Texas Trust Agreement

Description

How to fill out Texas Trust Agreement?

Access to high quality Texas Trust Agreement templates online with US Legal Forms. Avoid days of misused time browsing the internet and dropped money on forms that aren’t up-to-date. US Legal Forms offers you a solution to exactly that. Get around 85,000 state-specific legal and tax forms that you can save and complete in clicks within the Forms library.

To get the sample, log in to your account and click Download. The file will be stored in two places: on the device and in the My Forms folder.

For those who don’t have a subscription yet, look at our how-guide below to make getting started easier:

- Find out if the Texas Trust Agreement you’re considering is suitable for your state.

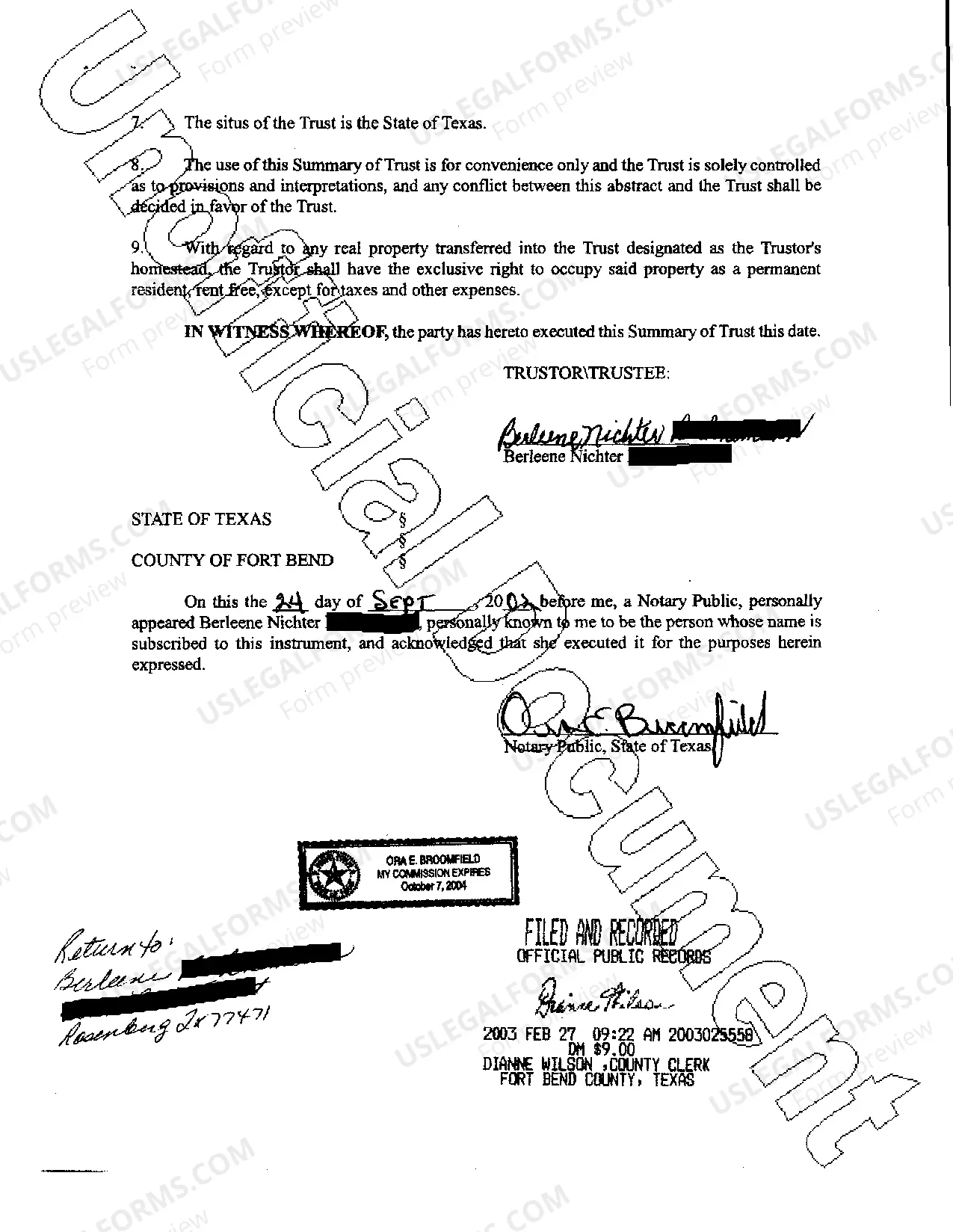

- See the sample using the Preview function and browse its description.

- Go to the subscription page by clicking Buy Now.

- Select the subscription plan to keep on to register.

- Pay out by credit card or PayPal to finish making an account.

- Pick a favored format to save the document (.pdf or .docx).

Now you can open up the Texas Trust Agreement template and fill it out online or print it and get it done yourself. Take into account giving the papers to your legal counsel to make certain all things are completed properly. If you make a error, print and fill application again (once you’ve registered an account every document you download is reusable). Make your US Legal Forms account now and get more samples.

Form popularity

FAQ

Unlike a corporation, which is required to file a certificate of formation with the Secretary of State, there is no such requirement for a trust.Rather, the trust remains a private document.

Qualified retirement accounts 401ks, IRAs, 403(b)s, qualified annuities. Health saving accounts (HSAs) Medical saving accounts (MSAs) Uniform Transfers to Minors (UTMAs) Uniform Gifts to Minors (UGMAs) Life insurance. Motor vehicles.

A Texas living trust is set up by the settlor, the person who places the assets in trust. The goal is generally to place as many assets into the trust as possible. Some assets, such as retirement accounts and life insurance cannot be transferred. The assets in the trust are managed for your benefit while you are alive.

List Your Assets and Decide Which You'll Include in the Trust. Gather the Paperwork. Decide Whether You Will Be the Sole Grantor. Choose Beneficiaries. Choose a Successor Trustee. Choose Someone to Manage Property for Minor Children. Prepare the Trust Document. Sign and Notarize.

An estate plan that includes a trust costs $1,000 to $3,000, versus $300 or less for a simple will. What a living-trust promoter may not tell you: You don't need a trust to protect assets from probate. You can arrange for most of your valuable assets to go to your heirs outside of probate.

Pick a type of living trust. If you're married, you'll first need to decide whether you want a single or joint trust. Take stock of your property. Choose a trustee. Draw up the trust document. Sign the trust. Transfer your property to the trust.

Endorsing the Check As the trustee or successor trustee, you must endorse the check. Sign your name just as you are identified in the trust document, for example "Jane Doe, Trustee, John Doe Revocable Trust." If another trustee is named, you do not need her signature to make the deposit.

Houses and other real estate (even if they're mortgaged) stock, bond, and other security accounts held by brokerages (but think about naming a TOD beneficiary instead) small business interests (stock in a closely held corporation, partnership interests, or limited liability company shares)

When signing anything on behalf of the trust, always sign as John Smith, Trustee. By signing as Trustee, you will not be personally liable for that action as long as that action is within the scope of your authority under the trust.