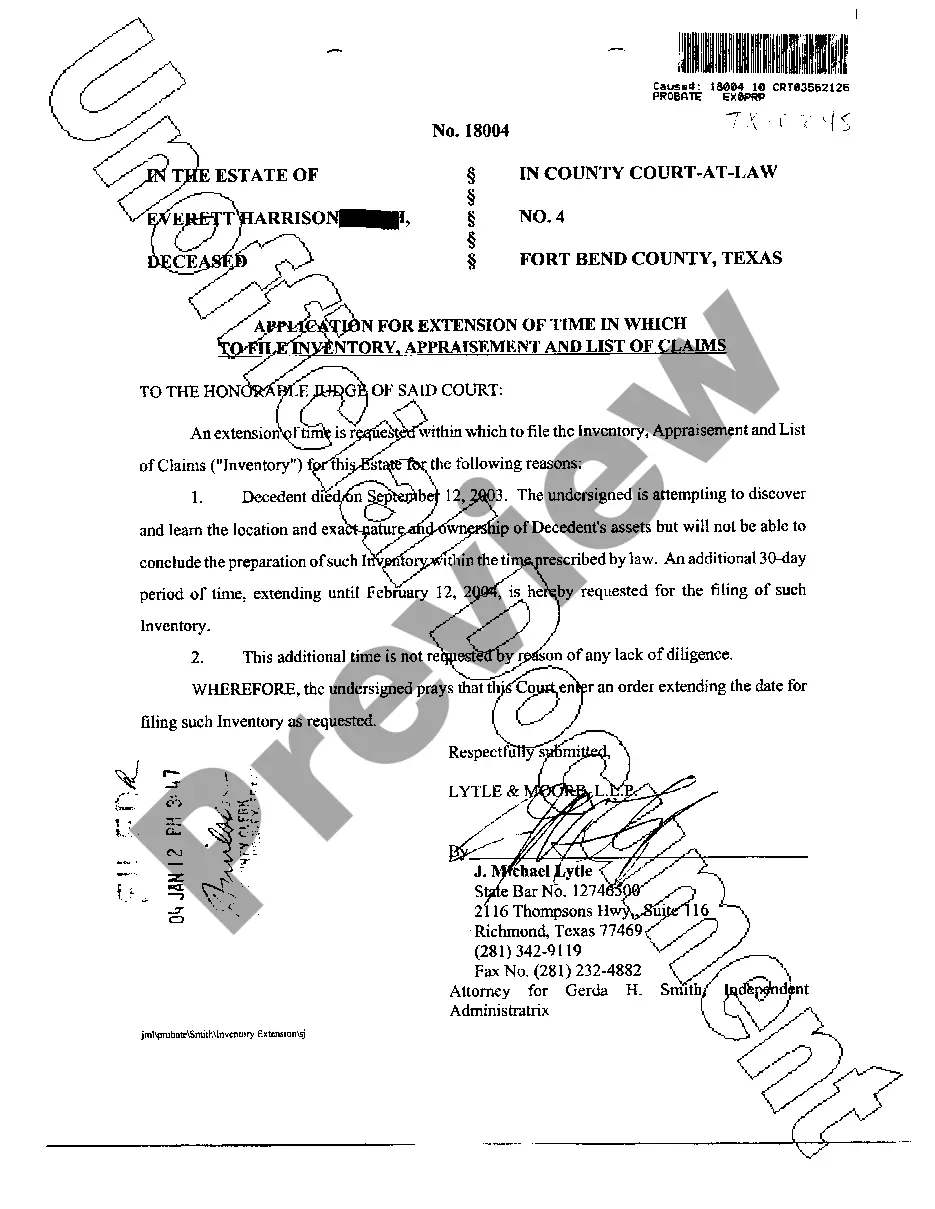

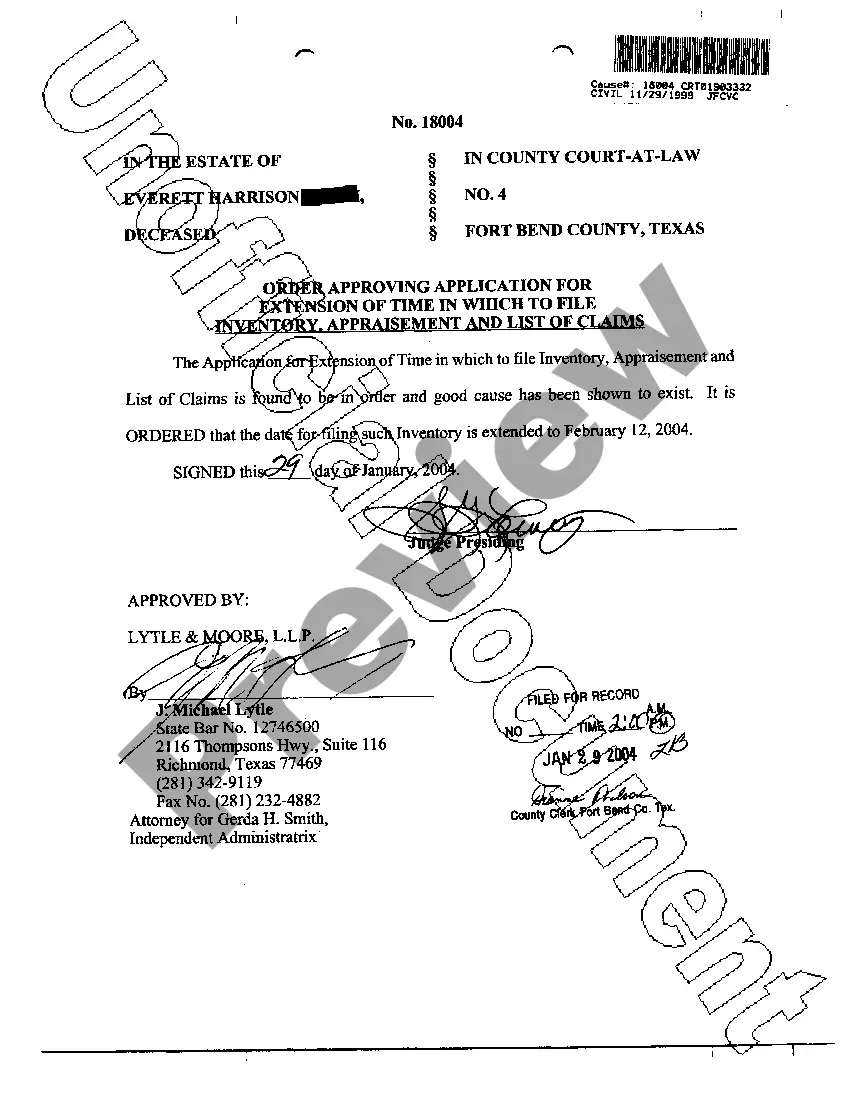

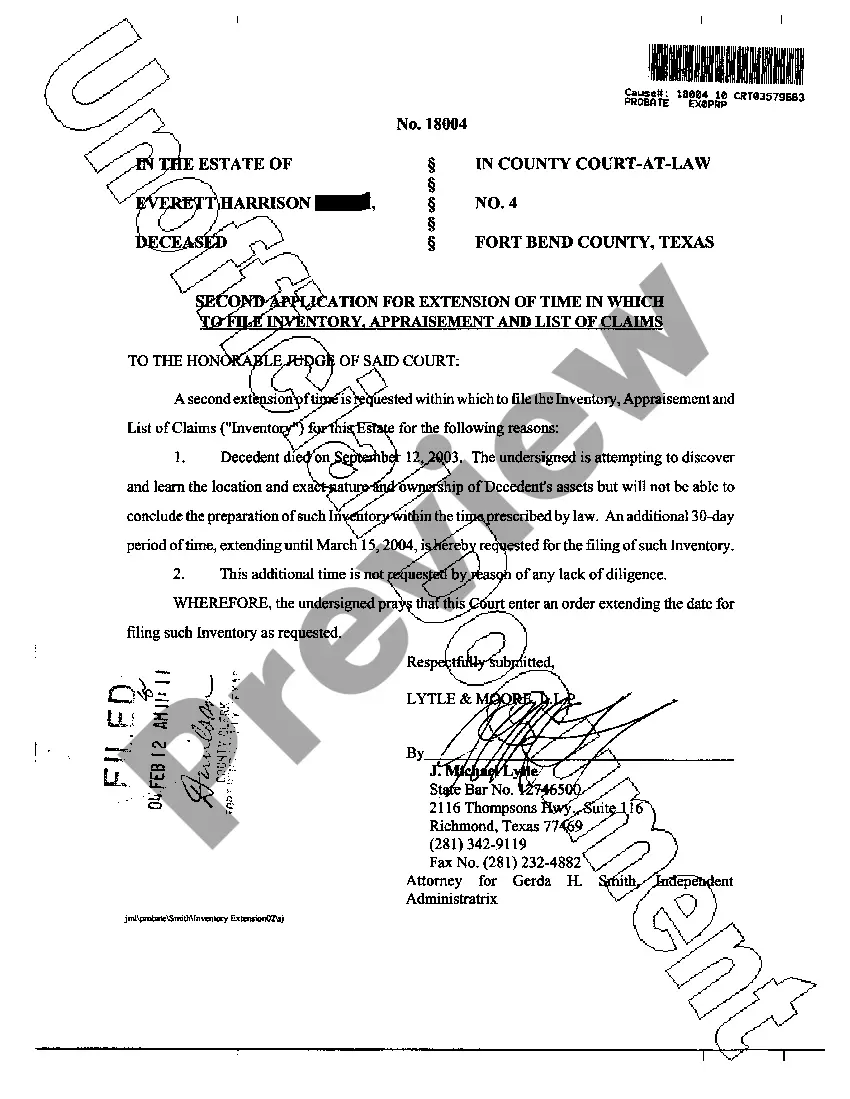

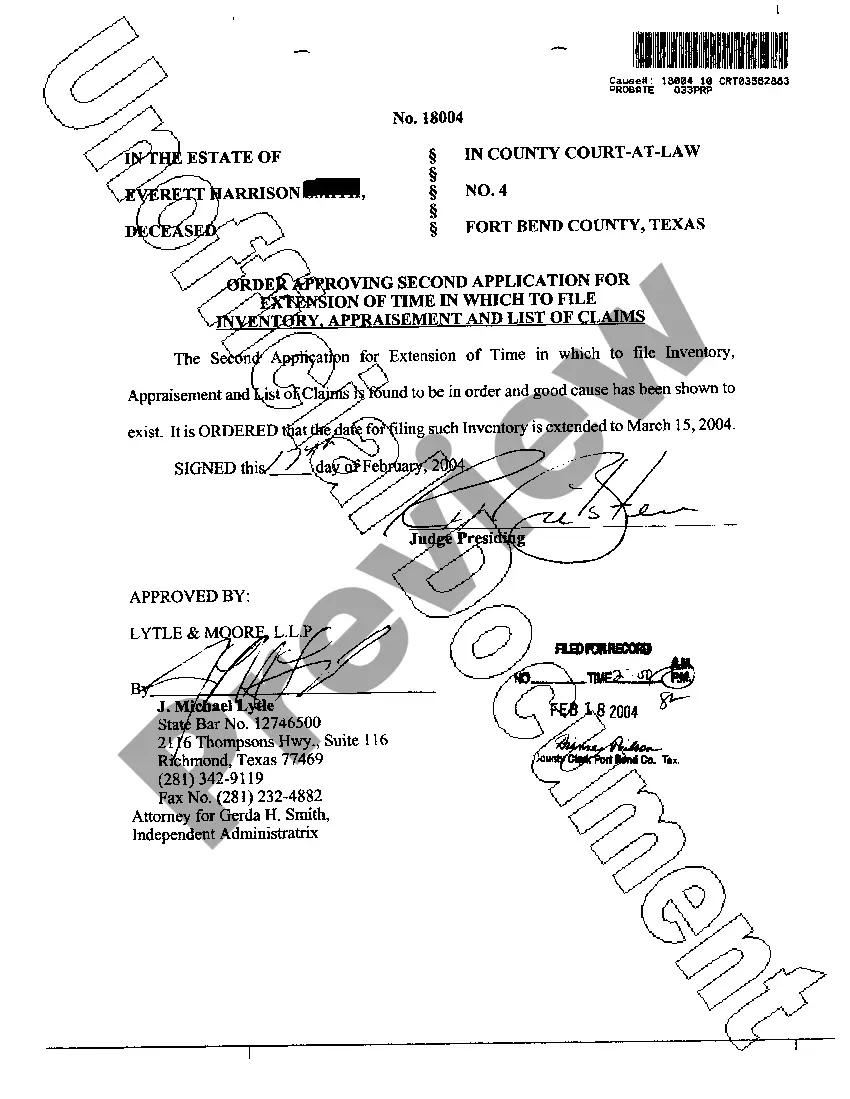

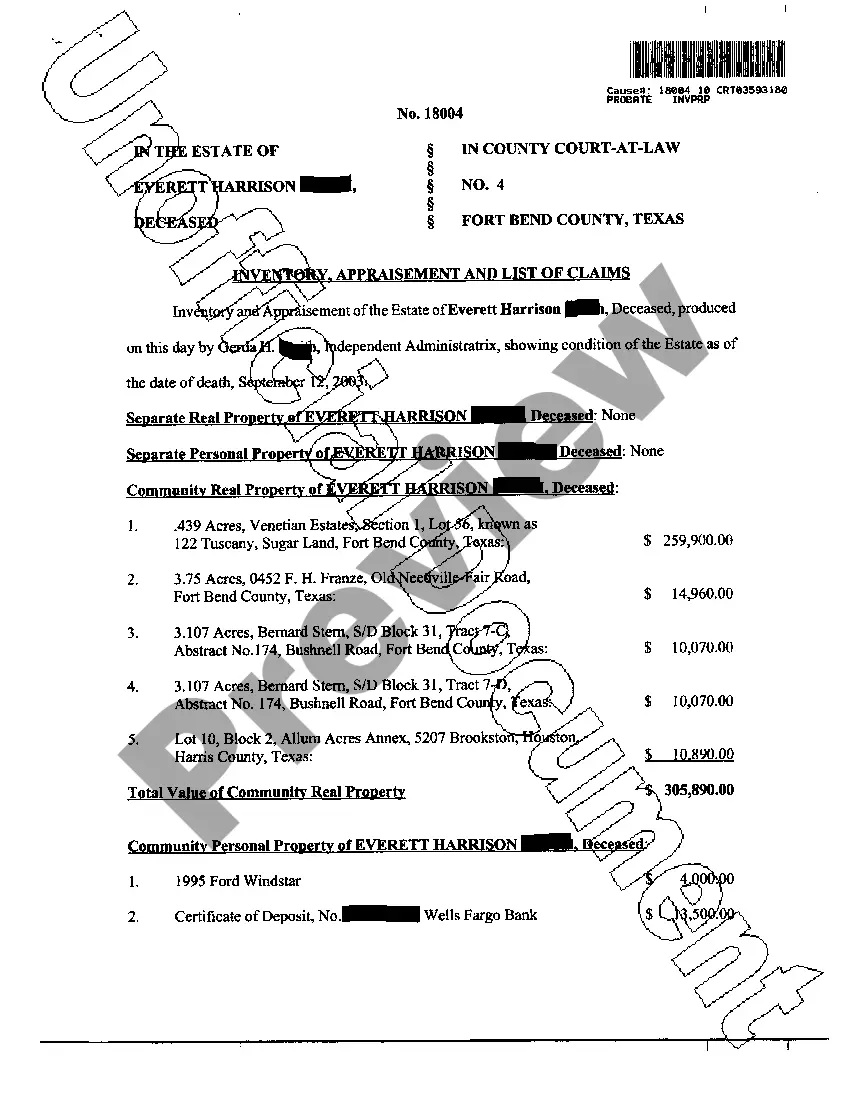

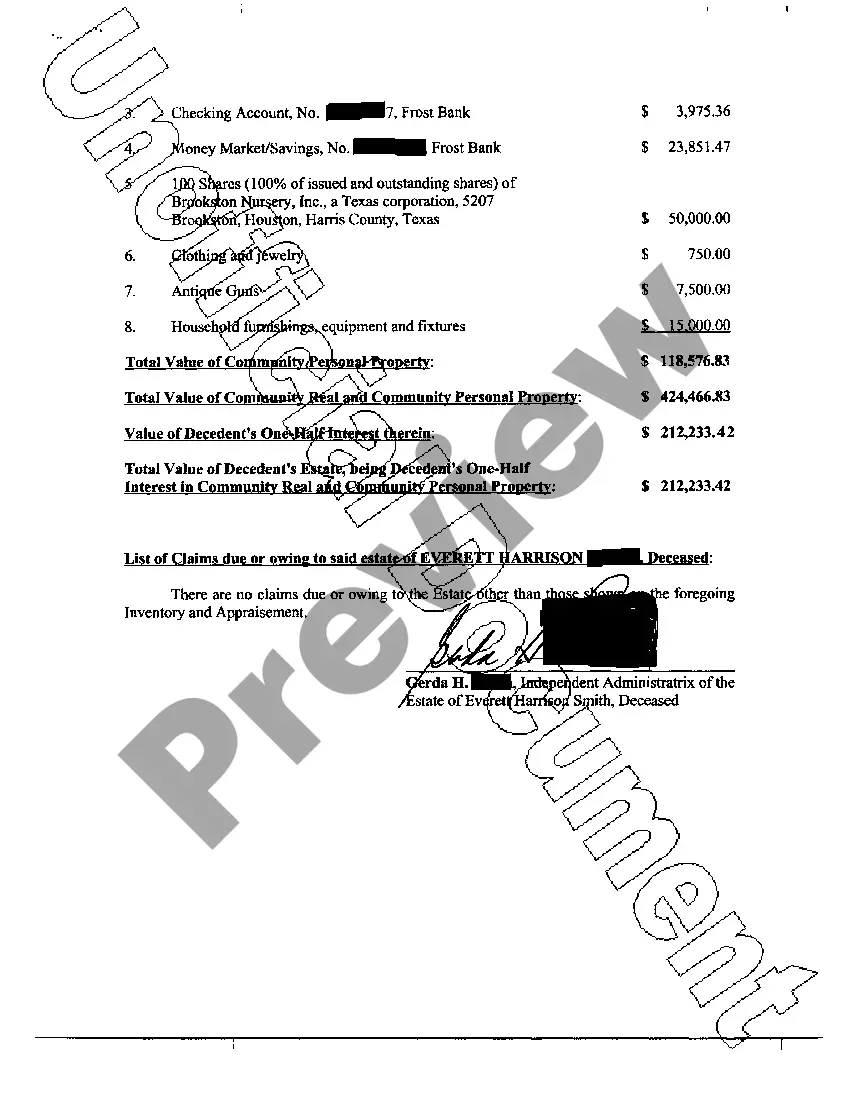

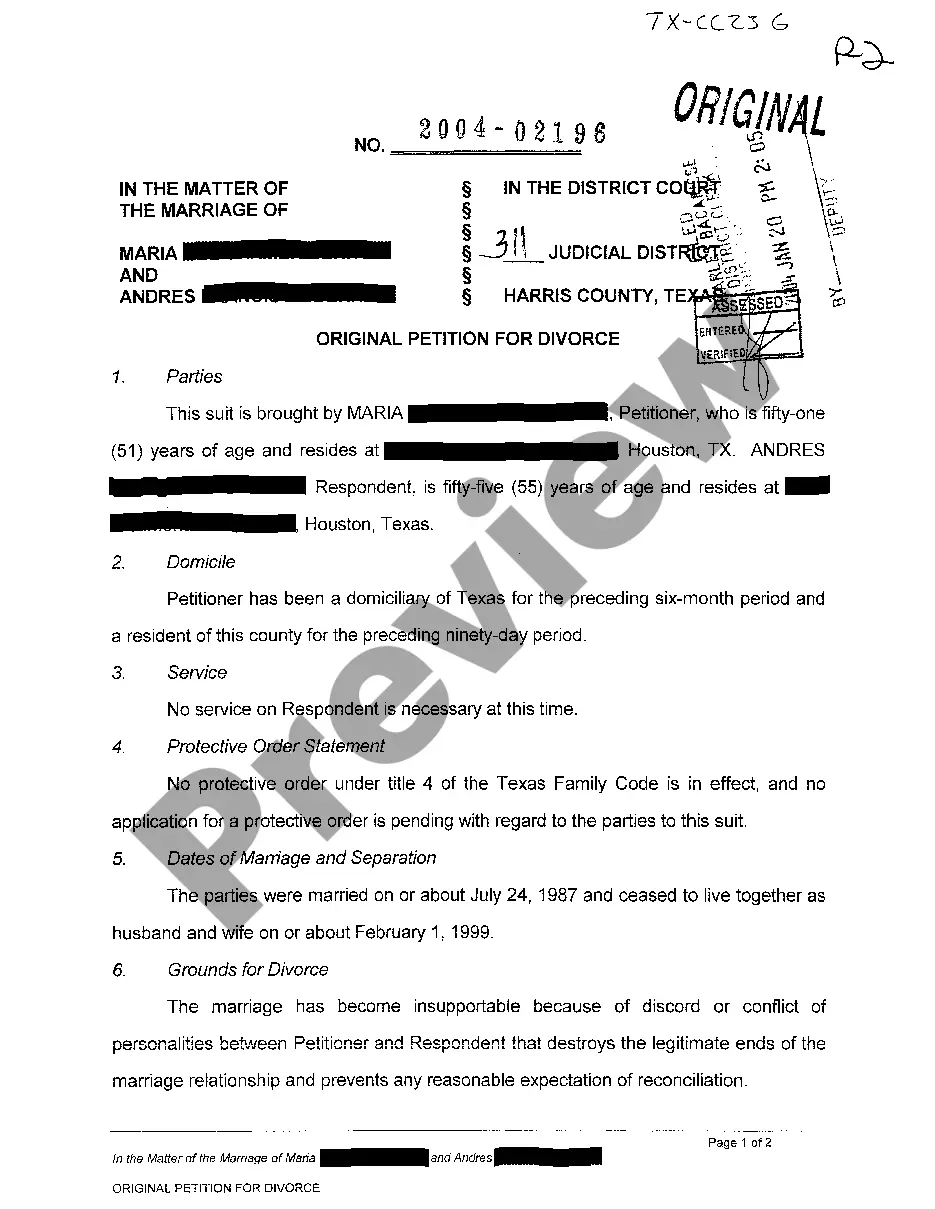

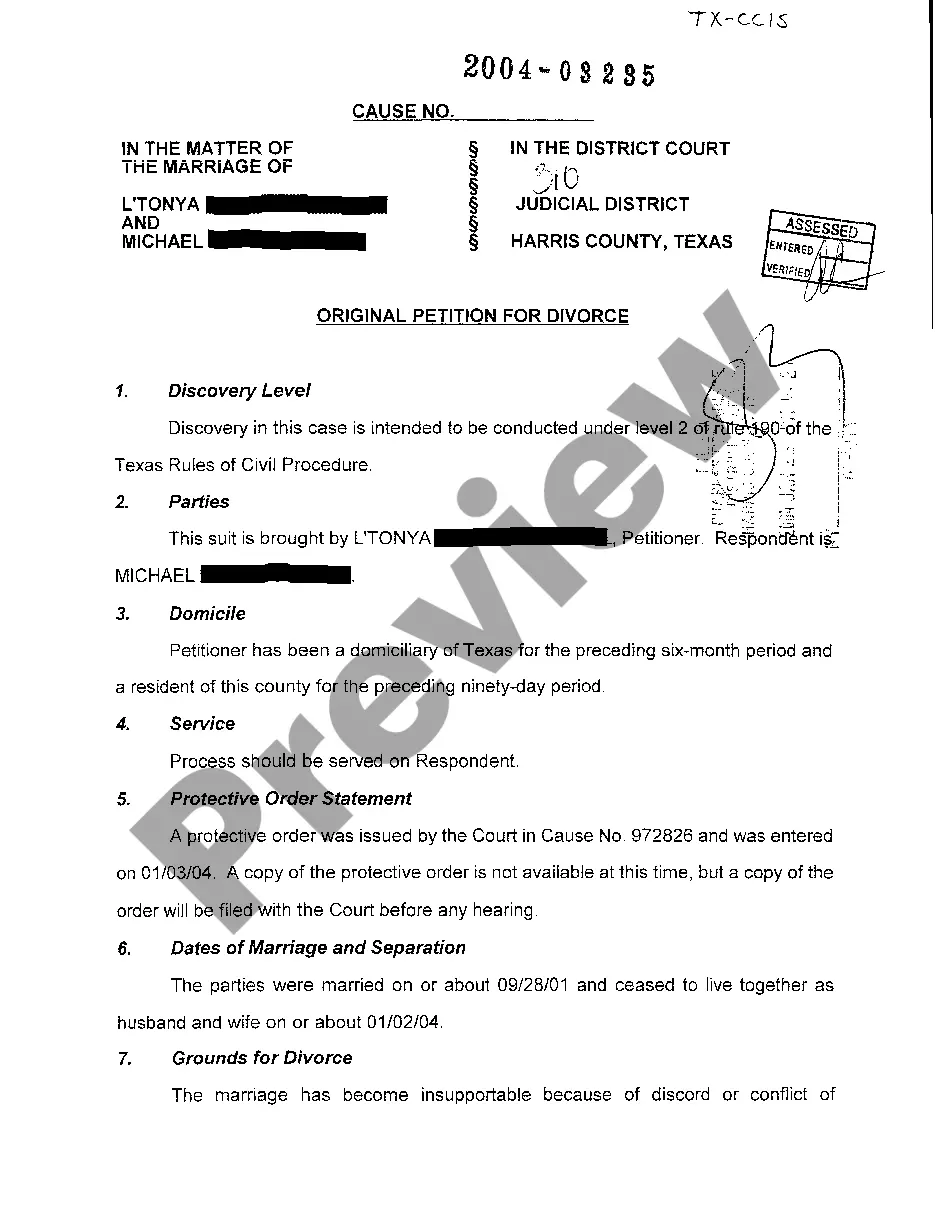

Texas Application for Extension of Time

Description

How to fill out Texas Application For Extension Of Time?

Get access to high quality Texas Application for Extension of Time templates online with US Legal Forms. Steer clear of days of wasted time searching the internet and dropped money on files that aren’t up-to-date. US Legal Forms gives you a solution to exactly that. Find around 85,000 state-specific legal and tax forms that you can save and complete in clicks within the Forms library.

To find the example, log in to your account and then click Download. The document will be saved in two places: on the device and in the My Forms folder.

For those who don’t have a subscription yet, look at our how-guide listed below to make getting started easier:

- Verify that the Texas Application for Extension of Time you’re considering is appropriate for your state.

- Look at the form making use of the Preview option and read its description.

- Visit the subscription page by clicking on Buy Now button.

- Select the subscription plan to keep on to register.

- Pay by credit card or PayPal to finish making an account.

- Choose a preferred format to download the document (.pdf or .docx).

You can now open up the Texas Application for Extension of Time template and fill it out online or print it out and do it yourself. Think about sending the papers to your legal counsel to make certain everything is filled out appropriately. If you make a error, print and complete sample once again (once you’ve created an account all documents you download is reusable). Make your US Legal Forms account now and get access to more samples.

Form popularity

FAQ

Line 1: Name and Address. Lines 2 and 3: Social Security Number(s) Line 4: Estimate Your Overall Tax Liability. Line 5: Provide Your Total Payments. Line 6: Your Balance Due. Line 7: Amount You're Paying with Your Tax Extension. Line 8: Out of the Country Filers.

Individual taxpayers who need additional time to file beyond the July 15 deadline can request a filing extension by filing Form 4868 through their tax professional, tax software or using the Free File link on IRS.gov. Businesses who need additional time must file Form 7004.

You can file an extension for your taxes by submitting Form 4868 with the IRS online or by mail. This must be done by the tax filing due date. Filing an extension for your taxes gives you additional months to prepare your return no matter the reason you need the extra time.

You can get an automatic extension of time to file your tax return by filing Form 4868 electronically. You'll receive an electronic acknowledgment once you complete the transaction. Keep it with your records.

Due to the COVID-19 pandemic, the federal government extended this year's federal income tax filing deadline from April 15, 2021, to May 17, 2021. This extension is automatic and applies to filing and payments.You will still owe penalties and interest if you don't pay by May 17.

You can file an extension for your taxes by submitting Form 4868 with the IRS online or by mail. This must be done by the tax filing due date. Filing an extension for your taxes gives you additional months to prepare your return no matter the reason you need the extra time.

The 2019 income tax filing and payment deadlines for all taxpayers who file and pay their Federal income taxes on April 15, 2020, are automatically extended until July 15, 2020.This relief is automatic, taxpayers do not need to file any additional forms or call the IRS to qualify.

The deadlines for individuals to file and pay most federal income taxes are extended to May 17, 2021.An extension of time to file your return does not grant you any extension of time to pay your taxes. You should estimate and pay any owed taxes by your regular deadline to help avoid possible penalties.

Request a second extension by making a timely TEXNET payment, using tax type code 13080 (Franchise Tax Extension), or use franchise tax Webfile to make the second extension payment on or before Aug. 15. The payment should equal the balance of the amount of tax that will be reported as due on Nov. 15.