damages and without cleaning up.