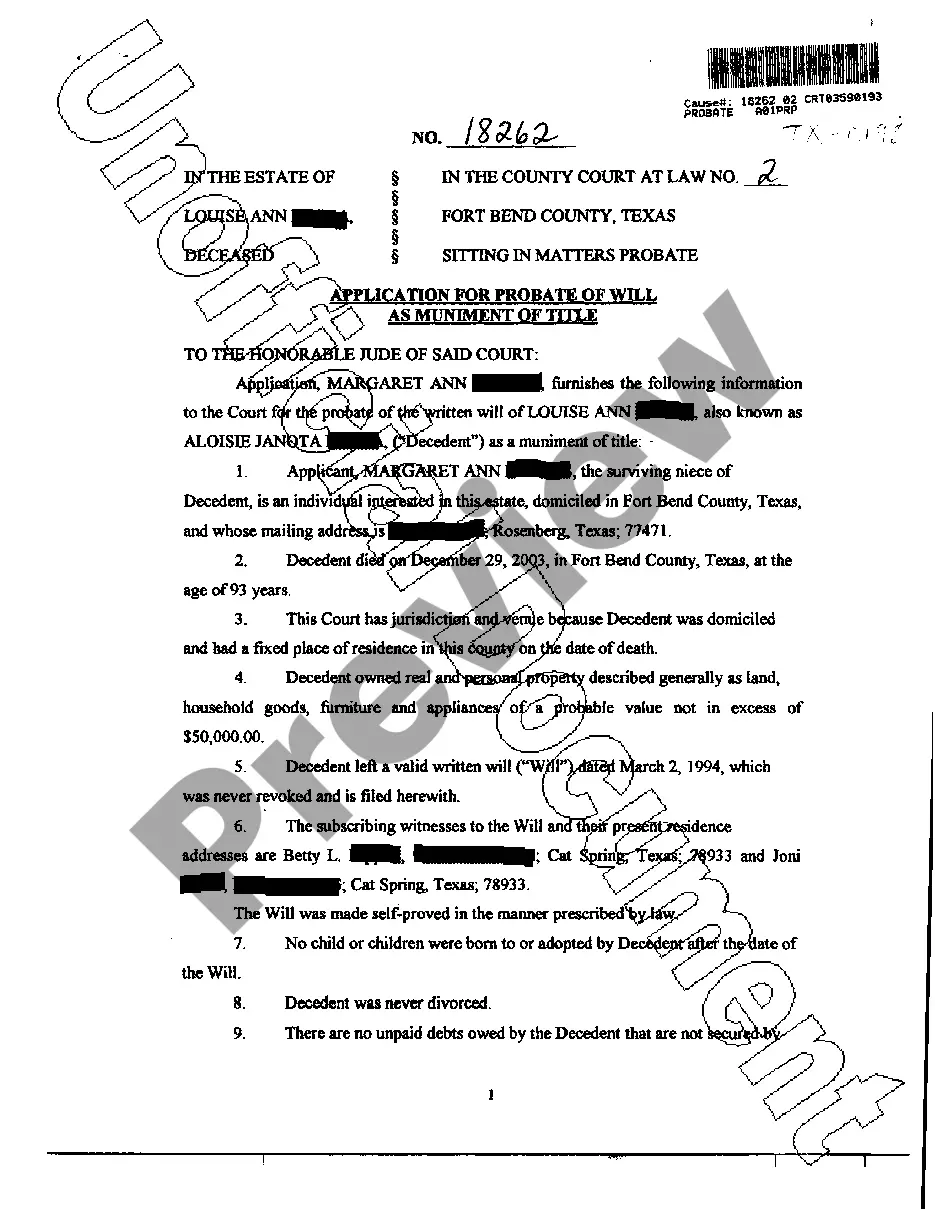

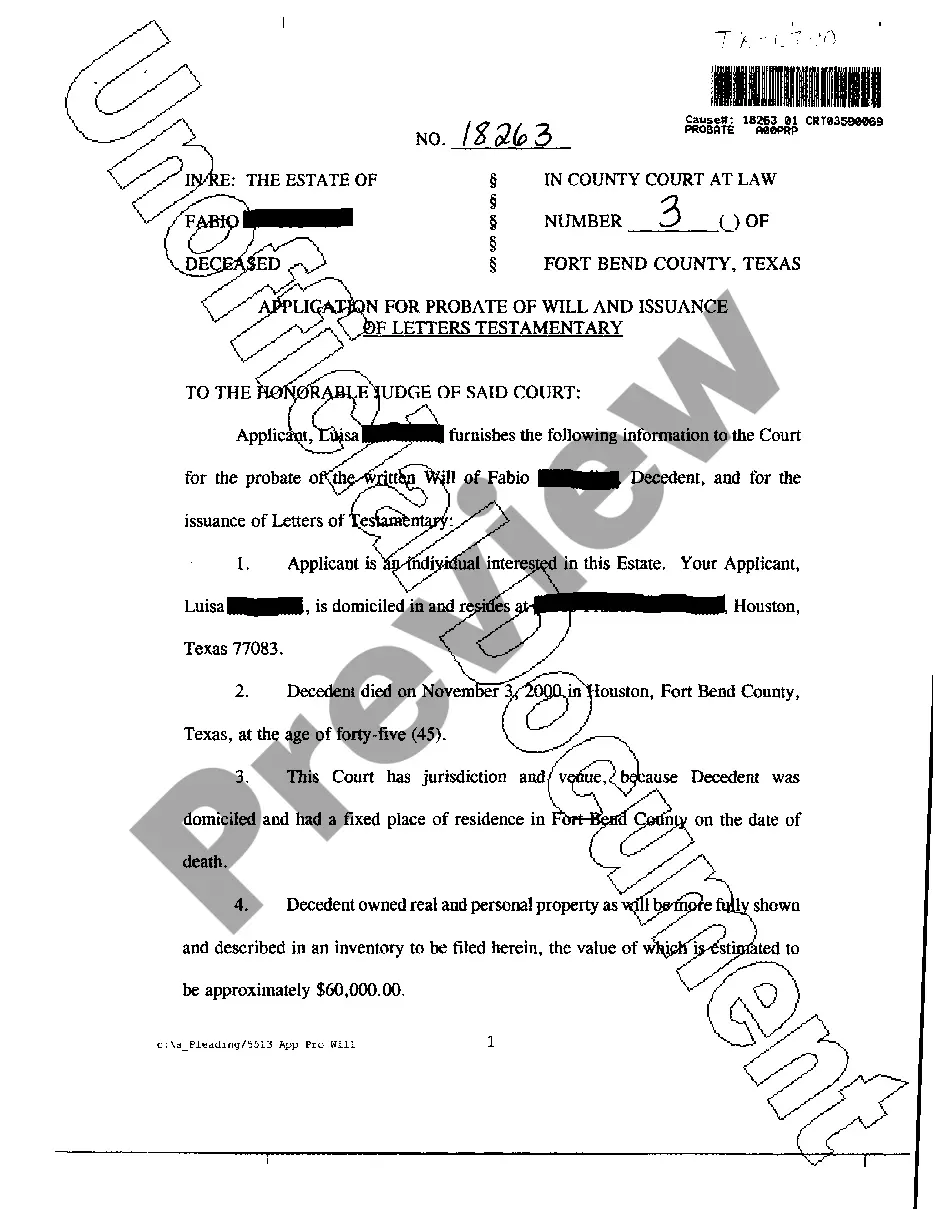

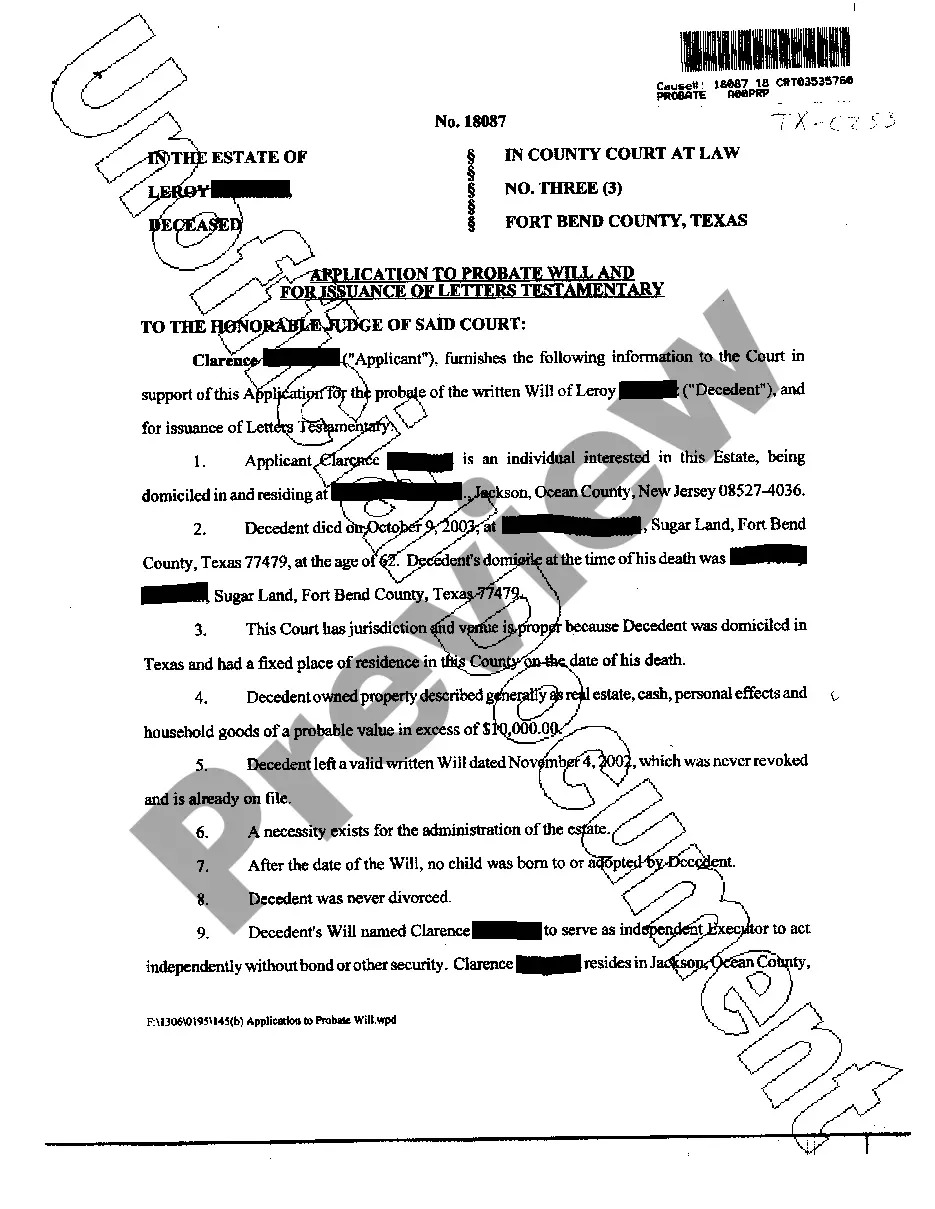

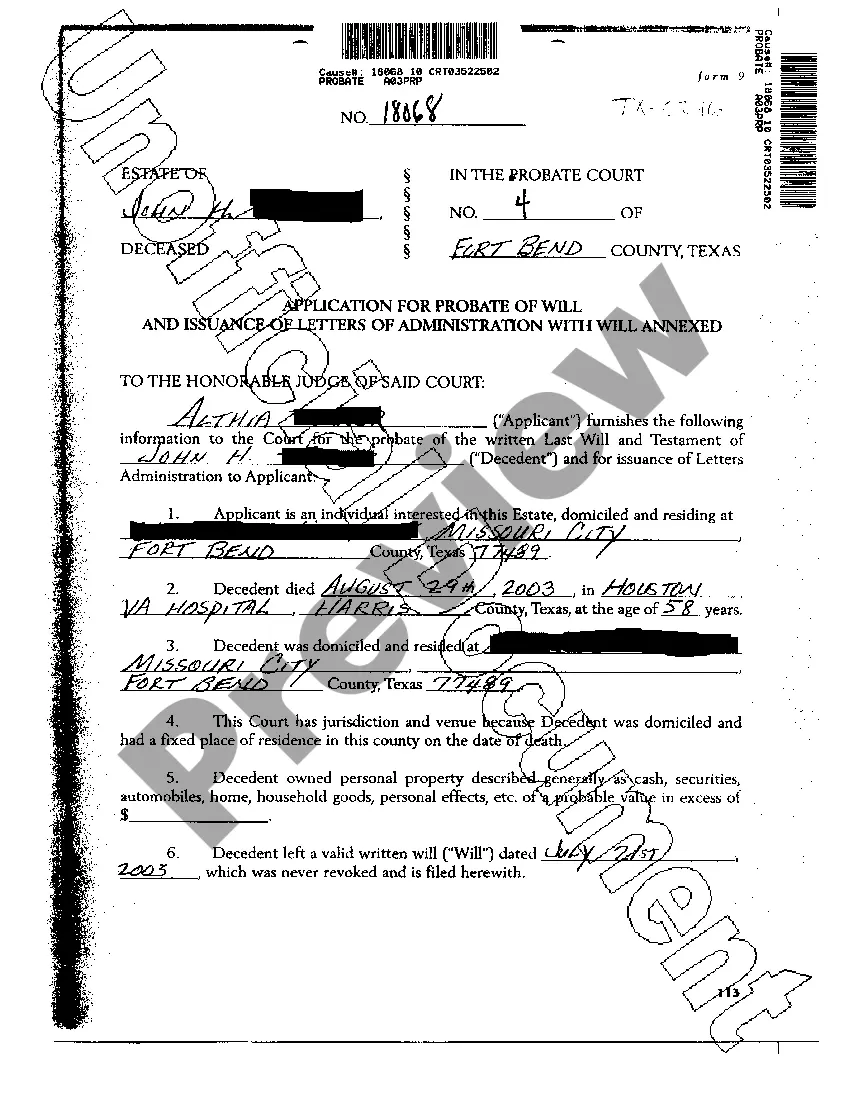

Texas Application for Probate of Will

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Texas Application For Probate Of Will?

Access to quality Texas Application for Probate of Will samples online with US Legal Forms. Prevent days of misused time searching the internet and dropped money on documents that aren’t updated. US Legal Forms gives you a solution to exactly that. Find over 85,000 state-specific authorized and tax templates that you could download and submit in clicks in the Forms library.

To get the sample, log in to your account and then click Download. The document will be stored in two places: on your device and in the My Forms folder.

For people who don’t have a subscription yet, take a look at our how-guide below to make getting started easier:

- Verify that the Texas Application for Probate of Will you’re looking at is suitable for your state.

- View the sample using the Preview function and browse its description.

- Check out the subscription page by clicking Buy Now.

- Choose the subscription plan to go on to sign up.

- Pay by credit card or PayPal to complete making an account.

- Select a favored file format to download the file (.pdf or .docx).

You can now open up the Texas Application for Probate of Will example and fill it out online or print it out and do it yourself. Take into account mailing the file to your legal counsel to ensure everything is completed correctly. If you make a mistake, print out and complete sample again (once you’ve made an account every document you download is reusable). Make your US Legal Forms account now and access much more templates.

Form popularity

FAQ

Without a probate attorney to guide you, the Texas probate process can be a daunting experience. To begin with, certain Courts will not allow non-lawyers to file applications to probate a will or an estate nor will they allow non-lawyers to represent an estate in Court.

Step 1: Filing. Step 2: Posting. Step 3: Will Validation. Step 4: Cataloging Assets. Step 5: Beneficiaries Identified. Step 6 Notifying Creditors. Step 7: Resolving Disputes. Step 8: Distributing Assets.

Meet the Legal Requirements for Will Creation in Texas. The underlying lost will must itself be valid under Texas law. Show Why Original Will Can't Be Produced. Explain to the probate court why you can't bring the original Will to court. Establish the Contents of the Will.

Each county has its own specific form for the small estate affidavit, so obtain the form from the website or office of the probate court in the county in which your loved one was a resident. Although each form is slightly different, they all require the following information: Name and address of decedent. Date of death.

Texas has a probate process similar to many other states, but before we go any further, let's ask an important question: Do you even need to probate the estate? Not all assets go through probate. Assets that automatically transfer to another person without a court order will avoid probate.

An order of court appointing a person to administer the estate of a deceased person. Where a person dies leaving a will that makes an effective appointment of executors, the executors' title to deal with the deceased's estate is completed by the issue of a grant of probate.

Complete probate forms The probate application (PA1) form can be downloaded from the HM Courts and Tribunals website and is used to collect details about the deceased person and their estate.

You should include: Probate application form PA1P. Inheritance tax form IHT205 or IHT400. An official copy of the death certificate.

Probate. If you are named in someone's will as an executor, you may have to apply for probate. This is a legal document which gives you the authority to share out the estate of the person who has died according to the instructions in the will. You do not always need probate to be able to deal with the estate.